Real estate debt financing growth, average cost innovation low

Author:Xiaoping Finance Time:2022.08.09

With the advancement of real estate rescue policies, real estate credit bond financing has also increased rapidly. In addition, the cost of financing is not high, the main rating of the issuance of bonds is high, and the sign of the industry's recovery shows that it is worthy of attention.

Real estate credit bond issuance financing situation

The scale of real estate bonds has been issued since this year. Data show that driven by policy, 400 real estate credit bonds have been issued this year, of which 396 only completed 358.631 billion yuan, a large scale.

Specifically, the distribution scale in January and February was above 30 billion, and March climbed significantly to 73.76 billion yuan. Immediately after the second quarter, real estate bond financing was stable, and basically fluctuated from 50 billion yuan. In July, it rose sharply to 58.86 billion yuan in July, a significant increase of 22.81%from June, and rose to the second peak of monthly issuance. It can be seen that with the support of policies, debt financing in the real estate industry is obvious.

Financing costs have decreased

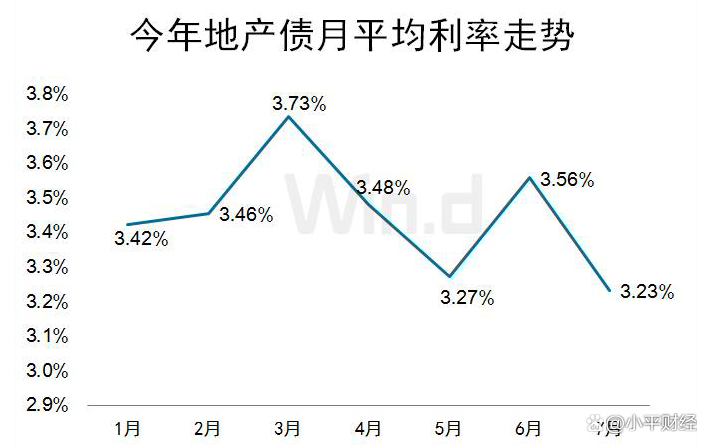

With the policy support, the market liquidity is abundant, and the cost of financing of real estate bonds is declining. The data shows that the monthly issuance of ticket rates issued for the monthly distribution is below 3.5%in January and February. With the increase in the issuance scale in March, the average interest rate also reached the highest at 3.73%. After the continued decline in April and May, there was a rebound in June, and the average interest rate in July fell to the lowest year to the lowest at 3.23%. It can be seen that although the average interest rate of real estate bonds has rebounded from time to time, it is gradually exploiting. In addition, the average monthly interest rate of each month is less than 4%, and it is in a lower position in credit bond financing, which is conducive to enterprise development.

Subject rating situation

The lower financing cost means that the issuer's rating is higher. Data show that the real estate bonds issued this year, except for 57 without rating, only "22 days of 01" 1 bond when issuing a bond. All AA or above. The AAA class has a maximum of 264, accounting for 66%. It can be seen that after the industry crisis, the high -grade rating of the real estate corporate institutions that still run.

In general, debt issuance of debt issuance in housing enterprises has recovered, and the cost of bond financing is not high. It has become a better fundraising channel. However, state -owned enterprises and central enterprises are still the main force. Recently, there are various types of issuance, including green debt, housing leasing bonds, and mergers and purchases of debt. The issuer has gradually covered high -quality private enterprises, and the company's development recovery is expected.

- END -

From January to May 2022, the total retail sales of consumer goods fell by 1.5%

China Economic Net, Beijing, June 15th. According to the website of the National Bureau of Statistics, from January to May, the total retail sales of social consumer goods was 1716.89 billion yuan, a

Two industry fusion experience exchange | Guiyang Economic and Technological Development Zone: Promote the digital transformation of the full chain of traditional industries

In recent years, the Guiyang Economic and Technological Development Zone (hereinafter referred to as the Economic Development Zone) has seized the opportunity for the integration of the two industri