Layout lithium battery negative material field Fuans shares plan to acquire 100%equity of Tianquan Fu saddle

Author:Daily Economic News Time:2022.08.09

On the evening of August 9th, Fu An (SH603315, the stock price of 26.61 yuan, and a market value of 8.17 billion yuan) issued an announcement saying that it is intended to purchase the shares and pay cash. Saddle) 100%equity, trading consideration is 3.6 billion yuan. After the transaction is completed, the main business of the listed company will add lithium battery littering processing business.

"Daily Economic News" reporter noticed that many listed companies have "increased" in the field of lithium battery negative materials.

Deepen the lithium battery industry chain layout

Fuansian Co., Ltd. is mainly engaged in the production and sales of large -scale cast steel parts of flue gas treatment engineering services and energy management engineering services, as well as major technical equipment supporting large -scale cast steel parts.

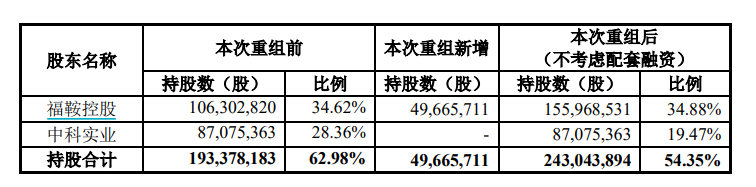

Fugu Holdings is the controlling shareholder of Fu'an. As of the end of March 2022, Fu'an Holdings directly held 106 million shares of listed companies with a shareholding ratio of 34.62%. The company holds 870.754 million shares of listed companies, with a shareholding ratio of 28.36%.

Picture source: Fu An Holdings Announcement

Tian Quanfu saddle was established in May 2019. It is mainly engaged in the graphization processing business of lithium battery negative materials. As of now, Fu'an Holdings, Li Shijun, Wei Fujun, Wei Gang, Li Xiaopeng, and Li Xiaofei hold 40%, 20%, 18%, 13%, 4.5%, and 4.5%of Tianquan Futda.

Picture source: Fu An Holdings Announcement

In this transaction, Fu'an plans to issue shares and pay cash to purchase Fuans Holdings, Li Shijun, Li Xiaopeng, Li Xiaofei, Wei Fujun, and Wei Gang. After the transaction is completed, Tian Quanfu saddle will become a wholly -owned subsidiary of a listed company.

In terms of finance, in 2020, 2021, and January to March 2022, Tian Quanfu saddle realized operating income of 14.4647 million yuan, 245 million yuan, and 108 million yuan, and the net profit attributable to the mother-in 283.459 million yuan.

The shareholders of Tian Quanfu Saders promised in 2022, 2023, and 2024. The net profit realized by Tianquanfu was not less than 188 million yuan, 494 million yuan and 560 million yuan, respectively. The profit is not less than 1.242 billion yuan.

Fuansian shares stated that the acquisition of Tianquan Fu ADATE will increase the asset -liability ratio of listed companies and increase financial expenses. However, in the long run, these matters are conducive to the transformation and upgrading of the listed company's industry, deepen the layout of the lithium battery industry chain, and achieve good investment income, enhance the return of all shareholders, and improve the financial situation of listed companies.

Many listed companies "add"

As a hot lithium battery negative material field in the capital market, many listed companies have been "added" since this year.

According to Jinbo (SH688598, the stock price is 37.0.9 yuan, and the market value of 34.19 billion yuan) announced on August 5th. The demonstration line is expected to exceed 281 million yuan. The project is expected to start construction from August 2022, and its production will be reached in August 2023. The construction period is expected to be 1 year.

On July 28th, the announcement announcement was disclosed by SH603659, the stock price was 73.18 yuan, and the market value was 101.8 billion yuan). The annual output of 960 million square meters of base film coating integrated construction projects and supplementary funds.

In addition, Betry (BJ835185, the share price of 67.9 yuan, a market value of 49.44 billion yuan) announced on June 24, and the proposed additional fundraising will not exceed 5 billion yuan. The fundraising funds will be used for the expansion project of 40,000 tons of silicon -based pole materials (first phase) and Bateri (Sichuan) New Material Technology Co., Ltd., an annual output of 50,000 tons of high -end graphite negative materials Supporting projects, Yunnan Betry New Energy Materials Co., Ltd., an annual output of 200,000 tons of lithium battery negative electrode material integrated base project (first phase), etc.

At the same time, Betry's wholly -owned subsidiary Beatri (Hong Kong) New Materials Co., Ltd. intends to sign a joint venture agreement with Stellar Investment Pte.ltd. Projects, the total investment of the project is about $ 478 million.

Zhongke Electric (SZ300035, the stock price of 28.7 yuan, and a market value of 20.76 billion yuan) with the main business includes the lithium battery negative material business), which was raised by 2.206 billion yuan in March this year, and the raised funds were launched to all the main business of the listed company.

Daily Economic News

- END -

The deputy chief of the science and technology gathered "group" to the "Zibo Road"

□ Zibo Daily/Zibo Evening News/Expo NewsReporter Zhao Ruixue Correspondent Zhang ...

Longyou farmers have "knocking on the door"!The "Family Asset Pool" financing model broaden the Gongfu Road

Thanks to the new model of financing of Yishang Bank 'Family Asset Pool', with my ...