The stock price is cut, and the sales are five consecutive!Adidas CEO acknowledged that making mistakes in China

Author:Zhongxin Jingwei Time:2022.08.11

Zhongxin Jingwei, August 11th (Chen Junming Wang Yongle) According to Reuters, Adidas CEO CEO Kasper Rorsested said in an interview with the German "Business Daily" on the 9th that Adidas failed to fully understand Chinese consumers in Chinese consumers ,This is a mistake. Earlier, Adidas' sales in Greater China had been "frustrated" for five consecutive quarters.

The performance of Greater China is "diving", and the stock price has been "cut"

Behind Adidas CEO is behind this statement that the company encountered "Waterloo" in Greater China in the first half of 2022.

According to Adidas's 2022 interim, the company's sales in Greater China decreased from 2.405 billion euros in the first half of 2021 to 1.723 billion euros in the first half of 2022; during the same period, the company's gross profit in Greater China was 1.299 billion The euro dropped to 907 million euros, a decrease of 30%.

During the same period, as the operating expenses of Greater China rose 9%to 589 million euros, the operating profit of Adidas Greater China decreased significantly by 57%to 325 million euros.

It is worth noting that from the second quarter to the fourth quarter of fiscal year, the sales of Adidas Greater China were 1.03 billion euros, 1.155 billion euros, and 1.037 billion euros, a year -on -year decrease of 15.9%, 14.6%, and 24.3%. In the first quarter of 2022, while Adidas increased by 0.6%to 5.302 billion euros in total sales, sales of Greater China fell 34.6%year -on -year to 1.04 billion euros; in the second quarter, the revenue of Greater China fell 35%.

This means that the revenue of Adidas Greater China has fallen for five consecutive quarters, and this year has fallen by 35%for two consecutive quarters.

Regarding Greater China's performance plummeted, Adidas said in the annual report that due to the new crown epidemic, the company faced a more challenging market environment.

However, Adidas' performance in Greater China has declined, which is not only affected by the epidemic. According to CCTV News in March 2021, foreign brands such as Adidas have caused anger for resisting Xinjiang cotton. Star Studios such as Yi Xi Qianxi, Yang Mi, Deng Lun, etc. subsequently issued a statement announced the termination of cooperation with Adidas.

Screenshot Source: Adidas Half of 2022 Report

Adidas reported from the 2022 semi -annual report that EMEA (Europe, Middle East, Africa) is the company's main sales region, followed by North America and the third in Greater China.

Affected by the decline in the popularity of marketing portfolio in Greater China and cleaning inventory, Adidas lowered 2022 product gross margin to 49%(previous value: about 50.7%), and at the same time lowered its net profit from 2022 to 1.3 billion euros (previous value (previous value : 1.8 billion euros to 1.9 billion euros).

Adidas Stock Price Chart Source: Wind

In terms of the secondary market, Adidas' stock price has fluctuated since August 2021. It is currently reported at 173.36 euros/share. The stock price is 336.25 euros/shares in August last year. The company's latest market value has also shrunk to 33.8 billion euros (About RMB 234.3 billion).

Tianfeng Securities Research Report stated that Adidas revenue continued to be under pressure in the second half of the second half of the second quarter of 2022, and the American market performed strongly.

The agency stated that the weakening of the foreign card continued to create an active development environment for the national brand. Market opportunities are crowded with foreign cards.

Institution: Optimistic about the rise of Guo Chao

In comparison, domestic sportswear brand performance is more stable.

According to the latest operating performance of Anta Sports in the first half of 2022, the company's retail sales of Anta brand products in the first half of 2022 recorded the number of middle units in the year -on -year increase; A year-on-year recorded growth of 30-35%.

Compared with Adidas, Anta Sports has a negative growth of FILA brand products, and the remaining brands remain positive.

In this regard, Anta Sports stated that due to the rebound of domestic epidemic, the Group followed the guidelines and requirements of various governments to suspend operating several physical stores (offline channels) in specific areas. Therefore, the Group's offline retail business has fallen significantly and the dual adverse effects of consumption intention to weaken. The suspension of the operation of the operation is concentrated in high -level cities and shopping malls. In the brand matrix of the Group, high -end brand business with a large layout of high -end cities is affected by the epidemic.

In addition, Li Ning has not announced the relevant performance in the second quarter of 2022, but from the first quarter of its performance, as of the first quarter of March 31, 2022, the same store sales of Li Ning's entire platform recorded 20%-30%low annual low-year low. Paragraph growth. As far as channels are concerned, retail (direct operation) channels record 20%-30%of the mid-range growth and wholesale (franchise dealers) channel records of 10%-20%of low-segment growth, e-commerce virtual store business increased annually to 30%by year to 30% -40%of mid -range growth.

The Everbright Securities Research Report shows that although the sales of various brands in the second quarter were affected by the epidemic, domestic sports leaders performed better than international leaders.The growth rates are better than Adidas and VF Group, which are the same period. In the future, we will continue to be optimistic about the rise of the national tide.The agency believes that from a structure, it is expected that the direction of sportswear is still high and its performance is expected to continue to lead the overall industry. At the same time, the domestic alternative trend is still ongoing. It is expected that local leading companies will continue to form a benign competition with international brands.

Guoxin Securities Research reports that since July, Adidas Greater China has weakened. It is expected that the two -digit number of declines in the second half of the year. The contrast of local brand growth is still obvious, and it will continue to be optimistic about the increase in local brands.(Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

- END -

"Unusual", the Federal Reserve has shot

On June 15, local time, the Federal Reserve Commission announced that it had raise...

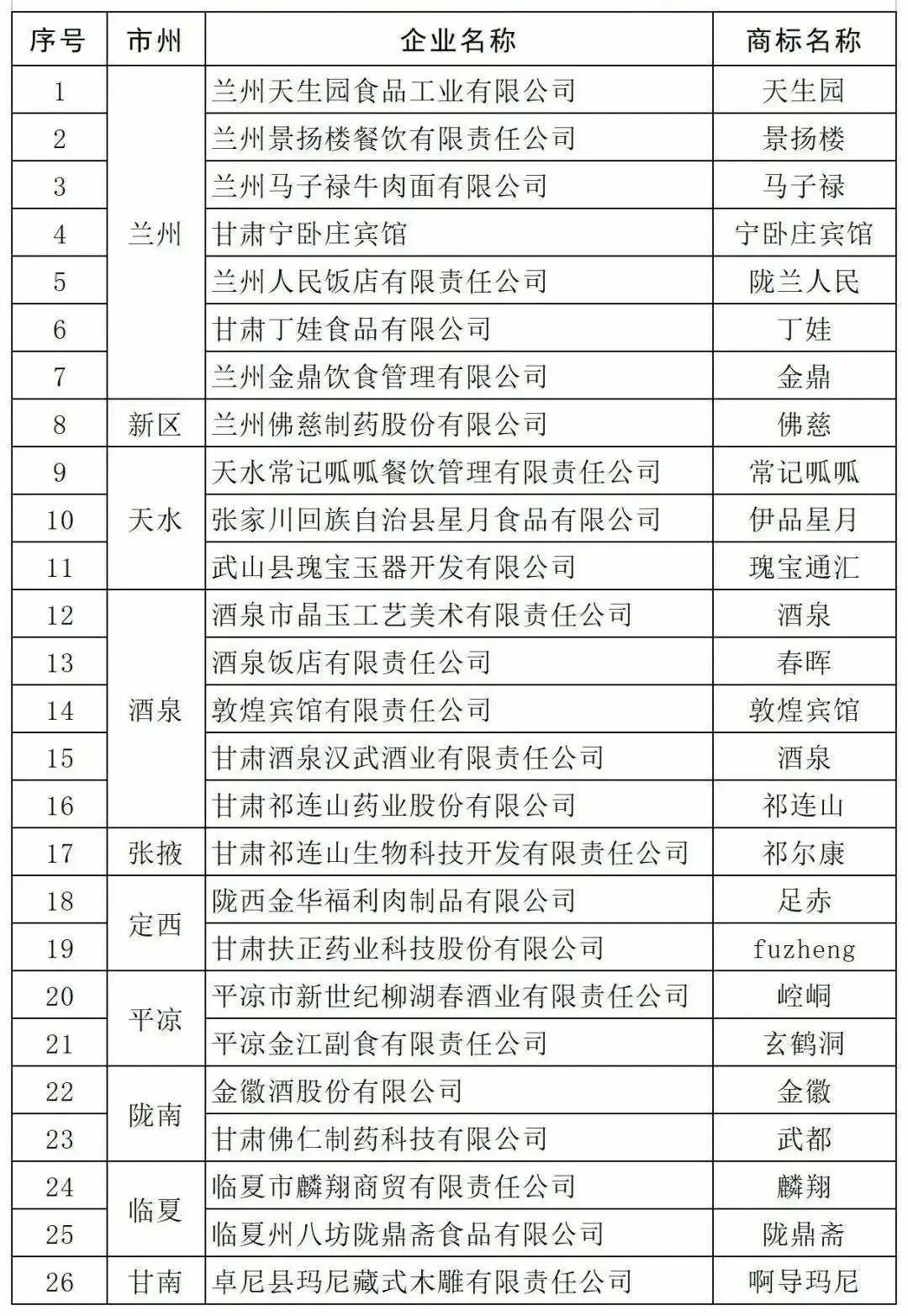

[Central Media Watch Gansu] The first batch of "Gansu Old names" list was released, and 26 companies (brands) were on the list

In order to guide and promote the protection and innovation development of old -fa...