Increasing income and increasing profit, the gross profit margin is innovative, the days of "Chemical Mao" are not good than 丨 Zhi Yan Comments

Author:36 氪 Time:2022.08.11

Dual pressure of raw materials and demand.

Text | Liu Yiting

Edit | Huang Yida

Source | 36 氪 Finance (ID: krfinance)

Cover Source | Vision China

Recently, Wanhua Chemical (Securities Code: 600309.SH), known as "Chemical Mao", disclosed the semi -annual report in 2022.

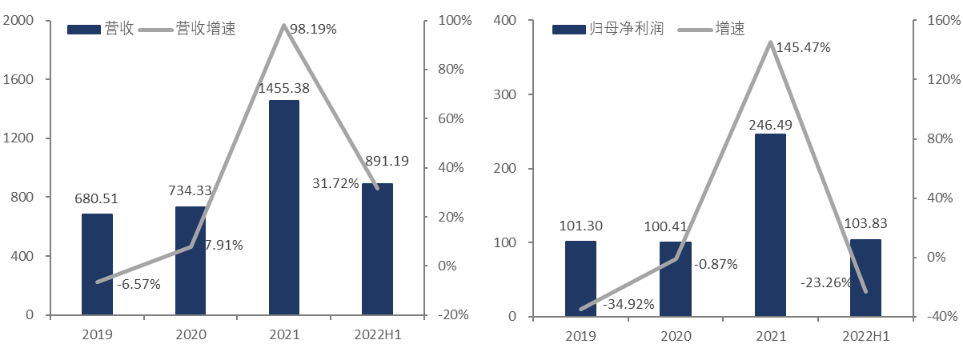

In terms of performance, Wanhua Chemical achieved operating income of 89.19 billion yuan in the first half of 2022, a year -on -year increase of 31.72%; the net profit attributable to mothers was 10.383 billion yuan at the same time, a year -on -year decrease of 23.26%. Among them, 2022Q2 achieved operating income of 47.334 billion yuan in a quarter, an increase of 30.24%year -on -year; the net profit attributable to mothers was 509 billion yuan at the same time, a year -on -year decrease of 27.5%.

2019-2022H 1.1 million Chinese chemical revenue and net profit, unit: 100 million yuan

Source: Wind, 36 氪 Organize

It can be seen that in the first half of this year and the second quarter, Wanhua's chemical revenue growth rates reached more than 30%, but the net profit attributable to the mother had a sharp decline of more than 20%at the same time, falling into the embarrassing situation of increasing increasing income. At the same time, the gross profit margin of 2022H 1.1 million Chinese chemistry reached a new low since it was listed, with only 18.45%, a year -on -year decrease of 12.62 percentage points; the net interest rate of the same period was only 12.11%, a year -on -year decrease of 8.26pct.

The reason is mainly due to factors such as the situation in Eastern Europe, the new crown epidemic and global inflation pressure. In the first half of 2022, the basic energy prices of international crude oil, natural gas, and coal maintained high. Essence At the same time, under the influence of the slowdown of global economic activities, the demand for downstream chemical products has been suppressed. Therefore, the price difference between the company's products and costs gradually narrowed, and the profit margin appeared in large landslides.

Polyurethane business: The gross profit margin has declined significantly

In 2022H1, the polyurethane business achieved revenue of 33.246 billion yuan, an increase of 16.99%year -on -year. The reason why the income recorded a better growth rate was because the new capacity benefits of Wanhua Chemical MDI and polyether were gradually released. Pull export sales growth.

Earlier, the proportion of polyurethane business revenue accounted for more than 50%year -on -year, but as the chemical industry gradually penetrated to higher profits, the proportion of petrochemical business revenue gradually exceeded the polyurethane business. %.

From the perspective of profitability, the gross profit margin of the 2022H1 polyurethane sector recorded only 28.2%, a year -on -year decrease of 18.1 percentage points. It is mainly due to the significant increase in the prices of the company's main chemical raw materials in the first half of this year. Among them, the average price of pure benzene increased by 30.15%year -on -year, and the average price of 5,000 calories coal, CP propylene, and CP butane rose by about 50%.

In addition, in the first half of this year, the global polyurethane operating rate picked up, the inventory maintained high, the growth rate of polyurethane markets slowed down, and polyurethane prices decreased slightly. In 2022H1, the average price of pure MDI and polymerization MDI listed on the main products of Wanhua Chemical fell by 1.5%and 3.4%year -on -year. Under the double squeeze of rising costs and decline in product prices, gross profit space was significantly compressed.

In terms of production capacity, as the world's largest MDI producer, Wanhua Chemical's existing MDI production capacity is 2.65 million tons. In the second half of this year, the 400,000 tons/year MDI project of the Fujian base is expected to be completed and put into operation. The Ningbo base 600,000 tons/year MDI technical reform project and the Fujian base 250,000 tons/year TDI projects are planned to be completed and put into operation in 2023. With the gradual landing of new production capacity, the status of Wanhua Julytic business global "one brother" will be more stable.

Petrochemical business: Rising raw materials to erode gross profit space

In 2022H1, the revenue of the petrochemical business achieved a revenue of 39.212 billion yuan, an increase of 44.92%year -on -year, and it still maintained a high growth, but it slowed significantly compared with the previous degree. Due to the steady growth of polyester business, the growth rate is far less than the petrochemical business. Therefore, the petrochemical business has become the company's largest source of revenue in the first half of this year. As of 2022H1, Wanhua's petrochemical business income has accounted for 44%of operating income.

From the perspective of profitability, the gross profit margin of the 2022H1 petrochemical sector recorded only 5.28%, a year -on -year decrease of 12.7 percentage points. The main reason is that the global oil and gas prices have increased sharply in the first half of this year, and the fluctuations of the major overseas economies have appeared. The inflation pressure of major overseas economies appeared. The domestic epidemic factors in the second quarter were suppressed or delayed to postpone the downstream consumption of chemical industry. The overall profit of the petrochemical industry was squeezed.

New material business: It is expected to become a new performance growth pole

In 2022H1, fine chemicals and new materials business achieved revenue of 10.441 billion yuan, an increase of 58.41%year -on -year, and the growth was strong. With the rapid development of strategic emerging industries such as photovoltaic, wind power, and new energy vehicles, the demand for new chemical materials has continued to improve, and my country has become the world's largest production and consumer country in chemical new materials. On the first half of this year, the company's 140,000 tons of polycarbonate (PC) projects and 10,000 tons of lithium battery material projects were completed in the first half of this year.

From the perspective of profitability, the gross profit margin of the 2022H1 new material sector recorded 28.59%, an increase of 0.1 percentage points year -on -year. At the same time, the gross profit proportion of new material business was 18.16%, an increase of about 10 percentage points. It can be seen that in the first half of this year, the new material business became the highest gross profit margin of the three major businesses. The trend of continuously increasing the profit contribution of fine chemicals and new materials is worthy of attention. Outlook: Short -term performance will still be under pressure

Since the second quarter, the MDI prices of the main products of Wanhua Chemistry have been declining, and according to the company's disclosure, since August 2022, Wanhua Chemical China has aggregated MDI listing price of 18,500 yuan/ton (the price of 1300 yuan/ton was reduced by the price in July) ; Pure MDI listing price is 22,300 yuan/ton (1500 yuan/ton was reduced by the price in July).

The down reduction of polyurethane listed prices reflects that the demand is still sluggish to a certain extent. In addition, the price of raw materials is still high. The gross profit space of polyurethane and petrochemical business will continue to be under pressure, which will affect the growth of Wanhua's short -term performance.

In the long run, with the gradual landing of new capacity, the long -term performance of Wanhua Chemical is expected to improve, but it still needs to pay attention to the supply and demand pattern. In terms of new materials business, in recent years, it has grown rapidly in recent years. The current profit proportion is close to 1/5. With the advantages of high value -added and good supply and demand patterns, new materials are expected to become the company's next stage of performance flexibility.

*Disclaimer:

The content of this article only represents the author's opinion.

Market risk, the investment need to be cautious. In any case, the information in this article or the opinions expressed in this article does not constitute investment suggestions for anyone. Before deciding to invest, if necessary, investors must consult with professionals and make careful decisions. We have no intention of providing underwriting services or any services that need to be held in the transaction parties.

36 氪 Public account

I sincerely recommend you to follow

Let's "share, watch" 享

"Chemical Mao" Wanhua Chemical Report in the semi -annual 2022

- END -

12 robotic industry projects landing in the new area of the new area of the New District of Mianyang Science and Technology City to seize the new track

Zu Mingyuan Zhonglin Cover Journalist Wang XianglongHow long does the robot indust...

Rongping: Steady growth and guaranteeing the market's main body to maintain employment, and test the city with effective results

Today, Chengdu's 40 stable growth has officially announced its full effort to go t...