Financial data was released in July!RMB loans increased by 404.2 billion yuan year -on -year newly increased by 319.1 billion yuan year -on -year

Author:Daily Economic News Time:2022.08.12

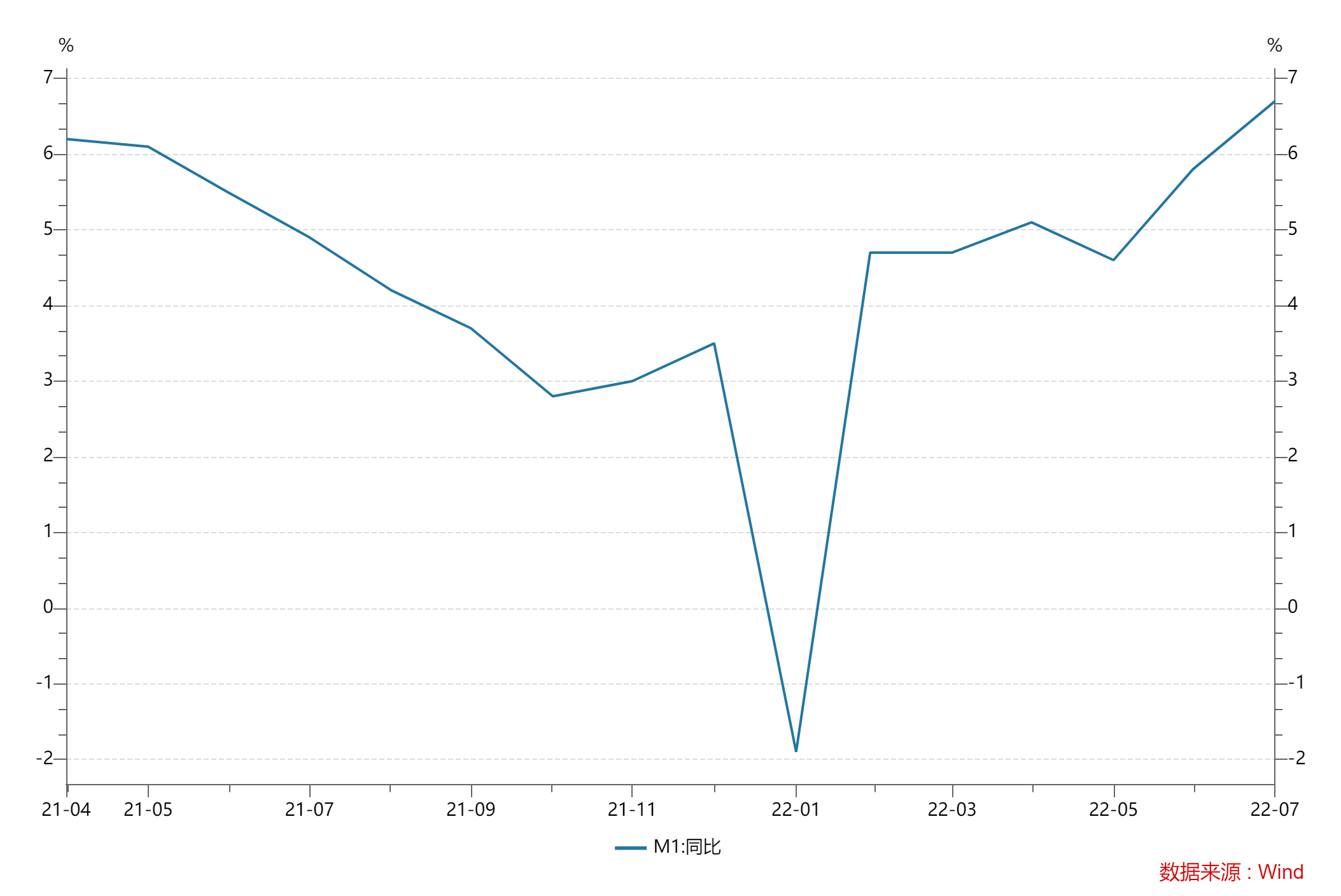

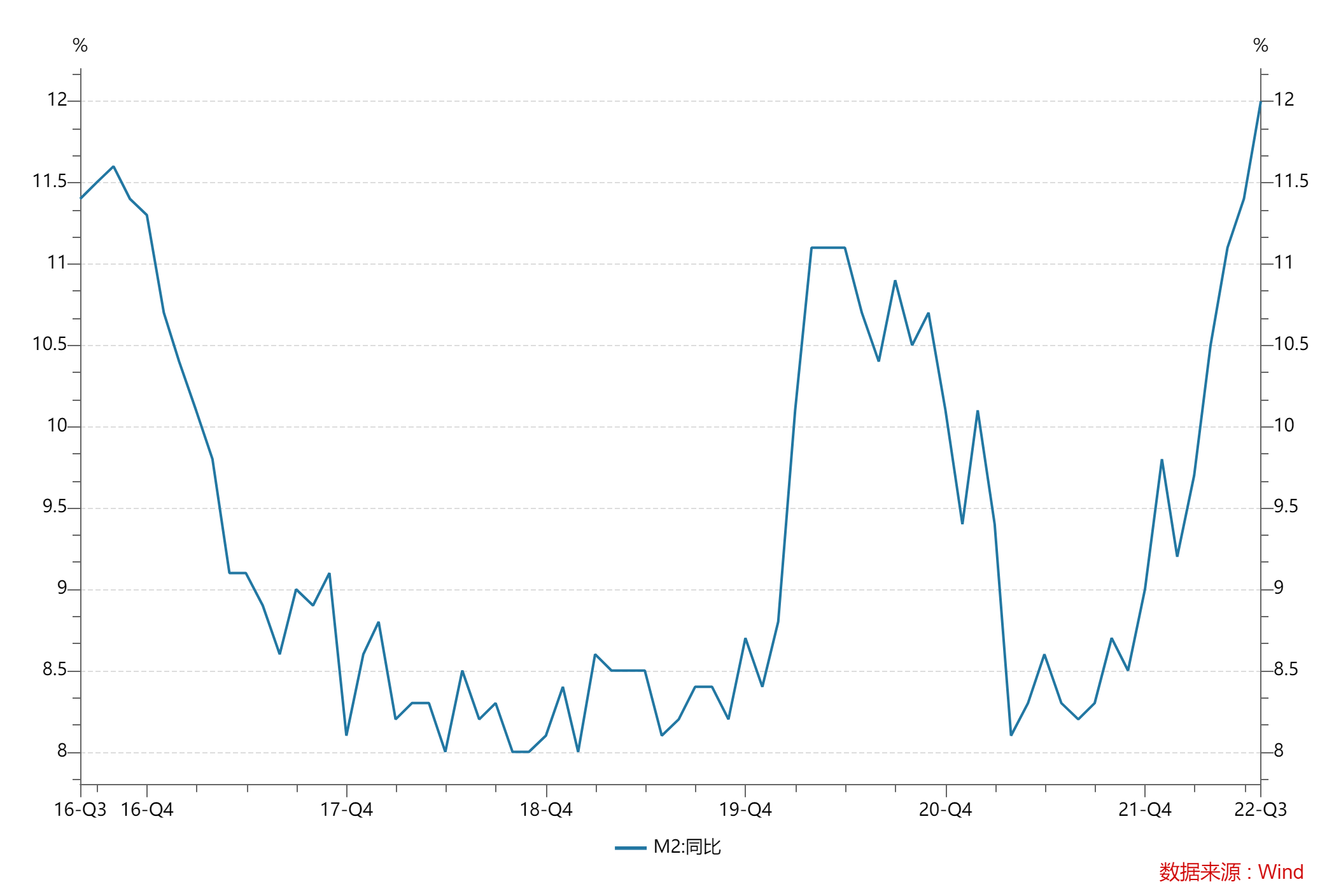

On August 12, the central bank announced that at the end of July, the broad currency (M2) and narrow currency (M1) increased by 12%and 6.7%year -on -year, respectively, and the growth rates were 0.6 and 0.9 percentage points higher than the end of the last month. Every reporter noticed that in July, the M2 growth rate reached a new high of 6 years, and the M1 was new high since April 2021.

In terms of RMB loans, RMB loans increased by 679 billion yuan in July, an increase of 404.2 billion yuan year -on -year. From a structural point of view, in July, short -term loans of residents and enterprises (affairs) industry units decreased by 26.9 billion yuan and 354.6 billion yuan, respectively, and medium- and long -term loans increased by 148.6 billion yuan and 345.9 billion yuan, respectively.

In terms of social financing scale, the scale of social financing at the end of July 2022 was 33.49 trillion yuan, an increase of 10.7%year -on -year. The increase in social financing in July 2022 was 756.1 billion yuan, 319.1 billion yuan less than the same period last year.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said in an interview with a reporter WeChat: "From July Credit, Social Finance and M2 data, domestic currency supply is reasonable and abundant, but physical financing needs weakly; Wide credit conversion. "

Wen Bin, chief economist of China Minsheng Bank, believes: "From financial data, it can be seen that the current foundation of my country's economic recovery is still unstable. The next stage should continue to implement various steady growth measures, especially to strengthen fiscal, currency, and industries , Coordination and cooperation of employment policies, stable external demand, expand domestic demand, promote consumption, expand investment, and support valid demand for credit. "

M2 balance increases by 12% year -on -year

Data show that at the end of July, the balance of M2 was 25.781 trillion yuan, an increase of 12%year -on -year, and the growth rate was 0.6 and 3.7 percentage points higher than the same period last month and the same period of the previous year. 0.9 and 1.8 percentage points higher than the same period last month and the same period last month; the balance of currency (M0) in circulation was 9.65 trillion yuan, an increase of 13.9%year -on -year. Cash on the month was 49.8 billion yuan.

"Daily Economic News" reporter noticed that in July, M2 hit a new high of 6 years, and M1 reached a new high in April 2021.

In addition, in July, RMB deposits increased by 44.7 billion yuan, an increase of 1.18 trillion yuan year -on -year. Among them, residents' deposits decreased by 338 billion yuan, non -financial corporate deposits decreased by 1.04 trillion yuan, fiscal deposits increased by 486.3 billion yuan, and non -bank financial institutions deposits increased by 804.5 billion yuan.

Zhou Maohua told reporters that M2 continued to rise in July, mainly due to the continuous efforts of fiscal and monetary policy, increasing basic currency investment, and driving the significantly increased deposit of corporate departments; reflecting the sufficient domestic currency supply.

"M1 continues to accelerate year -on -year, reflecting a significant increase in short -term deposits of enterprises. On the one hand, it reflects the increase in corporate activity; on the other hand, the short -term cash flow of enterprises has improved." Zhou Maohua said.

Wen Bin said that in July M2 increased by 12%year -on -year, and the central bank maintained the market liquidity and abundant market liquidity through a combination of multiple monetary policy tools. Although the effectiveness of the credit faction should weaken, as the fiscal expenditure increased steadily, fiscal deposits increased by 486.3 billion yuan Yuan, an increase of 114.5 billion yuan year -on -year, helps to improve liquidity. The weighted average interest rate and pledge repurchase weighted average interest rate of peers borrowed the weighted average interest rate and pledge repurchase at the same period last month and the same period of the previous year.

Zhou Maohua said: "M2 maintained a high year -on -year, and the domestic monetary policy remained stable and slightly loose, and continued to provide strong support for the real economy recovery; the domestic epidemic prevention and control situation was better, and domestic economic activities were accelerated. The policy effect of the city's policy stabilizing the property market has gradually emerged, driving the real estate market financing to recover; the implementation of key infrastructure projects drives upstream and downstream credit demand growth. It is expected that credit demand will gradually increase. "

RMB loans increased by 404.2 billion yuan year -on -year

In terms of RMB loans, it increased by 679 billion yuan in July, a year -on -year increase of 404.2 billion yuan. From the perspective of the sub -department, household loans increased by 121.7 billion yuan, of which short -term loans decreased by 26.9 billion yuan, and medium -to -long -term loans increased by 148.6 billion yuan; enterprises (affairs) loans increased by 287.7 billion yuan, of which short -term loans decreased by 35.46 billion yuan, medium to China, medium, medium to China Long -term loans increased by 345.9 billion yuan, and bill financing increased by 313.6 billion yuan; loans of non -bank financial institutions increased by 147.6 billion yuan. From January to July, the cumulative RMB loan increased by 14.35 trillion yuan, an increase of 515 billion yuan year-on-year.

Zhou Maohua pointed out that in July, domestic new RMB loans increased significantly year -on -year, and the main reasons for the rebound of bill financing: on the one hand, the demand for the real economy's financing was weak, and the basics of recovery needed to be consolidated. From the perspective of structure: residents and enterprises have increased significantly year -on -year loans, and the growth of residents and corporate deposits is obvious, reflecting the weak willingness to consumption and corporate investment in residents; Among them, residents' medium- and long -term loans have shrunk year -on -year, reflecting the foundation of real estate recovery.

On the other hand, after actively promoting wide credit in the first month and the first half of the year, the demand for corporate credit financing must be "overdrawn" in advance, amplifying seasonal fluctuations in July. In addition, in combination with the July PMI manufacturing index, the extreme climate in July has an impact on industrial enterprises' production.

Wen Bin said that in July, RMB loans increased by 679 billion yuan, an increase of 404.2 billion yuan year -on -year. From the perspective of the sub -department, resident loans increased by 121.7 billion yuan, which was less than the same period last year, and the demand for residential loans fell. Among them, short -term loans decreased by 26.9 billion yuan, reflecting the decline in the willingness of consumer loans; medium- and long -term loans increased by 148.6 billion yuan, which is less than the previous month, indicating that the real estate market is still bottoming out. Enterprise (affairs) loans increased by 287.7 billion yuan, of which short -term loans decreased by 354.6 billion yuan, medium and long -term loans increased by 345.9 billion yuan, and bill financing increased by 313.6 billion yuan, which was significantly increased from the same period last month and last year, reflecting the current corporate financing of financing Insufficient demand, the scale of bill financing flushed again. Social finance increases less than 319.1 billion yuan less than the same period last year

In terms of social finance data, preliminary statistics were that at the end of July 2022, the scale of social financing was 33.49 trillion yuan, an increase of 10.7%year -on -year. Among them, the balance of RMB loan issued by the real economy was 20.55 trillion yuan, an increase of 10.9%year -on -year; foreign currency loans issued by the real economy were equivalent to 2.23 trillion yuan, a year -on -year decrease of 3.6%; the balance of entrusted loans was 10.89 trillion yuan , A year -on -year decrease of 0.2%; the balance of trust loans was 3.93 trillion yuan, a year -on -year decrease of 28.3%; the balance of unspoken bank acceptance bills was 2.55 trillion yuan, a year -on -year decrease of 21.9%; %; Government bond balance was 5.812 trillion yuan, an increase of 19.4%year -on -year; the balance of domestic stocks in non -financial enterprises was 1.011 trillion yuan, an increase of 14.4%year -on -year.

Look at the incremental data, preliminary statistics, the increase in social financing in July 2022 was 756.1 billion yuan, 319.1 billion yuan less than the same period last year. Among them, the RMB loan issued by the real economy increased by 408.8 billion yuan, an increase of 430.3 billion yuan year -on -year; foreign currency loans issued by the real economy were equivalent to RMB 113.7 billion, a year -on -year decrease of 105.9 billion yuan; Increasing 24 billion yuan; trust loans decreased by 39.8 billion yuan, a year -on -year decrease of 117.3 billion yuan; unimpeded bank acceptance bills decreased by 27.4 billion yuan, a year -on -year decrease of 42.8 billion yuan; net corporate bond net financing of 73.4 billion yuan, 235.7 billion year -on -year less than 235.7 billion yuan Yuan; net financing of government bonds was 399.8 billion yuan, a year -on -year more than 217.8 billion yuan. From January to July, the cumulative increase in social financing was 2.177 trillion yuan, which was 2.89 trillion yuan over the same period last year.

Zhou Maohua pointed out that the slowdown of social finance data in July, increased less year -on -year. From the perspective of the split structure, real economic credit and corporate bond issuance became a drag; reflecting the weak physical financing demand and the policy of policy leading to the advancement of the policy in the first half of the year. There must be "overdraft". However, the fluctuation of new social financing and credit data in a single month is generally large, and the year -on -year growth rate of social integration is not low (10.7%), and it continues to match the growth rate of nominal GDP.

Wen Bin said that the increase in social financing in July was 756.1 billion yuan, and seasonal declines occurred, an increase of 319.1 billion yuan from the same period last year, reflecting the weaker demand for the current real economy. Among them: RMB loans issued by the real economy increased by 408.8 billion yuan, an increase of 430.3 billion yuan year -on -year, a significant decline. At the same time, the net financing of corporate bonds was 73.4 billion yuan, an increase of 235.7 billion yuan year -on -year. In addition, the net financing of government bonds was 399.8 billion yuan, a year -on -year more than 217.8 billion yuan, which helps to better play the role of active fiscal policies in the next stage.

Zhou Maohua pointed out that from the year -on -year data of credit, social finance and M2, domestic currency supply is reasonable and abundant, but the demand for physical financing is weak; domestic needs to further promote the transition from wide currency to wide credit. In the second half of the year, my country is facing the slowdown of global demand, and it is necessary to be vigilant about the tightening of overseas central bank policies and input inflation. Domestic monetary policy continues to maintain a stable tone, pay attention to the accurate quality and efficiency of the policy, and cooperate with the policy of monetary policy and fiscal, industry, and other policies to implement the previously introduced confession and stability, relieving rescue enterprises, stable growth policies, and promoting the virtuous cycle of supply and demand; Large -China, small and medium -sized enterprises such as weak links and manufacturing industries such as emerging areas such as support; support the financing guarantee of key projects, and accelerate the implementation of the project's implementation; as well as promoting financing services for new citizens.

Daily Economic News

- END -

"Unusual", the Federal Reserve has shot

On June 15, local time, the Federal Reserve Commission announced that it had raise...

Welcome to Tanabata in the "Cold Winter" of the condom brand: affected by the epidemic and changes in young people's habits

Recently, according to Jiuqian's data, in 2022, from the June data of 618 major promotion, in addition to Durex and Jehnbon, the top five celebrities, 6th sense, and Okamoto, all of which have decline...