Chongqing Liangjiang Bank Insurance Agency "Five Great Tackling Actions" stabilize the economic market

Author:Cover news Time:2022.06.17

Wang Dan cover news reporter Li Maocca

On June 17, the cover news learned from the Chongqing Liangjiang New Area that the Liangjiang Banking Regulatory Bureau launched the "Five Tackling Actions and Stable Operations" to guide the New District Bank insurance institutions to use more powerful measures to promote market confidence.

According to the person in charge of the Liangjiang Banking Regulatory Bureau, this plan is the expansion and upgrade of the early stable economic measures, focusing on five aspects: guiding bank insurance institutions to support new citizens' employment, living, education, etc. as the starting point, stimulating domestic demand to stimulate domestic demand Growth; take the opportunity to build the "City of Smart Finance in the New Area of Two Rivers" as an opportunity to increase support for science and technology enterprises; guide financial institutions to actively connect 33 key industrial chains in the core enterprises of Chongqing and upstream and downstream financial needs, optimize the industrial chain supply chain finance Services; increase financial support for key areas and difficult industries; innovate pilot pilots in cooperation with "silver administration insurance" for food safety liability insurance.

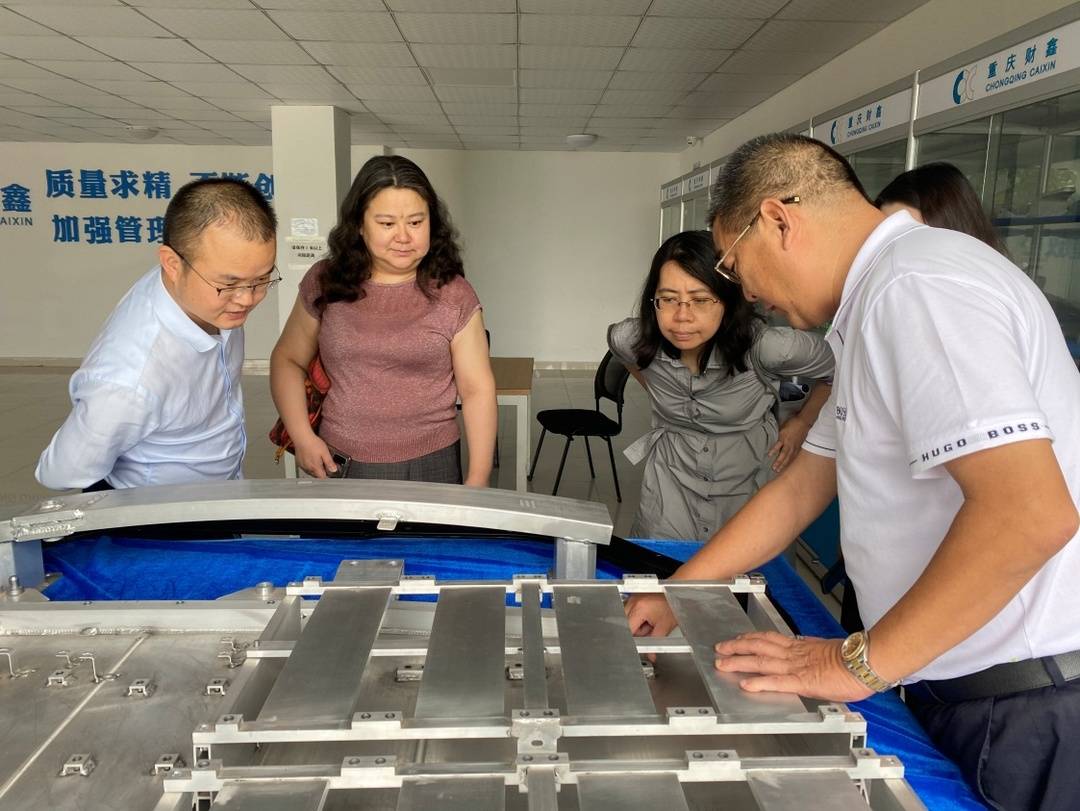

The staff of the ICBC Liangjiang Branch went to a new energy vehicle supporting manufacturer to understand the production and operation of the enterprise.

Escort "new citizen" entrepreneurial employment

Ms. He, a "new citizen" who started a business in Henan, was originally a grass -roots salesperson of a wire company in Chongqing. After more than 10 years of hard work, she accumulated a wealth of work experience and contact relationship with her husband. Sales company.

After understanding the situation, the Postal Savings Bank's Liangjiang Branch quickly matched the long -term and loan mortgage loans for its long -term period and borrowed it to the company.

This is a microcosm to support financial support for the entrepreneurial employment of the "new citizen" group. Focusing on the key people's livelihood fields such as entrepreneurship, employment, and comprehensive consumption in new citizens, the bank financial institutions of Liangjiang New District explore the "new citizens" group service ideas through questionnaire surveys, field surveys, and park preaching. Provides financial support for entrepreneurship.

Improve the guarantee of science and technology and financial services

Liangjiang New District Bank insurance institutions are also using fintech wisdom to improve service guarantee to stabilize the development of the new district project.

For example, the Bank of Chongqing's Liangjiang Branch further weakened the traditional pledge guarantee requirements for the "specialized new" enterprise. Through software copyright pledge, it provided a "specialized new" enterprise with difficulty in financing of 5 million yuan.

The Bank of China Liangjiang Branch, in terms of the characteristics of some "specialized new" enterprises light assets, high investment and other characteristics, flexibly use the policies of non -repayment loan, and open up green channels. Provide 10 million yuan in low -cost renewal funds. PICC Property & Casualty Insurance Co., Ltd. is conducting research and argumentation of the "Intelligent Communist" comprehensive innovation guarantee model in accordance with the current key projects of Chongqing's intelligent transformation.

Optimize the industrial chain supply chain financial services

In terms of optimizing the industrial chain supply chain financial services, the new district bank insurance institutions are also helping.

Take the automotive industry as an example. The new district banking institutions closely follow the high -quality development action plan of the new district's automobile industry, strengthen financial supply guarantee in supporting R & D and innovation in the automotive industry plan, as well as raw materials and key components of upstream and downstream enterprises.

For example, a vehicle production and sales company in the New District hopes to use its own excellent commercial credit to create a better financing environment for downstream dealers, help downstream dealers to obtain bank financing support, hedge the impact of the epidemic, realize the car sales business Continuous development.

According to the orders of the company's downstream dealers, the Liangjiang Branch of the Zhejiang Commercial Bank purchased vehicles to the company to provide funding support for dealers, alleviating the impact of the epidemic impact on the phased difficulties brought by the dealer, and through cross -regional branches collaborative, online financing and other methods Solving the problem of mobility of the personnel under the control of the epidemic.

In addition, under the guidance of the Liangjiang Banking Insurance Regulatory Bureau, the bank insurance institutions of the New District are still working hard to open the service channels for enterprises and expand the insurance increase.

- END -

Heilongjiang Financial Aid Enterprise Reuse | Introducing a variety of intellectual property pledge financing guarantee products

On June 24th, the Heilongjiang Provincial Government Information Office held the f...

Tianshan Review 丨 Tighten the "faucet" of high -quality development

Yue YanyunOn June 20, the Pomegranate/Xinjiang Daily reported the effectiveness of the water -saving water saving of farmland in Shaya County. One set of data was noticeable: the water consumption of