Exclusive | The New York Stock Exchange: For individual Chinese companies announced the start of the "non -comment" from the United States' delisting

Author:First financial Time:2022.08.13

13.08.2022

Number of this text: 1107, reading time for about 2 minutes

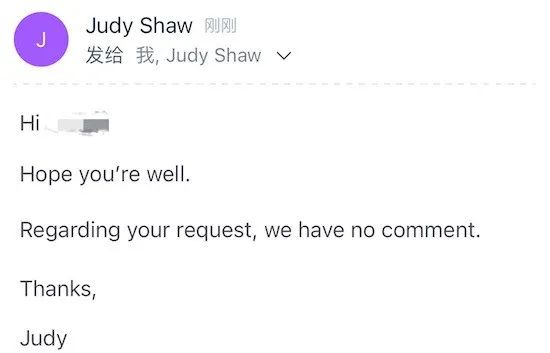

Introduction: PetroChina, Sinopec, China Life, China Aluminum and other medium -character companies announced that their deposit stocks were delisted from the New York Stock Exchange. In response, the New York Stock Exchange responded to the interview request of the First Financial Journalist and said that it would "not comment on the matter."

Author | First Finance Ge Weier

PetroChina, Sinopec, China Life, and China aluminum industry announced that their deposit stocks were delisted from the New York Stock Exchange. In response, the New York Stock Exchange responded to the interview request of the First Financial Journalist and said that it would "not comment on the matter."

The New York Stock Exchange responded to a wealth: "No comment"

In the early morning of Friday, PetroChina fell 3.25%, Sinopec fell 3.6%, and China's aluminum fell 3.79%. China Life fell 3.33%.

Chinese stocks generally declined, Alibaba fell 1.35%, JD.com fell 1.56%, Tencent music fell 2.5%, Weilai Automobile fell 2.16%, Xiaopeng Automobile fell 3.17%, a full gang fell 9.05%, and the daily fresh fell 7.14%. Essence

Although the main Chinese stocks in the early market generally declined, Brendan Ahern, the chief investor of the Kim Rui Fund, told the first financial reporter: "A positive signal is expected to promote the rebound of Chinese stocks."

The Internet index ETF (KWEB) in Kraneshares fell 1.92%.

The press release released by PetroChina on August 12 stated: "The company intends to submit form 25 to the SEC on August 29, 2022 or before and after, in order to delist it from the New York Stock Exchange. It is expected to take effect after submitting ten days in Table 25. The last trading date of the deposit shares on the NYSE is September 8, 2022 or around. Listed. "

Sinopec issued a press release released on August 12: "The company intends to submit a form 25 form 25 form 25 forms on August 29, 2022 to delist its deposit shares from the New York Stock Exchange. The delisting is expected to take effect ten days after the submission of Form 25. After the effective date and self -effective date, the company's depository shares will no longer be listed on the NYSE. "

The press release released by China Aluminum on August 12 states: "The company intends to submit a form 25 form 25 to the US Stock Exchange on August 22, 2022 to delist its depository shares from the New York Stock Exchange. It is expected to take effect after the delisting is submitted for ten days. The last date of the trading of the deposit shares on September 1, 2022 or before and after the New York Stock Exchange. The New York Stock Exchange is listed, and whether the company's depository shares will be traded on the off -site trading market after that will depend on the actions of shareholders and independent third parties, which does not involve the company's participation. "

"Recently, some Chinese companies have announced the start of the US delisting. What does the CSRC think?" In response to this issue, the China Securities Regulatory Commission responded in the evening.

"We have noticed the situation. Listing and delisting are the normal capital market. According to the announcement of relevant companies, these companies have strictly abide by the US capital market rules and regulatory requirements since listing in the United States. "The Securities Regulatory Commission pointed out that these companies are listed in many places, and the proportion of securities listed in the United States is small. The current delisting plan does not affect the continued use of the domestic and foreign capital market financing and development.

The China Securities Regulatory Commission respects the decision made by enterprises in accordance with its actual situation and in accordance with the rules of overseas listing.

"We will maintain communication with relevant overseas regulatory agencies to jointly safeguard the legitimate rights and interests of enterprises and investors," said the CSRC.

- END -

Qingshui County, Tianshui City: 10,000 acres of broad bean harvests in hopes of characteristic industries to help rural revitalization

Since the beginning of this year, Caochuanpu Town of Qingshui County seized the ma...

Identify financial fraud and build anti -fraud firewalls

In order to carry out the practical activities of the grassroots at the grassroots...