Suddenly "cutting meat" for 11 years!Tencent reduced its holdings, can Huayi Brothers still carry it?

Author:Beijing Commercial Daily Time:2022.08.08

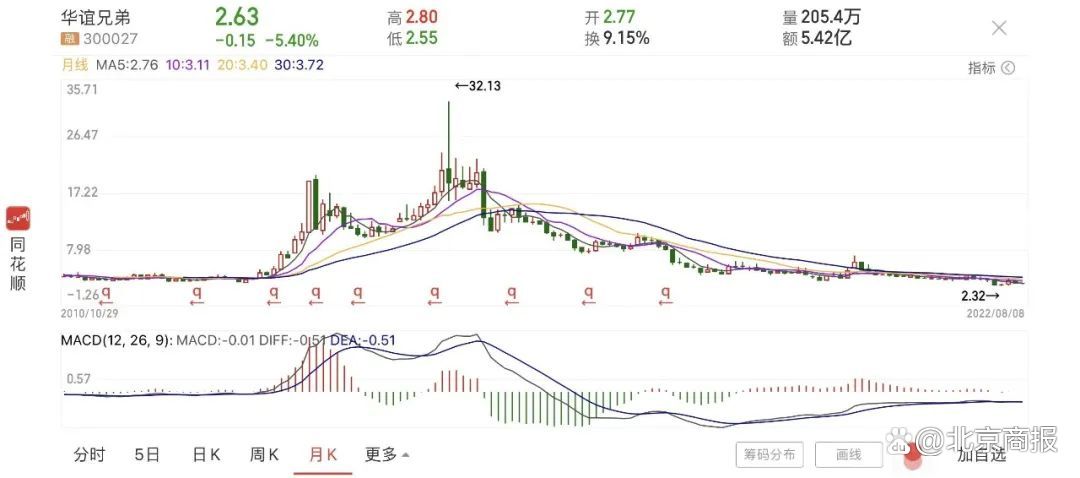

Huayi Brothers recently disclosed that the company's shareholder Tencent Tencent has accumulated a total of more than 1%through the transaction method and participation in the transaction of the transfer of Rongtong Securities from August 2nd to 4th, and the shareholding ratio has changed by more than 1%, and the shareholding ratio dropped from 7.94%to 4.99%. The shareholding ratio is less than 5%, and Tencent's subsequent reduction action will be unlimited, which is regarded by the outside world as a signal of Tencent's departure.

It is worth noting that, as the "first share of China Film and Television Entertainment", the Huayi brothers used to be unlimited, and the market value once reached 89.16 billion yuan. At that time, Tencent also threw olive branches to Huayi Brothers. Since 2011, the two sides have established cooperative relations. Tencent has become the company's second largest shareholder. However, the time of transit has moved, and the Huayi brothers have no longer the courage of that year. For many years, they have rarely exploded movies. The market value has evaporated by more than 90 %. Tencent adjusted its strategic focus and strengthened cost reduction and efficiency.

Picture source: wind

Regarding the purpose of this change in equity, the announcement stated that according to its own needs, Tencent reduced the shareholding of the listed company's shares held by the Shenzhen Stock Exchange's major trading system and participated in the transfer of the shares of Tencent's ownership of the equity through its own needs.

The Huayi Brothers announced that from August 2nd to 4th, Tencent reduced its holdings of Huayi Brothers 53.933 million shares through large transactions, accounting for 1.94%of the company's total share capital, and the average price reduction was 2.2 yuan/share; Securities borrowed 27.7450 million shares, resulting in a decrease of about 1%of the shares held. Total, the number of reductions was reduced by 81.6383 million, accounting for 2.94%of the total share capital of Huayi Brothers.

West Street Observation

Tencent reduced its holdings, can Huayi brothers still carry it?

Tencent's reduction of Huayi brothers, so that the Huayi brothers who were at the historic low were worried. Do you still need to reduce your holdings at the low historical level. Have you released a kind of worry about the future development of the Huayi brothers? After all, Tencent may not lack money. If it is just to return the funds, there is no need to reduce the holdings at the current price.

For a long time, the Huayi brothers have been proud of Ali and Tencent at the same time. Indeed, it is rare to make Ali and Tencent's shares at the same time. However, the stock price of Huayi Brothers fell all the way. Today, whether it is Ali or Tencent, the disappointment is definitely not small.

It is worth noting that Tencent reduced the number of shares to less than 5%, which means that if Tencent continues to reduce holdings of Huayi brothers stocks in the future, no further announcement is required. Suddenly discovered that Tencent is no longer among the top ten shareholders, and at that time Tencent may completely withdraw from the list of Huayi brothers.

So where is the problem of Huayi Brothers? Before listing, the performance of the Huayi brothers was bright, but after the listing raised a lot of funds, some flaws began to appear in the investment path of Huayi Brothers. Although there are great strokes such as holding on Palm Technology, there are also huge funds to invest in real -world entertainment entertainment As a result, the company's performance declined sharply, and then the coming of the epidemic was high. The cost of maintenance of these real -world entertainment was high, and the realization was not worth the money. It did become a huge chicken rib. The box office of the movie was also greatly affected by the epidemic. And the stock price has fallen again.

In fact, Tencent's reduction of Huayi brothers is more psychological adverse expectations for investors, making investors feel fear of the future. Continue to lose money, will the company face the risk of delisting? Will investors sell a large area of selling? This series of unfavorable expectations makes it difficult to hold the shares of Huayi brothers with peace of mind.

Judging from the performance of the Huayi Brothers, the company has lost performance every year since 2018, and the first quarterly report in 2022 is also a loss. It shows that the company's luck is very good, but it is difficult to rely on luck. If you continue to lose money in the future, it will not be guaranteed to be dealt with and enter the delisting process, so now Tencent's reduction of shares may be worsened to the future of Huayi brothers.

So what is the decisive factor of the performance of the Huayi brothers in the future? The development of the epidemic is obviously the most important factor. If the epidemic can quickly pass and the film industry can retaliate, then the performance of the Huayi brothers does not rule out the opportunity to explode; but if the epidemic continues, the bitter days of the Huayi brothers may not have come to the end.

Therefore, Tencent's reduction of shares is due to the fact that the future of Huayi brothers does not report too much fantasy. Investors should also be alert to investment risks, after all, gentlemen do not stand under the wall. When the company's performance really reverses, it may be a certain amount of investment opportunities.

Edit 丨 Zhang Lan Comprehensive Beijing Business Daily (commentator Zhou Kejing), China Securities News

Image 丨 Wind screenshot, fellow flowers shining screenshot, one picture network

- END -

The number of high -proportion of the controlling shareholders pledged the number of listed companies to 250, nearly eight, and nearly eight became the "cooked noodle holes" in the same period last year.

Reporter Xing MengIn recent years, the pledge market of A -share stocks has continued to improve, and the phenomenon of unscrupulous has changed significantly, and market risks are generally control

Vanke Yu Liang no longer shouts "wolf is here": There is no reason to lie down with the most stressful stage.

This year is particularly sad, this is also the most stressful time I have been st...