Stone landing!The results of HNA CITIC's illegal investigation were released, and the stock price daily limit!11 executives were punished, and some people resigned overnight

Author:Broker China Time:2022.08.11

After 8 months, the stone hanging by ST HNA finally landed.

Due to the illegal information disclosure of information disclosure, Hainan Aviation Holdings Co., Ltd. ("HNA Holdings", ST HNA) was investigated by the Securities Regulatory Commission in December last year. Book, that is, the results of the ST HNA Xinzi investigation were completely released.

Specifically, the punishment of ST HNA's beliefs and violations of laws and regulations is within the scope of tolerance. The main letter of illegal behavior is to be a single company under HNA Group. It lacks independence in the management and control of financial funds. Related related related transactions and guarantees have not been disclosed. ST HNA has been fined a total of 3 million yuan.

At the same time, as many as 11 executives who have been signed in ST HNA Holdings and semi -annual reports have been punished accordingly. That night, four ST HNA executives including directors, vice presidents and vice presidents and secretaries announced their resignation.

It is worth mentioning that the industry believes that the release of ST HNA information disclosure of the investigation of violations of regulations is conducive to re -departure for ST HNA, light up, and the next step may be removed.

On August 11, ST HNA opened the daily limit at 1.38 yuan/share, with a market value of 45.88 billion yuan.

The results of the investigation of a letter of illegal regulations were released, and 3 million were fined

The letter hanging on the ST HNA's "Damocles Sword" fell down. The main letter of illegal behavior is to be a single company under HNA Group. It lacks independence in the management and control of financial funds. Related related related transactions and guarantees have not been disclosed. ST HNA has been fined a total of 3 million yuan.

It is reported that ST HNA received the CSRC's "Notice of Filing C case" on December 17, 2021. The Securities Regulatory Commission decided to file a case against the company for suspected information disclosure.

After nearly eight months, the results of the investigation of the CSRC were released, and ST HNA officially received the "Administrative Penalty Prior to Administrative Penalties" from the Securities Regulatory Commission.

Judging from the overall qualitative of the facts of ST HNA faithfulness, the Securities Regulatory Commission stated that the HNA Group passed the three -story management structure of the "HNA Group -Institute/Industrial Group -Single Company". Financial implementation of the group integration, verticalization, and three -layer control and management: implement cash flow integration management in funding, and funds are uniformly allocated by HNA Group. ST HNA belongs to the aforementioned "single company" and lacks independence in the management and control of financial funds. Its funding exchanges with related related parties and signing external guarantee contracts are completed under the organization and control of the HNA Group.

As a result, due to the lack of independence, HNA Holdings failed to disclose non -operating affiliated transactions and association guarantees in accordance with regulations. Specifically, it includes: wherein, non -operating related transactions were not disclosed in accordance with regulations:

(1) There are related related parties and funds occupation. On December 31, 2020, 65 related companies including HNA Group occupied ST HNA funds for 37.278 billion yuan. On December 31, 2021, the Hainan Provincial Higher People's Court ruled that the bankruptcy reorganization plan was implemented, and ST HNA was illegally occupied by regulations of 39.301 billion yuan.

(2) The situation of non -operating affiliated transactions was not disclosed in time. In 2018, 2019, and 2020, ST HNA and 65 companies with HNA Group increasing hundreds of thousands of related transactions, the transaction amount was 83.4 billion yuan, 41.3 billion yuan and and 41.3 billion yuan and and 41.3 billion yuan and and 41.3 billion yuan. 40.4 billion yuan.

(3) Regular reports of major omissions. The above -mentioned correlation transactions have not disclosed major omissions in the 2018 semi -annual report, 2018 report, 2019 semi -annual report, 2019 report and 2020 semi -annual report.

In addition, ST HNA has not disclosed the association guarantee in time.

According to the above -mentioned illegal facts, the court ruled, HNA Holdings related announcements, conference documents, internal systems, financial information, business information, related situation explanations, and transcripts of the parties proved that it was sufficient to determine.

11 signed executives led the penalty, and someone resigned overnight

In addition to ST HNA's punishment for violations of laws and regulations, 11 executives involving relevant responsibilities also received the ticket.

The CSRC disclosed in the "Administrative Penalty Prior to the Administrative Penalties" that ST HNA from December 7, 2018 to the end of the investigation. personnel".

Among them, the responsible persons are: Xie Haoming, Xu Jun, Liu Bianjing, Chen Ming, Zhang Zhigang, Zhao Guogang, Xiao Fei, Ma Zhimin, Li Xiaofeng, Sun Dong, Zhang Hongqing, have served as chairman, president, executive director, deputy director of Stit HNA The positions of long, deputy presidents, supervisors, and director of risk control also signed and confirmed in the corresponding 2018 report, the 2019 semi -annual report, the 2020 semi -annual report, and the 2020 report.

The CSRC stated that the above -mentioned personnel did not diligently responsibilities and were responsible for the aforementioned illegal act. Among them, illegal acts of ST HNA illegal disclosure of non -operating affiliated transactions and funds occupation matters, Xie Haoming, Xu Jun, and Liu Zhi Jing are directly responsible for supervisors. Sun Dong and Zhang Hongqing are other direct responsible persons; In the illegal acts of guarantee, Xie Haoming, Xu Jun, and Liu Bixian were directly responsible for the supervisors. Chen Ming, Zhang Zhigang, Zhao Guogang, Xiao Fei, Ma Zhimin, Li Xiaofeng, Sun Dong, and Zhang Hongqing were other direct responsible persons.

In the end, the above 11 executives were given a warning and punished for a personal fine of 200,000 to 1 million yuan.

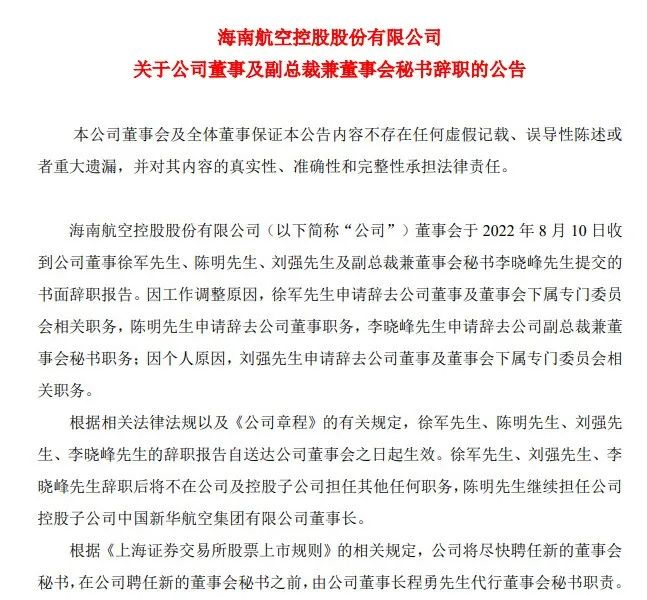

On the night of ST HNA's notice of punishment, four ST HNA executives announced their resignation.

ST HNA said that the board of directors received a written resignation report submitted by the company's director Xu Jun, Chen Ming, Liu Qiang, and vice president and secretary of the board of directors on August 10.

Due to the adjustment of work, Xu Jun applied for resignation of the company's directors and the relevant duties of the special committee of the board of directors, Chen Ming applied for resignation of the company's directors, Li Xiaofeng applied for resignation from the company's vice president and secretary of the board of directors; due to personal reasons, Mr. Liu Qiang applied to resign from the company's directors and the board of directors. Related positions of subordinate special committees.

Among them, Xu Jun, Liu Qiang, and Li Xiaofeng will not hold any other positions in the company and holding subsidiaries after their resignation. Mr. Chen Ming continues to serve as chairman of China Xinhua Aviation Group Co., Ltd., a holding subsidiary of the holding subsidiary.

Chinese reporters of securities firms noticed that three of the four senior executives were reported by the CSRC's "Administrative Penalty Promise".

The next step is completely removed?

With the results of ST HNA's illegal investigation, the company's goal is closer to the next step of picking up the hat.

Back to the process of the "Putty Star Wear Hat" (*ST) process of HNA Holdings, in January 2021, due to the company's non -operating funds occupied by shareholders and related parties, other risk warnings were implemented; in April 2021, the company was The net assets at the end of the 2020 audit period were negative, and the 2020 report was issued by the Pwi Yongdao Zhongtian Accounting Firm that it was unable to express the audit report of the opinion.

In May of this year, the reorganized HNA Holdings ushered in a improvement. PricewaterhouseCoopers had no reservation on the company's 2021 annual financial report audit, and as of the end of 2021, the company's net assets were 8.49 billion yuan.

In May 2022, the Shanghai Stock Exchange agreed to revoke the corresponding delisting risk warning and other risk warnings.

However, at that time, because the results of the investigation of the CSRC had not yet been released, because the "other risk alerts" application was not canceled to the Shanghai Stock Exchange, and stated that after the investigation of the case was completed, the "other risk warnings" application will be submitted to the Shanghai Stock Exchange in accordance with the regulations.

Therefore, since May 19 this year,*ST HNA has become Stain HNA. Now that the investigation results of the CSRC are released, HNA Holdings is expected to remove the hat.

In terms of performance, affected by factors such as the new crown epidemic and the rise in aviation oil prices, and due to business losses and financial exchange losses, ST HNA is expected to return to the mother's net profit in the first half of this year. It was -881 billion yuan. In 2021, the revenue achieved revenue of 34.02 billion yuan, an increase of 15.65%year -on -year, and the net profit attributable to the mother was 4.721 billion yuan.

It is reported that in July of this year, Fang Wei, chairman of the board of directors of ST HNA's new controller Fang Da Group, stated at the work conference of Hainan Airlines in 2022 that Fang Da wanted to introduce funds and inject funds. The processing decisions can be successfully increased to remove ST.

Responsible editor: Yang Yucheng

- END -

More than 130 listed companies preview the interim results of more than 80 % of the "pre -joy"

Xinhua News Agency, Beijing, July 7th. Question: More than 130 listed companies pr...

Together with Guotai Junan, Laser Laser planning to the North Stock Exchange to go public

On August 1, 2022, Laisai Laser (871263.NQ) issued an application for public offering to unspecified investors and announced the announcement of the listing counseling on the Beijing Stock Exchange.La