Over 40,000!Just now, this new stock has skyrocketed 200%, and the abandoned buying is going to cry ... The cultivation of diamonds will be hot again, and many double bull stocks have a new high

Author:Broker China Time:2022.08.12

Source: Securities Times ID: wwwstcncom

After experiencing the general rise of yesterday, the A -share and Hong Kong stocks continued to fluctuate today.

Turn off the fire of photovoltaic, energy storage, semiconductor, and other tracks. The A -share GEM index fell over 1%today. The cyclical stocks such as mining, coal, and oil rose against the trend.

Hong Kong stocks also continued to fluctuate in early trading. Electricity, oil, steel, catering and other performances were strong. Photovoltaic, online education, gaming, beer and other sectors fell the top. The real estate stock Longhu Group once fell more than 9%in the early morning.

One -sign earning 40,000

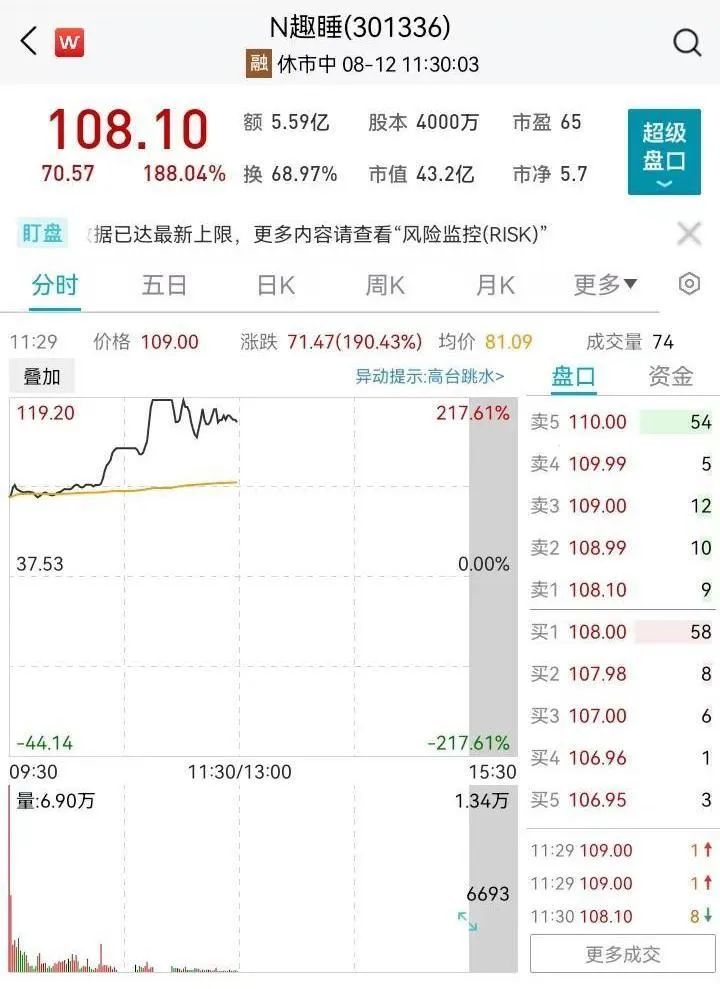

On August 12, Haiguang Information and GEM New Stock Fun Diamond Technology were listed simultaneously on August 12th. Two of the fun sleep technology disk stopped, the highest price rose to 119.2 yuan, an increase of 217.61%, and the income of 500 shares in the middle one was over 40,000 yuan. As of the afternoon closing, Fun Sleeping Technology closed up 188%to 108.1 yuan, and the single -signing income was 35,300 yuan.

Haiguang information disk rose to a maximum of 73.8 yuan, an increase of more than 100%, but then continued to call back. As of the afternoon closing, Haiguang information rose 75.69%to 63.25 yuan, and the single -signing income was 114,000 yuan.

Haiguang Information is a scarce X86 instruction collection CPU and compatible with the "CUDA" environment DCU manufacturer. The company obtained the X86 instruction set through AMD, and mastered the core micro -structural design of high -end processors, high -end processor SOC architecture design, processor security, processor verification, high main frequency and low power processor implementation, high -end chip IP design, etc. A number of key technologies have developed products with multiple performances that have reached the level of mainstream high -end processors in the same type. Products are widely used in the fields of key information infrastructure such as e -government, energy, transportation, finance, and communication.

As the main underwriter of Haiguang Information, CITIC Securities included 419,800 shares of abandoned purchase, with a maximum floating profit of 15 million yuan.

Established in 2014, it has focused on Internet retail, which has focused on its own brand technology innovation home products. The company's business structure can be divided into two major pieces of furniture and home textiles.

However, because its product sales highly depended on Xiaomi, the Securities Regulatory Commission asked the company twice. It is understood that Fun Sleeping Technology and Xiaomi Youpin were established in October 2014. In November 2015, Fun Sleeping Technology began to cooperate with Xiaomi and cooperated with Xiaomi Mall in August 2016.

Since cooperating with Xiaomi Group, Fun Sleeping Technology has continued to lead in Xiaomi's home furnishing category. From 2018 to 2021, it has won the Xiaomi Youpin Furnishing Sales Championship for four consecutive years. From 2019 to 2021, the company's revenue achieved through Xiaomi channels reached 418 million yuan, 327 million yuan, and 290 million yuan, respectively, accounting for 7569%, 68.43%, and 61.41%, respectively.

In the reply letter, Fun Sleeping Technology stated that the company is actively developing other sales channels. At present, in addition to the Xiaomi and Jingdong channels, the company has opened stores on many platforms such as Ali, Suning, Pinduoduo, Gome, and Zanzan, and conducts conduct. Promotion and sales.

Fun Sleeping Technology has also been abandoned by investors in China. CICC sold 77,000 shares as the main underwriter, with a maximum floating profit of 6 million yuan.

Cultivation of diamonds fiery again

Today's market leading sector is mainly based on cyclical stocks such as mining, oil, aluminum industry, and the cultivation of diamonds.

The Yellow River whirlwind in the diamond sector was the first to rose the daily limit. Power diamonds, Sifangda, Mancaron, and Zhongbing Red Arrows rose sharply. In fact, since the second half of 2021, many double bull stocks have been born in the cultivation of the diamond sector. Today, as the relevant stocks related to the sector have risen again, strength diamonds, Sifangda, and Zhongbing Red Arrows refresh record high records.

Cultivating diamonds is a diamonds that simulate the growth environment of natural diamonds. From the perspective of product attributes, the cultivation of diamonds and natural diamonds are the crystals of pure carbon. They have the same physical, chemical, and optical properties. They are also completely the same as natural diamonds in terms of brightness, gloss, fire, and flashing. The market price of Hepin Cultivation Diamond is only about 30%of the price of natural diamonds.

Cultivating diamonds was fired. On the one hand, the US sanctions against Russian diamond giants Erosa "AlROSA" caused the global diamond industry confusion. Manufacturers and traders had to find a way to obtain diamonds.

On the other hand, the industry's high boom is still continuing. According to the data of Indian import and export websites that occupy 95%of the world ’s cultivation of diamond polishing and processing market share, from January to June 2022, India's cumulative imports of diamonds were 870 million US dollars, an increase of 72%year-on-year.

The semi -annual report of A -share listed companies also proves the industry's prosperity. Power diamonds announced on August 11th annual report that in the first half of the year, operating income was 448 million yuan, a year -on -year increase of 105.14%; net profit attributable to mothers was 239 million yuan, a year -on -year increase of 121.39%.

In addition, the world's largest diamond mining companies, Dobels, the artificial crystal leading brand Swarovski, and the fashion jewelry brand Pandora, etc., have entered the cultivation of the diamond market, strengthened consumer cognition, enhanced consumers' acceptance of the cultivation of diamonds, promoted the continuous industry's sustainable industry Infiltration and scale development.

Shanxi Securities believes that at the current point of view, the cultivation of the diamond industry is still in the rapid growth stage. In the short term, Russia Erosa has brought the gap between the supply and demand of natural diamonds by European and American sanctions, the global inflation environment is superimposed. promote. For consumers, a higher -quality diamond can be purchased in a limited budget. In the context of consumers' younger and sustainable conceptual awareness, the cultivation of diamond penetration is expected to continue to improve. Hong Kong stocks electricity and other sectors rose sharply

Hong Kong stocks power, steel, oil, coal and other sectors are relatively strong, while photovoltaic, pork, semiconductor and other sectors have fallen significantly. In the power sector, China has risen by 7%, and Datang New Energy, Huadian International, and Huaneng International have risen.

Li Ning rose up by a maximum of nearly 7%. Li Ning released its mid -term results on August 12, with revenue rose 21.7%year -on -year to 12.409 billion yuan, and gross profit increased by 8.8%year -on -year to 6.2 billion yuan. The equity holders accounted for 11.6%year -on -year profit for net profit to 2.189 billion yuan.

The Hang Seng Technology Index was weakened in early trading. After opening the high opening of Xiaopeng Automobile, Weilai, and the ideal car, it fluctuated and weakened. After the rebound of Internet stocks yesterday, the trend was weak today.

The world's largest hedge fund bridge and water fund submitted the holding report in the second quarter of 2022 to the US Securities and Exchange Commission (SEC). In the second quarter, Bridge Water Fund plus positions in Baidu, Weilai, Clear Clearance Alibaba ADR, JD ADR. The holding report shows that as of the end of the second quarter, the market value of the U.S. stock stocks of Qiaoshui Fund reached US $ 23.598 billion, a 4.87%of the holding scale from the end of the previous quarter.

The real estate stock Longhu Group fell more than 9%at the beginning of the market, and then rose to narrow. Recently, there are rumors that Longhu business tickets have been overdue. The company's management urgently convened an interim conference on investors to communicate. Wu Yajun, the founder and chairman of Longhu Group, attributed the reasons for the decline in the stock price to the market panic. The Shanghai Bill Exchange also announced that after being verified by the office, Longhu Group has no business ticket default and refusal records, and there is a large number of business tickets for online companies.

In this context, CITIC Securities, Shen Wanhongyuan, and Haitong Securities have given rating "buy" and "better market". CITIC Securities believes that the credit of enterprises under the market economy does not mainly depend on the status of shareholders, but the company itself. Longhu Group is the most able to adhere to financial discipline in private enterprises. The assets are mainly distributed in first -tier and second -tier cities. The sales repayment fluctuations are small, the short -term debt burden is light, and the investment in property reserves are many. In July, the company successfully issued 1.7 billion yuan of corporate bonds, with a non -issuance ticket rate of 4.10%. CITIC Securities is confident in the company's credit.

Responsible editor: tactics

- END -

How to grasp the key points, make up for shortcomings, and strong foundations?

China Net News (Reporter Yao Yuchen) On July 27th, the How to grasp the agricultur...

The number of high -proportion of the controlling shareholders pledged the number of listed companies to 250, nearly eight, and nearly eight became the "cooked noodle holes" in the same period last year.

Reporter Xing MengIn recent years, the pledge market of A -share stocks has continued to improve, and the phenomenon of unscrupulous has changed significantly, and market risks are generally control