The prince milk auction equity was taken down by the three yuan, and it was the CCTV benchmark. Why is this?

Author:Radar finance Time:2022.08.12

Radar Finance Hongtu Products | Editor Wu Yanrui | Deep Sea

Recently, Sanyuan shares obtained 40%of the stake in Prince Milk through the second public auction. Since then, Sanyuan Co., Ltd. holds the prince milk company wholly.

As the former CCTV advertising "king", Prince Milk once ranked among the best in national lactic acid bacteria drinks. However, during the financing pairing period, Prince Milk had encountered the Sanlu incident and subprime crisis. In addition, the previous rapid expansion, on 2010, embarked on the path of bankruptcy and reorganization.

In 2011, Sanyuan participated in the bankruptcy and reorganization of Prince Milk, and invested 225 million yuan to obtain 60%of the shares of Prince Milk. Prince milk that merged into the financial report of the three yuan shares did not bring generous returns to Sanyuan. During the ten years from the end of 2011 to the end of 2021, the book value of Prince Milk's assets has shrunk by 59.05%.

5.6 % off the three yuan shares to take off Prince Milk's remaining equity

On August 8th, Sanyuan announced that the company won the Biotechnology Co., Ltd. of Hunan Prince Milk Group (hereinafter referred to as "Hunan, hereinafter referred to as" Hunan, " Prince Milk ") 40%equity, follow -up companies will go through relevant procedures in accordance with laws and regulations.

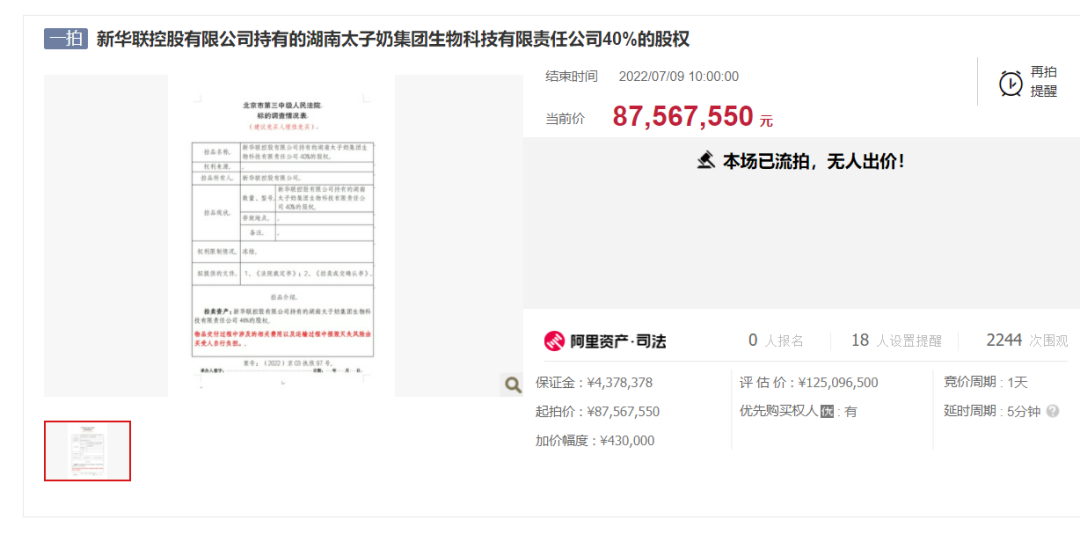

In fact, this is the second auction of the auction targets, which were previously shot because no one registered.

On July 2nd, Sanyuan announced that the company received a notice from the Beijing Third Intermediate People's Court to publicize a public auction of 40%equity of Hunan Prince Milk held by Xinhua Lian. As the company's prince's grandmother's shareholder, the company has the right to priority purchase. After comprehensive consideration, the company intends to give up the right to purchase priority and not participate in the auction.

The above auction was shot on July 9th, 0 people registered, and the relevant case number was (2022) Beijing 03, No. 97.

On August 6, at 10 am, the relevant shares were again auctioned on the Taobao judicial auction network platform again. On the same day, Sanyuan announced that the company recently received a notice from the court to a second public auction of 40%of the equity of Hunan Prince Milk, with a starting price of 70.54 million yuan. The seventh meeting of the Eighth Board of Directors of the Company reviewed and approved the "Proposal on the Second Auction of 40%Stocks of Hunan Prince Milk held by Xinhua Union".

The second public auction ended on August 7, 2022. One person signed up, and the transaction price was the same as the starting price.

Hunan Prince Milk was established in May 1997 and is mainly engaged in the research and development and production of fermented lactic acid bacteria milk drinks. Before the auction, Sanyuan shares held 60%of Hunan Prince Milk, and Xinhua Lian held 40%of the equity.

According to the evaluation report of the "Xiang Nights Evaluation Word [2022] No. 032" issued by the Hunan Public Asset Asset Evaluation Co., Ltd. entrusted by the court, with December 31, 2021 as the evaluation benchmark date, the 40%equity of the Hunan Prince Milk held by Xinhua Lian The value is 1250.965 million yuan. Sanyuan shares are equivalent to the equity of the auction at 5.6 % off.

At the end of 2021, the company's total assets were 233 million yuan, the total liabilities reached 9.2017 million yuan, and the net assets were 223 million yuan. In 2021, the company's operating income was 18.5196 million yuan, and the net profit was -58.993 million yuan.

In the above evaluation report, Hunan Prince's assets are mainly based on fixed assets, accounting for 89.46%of total assets. At the same time, the book value of the company's fixed assets was 15.38%higher than the evaluation value, and the actual shrinkage was 31.999 million yuan. Among the debt composition, the company has no non -current liabilities, and its liabilities are 9.2017 million yuan in liabilities.

Sanyuan Co., Ltd. participated in the bankruptcy and reorganization 11 years ago

Radar Finance noticed that the "Prince Milk" was established the following year, and it was a childhood memory of some people.

After graduating from the prince's founder Li Tuchun, he has worked in pasta shops and ramen shops for many years. Since then, he has run through grain and oil sales, bought calendars, opens a bookstore, engaged in video halls, and hosted magazines.

In March 1996, 36 -year -old Li Tuchun founded the Zhuzhou Prince Milk Factory. At the end of the year, the first batch of lactic acid bacteria milk drink products was officially put into production and produced. After slowly famous in Zhuzhou, Li Tuchun wanted to put advertisements on CCTV in order to push prince's milk to the country.

At the end of 1997, CCTV's 1998 gold advertising segment bidding meeting was held. Prince Milk finally obtained the advertising playback right of "Weather Forecast" for 8888898 yuan. After becoming a baby, another food brand in CCTV's gold advertising section.

At that time, the sales of Prince Milk were less than 5 million yuan. After winning the "Bid King", the order was as many as 100 million.

In 2001, the output value of Prince Milk was tenfold, from 5 million revenue to 50 million yuan. In 2007, Prince Milk had more than 7,000 dealers across the country, with a total revenue of more than 2 billion, and the market share climbed to 76.2%, becoming the best brand of lactic acid bacteria in the country.

At the same time, Prince Milk has also raised huge sums of money in Hunan Zhuzhou, Beijing Miyun, Huanggang, Hubei, Kunshan, Jiangsu, and Chengdu, Sichuan.

In 2007, Prince Milk Group introduced US $ 73 million in risk investment such as British Federation, Morgan Stanley, Goldman Sachs, and signed a gambling agreement: in the first three years after capital injection, if the performance of Prince Milk Group increased by more than 50%, It can be adjusted (reduced) the equity of the other party; In addition, Prince Milk has obtained 500 million unpaid guarantees and low interest rates for banks such as Citi, Singapore Star Show, and Dutch cooperation. In 2008, the financial crisis broke out, and the sales of Prince Milk were unfavorable, failed to complete the gambling, and Li Tuchun lost his control of prince milk.

Since then, Prince Milk has not improved under the leadership of the new leadership. In July 2010, Zhuzhou Intermediate Court ruled that Prince Milk Group entered the bankruptcy reorganization procedure.

According to the Asian (Beijing) Asset Asset Evaluation Co., Ltd. Jingya Review Report [2012] No. 015 Evaluation Report, the value reorganization value of all the shareholders' equity reorganization of Hunan Prince Milk on November 8, 2011 was 451.7036 million yuan.

At that time, the book value of Hunan Prince Cecilia's cities was 569 million yuan, and the types of assets mainly included fixed assets (including house buildings, structures, machinery equipment, transportation vehicles and electronic equipment), engineering, and intangible assets.

In November 2011, Sanyuan signed the "Reorganization Agreement" with Xinhua Union and Hunan Prince. Sanyuan shares invested 225 million yuan to obtain 60%of Hunan Prince Milk, and Xinhua Union invested 150 million to hold 40%of Hunan Prince Milk.

At the same time, Xinhua Lian provided 340 million yuan in debt repayment for this special establishment of Zhuzhou Runkun Technology Development Co., Ltd. (hereinafter referred to as "Runkun Technology") to participate in the reorganization. , Hunan Prince Milk Group Supply and Marketing Co., Ltd. 100%equity and its corresponding assets. Run Kun Technology guarantees that the aforementioned assets obtained in any way (including self -operating or transferring) will not form a competition with Hunan Prince Milk in the dairy industry.

After the acquisition, the prince milk is "troubles" continuously

Radar Finance reads the financial report of Sanyuan's years, and the operating conditions of Hunan Prince's Milk are not ideal. During the ten years from the end of 2011 to the end of 2021, the book value of Hunan Prince's Milk has shrunk by 59.05%.

The Sanyuan shares stated in the 2013 annual report that Hunan Prince's milk equipment was aging and production efficiency was low. At the same time, Hunan Prince Milk, in the lack of construction parts, and the old equipment models, mostly pipe tanks, and the cost of disassembly is high. It is higher than the value of new equipment. At present, it is all in the state of abolition, and impairment is required.

In order to support the construction of national defense in 2017, the Zhuzhou Municipal People's Government commissioned the Land Reserve Center of Lujing District, Zhuzhou City to collect and store the land of Hunan Prince's milk in solid village in Qukan Township, Lujing District, Zhuzhou City, for national defense scientific research and supporting land. The board of directors agreed to collect and storage centers to store the above land of Hunan Prince Milk, and the acquisition was RMB 90 million.

In addition to the original property rights, the above land has some illegal buildings. In order to cooperate with the land collection and storage work, Hunan Prince Milk will be in the process of land clearance. ) The demolition of illegal buildings on the land was prosecuted by the other party, requesting compensation for losses.

After the dismissal of Xiangping Company in early 2018, it was re -prosecuted with the Xiang company and shareholder Tan Shengping, requiring the three defendants, including Hunan Prince Milk, to compensate them for losing RMB 8.7162 million. In December 2018, the Zhuzhou Intermediate People's Court of Hunan Province made a second trial judgment to judge that Hunan Prince Milk paid 500,000 yuan in compensation to Tan Shengping, Xiangping and Xiangsian Company to reject the plaintiff's other lawsuits for Hunan Prince Milk.

In 2019, the net profit of Chea -prince in Hunan increased significantly to 50.58 million yuan, mainly for the increase in government subsidies.

During the period, Hunan Prince Milk had a loan with another shareholder Xinhua Lian. In August 2013, Hunan Prince Milk borrowed 3.3 million yuan from Xinhua Union, with a loan interest rate of 6.6%.

In February 2020, Hunan Prince Milk provided a loan of 25.4 million yuan to Xinhua Lian, with a loan period of 36 months. The interest rate was a loan market quotation interest rate announced by the National Banking Center Borrowing Center.

Can the prince milk that is completely won by Sanyuan has won glory? Radar Finance will continue to pay attention.

- END -

The Wuhan section of Wuhan University has the conditions for opening at the end of October. Hubei will build 6 highways this year

Jimu Journalist Lu RuiCorrespondent Song Chao Chu GangOn July 21, at the junction ...

Chengdu Cultural and Creative "transcripts" in the first half of the year are freshly released!

Today, the reporter learned from the Chengdu Cultural Industry Office that from Ja...