In the first half of the year, the performance of 61 non -listed life insurance companies was released: 29 net profit of 13.45 billion yuan

Author:Securities daily Time:2022.08.09

In the first half of the year, the performance of 61 non -listed life insurance companies was released: 29 net profit of 13.45 billion yuan 32 total losses of 9.32 billion yuan

As of August 8, most non -listed insurance companies have disclosed the second quarter solvency report, and relevant insurance companies' performance in the first half of the year has also been released. According to the incomplete statistics of the "Securities Daily" reporter, among the non -listed life insurance companies that have been disclosed, 29 companies have profitable, with a total net profit of 13.45 billion yuan; 32 companies have lost money, with a total loss of 9.32 billion yuan.

On the whole, the net profit growth rate of non -listed life insurance companies in the first half of the year fell sharply. The net profit of the above 61 insurance companies was 4.13 billion yuan, a year -on -year decrease of 86%. Interviewed experts believe that the decline in investment income is the main reason for dragging down the performance of non -listed life insurance companies. In addition, the epidemic and other factors have also affected the insured profit.

Non -listed life insurance company

Obvious performance of performance

On the whole, the total net profit of 61 non -listed life insurance companies in the first half of the year declined significantly compared with the same period last year, and the number of losses insurance companies exceeded the number of profit -making insurance companies.

Among the 29 non -listed life insurance companies that have made profit in the first half of the year, Taikang Life, Sunshine Life, Zhongyi Life, and CITIC Promoting Cheng's net profit ranked among the first half of the year. Among them, Taikang Life and Sunshine Life Profit Profit ranked first and second in the net profit ranking of non -listed life insurance companies in the first half of the year, with 6.155 billion yuan and 2.923 billion yuan. 29 non -listed life insurance companies in the first half of the year were 67.5%of the total net profit of the listed life insurance company.

From the perspective of the non-listed life insurance company that loses losses in the first half of the year, China Post Life's net profit losses of 1.78 billion yuan, and the solvency report shows that the yield on the net assets of the postal life in the first half of the year was -5.6%, and the total asset yield was -0.4%. The investment yield is 1.8%, and the comprehensive investment yield is 0.8%. In addition to China Post Life, there are two non -listed life insurance companies lose more than 1 billion yuan in the first half of the year; the other two non -listed life insurance companies have a loss of 500 million to 1 billion yuan; the other 27 losses in the first half of the year loses the losses in the first half of the year. Non -listed life insurance companies have a loss of less than 500 million yuan, of which 11 losses are less than 100 million yuan.

Judging from the data disclosed by insurance companies, the current small and medium -sized insurance companies are facing many problems: one is that some insurance companies' premiums are large, but their net profit is significantly losing money. The product surrender rate exceeds 50%; the third is that it depends more on the investment end, but the investment capacity is obviously insufficient.

Investment and underwriting

Dual pressure

In the first half of this year, both the investment side of the non -listed insurance enterprise and the underwriting end both underwritten, especially the return on the investment terminals generally declined, affecting the net profit growth of insurance companies.

Zhou Jin, a member of the Chinese Financial Industry Management Consultation Partner, told the reporter of the Securities Daily: "Compared with the property insurance company, the short -term operating performance of life insurance companies is more likely to be affected by the fluctuation of the capital market. Big is the most important factor in dragging the profit level of the life insurance industry. "

Huang Dazhi, a researcher at the Star Financial Research Institute, told a reporter from the Securities Daily that the investment income of non -listed insurance companies in the same period last year was higher, and it was one of the important reasons for the significant decline in non -listed insurance companies.

From the perspective of the underwriting side, due to the macroeconomic and epidemic, the growth rate of premiums in the first half of the year of life insurance continued to sluggish. According to the data disclosed by the Banking Insurance Regulatory Commission, the original insurance company's original premium income in the first half of the year increased slightly by 3.5%year -on -year.

Many insurance companies said that the value of new business is under pressure. For example, Taikang Life Insurance said that in the second quarter, the industry was still in a period of high -quality development and transformation. Although premium income was initially stabilized, it was affected by many factors such as the continued increase in downward pressure on the macroeconomic decline and insufficient consumption confidence in the epidemic. Delays, the offline exhibition industry will be tested, and premium income and new business value will continue to be under pressure.

Regarding the pressure of small and medium -sized life insurance companies at present, Zhou Jin said that compared with the short -term fluctuations of the investment end, the impact of insufficient customer operating capacity and the weak channel sales is more serious, which is the most important reason for small and medium -sized life insurance companies to face business difficulties. Markets and consumers have entered a new period, but some insurance companies' operating models and competitiveness are still on the old track.

Regarding the development trend of the life insurance industry in the second half of this year, Zhou Jin said that there is certain uncertainty in the capital market in the second half of the year, but the underwriting end may still be under pressure, and the industry will continue to explore and try on a high -quality transformation road.

Huang Dazhi said that the performance of insurance companies in the second half of the year still depends on variables such as stock market fluctuations, the bases of investment income last year, and new business value. Among them, the investment income of insurance companies in the second half of last year was not as good as the first half of last year, so the pressure of performance growth in the second half of this year may ease.

"At the underwriting end, small and medium -sized life insurance companies must continue to improve customer operating capabilities, especially the ability to strengthen customer needs in the digital era, product custom design, customer experience improvement, comprehensive service system, and marketing model innovation. . On the investment side, we must make full use of the long -term characteristics of insurance funds, give full play to the long -term return advantage of equity investment, increase the construction of investment and research capabilities and large -scale asset allocation capabilities, and use the value investment concept of crossing cycle Mission and winning differentiated competitive advantages, "Zhou Jin said.

Ma Xiao, director of the strategic development department of Huixuan Insurance, told reporters that in the short term, the growth rate of my country's danger market has slowed down, but long -term development potential is still favored by the market. There are three reasons. The revenue of dominance continues to increase; the second is the increase in the willingness of residents to save; the third is that the danger penetration rate of people in my country is still at a lower level.Based on this, insurance should pay attention to refined operations, conduct differentiated operations for different customer groups, and further dig out customer value.(Reporter Su Xiangyi) [Editor in charge: Li Tong]

![]()

- END -

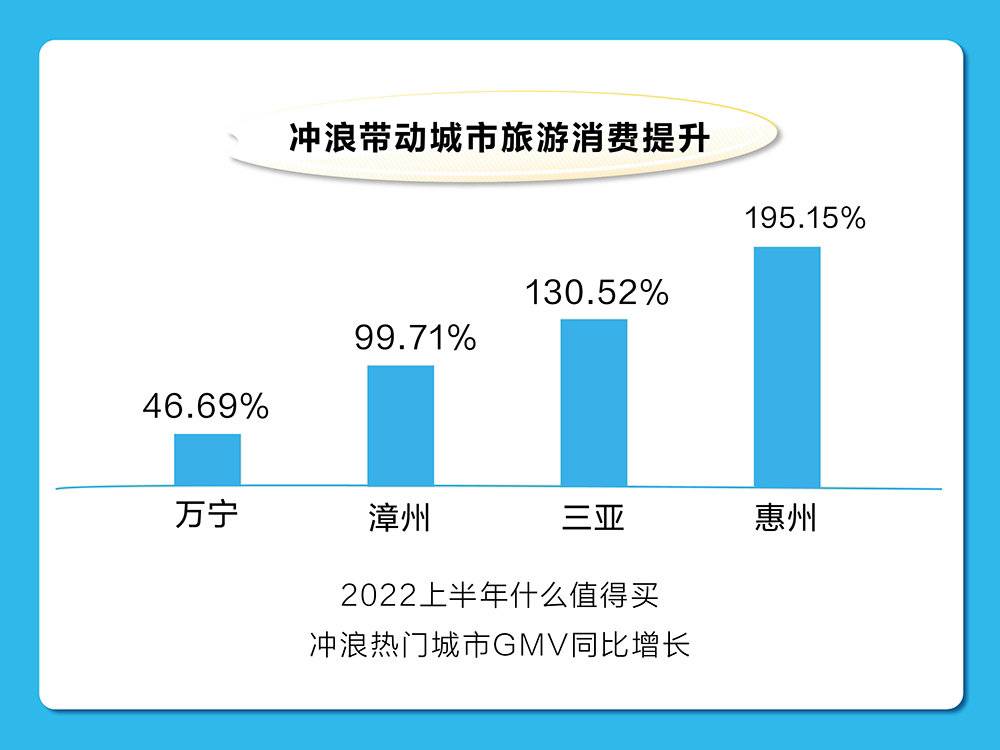

New consumption observation 丨 domestic surfing boom gradually starts, and the field of rinse consumers is still in its infancy

Cover reporter Wu YujiaIn the past, there was a wave of national movement in the W...

The list of Fortune 500 companies is released!Two companies in Hebei are on the list

On August 3, the top 500 list of the Fortune World 500 in 2022 was officially rele...