Chu Zhaowu's performance meeting of the new chairman of urban construction development: Tiantanfu has not obtained the certification batch or the price adjustment has not been mentioned by the annual sales target

Author:Daily Economic News Time:2022.08.12

On August 11, the development of urban construction (SH600266, a stock price of 4.02 yuan, a total market value of 9.071 billion yuan) held a semi -annual performance briefing in 2022. Chu Zhaowu, chairman and general manager of the company, talked about future development, key projects, financial assets, etc. However, it chose to avoid issues such as performance growth.

"Stable operating performance in the real estate sector"

On July 20, the Urban Construction Development Announcement stated that Chu Zhaowu was elected as the chairman of the company's eighth board of directors, and former chairman Chen Dahua no longer served as the company's director and chairman.

Chu Zhaowu is 57 years old. He was the assistant to the general manager of the Beijing Urban Construction Group Co., Ltd. and the manager of the general contracting department of the construction engineering engineering and deputy secretary of the party committee.

Shortly on August 5th, Chu Zhaowu announced the development of the 2022 half -annual report. According to the "Daily Economic News" previously reported, the company's operating income in the first half of the year was about 8.39 billion yuan, a year-on-year decrease of about 22%; the net profit attributable to shareholders of listed companies was about -33 million yuan, a year-on-year decrease of 153.13%; The company's shareholders' deduction of non -recurring profit and loss was about 13.69 million yuan, a year -on -year decrease of 98.97%.

Regarding these declined operating performance indicators, Chu Zhaowu did not talk too much, only said: "The company's current funds are relatively abundant, and sales in the Beijing market in 2022 are ranked among the Beijing market. In the second half of 2022 Multiple projects will be delivered one after another, and the company will strive to maintain a healthy and stable development. "

Regarding the performance, the chief financial officer Xiao Hongwei said: "Eliminating the impact of changes in fair value changes and investment income, the total profit will increase by 1.1 billion yuan. The main business gross profit is 2 billion yuan. Stablize."

"The gross profit margin was 23.88%, and the same period last year was 17.58%. The main reason for the year -on -year increase was due to the different projects of this year's revenue from the project that revenue in the same period last year."

Starting as soon as possible, selling as soon as possible

For sales, Chu Zhaowu talked about several key projects.

According to the "Daily Economic News" previously reported, Tiantanfu was sold well. In April 2022, 134 sets of online signed by the 545 sets of pre -sale permits, the average transaction price was 122823.9 yuan/square meter, and November 2021 Among the 351 suits of the pre -sale certificate, 238 sets of online signed.

When answering whether the price of Temple of Temple will increase in the future, Chu Zhaowu said: "The first phase of the Temple of Tanfu project was before September 30, 2023 (including the day). The period has been sold for evidence, and the price prices on the ground residential houses are 122,000 yuan/square meter, 122,000 yuan/square meter, and 123,000 yuan/square meter. The batch price of the non -evidence will be adjusted in accordance with market and government guidance. "

In addition, Chu Zhaowu revealed that the company's total investment in the Wangtan shed reform project related to Tiantanfu is about 40 billion yuan. The entire project is expected to be completed in 2025. The specific income of the project is subject to the announcement data.

Regarding the development of the next step, Chu Zhaowu seems to be very confident. He said: "Due to the reform of the business environment of Beijing, the initial procedures for the initial period of each project have accelerated. During the period, the company's land reserves were about 5.717 million square meters, which increased the rapid processing of the early stage of land. Each project was sold as soon as possible. "

But when answering "whether the company has a plan to increase the annual sales target according to the sales of the first half of the year?", Chu Zhaowu replied: "Please refer to the information disclosed by the company."

"It will indeed affect the company's performance"

According to the "Daily Economic News" previously reported, "foreign equity investment" is one of the main business of urban construction development, but its contribution to its performance has mainly played a negative role. In the first half of the year, the stock price of Guoxin Securities held by the Urban Construction Development Development Falling, according to the provisions of the corporate accounting standards, the profit or loss of the fair value of the transactional financial assets of this transactional financial assets; The law calculates its investment income of -611 billion yuan.

Chu Zhaowu acknowledged this problem: "The price fluctuations of financial assets that are measured at the current accounting standards are measured at fair value and their changes in the current profit and loss."

The solution given is: "The company will actively manage the financial assets held in accordance with its own strategy and market conditions, ensure the reasonable and orderly flow of financial assets, and strive to improve the company's income."

In addition, as a subsidiary of the Beijing Urban Construction Group, Chu Zhaowu reiterated the support of the parent company's policy support and will use urban construction development as the only listed platform and capital operation platform for urban construction groups and asset integration.

"Beijing Urban Construction Group promises: If the company has the same business opportunities that are the same business as the main business of urban construction, similar, and constitute a substantial competition relationship, the company will meet the relevant laws and regulations and the existing reasonable business agreement.When commercial opportunities notify urban construction development, the urban construction development will be willing to use such business opportunities during the notification period, and the company will actively promote the development of urban construction development.The real estate business is the same as the main business of urban construction development, similarly, and similar to a substantial competition relationship. "Daily Economic News

- END -

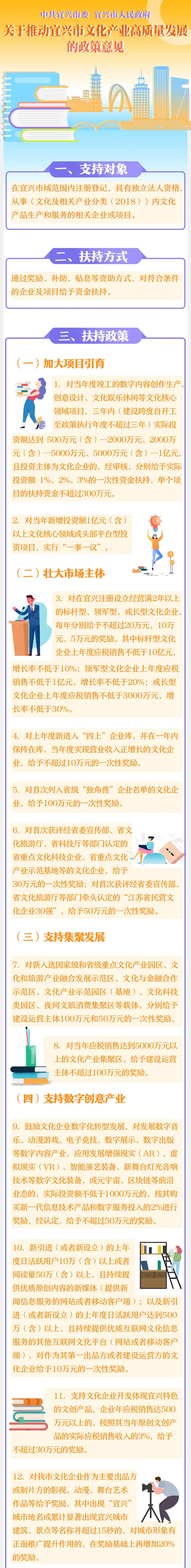

Heavy!Yixing issued 21 incentive policies to accelerate the promotion of the high -quality development of the cultural industry

Recently, Yixing City issued 21 policies on Policies on Promoting the High -qualit...

The three major indexes fell across the board, educational stocks rose against the trend, and New Oriental rose more than 12%

On July 6, Capital State learned that the three major indexes of Hong Kong stocks fell across the board. As of the close, the HSI fell 1.22%at 21586.66 points, the Hang Seng State Index fell 1.26%to 7