Douyin "Back Thorn" Meituan

Author:Value Planet Planet Time:2022.08.11

Author | Tang Fei

After two years of development, the local life of Douyin has begun to see the scale.

So far, the local life of Douyin has formed a group purchase business for gourmet food, wine travel, medical beauty, and cultural tourism, and has also created a relatively complete background service system. The operating model of the local life of Douyin is the cooperation model of direct operations, third- and fourth -tier, and suburban service providers in the first and second lines and Internet celebrity cities. At this stage, cities that are focusing on Beijing, Shanghai, Chengdu, Hangzhou, etc. At this stage,

Faced with a series of actions of Douyin's local life, other Internet giants are also preparing for the war.

Meituan announced this year to cooperate with Kuaishou, and will launch Meituan Mini Program on the fast -moving open platform, providing a complete service capabilities such as package, voucher, booking and other products, online transactions and after -sales service for Meituan merchants. Ali launched "" "Explosion group", focusing on the city's food discount group purchase; Tencent launched the group purchase tool "Goose Enjoy Group" for the first time, based on WeChat, the local group purchase.

The local living track, which has been silent for many years, seems to be activated by the "catfish" of Douyin.

On the surface, the way Douyin cuts into the local life is group purchase, and has the advantage of "traffic". According to statistics, Douyin's current daily vivid peak has exceeded 700 million, and the average daily use of users is more than 100 minutes.

In addition, Douyin group purchase can "plant grass" through the combination of product videos and pictures, and attract consumers to the store in the form of coupons and subsidies, so many practitioners are also optimistic about it.

It is just that in the face of competition with the local life giant Meituan, the two sides not only deeply penetrate the other's core sites, and their shortcomings are also obvious.

Meituan's barriers

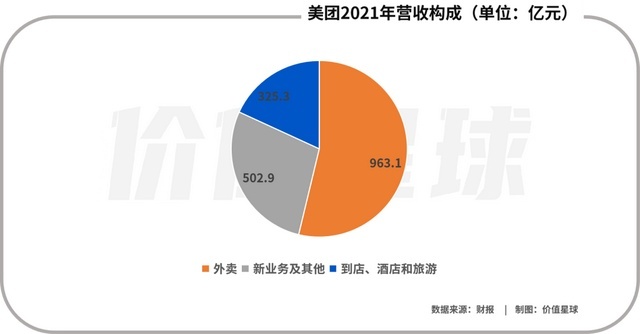

Meituan's revenue is mainly divided into three parts, namely takeaway, stores, hotels and tourism, new businesses and others.

The financial report in 2021 showed that the revenue of 32.53 billion yuan in stores, hotels and tourism contributed a revenue ratio of 18.16%. Although this is not the largest proportion of business, it is the cash cow of Meituan. It is the basic profit of the company's most stable profit at the moment. In 2021, the operating profit of the wine and travel business reached 14.1 billion yuan, which was much higher than that of takeaway, and the new business was still in a state of losing money.

The reason why such a performance has a lot to do with its unique "transaction+review" model.

Earlier, Meituan cut into the trading link by "group purchase", but the stickiness was limited; and the early days of the public review created consumer stickiness -reviews, but it was difficult to monetize.

In the end, the merger of Meituan and the public comment made the entire business model complete: the review system and merchant supervision provided consumers with information collection and decision -making auxiliary platforms; merchants have obtained online sales channels and marketing methods, and they can also drain from online Go offline.

The above two are the source of value creation of the Meituan platform. The platform has guided merchants to go to the shelves to set up shallow discount group purchases, master the transaction flow, clarify the value they created, and charge a certain fee.

This "transaction+review" model has also become the moat of Meituan in the field of local life to a certain extent.

This barrier of Meituan mainly comes from credibility, scale threshold and scale difficulty. First of all, because consumers need to go to the store to experience, and it is difficult to return after the experience, the cost and error cost is high. The first is the credibility of the review of the value of the service industry information platform, and the second is the number of reviews. This credibility mainly depends on the supervision of the platform in the early stage. After entering the consumer's mind in the later period, a certain moat formed, and gradually strengthened over time.

Secondly, because of the requirements for credibility, the service industry information platform requires a higher scale to prove the credibility of its review. This scale threshold is not only reflected in the number of shops, but also in the number of stores. superior. High -quality merchants selected from 1,000 stores are more credible than high -quality merchants selected from 100 merchants.

Finally, the service industry has a long -tail attribute, and the review of a single shop also has long -tail attributes. If you want to replicate the threshold of the same point, it is much more difficult than the e -commerce industry. According to the survey, as of Q1 of 2021, the number of Meituan reviews exceeded 10 billion.

The above points have made the seemingly light asset review system have become the most important barriers for the service information platform. This is also an important reason for Meituan to resist similar competition.

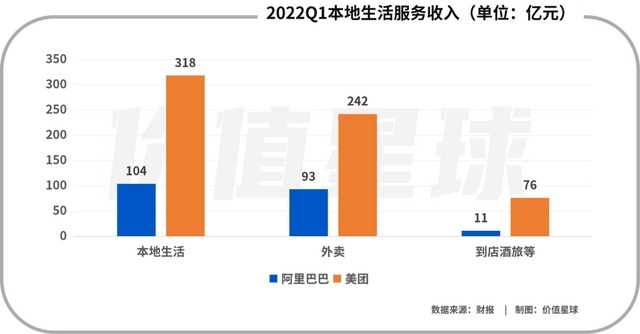

In addition, in terms of the number of trading users and active merchants, the Meituan and main competitors, Alibaba, have opened a large gap. In 2021, the Q3 Meituan trading users and active merchants were 1.9 times and 3.0 times of Alibaba. From the perspective of income, in Q1 in Q1 Ali's local life, African takeaway revenue was about 1.1 billion yuan, and it was also less than 7.6 billion yuan in Meituan.

Based on the above, Zhongtai Securities believes that Meituan has established a multi -dimensional competitive advantage as a local life service platform, and has also resisted the powerful impact of Ali's local life several times.

Standing at the moment, the rise of short video platforms such as Douyin has brought new traffic highlands. It seems that the local life of the local life seems to have great imagination with the advantages of traffic, but after the system analyzes the exploration and layout of Douyin in the local field of life, the system analysis You can also see more obvious limitations.

Douyin's limitations

As the short video business entered a mature period, Douyin began to gradually expand commercialization, and local life was one of the highlights.

In 2018, the company tried to deploy local living business for the first time, but due to the lack of in -depth management experience, the early development was not smooth.

Beginning in October 2020, the byte beating group's manpower and strategic departments had investigated the local living business structure of the US group. According to media reports, the Ministry of Commercialization of Bytes set up a "local direct business center" that specializes in expanding local living businesses. After the original SMB (small and medium -sized customers) business line was canceled, about 10,000 employees adjusted to the center in January 2021, and carried out customer mining around life services, catering and other industries. Subsequently, Douyin began to push through the ground, constantly marching towards the first and second lines and sinking markets, attracting local merchants to settle in Douyin, and obtained a certain number of businesses. However, according to media reports, after a large number of merchants settled in, they did not obtain expected order growth.

In 2021, the same city page of the Douyin APP changed. It can be found that it can be found in the first and second -tier cities such as Hangzhou, Beijing, and Shanghai that its homepage is to increase the "city name+food, drink and play" area. This is the initial group purchase entrance. The establishment of important entrances has obtained greater traffic in the local life business. Douyin also continuously optimized the entrance in the later period, and added a group purchase port in the Douyin "wallet".

In addition, the local life merchants have also opened up new operations, such as launching the same city delivery and flash delivery methods so that the goods can be sent to customers in a short time like takeaway. Through diversified marketing methods and operation methods, a new situation is opened for Douyin's local life services.

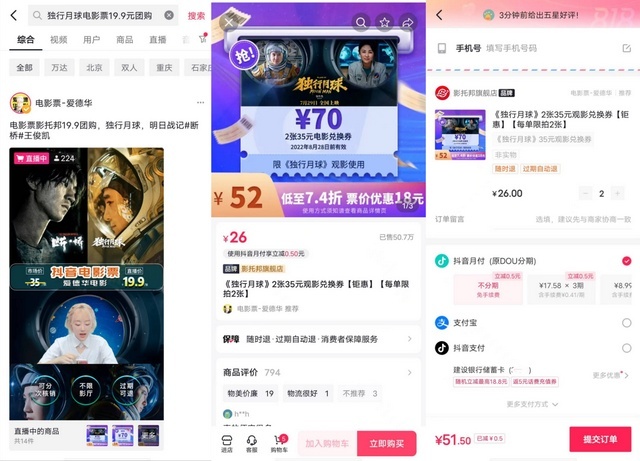

Taking the common group purchase category of movie tickets as an example, after entering the "Lone Moon Film Ticket Group Purchase" in Douyin, you can see that multiple merchants are selling for sale. Among them, most of them are in the form of video and live broadcasts. The fare sold as low as 19.9 yuan/piece.

Picture source: Douyin

After selecting a merchant to enter, you can see that the actual price of 2 yuan for the "" Lonely Moon "" "Lone Moon" sold by the merchant is 52 yuan. 0.5 yuan, compared with the standard price of 50-80 yuan/piece on the market, the discount range is close to 30 % to 50 % off.

This form of deep discount group purchases is essentially the group purchase model when the "Thousands of Mission War", that is, to attract users and "burn money to exchange scale" at a low price.

Zhang Tao, CEO of Public Comment in 2014, pointed out in an interview with the media: In the long run, group purchase is not a stable business model. "Merchants cannot rely on group buying to survive for a long time ... There are business issues. "

Therefore, the reasonable model of local life services based on "group purchase" should be moderate discounts+extensive supply, and the proportion of deep discount group purchases in local life services can only be reasonably controlled by this model.

Furthermore, considering the operating leverage of the store business, the total proportion of Douyin's profit throughout the store market is lower. As merchants need a large number of pushing teams to maintain, it is difficult for local living services to establish a global scale economy, and the profit margin of the latter in the market share will be significantly thinner.

Obviously, the local living in the Douyin monetization system is a "low -profit niche market", but fortunately, Douyin has the chance of traffic. According to QuestMobile data, the per capita use of Douyin's per capita in 2021 is 101.7 minutes. This data exceeds WeChat and Weibo and other communities. In June 2022, Douyin Monthly active user users 680 million people, this user base allows Douyin to "try and error" in the field of local life.

Although the huge traffic of Douyin can support the operation and survival of its local life business, the attributes and Douyin push models of local life determine that it has certain uncertainty in terms of nuclear sales. According to the calculation of Zhongtai Securities, the proportion of push-type group purchases from GMV to real nuclear sales is only 50-60%, while the verification rate of active search group purchases is more than 90%.

From this point of view, the design positioning of the Douyin APP is just contradictory.

Starting from today's headlines, byte products are mainly recommended, so that users can unknowingly disappear time during the continuous decline and get fun, the so -called "time furnace". The positioning of the search lies in the purpose, accurately solve the required problems in a short time, and the logic of "people find goods" is contrary to the bottom design of Douyin.

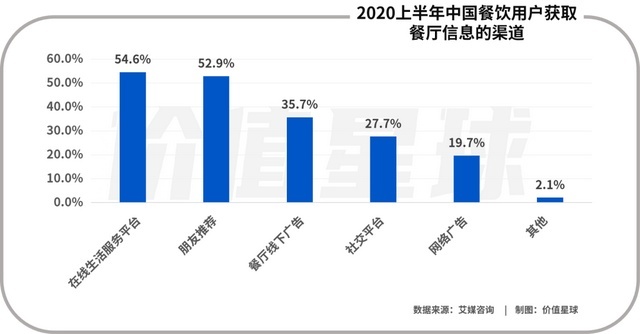

And when consumers have a clear consumer demand, the most important thing is to get high efficiency to obtain information. Short video victory can stimulate potential demand in providing consumer scenarios, but it is not as good as graphics in terms of information transmission efficiency. From the perspective of merchants, the initial production and maintenance costs of short videos are significantly higher than the graphic, which may "persuade" merchants to a certain extent.

Based on the above, although Douyin's interest in e -commerce has developed rapidly, the GMV increased by 3.2 times during the first anniversary (April 2021 to April 2022). However, the core of the local life market may be difficult to obtain similar development speed. The core is that the infrastructure is different -the infrastructure of the physical e -commerce is public, and the infrastructure of the service industry platform is private.

In the research report, Cinda Securities pointed out that although Douyin has some video -based content more eye -catching, it still cannot be compared with Meituan+reviews in comprehensiveness, objectivity and time accumulation.

Summarize

In May 2022, Douyin released the "Explanation of the Software Service Software Service Fees of 2022", which is clear that the service fee will be charged to the living service business from June 1. In each product category, the marriage rate rate is the highest, with 8%, followed by 4.5%of accommodation, parent -child, education and training. About 3%, compared with the US group's rates, are low. In order to encourage merchants to carry out marketing activities on the platform, Douyin has set up different software service fee return policies based on different merchant types. Among them, for each urban merchant in each natural month (t -month) to adopt the "static control" days of the epidemic situation ≥10 days, the platform will take the initiative to return 100%of the T+January.

And Douyin also provides a one -stop solution -guests. At present, the four main capabilities of Douyin visitors are: group purchase promotion, experts with goods, marketing tools, and accurate traffic to help improve the operability of merchants, reduce the entry threshold, and enhance the confidence of businesses in Douyin for group purchase. Essence

However, comprehensive view of Meituan+reviews provides LBS -based search+graphic effect marketing for merchants. Based on the needs of users to actively find stores, the goals are accurate and cost -effective, and they are more suitable for small and medium -sized merchants. Douyin can only provide short video content marketing in urban levels, and the proportion of traffic assigned to local life is also very limited. Not only did the user's accuracy not enough, but also the cost and traffic cost of content production, only suitable for large brand merchants and online celebrity shops.

Therefore, Cinda Securities claims that it "has a limited business value for users and merchants for a long time."

Reference materials:

[1] "Why is Douyin difficult to shake Meituan's business? ", Zhongtai Securities

[2] "In the era of fine cultivation, the toughness and space of the Mode of the Meituan", Soochow Securities

[3] "Douyin Local Life Re -attack: Tuocheng, Business Expansion, GMV Target to 50 billion", Tech Planet

[4] "Meituan In -depth Report:" Search Engine "in Local Living," Three Curves "Connect the Past and the Future"

*This article is based on public information, which is only used as information exchange, and does not constitute any investment suggestions

- END -

Nearly a hundred funds encountered liquidation during the year, a decrease of more than 30 % year -on -year

On July 5th, Capital State learned that on July 1, Minsheng and Silver Fund issued a prompt announcement on the termination of the share of Minsheng and Silver Class A Fund to terminate the listing. d

The road of high -quality development of Wuliangye: The way of being safe, observing and solid, and dedicated to far -reaching are committed to the good wishes of the Changqing

In recent years, the total output of the liquor industry has shrunk, the overall p...