Trillion explosion!China's stock market has risen across the board, and foreign capital sweeps crazy!What is the stimulus?What is the impact of this brokerage company?

Author:Broker China Time:2022.08.11

Collective outbreak!

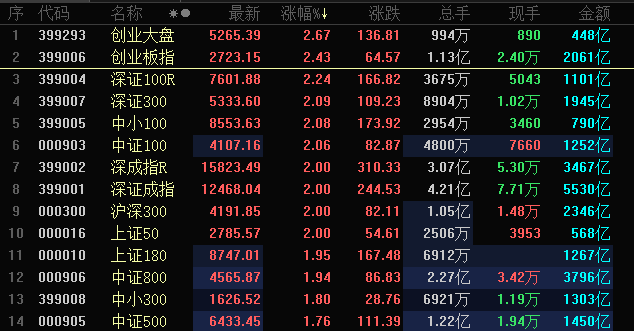

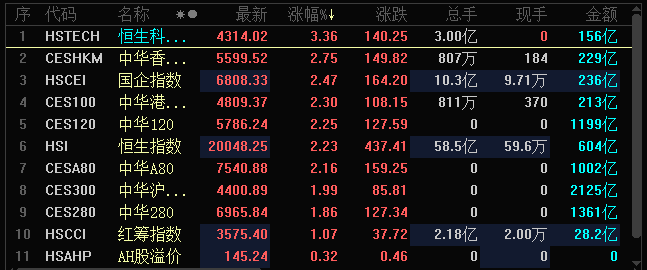

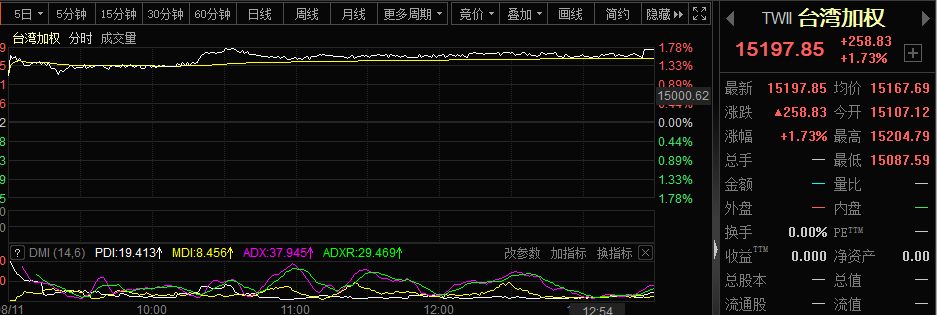

Today, the Chinese stock market rose across the line, including A shares, Hong Kong stocks, and Taiwan stocks yesterday. Among them, Taiwan stocks, which were the first to close, rose nearly 1.8%, and the main index of Hong Kong stocks rose by more than 2%. The financial stocks of the A -share market exploded across the board. The major stock indexes performed very powerful. The performance of individual stocks was wonderful. The market value of the market surged exceeding trillion yuan. Foreign capital once bought more than 10 billion yuan.

So, what is the stimulus, is the bull market opened? Analysts believe that from a favorable perspective, the inflation data between China and the United States yesterday were lower than market expectations, which may be the strongest catalyst in the market. However, it means that the opening of the bull market will be discussed and observed. At present, it is a question of whether global inflation will fall down quickly, and the prospect of economic development is another problem. In addition, the unpredictable international situation may also cause market prospects.

Rising crazy

Today, the Chinese stock market rose crazy.

First look at the A -share market. Many important indexes have risen by more than 2%. The financial stocks represented by securities firms have risen across the board, and individual stocks are also wonderful.

Secondly, looking at the performance of the A50, the index has recently performed sluggish, but today we sweep the trend.

The performance of Hong Kong stocks was also very amazing, and the Hang Seng Technology Index rose by more than 3%.

The performance of the Taiwan stock indexes is also strong, and the Taiwan weighted index closed up nearly 1.8%.

Foreign capital rushed into A shares, and the net purchase of the two cities exceeded 10 billion yuan, reaching 12.4 billion yuan.

what happened?

The key factor is that the market is crazy, and the key factor is the inflation data between China and the United States.

Last night, data released by the US Labor Agency showed that the annual growth rate of the consumer price index (CPI) in the United States in July reached 8.5%, which was lower than the 8.7%and 9.1%increase in June. The main reason was that food and crude oil were crude oil The price declines significantly. The core CPI increased by 5.9%, which was also lower than the market expectations of 6.1%and 0.7%below June.

According to data released by the National Bureau of Statistics yesterday, the National CPI (residential consumer price index) in July rose 2.7%year -on -year and 0.5%month -on -month. PPI (industrial producer's factory price index) increased by 4.2%year -on -year and 1.3%month -on -month.

Matt Weller, head of Global Research on Jiasheng Group, told a Chinese reporter from securities firms that the CPI report released on Wednesday showed that the inflation decline was faster than the expectations of economists. The reading of inflation is so important, and the market responds to the latest unexpectedly weak reading, which is also reasonable. The most important thing is that according to CME's Fedwatch tool, the market implicit volatility of the market at the next meeting of the Fed's next meeting has fallen from nearly 70%before the release of the CPI to 25%. From now on the next meeting of the Federal Reserve, a non -agricultural employment and CPI report will be ushered in in the middle. However, the inflation of the strong employment growth in the past week has been relieved by Powell and his colleagues. If the theme of the "inflation to the top" will heat up in the next few weeks, the inflation data announced on Wednesday may form a major turning point in the market trend so far.

After seeing the strong employment in July, the inflation fell, investors will explore the views of American consumers, find clues to the prospects of economy and inflation, and be scheduled to be released on Friday. By the attention. In recent months, due to natural gas to food prices, prices have risen across, and American consumer confidence has shrunk sharply, and the situation in Europe and other countries is also the same. However, the US economy's ability to respond to inflation is better than other countries and regions.

However, investment bank analysts such as BlackRock and PIMCO are skeptical about inflation. The core CPI is a standard index that eliminates volatility foods and energy costs, which can be regarded as a potential inflation trend that reflects real inflation by the market.

Pacific Investment Management Company (PIMCO) economist Tiffany Wilding and Allison Boxer released a report stating that the annual growth rate of CPI in July from 9.1% in June to 8.5%. If food and energy prices continue to weaken, in June may It is the peak of inflation, but the core CPI data may rise again in August, and it may not reach the peak until September.

PIMCO economists said that the category of "air tickets and restaurants" that led to the downward inflation in July often had greater volatility, and the details such as rents remained stable. In addition, the core inflation indicators of the Feds of the Feds of Cleveland, the Fed of New York, and Atlanta are accelerating, and the inflation pressure is expanding in terms of depth and breadth. At the same time, salary inflation has also expanded from low wages and low skills to various industries.

They believe that the July CPI report did not change their predictions of 5.5% and 3.5% of the core inflation rates in 2022 and 2023, nor did they not change their expectations for the Federal Reserve's recent tightening policy. PIMCO analysis is relatively likely to raise interest rates in September 75 basis points.

Rick Rieder, the global fixed income investment director of Belle, said that the overall inflation is still worrying about high -speed high -speed forward, and continuous and stable inflation data will make the Fed firmly embark on the road of continuous and positive policies. Rieder, like PIMCO economists, is also expected to raise interest rates by 3 yards next month. CITIC Securities also believes that the growth rate of CPI in the United States in July has fallen, and the negative growth of energy items offsets the growth of food and residential items. The decline in energy prices has led to the growth rate of the US CPI in July, but the core CPI stickiness is still strong. In the third quarter, the United States inflation may still be used to the top, and there is a possibility of repeated possibilities. In September, the interest rate hike still depends on more data. It is expected that the short -term market will be overwhelmed. U.S. stock shock rebound may last at least until the announcement of the US CPI data in August, but the subsequent U.S. stock market trend still depends on when the Fed's currency policy will be when the Federal Reserve monetary policy Turn.

Zhongtai Securities Everbright Announcement

As the financial stocks rose sharply, Zhongtai Securities threw a heavy announcement.

According to the announcement of Zhongtai Securities, the company has recently inquired about Pao Shenghua and its controlling shareholder Baoneng Investment Group, subsidiaries, and actual controller through public channels. Automobile and Shenzhen Baoneng Investment Group was prosecuted for a financial borrowing contract. The court was tried to be the Intermediate People's Court of Suzhou City, Jiangsu Province.

Shenzhen Huishenghua, Shenzhen Shenye Logistics Group, Shenzhen Baoneng Investment Group, and Yao Zhenhua were listed and executed. City Intermediate People's Court. Baoneng Logistics Group has been newly executed information, and the obligation of effective legal documents is 1,580,263.14 yuan.

Today, the brokerage stock index rose by more than 5%, but China -Thailand Securities increased by 4%.

Responsible editor: Luo Xiaoxia

- END -

The maximum distribution total 40 billion yuan!Two phases of electronic Treasury bonds will be issued from tomorrow

Due to low purchase threshold and high security, savings Treasury bonds have been ...

The nation's first single fishery carbon exchange index insurance landing Kuishan