Brokerage stocks rose sharply!Is it coming?——Doda Investment Notes

Author:Daily Economic News Time:2022.08.11

Source: WeChat public account "Daida" (WeChat public account ID: daoda1997)

I saw a hot search early in the morning and stunned Dago.

Some shareholders have exposed their own stock income. In the past year, they lost 10.4 million and lost 96%of the principal. What is even more surprising is that such a loss has even defeated 1.72%of the shareholders.

I didn't know what to say for a while, Da Ge could only smile bitterly. After reading a statistics, in the past year, of the top ten stocks in the Shanghai and Shenzhen A shares, the two largest stocks of the decline were Kangshino and*ST amethyst. The declines exceeded 60%.

Theoretically, even if you buy the worst stocks in this year, it will not lose 96%of the principal. The reason for the reason is to bring leverage transactions and keep chasing and falling. He may have little accumulation of knowledge in the stock market, and he rushed in; in the process of stock trading, he lacked the ability to think independently, so that this situation occurred.

Of course, it is also related to the investor's richer and willful. After watching the netizen's reply on the hot search, it is still very optimistic. Maybe such a loss has little impact on his own.

Dago hopes that the friends of Daida will not have such a situation, strictly abide by the trading rules and trades in their own cognition. Although these are difficult to do, isn't life a process of constantly defeating self? Stock trading cannot be a confused account. It is clear that you have to make a clear loss, and you must earn clearly.

Come back, let's talk about A shares. Today, the market has risen, and a 180 -degree turn can be interpreted from the message. In the night, CPI data in the United States increased by 8.5%year -on -year, giving people a peak, which brought the Federal Reserve monetary policy to be relatively relaxed.

Domestically, the National Bureau of Statistics shows that CPI increased by 2.7%year -on -year. The central bank also announced the next plan. The central bank said that the implementation of stable monetary policy will be strengthened to provide stronger and more quality support for the real economy.

Two favorable blessings, A shares broke out today. From this point of view, Dago's prediction of the market on Tuesday was fulfilled, and the embarrassment of being beaten was avoided. Unfortunately, you couldn't see the jokes of your brother. But anyway, Dago was very happy to see you making money.

On the disk, the securities sector and the consumer electronics sector are the most beautiful babies today. Near the end of the afternoon, the brokerage stocks suddenly soared, and the afternoon continued to remain strong. When it comes to brokerage stocks, Da Ge still regrets it. When he wrote investment notes yesterday, he also noticed that the small -scale box shocking structure of the securities sector index was noted. As a result, it wrote that it was forgotten.

Many investors are unsatisfactory for the rebound led by the brokerage sector. The brokerage sector often travels one day, and is nicknamed the "scum man" section by investors. Now that the trading commission of securities firms has been declining, it is difficult to make money by self -employment of securities firms under the structural market. Substitutions and issuance have gradually concentrated on head brokers. The cyclical fluctuations are fluctuated according to the Bull and Bear market. In the structural market, the probability of a full bull market is relatively small. Generally speaking, the life of the brokerage firms is not good, and the fundamentals of the brokerage firms are not supported.

Looking at the performance of today's brokerage stocks, on the one hand, the number of stocks in daily limit is not large, and on the other hand, it is not hard enough to close the order. Regarding the rise of brokerage stocks, market speculation is news about the registration system, but according to media reports after the market, the news was faked.

In this way, tomorrow will test the brokerage sector. As long as it can be stabilized as the previous semiconductor, it will not rule out the opportunity to perform. And if the big finance led by the securities company can be stabilized, the performance of the index can be expected. Before the brokerage stocks showed continuity, Da Ge could only understand that their rise was to set up the subject matter, and the focus of attention was still on the previous hotspot sector.

Consumer Electronics has risen today. Apple will release a new generation of mobile phones in September. Some analysts posted on social media that the average price of iPhone 14 series models will rise by 15%. High shipment ratio. It is also interesting to say that in September, Huawei will hold a press conference of new Mate50 series.

Da Ge feels that it is difficult to say whether the news of Apple's price increase is good; it is difficult to say how much benefits it can bring for the Apple industry chain. The news is just a fuse. On the grounds of favorable news, the low position is replenished. It may be that it had fallen too hard before, the stock price was low, and there was no place for funds to go.

A few days ago was a semiconductor, and today it was reorganized to consumer electronics and other sectors. The entire technology theme should increase attention and observe whether it can form a diffusion effect of dot -noodles.

Based on today's market, Da Ge thinks that the main points are mainly the following:

First of all, the Shanghai Stock Exchange Index rose sharply today, laying the foundation for the market further, but it still cannot qualitatively enter the upward trend. Today, the index of the index is good, and the mild volume instead of explosion, indicating that there are not many retail investors chasing in, so it is a relatively healthy capacity, indicating that the multi -headed power is exactly the power. The kinetic energy.

However, from a structural point of view, the Shanghai Index faces 3,300 points next to the Shanghai Index. This position is the neckline of the clinic area of the box transaction densely in the early stage. It does not rule out that the market will rest here, and then go to the gap above. However, due to the accumulation of a lot of prison in this gap, the probability of breaking through the box at once was not high. Secondly, pay attention to the change of market style. Small -mouth stocks have been active for many days. From the perspective of the CSI 1000 index, if you can't put it next, pay attention to the risk of departure. The large -cap stock has been suppressed for a long time, and it does not rule out that it will show sustainability in the near future. Be careful of this style of switching for the blood drawing effect brought by small -cap stocks.

In addition, from the perspective of the hotspot sector, it was new energy before, and recently a technology stock led by semiconductor. Today, there is another large financial sector. It has a taste of "Three Kingdoms". Considering that under the current market volume, the full bull market is not realistic, and it is still a local structural market, which means that the strengthening of the new direction is at the cost of sacrificing some old directions. Therefore, for high -level hotspots, we must set up profit positions and stop losses.

Finally, pay attention to the rhythm of operation. The variety of explosives does need to be paid attention to, but it is not suitable for chasing the rise. You can pay attention to the moderate variety today. Generally speaking, when the weight sector is pulled up, the stock will be changed faster, so pay attention to the rotation rhythm in the sector. Overall, today's measurement is on the measurement as scheduled, and the mid -line trend has shown signs of improvement. For holding stocks with low positions, do not frequently exchange stocks.

(Zhang Daoda)

According to the latest regulations of relevant national departments, this note does not involve any operating suggestions, and the risk of entering the market should be borne.

Daily Economic News

- END -

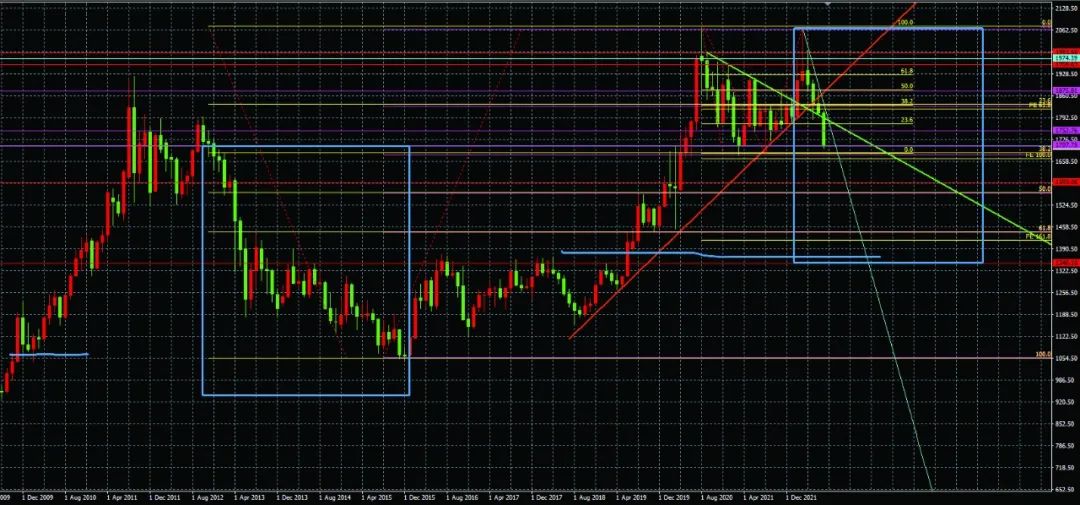

The gold market repeats the bear market?Gold price or fall back to this price

From January 2013 to December 2015, the Fed's monetary policy began to tighten fro...

Foreign media: Facebook parent company Meta's second quarter revenue fell, and net profit declined continuously

Zhongxin Jingwei, July 28. Comprehensive foreign media reports that Facebook's parent company Meta's second quarter revenue was US $ 28.82 billion, a decrease of 1%compared with the same period of 202...