Consultation service fee for corporate corporate consultants, Guiyang Rural Commercial Bank was fined millions

Author:Daily Economic News Time:2022.08.11

Recently, a decision on administrative penalties announced by the Guiyang Market Supervision and Administration Bureau made Guiyang Rural Commercial Bank Co., Ltd. (hereinafter referred to as Guiyang Rural Commercial Bank) that collected consulting service fees to the enterprise.

The punishment information shows that the two branches of Guiyang Rural Commercial Bank charged the consulting service fee of 11.41 million yuan from five enterprises, but there was no targeted and substantial service, and there was an act of collecting consulting fees and inconsistent quality. In the end, the bank not only retreated the above illegal income, but also fined 1.141 million yuan.

It is worth noting that in recent years, the problem of illegal charges for commercial banks has been the focus of regulatory authorities. According to the “Special Rectification Action Plan for illegal charges related to enterprises” issued by the National Development and Reform Commission and other departments in June this year, the CBRC system has made deployment, focusing on the goal of “reducing the burden on enterprises”, and carrying out special rectification actions in the banking field. Among them, "only charges, not serving or less service" are one of the key governance issues.

Retirement of 11.41 million yuan in illegal income

The above -mentioned administrative penalty decision pointed out that after investigation, the Guiyang Rural Commercial Bank Nanming Sub -branch and Yunyan Sub -branch charged the consulting service fee of 11.41 million yuan from the five companies from January 1, 2019 to June 30, 2021.

Although tens of millions of service fees are charged, the services given by the two branches are mixed with a lot of "moisture".

The Guiyang Market Supervision and Administration Bureau pointed out that in the service report provided to the enterprise, there are logical problems or obvious errors, and the reports provided by different enterprises are basically the same. The signs of plagiarism are obvious. The actual operation of the enterprise proposes substantive plans and proposals, the lack of targeted services, and the existence of consulting fees and inconsistent quality and price.

Although the Guiyang Rural Commercial Bank has cleared the service fee of 11.41 million yuan after inspection in the inspection team, it has not been able to avoid punishment.

The administrative penalty decision shows that the Guiyang Rural Commercial Bank violated the relevant regulations. The regulatory authorities ordered the bank to correct the above -mentioned illegal acts and decided that all the offices had retired from 0.1 times the fine of 11.41 million yuan of 11.41 million yuan.

According to the financial report, in 2021, Guiyang Rural Commercial Bank's operating income was 3.09 billion yuan, a decrease of 4%year -on -year; net profit was 628 million yuan, a year -on -year increase of 103%. In the first half of 2022, the bank realized operating income of 1.371 billion yuan, a year -on -year decrease of 10.51%; net profit was 515 million yuan, a year -on -year increase of 23.56%.

Regulatory strict check service charging issues

In recent years, the service charging problem of commercial banks has been a hot spot for the market, and it is also the focus of supervision departments.

The "Guidelines for the Law Enforcement of Commercial Bank Charges" issued in June 2016 pointed out that the charging behavior of commercial banks should follow the principles of compliance, equality and voluntariness, separation of interest fees, and qualitative price consistency in accordance with laws.

However, individual commercial banks do not fully follow this principle. In August 2019, the General Office of the Banking Insurance Regulatory Commission reported on the on -site inspection of some local small and medium -sized banking institutions that some institutions did not implement the policy of serving the real economy, especially the private small and micro enterprises. Among them, individual business charges are "quality and prices do not match", and the consultant fee is charged in violation of regulations. Some institutions charge a large amount of financial advisory fees, but the financial counseling services are mainly excerpted with Internet disclosure information and do not provide customers with valuable services.

In March of this year, at the special press conference of the "Banking Insurance Industry In -In -In -the Promoting Financial Consumer Protection", Guo Wuping, director of the Consumer Protection Bureau of the China Banking Regulatory Commission, introduced that the current banking insurance industry reduction has made the profit more and more profitable. A significant decline, but there are still some problems in the local area. "Only charges and not serving" are one of them. Common financial advisory services, some bank branches provide a template to the enterprise before the loan. In fact, they are almost the same content. In this name, a financial advisory fee is charged, but there is no practical service.

Public information shows that in response to the problems exposed in the inspection in recent years, the relevant departments have adopted a series of measures to further standardize the service charges of commercial banks.

In 2020, the CBRC and other departments jointly issued the "Notice on Further Regulating Credit financing charges to reduce the comprehensive cost of corporate financing", further standardize the fees and management of all aspects of credit financing, safeguard the right to corporate knowledge, independent choice and fair trading rights, reduce Comprehensive cost of corporate financing.

In early 2022, the China Banking Regulatory Commission issued the "Guiding Opinions on Regulating the Management of Regulatory Bank Service Market Regulatory Price Management". Among them, it is emphasized that financial services suppliers and demand squares are equally negotiated to prevent the use of non -standard pricing of market status and protect customers' independent options and fair transactions. The guidance was implemented from May 1, 2022.

At the same time, in order to promote the implementation of various policies for reduction in fees, support the help of enterprises, and further optimize the business environment, in June 2022, the National Development and Reform Commission and other departments issued the "Special Rectification Action Plan for illegal charges involving enterprises" and decided to decide Carry out special rectification actions for illegal charges involving enterprises in the country.

According to the overall plan arrangement, the CBRC system summarizes the management of bank service charging and special inspections in recent years, prints and distributes industry implementation plans, and deploys regulatory departments and banking institutions at all levels to carry out in -depth actions.

Daily Economic News

- END -

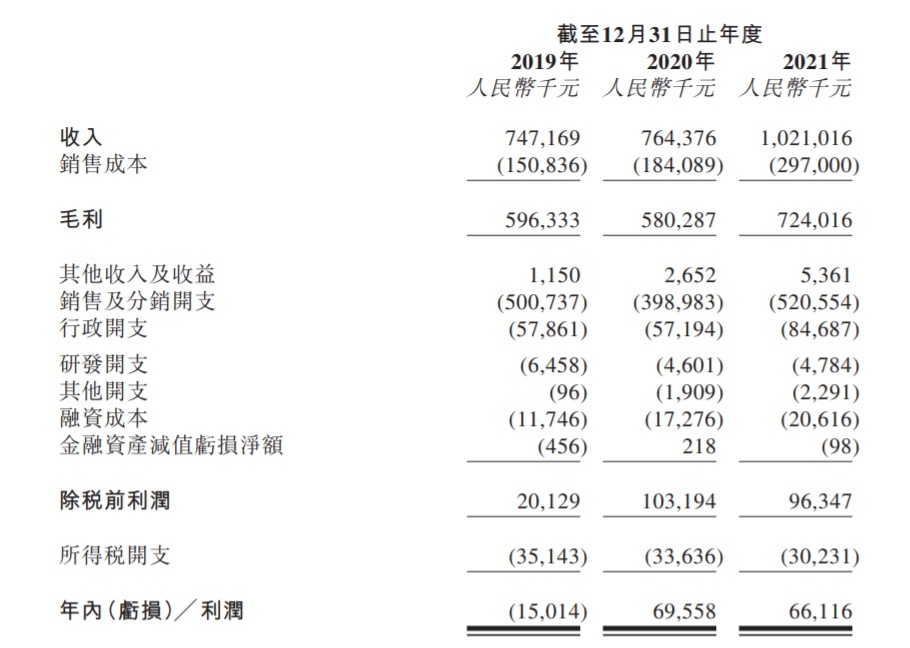

Hong Kong stocks or another hair transplant medical company, Damai hair transplantation submits a prospectus to provide the first medical group in the industry to provide microneedal hair transplantation

On June 30, Capital State learned that Damai Hair Transplant Medical submitted a p...

The effectiveness of the establishment of the provincial modern agricultural industrial park in Donggang District has prominent

Recently, Rizhao Haichen Aquatic Products Co., Ltd. was successfully selected as a list of leading enterprises in Shandong Province's aquatic product industry and a list of national breeding industry....