Xingye Securities calls you to pay off!Among them, no more than 7 billion yuan is used for financing and securities trading business. Since last year, there have been 6 securities firms.

Author:Daily Economic News Time:2022.08.11

On the evening of August 11th, Xingye Securities (SH601377, closing price: 6.74 yuan, total market value: 45.14 billion) issuance announcements showed that it was based on the total share capital after the market closed on August 16, 2022, 6.697 billion shares after the market, according to the basis of 6.697 billion shares, according to the basis, according to the basis, according to the basis, according to the number of shares, according to the number of shares, according to the number of shares, according to the number of shares, according to the number of shares, according to the number of shares, according to the number of shares, according to the 6.697 billion shares, according to the basis, according to the 6.697 billion shares of the Shanghai Stock Exchange. The proportion of 3 shares for each 10 shares is equipped with all shareholders, and the total amount of shares can be sale is 2.09 billion shares, which are unlimited sales of cursor.

This off -share shares are the payment period from August 17th to August 23rd, and the company's shares will be suspended throughout the day; August 24th is the online liquidation period of the registration company, and the company's shares will continue to be suspended for one day; the company's shares will be in August. On the 25th, the market will be resumed.

The largest shareholder of Fujian Province has promised to subscribe for full subscription

According to the announcement, the price of the shares of Xingye Securities is RMB 5.20 per share, which uses a substitution method. The total amount of funds raised in this offering is expected to not exceed RMB 14 billion (specific scale depends on the market conditions at the time of distribution). After deducting the issuance costs, it is intended to increase the company's capital and supplement the operating funds. The sponsorship of the offering of the shares is CICC, and the joint underwriter is CITIC Securities and Shen Wanhongyuan underwritten and Huatai.

As of the end of the first quarter of 2022, there were a total of 280,200 shareholders. Its largest shareholder is the Fujian Provincial Department of Finance, holding 1.357 billion shares of the company, accounting for 20.27%of the company's total share capital.

It is worth mentioning that in August last year, the Fujian Provincial Department of Finance has issued a letter of commitment that in accordance with the shares and distribution ratio of the shares and shares determined by the promotion securities and sponsor (underwriters), it will be fully subscribed for this shares in cash. For allocating shares. Based on this, the shares of the Ministry of Finance of the Fujian Provincial Department of Finance will spend about 2.116 billion yuan.

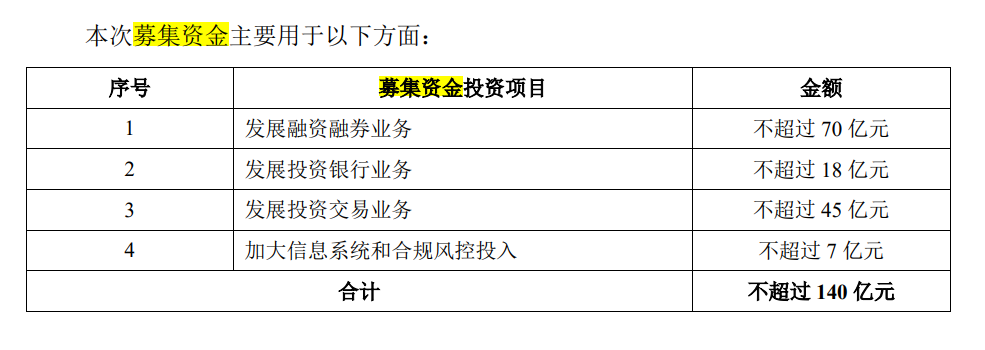

In addition, in the shares, Xingye Securities also pointed out that this fundraising is mainly used in the following four aspects: the development of financing and securities lending business does not exceed 7 billion yuan, the development of investment banking business does not exceed 1.8 billion yuan. 4.5 billion yuan, increasing the investment system and compliance control investment of not more than 700 million yuan.

It is worth mentioning that Industrial Securities has recently showed the desire to expand its capital strength. On July 25, the company just announced that the CSRC approved the company's total amount of face value to professional investors to issue a total of not more than 15 billion yuan of corporate bonds.

Since 2021, securities firms have raised up to 62.2 billion yuan through A -share allocation

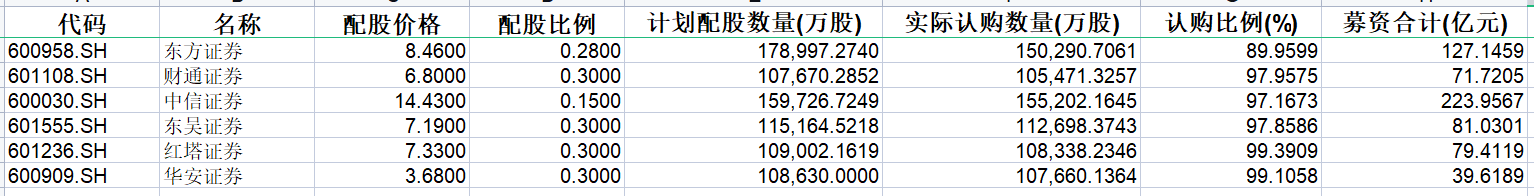

In recent years, the distribution shares have not been common in the A -share market, but securities firms have become the main force of the distribution. Oriental Fortune CHOICE Financial terminal data shows that since 2021, a total of 14 companies in the A -share market have conducted shares, 6 of which are brokers, with a total funding of 62.2 billion yuan (excluding H -share financing parts).

Among them, the A+H shares completed by CITIC Securities this year are the largest shares in the history of the securities industry. In the end, the number of effective subscribed shares of A shares was 1.552 billion shares, the actual subscription ratio was 97.17%, and the fundraising was 22.396 billion yuan. On March 2nd, CITIC Securities announced the results of H -shares allocation, and finally raised 6.04 billion Hong Kong dollars (equivalent to RMB 4.93 billion), of which the issuance fee was 53.65 million yuan. A+H -shares raised about 27.2 billion yuan.

However, each time the shares are encountered, it seems that the stock price of related companies is mostly empty. Even from the announcement of the shares and the approval of the Securities Regulatory Commission, the middle will experience a long period of time. The market has expected, but some investors will still choose to withdraw before the implementation of the shares. For example, CITIC Securities announced the implementation of the shares on the evening of January 13, and its stock price fell nearly 5%the next day.

For investors in Xingye Securities, August 16th is the equity registration date. Because the 13th and 14th coincides with the weekend, if you choose not to participate in the off -distribution, you need to be traded on August 11th, 15th, and 16th. Sell on the day. In accordance with the rules of shares, the stock price of the listed company will be removed after the shares.

Daily Economic News

- END -

Transaction is changing!Ancai Hi -Tech: The price increase of the price increase within three consecutive trading days has reached 20%

Every time AI News, Ancai Hi -Tech (SH 600207, closing price: 7.12 yuan) issued an...

Improve the supply chain mechanism of stable industrial chain, strengthen supply and demand docking ... These measures further boost the industry

Xinhua News Agency, Beijing, June 27th: Improve the supply chain mechanism of stab...