R & F Real Estate's 2021 Report 4 months late: Giant loss of 16.3 billion, nearly 30 billion borrowings have defaulted, receiving "non -standard" opinions

Author:Daily Economic News Time:2022.08.08

On the evening of August 7, R & F Real Estate (02777.HK, a share price of HK $ 1.67, a market value of HK $ 6.266 billion) released the 2021 annual performance report for 4 months.

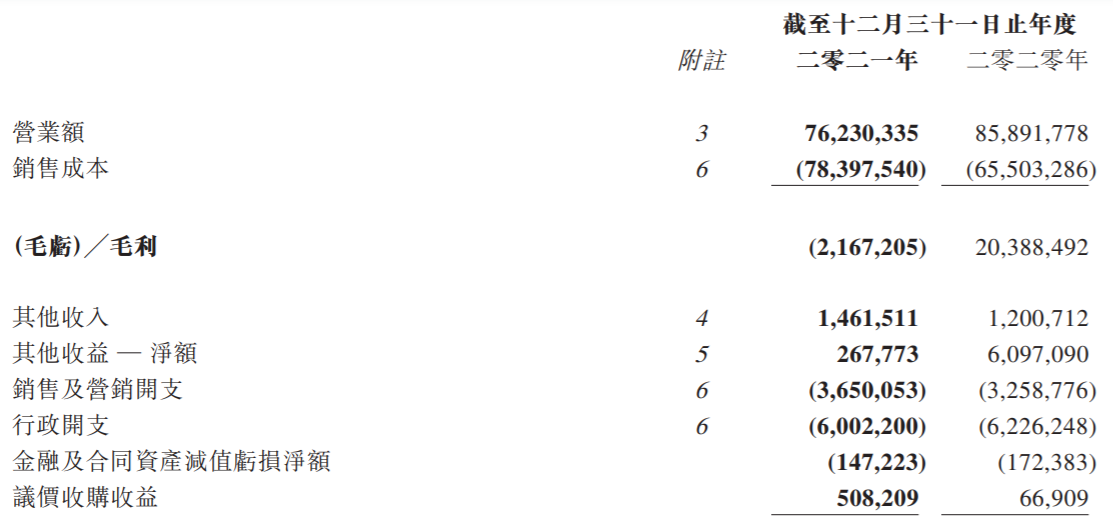

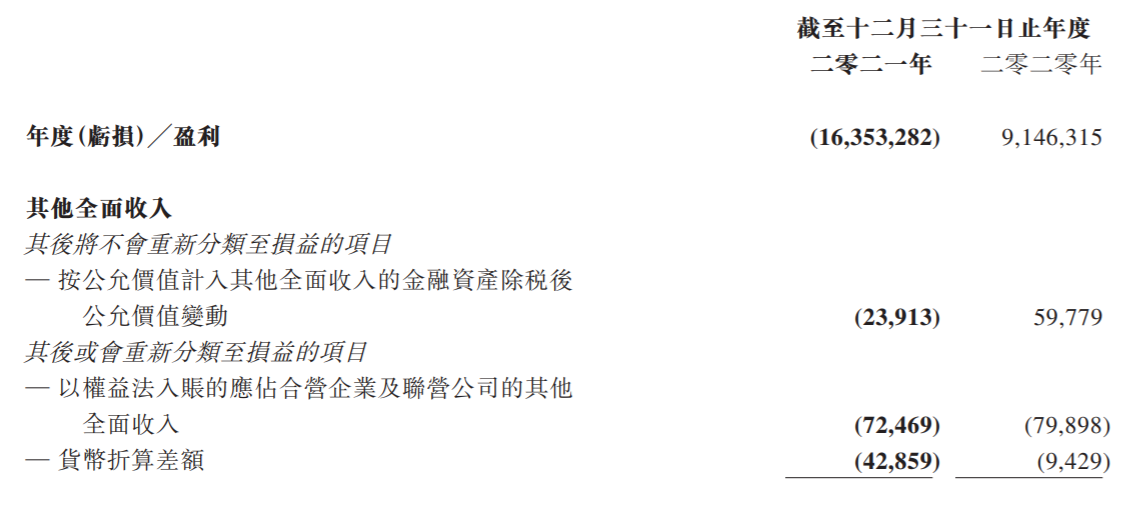

The annual report shows that R & F Real Estate recorded a net loss of 16.353 billion yuan (RMB, the same below) in 2021. The profit was 9.146 billion yuan in 2020, a year -on -year loss to losses; the total turnover was 76.23 billion yuan, a year -on -year decrease of 11.25%.

In this annual report, R & F Real Estate also disclosed in detail the progress and latest situations in the exhibition, financing, and project sales of bonds in the past year. It is worth noting that the annual report mentioned that the sale of several subsidiary companies in 2020, and received a total of about 3.933 billion yuan in funds from an investor. The funds that were previously lent to R & F.

The nuclear number Hong Kong Lixin Dehao Accounting Firm ownership company issued a reservation opinion on the annual report of R & F Real Estate. One is that the two parties have different differences in deferred income tax assets, and the other is to pay attention to "major uncertainty related to continuous operation". Essence

Li Silian, chairman of R & F Real Estate, said in the annual report that the Group's strategy in 2021 was to quickly respond to the market conditions by seeking other funds, accept lower pre -sale profit and accelerate asset sales, and the latter has achieved obvious results in the past 12 months. The ability to find other mobile funding channels is essential for the Group to continue to reduce financial risks, reduce total debt, and improve the overall financial leverage.

Source: R & F Real Estate 2021 Report

Net loss 16.353 billion yuan, continue to sell non -core assets

The annual report shows that the total sales of Fuli Real Estate contract in 2021 were 120.2 billion yuan, with a total sales area of 9.41 million square meters; the total turnover fell to 76.2 billion yuan, including the average price of 8,300 yuan per square meter, 8.31 million square meters, Essence

Due to the frequent price replacement, the continued decline in gross profit margin and profitability has become a common phenomenon of most housing companies, and R & F Real Estate is no exception. In 2021, the overall gross profit margin of R & F Real Estate's development was 13.9%, while 2020 was 25.2%. "Reduced the pace of adjustment of the average selling price to accelerate sales, and subsequently affected the gross profit margin of the Group."

"The net loss is mainly due to the challenging situation of the real estate industry, which has led to the Group's annual record of reserved property development and decreased gross profit margin for the annual record of the annual record of the annual recording of property development by December 31, 2021. The inventory has made impairment. "R & F Real Estate made an impairment of about 12.986 billion yuan due to the inventory during the year.

Li Silian said that in 2021, the buyer's demand for house purchase is still strong, but factors such as economic uncertainty, employment security, mortgage risks and developers' defaults to make consumers take a wait -and -see attitude and affect the overall pre -sale level. "As the pre -sale situation has steadily recovered and the financial management is stable in an orderly manner, we expect that it will be more active in the second half of 2022, and the real estate industry will still be a key part of China's growth strategy."

In the past year, R & F Real Estate has been selling assets frequently. Blackstone Group successfully acquired 100%equity of Guangzhou International Airport R & F Comprehensive Logistics Park project, with two considerations of about 7 billion yuan and 1.263 billion yuan. In March of this year, R & F Real Estate also discounted the London project to develop in the Far East.

Li Silian pointed out that the group still retains a large amount of asset value investment property and hotel portfolio. Through strategic sales, a large amount of funds can be obtained to reduce liabilities and support the development of the Group's sustainable property. As the market price starts to return to normal and the expected gap between the buyers and sellers is reduced, the Group is expected to achieve more asset sales in 2022, thereby providing additional funding sources.

In 2021, R & F Real Estate's new land capital expenditure was only 3 billion yuan, a decrease of 80%from 2020. Despite the decrease in capital expenditure of new land, R & F Group still has a large amount of total available land reserves for a total of 49.97 million square meters, which is enough to cope with the needs of the next few years. In 2022, R & F Real Estate has more than 200 pre -sale projects, and it is expected to bring 220 billion yuan of sale resources.

Source: R & F Real Estate 2021 Report

Nearly 30 billion borrowings have been defaulted, and the annual account of receiving "non -bids" opinions

Since the end of December 2021, R & F Real Estate has been seeking solutions for the upcoming U.S. dollar bond. To this day, R & F Real Estate is still a rare real estate company in the industry that has repeatedly obtained the exhibition period in due debts.

In July of this year, R & F Real Estate's success will be reorganized with a total of 4.944 billion US dollars (about RMB 33.103 billion). 2022, 20123, 2024, respectively.

As of the end of 2021, R & F Real Estate's bank borrowing, domestic bonds, priority notes and other borrowings (including prepaid fees and other payers) total 137.171 billion yuan, of which 70 billion yuan will be repaid within the next 12 months, The total cash (including restricted cash) was 21.04 billion yuan.

In addition, Fuli Real Estate could not repay several banks and other borrowings of 7.07 billion yuan according to the predetermined repayment date. After December 31, 2021, R & F Real Estate could not repay it from January and until this announcement was approved on the day of the date to date to date. Several banks and other borrowings were 10.29 billion yuan. "Therefore, banks and other borrowings with a total principal with a total principal of 29.883 billion yuan have been defaulting or crossing the contract. In addition, the Group has been sued in multiple parties for various reasons. Extra major doubts. "

The nuclear division also put forward this in the annual report reservation (non -standard audit opinion), and said that it did not modify the opinions of the matter. The differences between nuclear and R & F Real Estate are in deferred income tax assets.

Nuclearian said that R & F Real Estate in 2021. Several subsidiaries of different operations departments in 2021 are 2.887 billion yuan due to unused tax losses and deductible temporary differences. R & F Real Estate varies from the comprehensive profit and loss statement to the deferred income tax in the comprehensive profit and loss statement for the loss of tax losses and deductible temporary differences in the comprehensive profit and loss statement. The amounts of these deferred income tax assets and income tax expenses were disclosed at the comprehensive balance sheet and comprehensive profit and loss statement at the comprehensive asset liabilities and comprehensive profit and loss statements, respectively.

R & F Real Estate Management explained to the nuclear division that in order to use these unused tax losses and deductible temporary differences, they have formulated several plans. Management expects that the group's subsidiaries can generate sufficient taxable profits in the future to offset the loss of such uncontinental tax losses and deductible temporary differences.

"However, as of the date of the report of the nuclear division, the management has not provided us with detailed action plans and analysis of the possibility of successfully implementing such plans. Therefore, we cannot obtain a sufficient audit voucher that we think is necessary to be 2.887 billion, with 2.887 billion Yuan's deferred income tax assets and the corresponding amount of the comprehensive profit and loss statement of this year is 161 million yuan. "

In addition, it is worth noting that in the annual report, R & F Real Estate's shareholders' shareholders of a joint venture/several joint ventures increased by about 32%year -on -year. This is because an investor wants to withdraw from the central part of the joint venture and issues a notice to repay the funds before lending to R & F Real Estate. About 1.343 billion yuan was classified as liabilities.

R & F Real Estate sold some of its subsidiaries to the investor in 2020. In that year, R & F Real Estate has also received several funds from the investor, with a total amount of 3.933 billion yuan, an annual interest rate of 13%to 15 to 15 %. These balances are mortgaged by R & F Real Estate's rights to collect economic benefits in a joint venture with the joint -controlled enterprise with the investor and the company. Among the total amount of Yu Jie, about 1.343 billion yuan was classified as non -current liabilities on the date of date.

However, R & F Real Estate did not disclose the specific information of the investor in the annual report.

"This is a difficult 2021, but we still maintain optimism and commitment to overcoming challenges and returning to stability." Li Silian finally said in his speech.

[Original real estate, if you like it, please pay attention to WeChat Real-ESTATE-CIRCLE]

Daily Economic News

- END -

Shanghai's GDP in the first half of the year fell 5.7%: the impact was unprecedented before, and rebounded quickly in June

On the 18th, the Shanghai Municipal Bureau of Statistics released data. In the fir...

The upper limit of the number of commodity items of the new version of the China -Korea Ponesty

On June 13, the reporter learned from Zhanjiang Customs that according to the Announcement of the Certificate Format of the Origin of the Origin in the South Korean Free Trade Agreement (announcemen