In a record, it lost 158 billion in three months, and the venture capital giant defeated!Former richest man in Japan: The cost will be reduced by the use of layoffs and other means

Author:Daily Economic News Time:2022.08.09

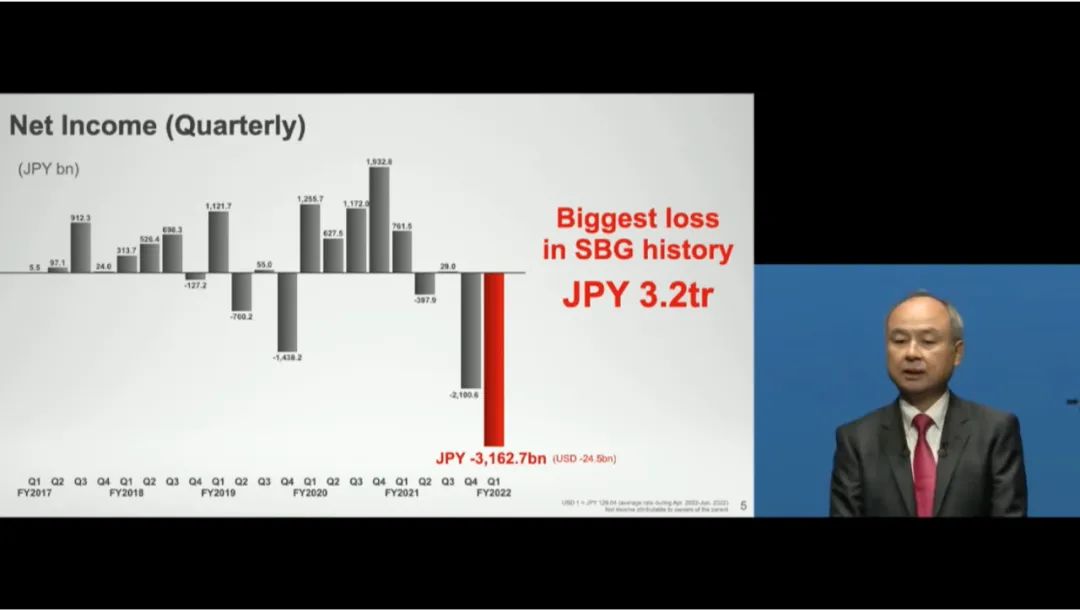

On the afternoon of August 8th, the SoftBank Group (hereinafter referred to as "SoftBank"), a subsidiary of the richest man in Japan, released its performance report in the first quarter of the 2022 fiscal year (three months as of June 30, 2022). The report shows that in the first quarter of fiscal year in fiscal year, the net loss of SoftBank shareholders was 3.16 trillion yen (about RMB 158 billion), and this number also refreshed the company's loss record.

In addition, SoftBank's investment loss was 2.83 trillion yen (about 20.7 billion US dollars) in the first quarter; two high -profile funds of SoftBank lost 2.91 trillion yen (about 21.4 billion US dollars), of which 63.14 billion yen were attributed to the due to Third party interests.

At the press conference, the chairman of SoftBank and CEO Sun Zhengyi admitted that this is the biggest loss since the establishment of the company. The current situation is actually more unsatisfactory than June. Among them, the investment losses are mainly due to the turmoil of the global stock market and the rapid depreciation of the yen. The newly released financial report also reported 820 billion yen of foreign exchange losses.

(Picture source: SoftBank Online Conference)

At the same time, he emphasized that the main strategy for the vision fund at this stage is: to increase the standards for new investment, increase the value of the current investment portfolio, and reduce operating costs; Pursuit of vision goals. Earlier, according to foreign media reports, SoftBank sold about one -third of Alibaba shares held through a prepaid long -term contract this year to quickly raise cash at the time when science and technology investment plummeted.

Vision Fund with a loss of 2.91 trillion yen

At this performance conference, the vision fund is still one of the most mentioned topics mentioned by Sun Zhengyi. The grades of the 100 billion -level technology funds that are highly hoped by investors have really been unsatisfactory in the past year. The financial report shows that in the first quarter of fiscal year in fiscal year, SoftBank's investment loss was 2.83 trillion yen, and the investment loss of the vision fund was 2.91 trillion yen (of which 631.4 billion yen were attributed to third -party interests).

Specifically, as of the end of June 2022, the Fund Fund of SoftBank Vision held 80 investment projects, and in the first quarter, it added a $ 60 million investment in the existing target. In the first quarter, the first phase of the fund achieved a loss of 30.5 billion yen; the valuation loss (unrealized) of the investment portfolio was 1.22 trillion yen. Investment losses are mainly economic recessions caused by global inflation and upward interest rates. The global stock price decline and the fair value of investment portfolio companies decline.

SoftBank Vision Phase II Fund conducted a new investment of US $ 2.11 billion in the first quarter and the addition of existing investment projects. As of the end of June, the fund held 269 investment portfolio; in the first quarter The valuation loss (not realized) of the investment portfolio is about 1.33 trillion yen; the cause of valuation loss is similar to the first phase of the fund.

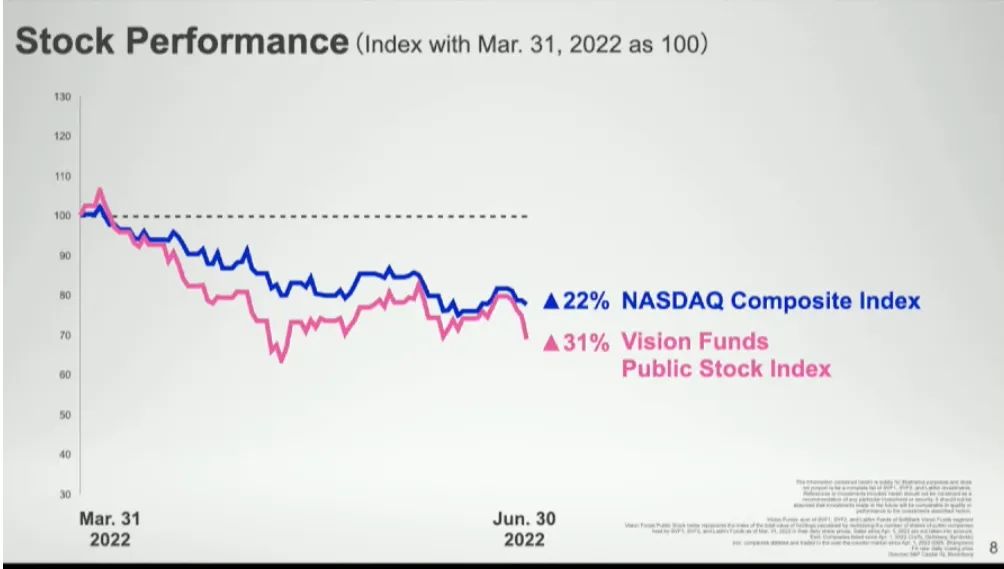

Investment company's stock price performance is worse than the Nasdaq index

At the press conference, Sun Zhengyi said that investment losses mainly originated from the turbulence of the global stock market and the rapid depreciation of the yen, and admitted that the performance of Vision Fund Investment Company in the secondary market is worse than the Nasdaq Composite Index.

According to its introduction, SoftBank Vision No. 1 and Two Fund, as well as SoftBank Latin America Fund, has invested 473 companies worldwide. He admits that the first phase of the vision fund has learned from many of the previous investment. Didi, WeWork, and Uber were typical examples. "At that time, I had strong emotions for some specific companies and business models, but I am also among them. We have learned lessons, so we have become more systematic and smaller checks to ensure better benefits. "

Earlier, some foreign media reported that SoftBank Group has sold 213 million Alibaba shares that has been sold through a long -term contract this year, accounting for about 1/3 of its positions, and it is expected to cash out about $ 22 billion.

At the press conference, Sun Zhengyi mentioned that the change in Alibaba's stock price was also one of the important reasons that affecting the changes in SoftBank's investment income. As the company's high -quality liquidity assets, Alibaba's stock price has fallen from $ 309.92/share at the peak of 2020 to $ 92.56/share (closed on August 5). Therefore, Alibaba's contribution to its investment income is also declining.

However, he also believes that among the 473 companies in the vision layout, they may grow out of Alibaba and ARM in the future; and say that SoftBank will listen to and learn the business model of these companies more, and will continue to use resources to invest in resources. With greater risks and the goal of pursuing vision, "these investment combinations give me a deep impression, and I also continue to believe in them."

SoftBank continues to "cut meat" cash,

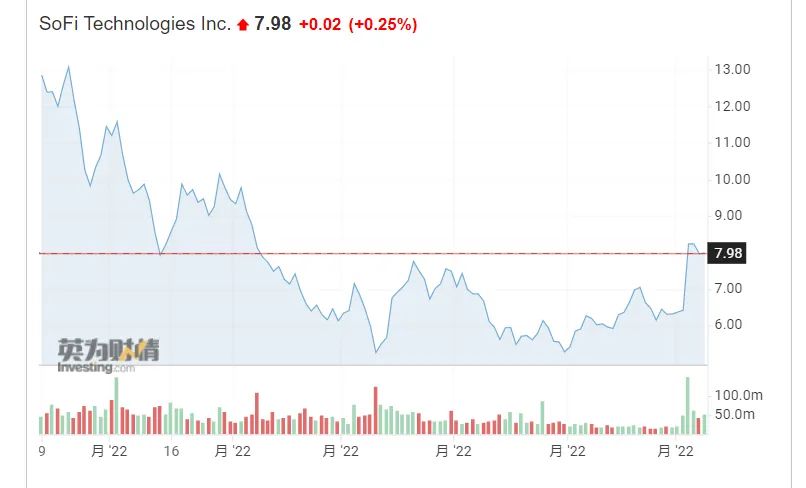

Reduce holding Sofi TECHNOLOS

According to the documents submitted to the US Securities and Exchange Commission on Monday, SoftBank sold about 5.4 million Sofi TECHNOLOGIES shares at a weighted average price of $ 7.99 on August 5. On Monday, it sold 6.7 million Sofi TECHNOLOGIES shares at an average price of $ 8.17. The document shows that as of June 30, a subsidiary of SoftBank has 83.2 million Sofi TECHNOLOGIES.

SOFI TECHNOLOGIES is an online personal financial company and online banking in the United States. SOFI is headquartered in San Francisco. It provides financial products through mobile applications and desktop interfaces, including re -financing of students and car loans, mortgage loans, personal loans, credit cards, investment and banking business. SOFI TECHNOLOGIES has fallen by nearly 50%this year. Image source: Yingwei Caiqing

It is worth mentioning that SoftBank withdrew from the holding of Uber in the first quarter. In the original imagination of SoftBank, Uber should have become a star stock in its investment portfolio. According to Sun Zhengyi, in the last quarter, SoftBank's recorded 284 companies in his investment portfolio, only 35 companies. He also said that SoftBank is strictly restricting new investment.

According to CNBC, SoftBank said that it sold all the Uber shares it held at a price of $ 41.47 per share at a average of $ 41.47 per share. SoftBank said the average cost per share was $ 34.50, so the company sold Uber shares in a profit -making manner.

"Daily Economic News" reporter noticed that SoftBank invested in Uber in 2018 and 2019, and once became its largest shareholder. Last year, SoftBank sold about one -third of its shares in Uber.

Sun Zhengyi said earlier on Monday that after a record of about $ 23.4 billion in losses, he plans to cut costs in his company and vision funds in Tokyo.

"We have to expect the cost of reducing the vision fund (overcome) through a large -scale cutting vision fund. The way to cut costs will have to include layoffs -this is what I have made up to do." Sun Zhengyi said that he would consider "everything" Possible cutting costs, including layoffs, should be "unquestionable."

Since the beginning of this year, Softbank's stock price has fallen by 12%, and the cumulative Japanese stock price has risen by about 4%.

Reporter | Tang Ruyu, Li Menglin Zheng Yuhang (Internship)

Edit | Ye Feng Gaohan He Xiaotao Dubo

School pair | Duan Lian

Cover picture source: video screenshot

| Daily Economic News nbdnews original article |

Reprinting, excerpts, replication, and mirroring are prohibited without permission

Daily Economic News

- END -

In just one quarter, an increase of 1214.84%!Who is making 200 billion cakes in Daimongye Stock Fund?

China Times (chinatimes.net.cn) reporter Hu Jinhua, an apprenticeship reporter Gen...

"Zhichuang TOP" starting project industrial agglomeration effect first shows

At the centralized signing ceremony of the third key project of 2022 Putuo Distric...