Heavy!The latest statement of the central bank: No currency, strengthen the supervision of deposit interest rates

Author:Zhongxin Jingwei Time:2022.08.10

Zhongxin Jingwei, August 10th, the central bank website released the report of China's monetary policy in the second quarter on the 10th (hereinafter referred to as the report). What is the direction of monetary policy in the next stage? What is the level of price? How does real estate develop? The above report gives the answer.

Stick not to engage in "big water"

Strengthen the implementation of stable monetary policy, give full play to the dual functions and structural dual functions of monetary policy tools, take the initiative to respond, boost confidence, do a good job of cross -cyclical adjustment, take into account short -term and long -term, economic growth and price stability, internal equilibrium and external balance , Persist in do not engage in "big water drilling", do not exceed currency, and provide more powerful and high -quality support for the real economy.

Focus on supporting the construction of infrastructure fields

Maintain reasonable liquidity, increase credit support for enterprises, make good use of policy development financial instruments, focus on supporting the construction of infrastructure, maintain a reasonable increase in currency supply and social financing scale, and strive to achieve the best results of economic operation realization. Essence

Keep the level of price basically stable

Pay close attention to changes in the inflation situation at home and abroad, continuously consolidate the favorable conditions for domestic food stable production and the stable operation of the energy market, and make proper responses to maintain the level of price.

Increase the support of inclusive micro loans

Structural monetary policy tools actively do a good job of "addition", increase support for inclusive small and micro loans, support small and medium -sized enterprises to stabilize employment, and use good use of coal clean and efficient utilization, technological innovation, inclusive pension, transportation and logistics special loans and re -loans and re -loans of transportation and logistics Carbon emission reduction support tools, promote financial resources to key areas, weak links, and industries that are seriously affected by the epidemic, and to cultivate new economic growth points.

Strengthen deposit interest rate supervision

We will improve the formation of market -oriented interest rates and conduction mechanisms, optimize the central bank's policy interest rate system, strengthen the supervision of deposit interest rates, give play to the important role of the market -oriented adjustment mechanism of deposit interest rates, focus on stabilizing the cost of bank liabilities, give play to the effectiveness and guidance of the loan market quotation interest rate reform, promote reducing enterprises to reduce enterprises Comprehensive financing costs.

I mainly take into account the internal and external balance

Pay close attention to the impact of the economic trend of major developed economies and the overflow of monetary policy adjustment, and take care of the balance of internal and external balance.

Keep the RMB exchange rate reasonable and balanced level basically stable

Adhere to the market supply and demand, refer to a basket of currency to regulate and manage the floating exchange rate system, adhere to the bottom line of thinking, strengthen the macro -prudential management of cross -border funds flow, and maintain the basic stability of the RMB exchange rate at a reasonable and balanced level.

Keep the bottom line of no systemic financial risk without having a systemic financial risk

Follow the principle of marketization and rule of law, coordinate economic development and risk prevention work, maintain the overall stability of the financial system, and resolutely adhere to the bottom line that does not occur without systemic financial risks.

Steady implementation of real estate finance and prudent management system

Firmly insist that the house is used to live, not for speculation, insist on not using real estate as a means of short -term stimulation economy, and insist on stable price, stable house prices, and stable expectations. Rigid and improving housing needs, steadily implement real estate and finance management systems, and promote the healthy development and virtuous circle of real estate markets.

Reduce the cost -aversion cost of exchange rates of small and medium -sized micro -enterprises

Further develop the foreign exchange market, guide enterprises and financial institutions to establish a "risk neutral" concept, and guide financial institutions to actively provide exchange rate shelter services to small and medium -sized enterprises based on the principle of actual demand and risk neutrality, reducing the cost of exchange rate shelter in small and medium -sized micro -enterprises. Maintain the smooth and healthy development of the foreign exchange market.

Increase the investigation and punishment of the illegal behavior of the bond market

Increasing the bond market's innovative support for key areas and weak links, and improving the quality of the bond market to serve the real economy. Strengthen the supervision of the bond market, adhere to the principle of marketization and rule of law, continue to implement the concept of "zero tolerance", increase investigation and punishment of illegal and illegal behaviors of the bond market, and timely prevent and resolve the risk of the bond market in a timely manner. We will unswervingly promote the opening of the bond market.

Improve system importance financial institution supervision

Improve the system of prevention, early warning, disposal, and accountability for financial risks, and build a long -term mechanism for preventing and resolving financial risks. Further improve the macro -prudential policy framework, improve systemic risk monitoring, evaluation and early warning capabilities, and enrich the macro -prudential policy toolbox. Improve the supervision of system importance financial institutions, promote the importance of system importance banks to meet the additional supervision requirements on time, accelerate the promotion of my country's global system importance banks to establish and improve the total loss and absorption capacity, and effectively improve risk resistance. (Zhongxin Jingwei APP)

- END -

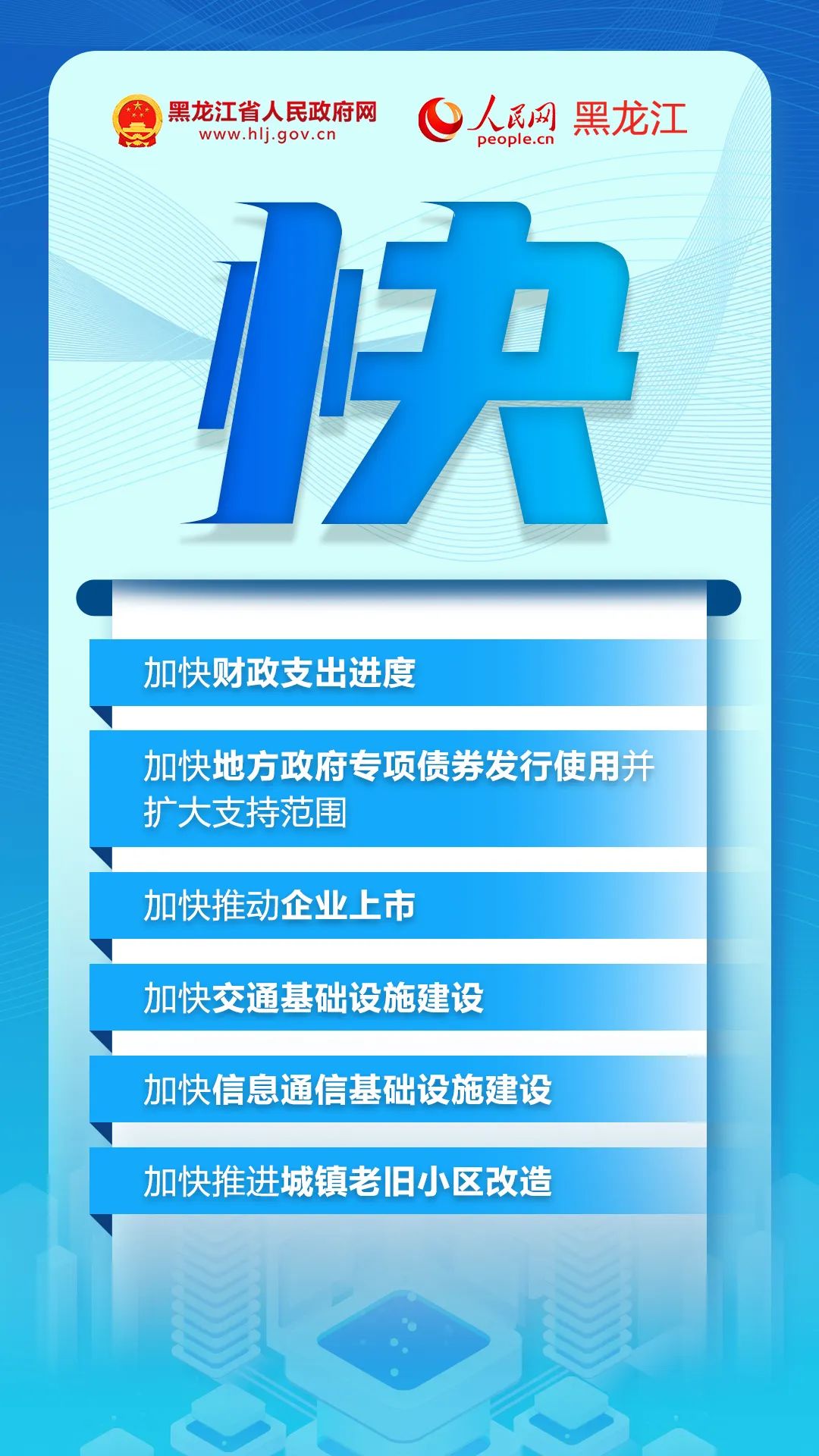

Five keywords, look at the stable economic tricks of Longjiang!

A few days ago, the Heilongjiang Provincial Government issued the \Implementatio...

Three keywords, visit the city's "stability" and "entering" confidence

On July 20, Wangcheng's transcript in the first half of the year was released.Data...