In advance to repay the loan of 2 million yuan in advance, pay 20,000 yuan in compensation?The new rules of the Bank of Communications are questioned

Author:China Consumer News Time:2022.08.09

With the decline in deposit interest rates and wealth management income

"Whether to repay the mortgage in advance" topic

Rush on the hot search

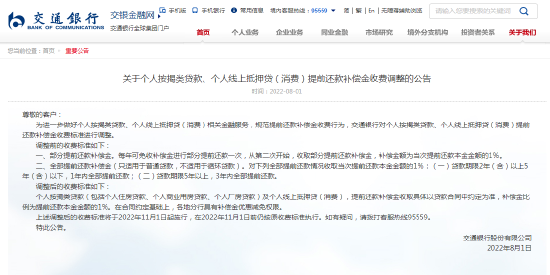

Recently, Bank of Communications released on the official website

"About personal mortgage loans, personal online mortgage (consumption)

Announcement of Adjustment of Pay Compensation Charges in advance ""

Attract attention

Should "compensation" be collected in advance to repay the mortgage?

Can the bank be adjusted with a paper announcement

Early repayment compensation rate?

"China Consumer Daily" reporter conducted an interview investigation

On August 1, Bank of Communications issued an announcement saying that starting from November 1, 2022, personal mortgage loans and personal online mortgage loans (consumption) including personal housing loans, personal commercial housing loans, personal factory loans, and personal factory loans (consumption) The collection of early repayment compensation is subject to the depends on the loan contract, and the compensation ratio is 1%of the amount of the initial repayment principal. On the basis of the contract, branches in various places have preferential compensation and exemption permissions.

It is understood that before the adjustment

Bank of Communications' early repayment

Compensation fee standards are divided into two types

01

The first is partially repayed compensation in advance

Each year can be exempted from the compensation for partial repayment once, starting from the second time, the collection of some repayment compensation is collected, and the compensation amount is 1%of the amount of the principal repayment in advance.

02

The second is the full repayment compensation (only applicable to ordinary loans, not applicable to circular loans)

If the loan period is 2 years (including) or less (inclusive) or less, and will be repaid in advance within 1 year, or the loan period is more than 5 years, and all of them will be repaid in advance within 3 years. 1%of the amount of money.

That is

After adjustment, the repayment is charged in advance

No longer enjoy reduction

As soon as the announcement came out, it immediately caused controversy. Mr. Lin, a loan intermediary, told the reporter of the China Consumer News:

The so -called compensation is also a baedy liquidated damage in advance. Most of the mortgage business will agreed to collect a certain breach of liquidated damages within a certain period of time (such as within two years after the loan is issued). "However, most of the mortgages in first -tier cities are several million yuan. If 1%of the repayment principal is received, it is quite high."

Ms. Wang, a Beijing citizen who just changed the room, also questioned the charging rule. Ms. Wang said that in order to change the house, she must sell the original house, and the premise of selling is to repay the mortgage in advance:

""

"If you charge more than 2 million yuan in mortgages, it will have to give banks more than 20,000 yuan. Originally, the interest rate of bank mortgages was high, and it was too unreasonable to receive advance repayment compensation."

"

Dong Ximiao, chief researcher at the Institute of Internet Finance of Zhongguancun Internet Finance, pointed out in an interview with a reporter from the China Consumer Daily that the "Notice on Further Regulating Credit financing fees to reduce the comprehensive cost of corporate financing" issued by the China Banking Regulatory Commission in May last year was clearly required. Credit financing shall not be repaid in advance or delayed deposits in the loan contract. Although it is aimed at financing of small and micro enterprises, the principle and spirit of reducing the cost of real economy financing are also applicable to residents. Moreover, the statistical caliber of inclusive micro loans includes individual industrial and commercial households who apply for loans in the name of natural persons. Therefore, the Bank of Communications issued an announcement that the "compensation" of the personal loan's "compensation" to tighten the collection conditions and improve the corresponding standards, which is neither wise, and it violates the spirit of the documentation of the regulatory authorities.

Reporter investigation found

Currently, various banks repay the mortgage in advance

Whether the compensation regulations are charged are different

The reporter learned from many bank customer service personnel in Beijing that at present, the mortgage is repaid in advance at the Industrial and Commercial Bank of China, the Construction Bank, and the China Merchants Bank, and no compensation is required. However, some consumers posted in the Mizuki community that they were charged when they repaid their loans in advance in the Bank of China.

Dong Ximiao said that in practice, few banks collect liquidated damages (compensation) on early repayment behavior. Even if a small number of banks have received a liquidated damages (compensation), customers can often apply for exemption, or obtain exemption by purchasing a certain amount of financial products or deposit deposits in deposits.

The bank passes the announcement method

Random adjustment of advance repayment charging methods

A ritual of infringing the contract for buyers

It is worth noting

After triggering controversy

Bank of Communications on August 2nd

Withdraw the above announcement

Then, withdraw the announcement

Does it mean no charge?

In this regard, the Bank of Communications customer service said on August 4th to the reporter of the China Consumer News that due to the different provisions of the collection methods of compensation for each branch, the specific situation should be asked for the loan manager in detail. In practice, it shall be implemented in accordance with the relevant agreement of the loan contract.

Dong Zhengwei, a lawyer of Beijing Lianggao Law Firm, said in an interview with the China Consumer Daily that the agreed liquidated damages collected by the bank in advance are in line with the principles of contract legal. However, the bank has adjusted the early repayment charging method through the announcement method, infringing the contract negotiation of the buyer. Moreover, if the previous borrowing contract agreed on the method of repayment in advance, the charging method announced by the bank is not higher than the agreed fee, which is a burden on the buyer and acceptable. If the loan contract does not agree to pay the paid method in advance, and now adjust the charging method, it is illegal to increase the charging of bank unilateral announcements.

"Since the beginning of this year, the financial management department has repeatedly required banks to take practical measures to actively solve the difficulties of enterprises and individuals to reduce the cost of comprehensive financing of the real economy. Therefore, after the Bank of Communications issued this announcement, it is expected that other commercial banks will not follow up simultaneously."Dong Ximiao suggested that the regulatory authorities and industry associations should regulate and strengthen supervision in response to personal loans repayment of contracts in advance.Produced by Chinese Consumer Newspaper New Media Editorial Department

Source/China Consumer News · China Consumer Network

Author/Nie Guochun

Edit/Li Xiaoyu

- END -

Seven hard core measures to promote the development of high -green black cattle entire chain industry

□ Zibo Daily/Zibo Evening News/Expo NewsReporter Ma ShuyanOn the morning of July ...

Fan Wenzhong: The core positioning and development path of the data exchange

On July 29, the 2022 Global Digital Economic Conference was held at the National C...