Foreign capital buying 1.9 billion!The market value of over 60 billion yuan, A shares 400 billion leaders!Another giant was sold more than 1.5 billion

Author:Broker China Time:2022.08.13

Source: E Company ID: lianhuacaijing

This week, the funds of the north were suppressed first and then sold. In the first half of the week, it was sold continuously. In the second half of the week, it was affected by the MSCI quarterly index adjustment. A share was greatly increased. Buy.

A total of 7.65 billion yuan was bought throughout the week, of which 6.456 billion yuan was bought at the Shanghai Stock Connect, and 1.194 billion yuan was bought by Shenzhen Stock Connect.

The good data announced by the China Automobile Association will be boosted, and the net purchase of the car industry in the north to the automotive industry is 1.935 billion yuan, which is the highest buying industry this week. The industry with stable performance has also been favored by funds from north this week. Household appliances, computers, real estate, building decoration and other industries have been sold over 100 million yuan.

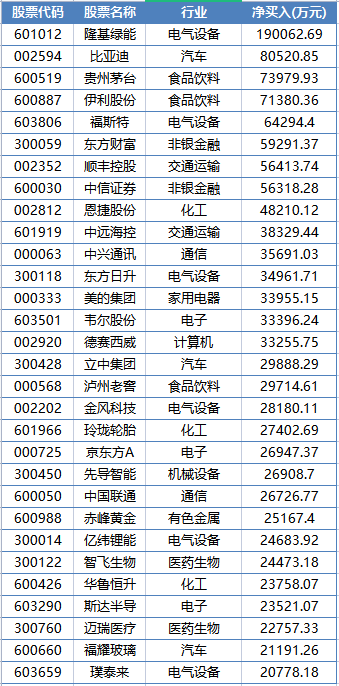

Buy more stocks in the north this week to buy more stocks

The prosperity of the automotive industry continues to increase

This week, the China Automobile Association announced the domestic car production and sales data and export data, all showing a prosperous trend. In July, the production and sales of domestic passenger vehicles completed 2.21 million and 2.174 million, respectively, an increase of 42.6%and 40%year -on -year, respectively. Among them, the production and sales of the new energy vehicle market completed 617,000 and 593,000, respectively, an average of 1.2 times year -on -year.

In July, my country ’s automobile exports were 290,000 units, a record high, and the export volume increased by 16.5%month -on -month, an increase of 67.0%year -on -year. From January to July this year, my country's automobile exports were 15.09 million, a year -on -year increase of 50.6%. The China Automobile Association also predicts that automobile exports are expected to exceed 2.4 million vehicles throughout the year.

Although the automotive sector is under adjustment this week, the funds in the north have made huge sums of money to increase the stock stocks. From the perspective of the subdivision industry, the automotive parts sector has become the focus of additional positions. A total of 1.176 billion yuan of net purchase has been obtained.

Lizhong Group is a large domestic aluminum alloy wheel manufacturing enterprise. In recent years, it has expanded to the new energy vehicle lithium battery industry. After the company's stock price was bottomed out in April this year, the company's stock price was greatly strengthened, and the historical high (re -rights) was a new high. This week, Northern Fund Capital Buy Lizhong Group 299 million yuan, plus 7.86 million shares, accounting for 1.27%of the total share capital. It is the highest share of the total share capital this week. The increase was increased to 14.15 million shares, with a increase of 125%, and the total shareholding reached a record high.

In addition, Fuyao Glass, Tuopu Group, Junsheng Electronics, Zhongding, etc. also received net purchase of more than 100 million yuan in northern funds this week.

Most institutions are optimistic about the market outlook of the automobile sector. Shanxi Securities said that the industry production and sales in July were faster than last month. The market expectations were expected. Considering that the consumption stimulus policy continued to ferment, and the shortage of production and sales in August last year, the production and sales volume was low. In August this year, the growth rate of production and sales is expected to maintain a high level. It is a high probability event to achieve positive growth in industry production and sales throughout the year, and the prosperity continues to increase.

However, some institutions have prompting risks. Zhongtai Securities pointed out that compared with the new energy sector, although the overall increase in the automotive sector is not as good as the overall increase, the internal division is small, and it also shows the "from real to false" that the previous market shows several times. specialty. It is worth noting that the more conceptual intelligent driving sector has performed strongly since July, which may mean that the overall rebound of the sector may enter the middle and late stages. While paying attention to the trend of the market outlook, it is recommended to meet at high time to control fluctuations.

The photovoltaic sector is different

This week, the funds in the north were different in the photovoltaic industry. The two giants Longji Green Energy and the Tongwei shares were topped the list.

Longji Green Energy is the world's largest single crystal silicon manufacturer. It has benefited the global energy transformation. In the past 10 years, Longji Green has maintained a compound growth of more than 30%of the year. The net profit increased from 52.7 million yuan to more than 9 billion yuan year year after 80.9 billion yuan. Earlier, Longji Green Energy was expected to achieve a net profit of 6.3 billion yuan to 6.6 billion yuan in the first half of 2022, a year -on -year increase of 26%-32%.

Bei Shang Fund bought Longji Green Energy more than 1.9 billion yuan this week. It was the only stock that bought over 1 billion yuan this week. Yuan is the fourth largest heavy stock stock in the north.

Tongwei has developed a new energy industry from the feed industry and cross -bank. It now has an annual capacity of 180,000 tons of high pure crystal silicon, and the annual production capacity of solar cells exceeds 50GW. The company planned high -pure crystal silicon and solar cells from 2024 to 2026, respectively, reaching 800,000 tons to 1 million tons, and 130GW -150GW, respectively.

Tongwei shares are also 10 billion yuan stocks in the north, and the current market value of more than 15.9 billion yuan. However, the North Shanghai Fund sold 1.526 billion yuan in Tongwei shares this week, which sold more than 10 yuan for the only net stock, reduced its holdings of more than 29.65 million shares. 40 million shares.

Photovoltaic concept stocks such as Foster, Dongfang Risheng, Tiantuangneng, Gudewei, and Guideway also obtained a net purchase of more than 100 million yuan in northern funds this week. Sunshine power, TCL Central, Mingyang Smart, etc. 100 million yuan.

CITIC Securities pointed out that in the fourth quarter of 2022, although silicon material may usher in a small peak in phased production, as photovoltaic entering the installation season and the potential construction of domestic ground power stations, the actual supply and demand of the silicon material may still be relatively tight.It is expected that the price of silicon material is relatively limited.At present, silicon materials will still be the most tense supply and the smallest production energy elasticity in the photovoltaic main industry chain.Responsible editor: Yang Yucheng

- END -

Over 1,300 international brands participated in the exhibition and opened to the public for two days

The Second Expo was hosted by the Ministry of Commerce and the Hainan Provincial P...

Weiyuan Road Street: "Anti -fraud" propaganda often reminds residents to tight "peace" string

In order to effectively enhance the awareness of telecommunications network fraud ...