"Fengkou Research Report · Company" cultivates diamond+semiconductor consumables+military special bearing+wind power high -power main shaft. This company's multiple businesses enter the volume period. The current valuation is still in the industry average offline offline.

Author:Federation Time:2022.08.09

① Cultivate diamond+semiconductor consumables+military special bearing+wind power high -power main shaft. Multiple businesses under the company's business entry volume period, the current valuation is still under the level of the industry average; Increasing space, the company is the leading first -level supplier in China. It will also usher in double production capacity next year. It is expected to enjoy the tide of the era of local alternatives.

"Fengkou Research Report" Today Introduction

1. Company 1: ① The company has strong competitiveness in the field of high -precision, high reliability bearing and high -speed and high -efficiency super -hard materials products. The downstream covers special bearing (military+wind power), cultivated diamonds, semiconductor and other fields. Currently entering rapid development Phase; ② Cultivating the field of diamonds is the company's new profit growth point, which involves the business for foreign sales to synthesize diamonds (cultivating diamonds) and the MPCVD to create the cultivation of diamond blanks. Forging six -sided top compressor business is expected to increase significantly in 2022; ③ In the semiconductor field, the products provided by the Sancha provided by the subsidiaries are mainly semiconductor packaging and cutting wheels, chip knives, etc. The supply of Tongfu Microelectronics; ④ Tianfeng Securities Li Lujing expects the company to return to the mother's net profit from 2022-2024 to 2.39/3.64/457 million yuan, respectively, 87.33%/52.36%/25.56%year-on-year, and the target market value of the company is 10.738 billion yuan Correspondingly the reasonable valuation is 20.29 yuan (currently 16.11 yuan), the first coverage and "buy" rating; ⑤ risk tips: The high -end equipment manufacturing of downstream industry is greatly affected by macroeconomic fluctuations.

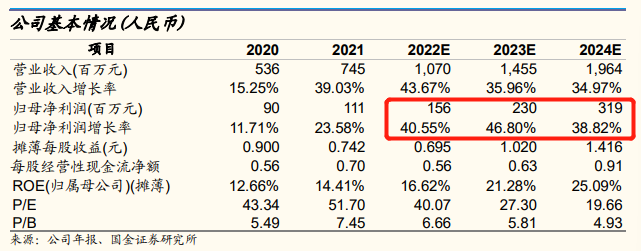

2. Company 2: ① Safety becomes one of the topics that cannot be got rid of the development of electric vehicles. The average passive safety of Chinese cars is worth $ 210, which is still 30%-50%of the space for developed countries. At the same time, the car is passive. The security market is currently dominated by foreign investment, and car companies are increasing localization of localization. Production, in the future, the company will accelerate the development of new customers along the "low-end-independent brand-independent brand high-end-joint venture brand-foreign-funded brand"; The first advantage and overall supporting advantages to further enhance the industry's status. It is expected that the company's net profit of 2022-124 years will be 1.56/2.30/319 million yuan, an increase of 40.55%/46.8%/38.82%year-on-year; The fierce competition in the industrial chain is exceeded.

Theme one

Cultivate diamond+semiconductor consumables+military special bearing+wind power high -power main shaft. Multiple businesses under the company's business enter the volume period.

Cultivating diamonds and semiconductors are currently hot tracks. Tianfeng Securities Li Lujing today covers National Aircraft Precision (002046). Bearing, cultivating diamonds, semiconductor fields. The current company's three arrows are expected to usher in the period of accelerated growth.

Li Lu Jinggong expects the company to return to the mother's net profit from 2022-2024 to 2.39/3.64/457 million yuan, respectively, an increase of 87.33%/52.36%/25.56%year-on-year. For 20.29 yuan (currently 16.11 yuan), the first coverage and "buy" rating.

Bearing industry: Special bearing setting monopoly position, military products+high -end civil products joint support

National Aircraft Seiko is the State Machinery Group's precision industry platform, and the axis research institute+the two -wheeled two -wheeled two -wheel drive. The field research institute is located in the market monopoly position in the field of aerospace special bearing. At present, the company's aerospace special bearings and their components have formed an industrial scale.

1) Military products: The company ranks in the market monopoly in the field of aerospace special bearing. At present, the company's aerospace special bearings and their components have formed an industrial scale. Benefiting from the sustainable development of national defense construction, the steady advancement of aerospace power, and the gradually scale of the commercial aerospace market. Special bearing business is expected to continue to grow;

2) Civil Products: In 2022, the wind power bearing market space is expected to reach 15.6 billion yuan, and the CAGR period during the 14th Five -Year Plan period is 24.19%; at present, the company's 3.2MW wind power main bearing has received batch orders and successfully developed the first 7MW sea wind power main shafts in China , Broken the monopoly of foreign bearing enterprises;

In the context of the large -power main bearing national replacement space, the company will continuously promote the industrialization of high -power wind power main shaft bearing and open the second growth pole of the bearing business.

Cultivate diamonds: Sanmo equipment+product dual -hair power, open the company's new growth curve

Cultivating the field of diamonds is the company's new profit growth point. It involves business for foreign sales to synthesize diamonds (cultivating diamonds) and manufacture diamond blanks by MPCVD.

Foreign sales forging six -sided top compressor: The company's DZ series forging six -sided top compressor represents the leading level of large -scale high -end equipment processing and manufacturing technology of the super -hard material industry. The company's six-sided top compressor production capacity was about 200-300 units in 2021, corresponding to business income of 20-300 million yuan, and gross profit margin of 10%-20%. The company's wholly -owned subsidiary Sanmo Forge six -sided top compressor business is expected to increase significantly in 2022. Cultivate diamond rough by MPCVD (high temperature and high pressure method): The company adopts the MPCVD method, which has formed a certain cultivation of diamond blank production capacity. With the production capacity in terms of production capacity, it ranks among the top domestic industries.

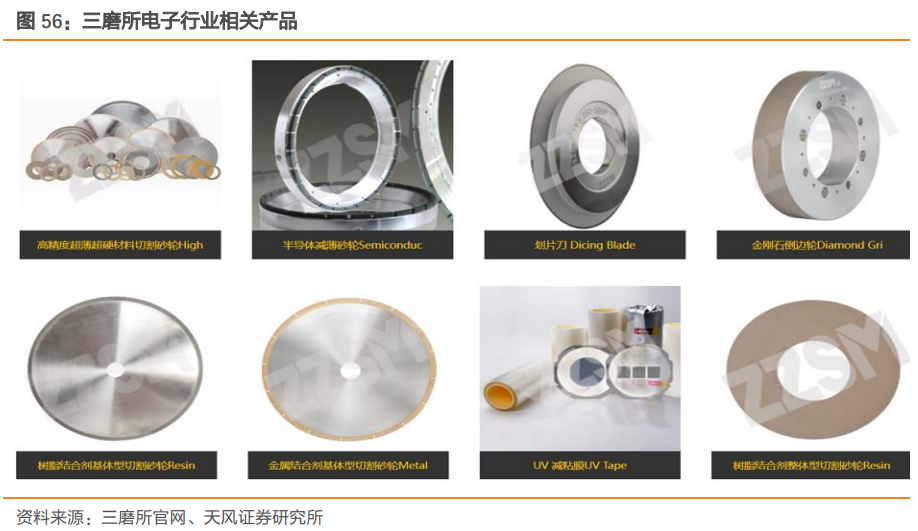

Semiconductor: The overall prosperity of the industry is good, and the consumables have a wide range of spaces.

In the semiconductor wafer cutting session, the cutting knife will be one of the indispensable materials in the semiconductor packaging process for a long time, and its demand will also increase year by year with the growth of the semiconductor integrated circuit and device market.

The semiconductor field of Sanmo Institute has achieved breakthroughs. Entering the supply chain of the semiconductor enterprise: In the semiconductor field, the products provided by Sanmo provided by the subsidiaries are semiconductor packaging and cutting wheels, chip knives, silicon wafer thin sand wheels, ceramic suction cups, UV membrane membrane membranes Wait, realize the main supply of semiconductor packaging and cutting wheels and chip knives products to China Technology, Changdian Technology, Tongfu Microelectronics, Sun Moonlight, SMIC's subsidiaries and other subsidiaries.

There is still a certain gap between the company's product performance and foreign companies, but the company's services and delivery periods are better than foreign companies. In the field of chip processing, the company's products are similar products to foreign companies and compete with them.

Recent high -end manufacturing series in this column:

On August 7th, the semiconductor "comprehensive counterattack, this semiconductor" domestic "simulation+manufacturing+digital EDA triple growth new space opened, and the analyst also gave four cognitions different from the market." On August 4, " A article sort out the robot industry again, not only because of the catalytic brought by Tesla's entry, analysts are optimistic that with the promotion of technological iteration and demand, the industry will start the new era. " The leader has reached a two -year high in hand. This "dark horse" won 21 equipment orders in July. Analysts are optimistic about its platform layout. The two major markets, this company's EPS motor has successfully cut the designated points of 13 projects and more than 30 projects continued to advance, the current valuation is only 20 times "

Theme two

The value of passive safety bicycles in Chinese cars is still nearly 50%of the increase. The company is the leading first -level supplier in China. Next year, the capacity of production capacity will double.

Recently, frequent electric vehicles accidents have appeared in major news headlines. On the ventilation of new energy vehicles, safety has become one of the topics that electric vehicles continue to develop.

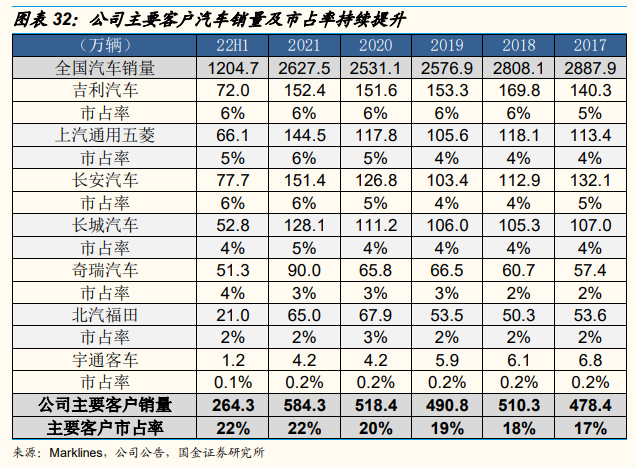

Guojin Securities Chen Chuanhong covers Songyuan (300893) for the first time. The company is the leading domestic supplier of automotive passive safety systems (seat belts+airbag+steering wheel). rank in the field.

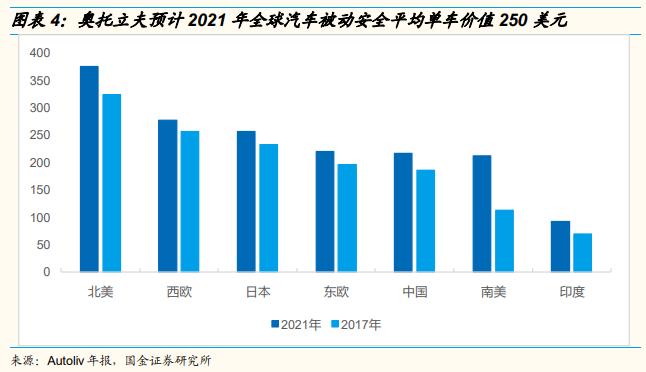

The average passive safety of Chinese cars is worth $ 210, which is still 30%-50%compared with developed countries. At the same time, the automotive passive safety market is currently dominated by foreign investment, and car companies are increasing local procurement.

The main business of the seat belt has become the main business of the company. Since the fourth quarter of last year, the airbags and steering wheel business will achieve mass production. In the future, the company will accelerate the development of new customers along the "independent brand low-end-independent brand high-end-joint venture brand-foreign-funded brand".

Chen Chuanhong is optimistic about the domestic replacement prospect of the car safety system. It is expected that the company's net profit of 2022-124 years will be 1.56/2.3/319 million yuan, an increase of 40.55%/46.8%/38.82%year-on-year.

The value of Chinese cars passive safety average bicycle still has 30%-50%room for improvement, and independent brands ushered in local alternative opportunities

In 2021, the average bicycle value of the North American market is worth more than $ 300, and the average bicycle value of the Chinese market is about $ 210. Compared with developed countries, there is still room for improvement of 30%-50%.

Chen Chuanhong believes that the driving force is: passive safety system functions are more active and intelligent, as well as higher safety standards, stricter regulations and increasingly stringent car safety rating frameworks.

The car passive safety market is currently led by foreign investment. The global leader is Ortolif to Sweden, with a market share of 43%.

With the increase in the price of raw materials, the shortage of parts and components, and the improvement of the comprehensive strength of domestic automotive component companies, car companies have increased their localized procurement efforts, and high -quality autonomous car parts companies are expected to usher in local alternative opportunities.

Matsunhara's seat belt business is profitable, and the airbags and steering wheel business have made breakthroughs

(1) The general business belt has become the main business of the company. The proportion of raw materials is high, and the gross profit margin has maintained a high level of about 30%for a long time.

After the fundraising project was put into operation, Chen Chuanhong expects that the seat belt production capacity will double to more than 25 million units in 2023. In 2022-24, the income of 8.4/10.2/12.35 billion yuan, an increase of 18%/21%/21%year-on-year.

(2) The steering wheel and airbag business have achieved mass production, and in the first quarter, it has continued to obtain a number of car companies recognized, and it is expected to become the second curve of the company's performance growth. Chen Chuanhong expects that the total income of the airbag+steering wheel business from 2022-2024 is 2/4/7 billion yuan, an increase of 4165%/101%/72%year-on-year.

Matsunhara's product structure and customer structure have been continuously optimized, and have been officially recognized by Volkswagen German Headquarters

On the basis of the existing customers, the company's transformation from the original single seat belt assembly product supplier to a system integration supplier of airbags, steering wheels, and seat belts.

In terms of new customers, in 2021, the company's pre -tightening roll device product was officially recognized by Volkswagen's German headquarters, laying the foundation for the company to enter the Volkswagen Global Supply System.

In the future, the company will optimize the customer structure along the "independent brand low-end independent brand high-end-joint venture brand-foreign-funded brand" to accelerate the development of new customers.

Recently in this column car series:

On August 2nd, "Auto Electronics+Semiconductor Drawing Framework+MLCC+Ceramics Board, this car electronic business volume of more than 2 billion small market value companies is imminent, and for the first time after listing, there will be a securities dealer in depth" on August 1 Demand 7 times expansion+value of value of 3 times, this subdivision product has been carried by mainstream models, this company is Tesla's unique supply, increased in this year, or doubled. "On August 1," Electric Vehicle Precision Precision Electric Vehicle Precision The related business of parts and components has become the largest growth engine of this company. This year's revenue is expected to increase by nearly 90%, and it has cut into the Ningde Times, Huichuan, BMW and other industrial chains. " Electronic components, the compound growth rate of compound growth in this field will reach 30%+in the next four years, the total market space or a level of 100 billion, analysts have tapped a new industry main line "on July 31" The valuation is only 1/ 4. The core component of this car thermal management leader has occupied over 20%of the market share, and actively deployed high -voltage fast charging, car electronics and other scenarios to open up new growth curves "

- END -

The General Administration of Market Supervision rectifies the problem of overpackaging of products such as moon cakes

Xinhua News Agency, Beijing, August 17 (Reporter Zhao Wenjun) The General Administration of Market Supervision has launched a two -month -old centralized packaging centralized remediation, focusing on

Enterprise Honor 丨 Win -win equipment won the national specialty new "little giant" enterprise!

Fruit fruit is full of autumnBiographyWin -win equipment wonNational Specialty New...