What changes will it bring about the "upgrade" of the Shanghai -Shenzhen -Hong Kong -connected trading calendar?

Author:Xinhua News Agency Time:2022.08.14

The China Securities Regulatory Commission recently announced that it has launched the optimization of the calendar of Shanghai -Shenzhen -Hong Kong -connected transactions. According to estimates, after the transaction calendar is optimized, it is expected that the number of days that cannot be traded in the Shanghai and Shenzhen Connect of the Shanghai -Shenzhen -Hong Kong Stock Connect will be reduced by about half.

How to achieve the "upgrade" of this trading calendar? What changes and impacts will it bring?

The Shanghai -Shenzhen -Hong Kong Stock Connect will be unblocked in the joint trading day of the two places

The calendar of Shanghai -Shenzhen -Hong Kong Stock Exchange trading means that in the year of the year, Hong Kong investors can buy and sell stocks of the two places through the Shanghai -Shenzhen -Hong Kong Stock Connect.

When the Shanghai -Hong Kong Stock Connect was opened in 2014, there were differences in the holidays and settlement arrangements of the two places. The exchanges and settlement companies of the two places agreed that they were opened only in the Mainland and Hong Kong and can meet the settlement arrangements. This arrangement was used when the Shenzhen -Hong Kong Stock Connect was opened in 2016.

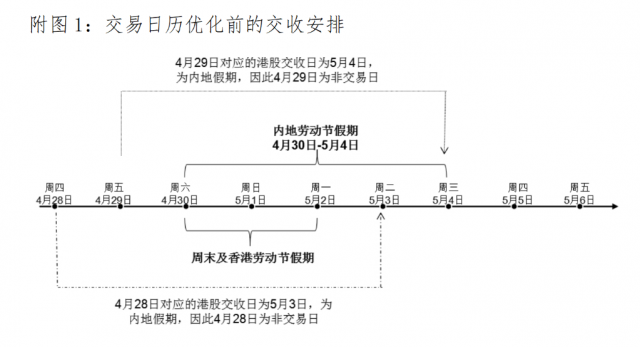

Under the current trading calendar, there are two cases of "one party opening and market investors cannot participate in the transaction": one is that one of the markets in the two places markets in the two places are trading days and the other party market is holidays; Both markets are trading days, but they are not satisfied with the settlement arrangements of the markets of the two places.

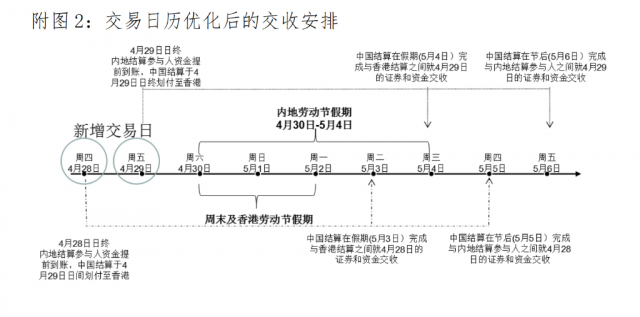

Taking this year's "May 1st" holiday as an example: April 28 and April 29, both places are opened, and local investors can be traded in the local market. However, because the Hong Kong market is T+2 to complete the settlement of securities and funds, the Hong Kong stock payment date corresponding to the above trading date is May 3 and 4, respectively. It is a Mainland holiday and cannot handle the settlement business. Therefore, the Hong Kong Stock Connect transactions cannot be conducted in the past two days. After the transaction calendar optimization, mainland investors on April 28 and 29 can also buy and sell the Hong Kong stocks of the Hong Kong Stock Stocks on April 28 and 29.

A person in charge of the China Securities Regulatory Commission market introduced that after the optimization, the Shanghai -Shenzhen -Hong Kong Stock Connect will be fully opened during the trading day. It is expected that the number of days that cannot be traded will be reduced by about half. The average annual new trading day in the southward trading, the coverage of the Hong Kong Stock Connect on the Hong Kong stock market trading day has been increased from 92.68%to 96.34%; the average annual increase of 5 trading days in the north direction trading, Shanghai -Shenzhen Stock Connect's transaction on the A -share market transaction The coverage of the day increased from 95.47%to 97.53%.

It is conducive to improving the transaction efficiency of the interconnection mechanism of the two places

As of the end of June this year, Shanghai -Shenzhen Stock Connect holds a market value of 2.55 trillion yuan in A shares, and the Hong Kong Stock Connect holding a market value of Hong Kong stocks is 1.91 trillion yuan, which has become an important force participating in the operation of the two places. With the deepening of the development of the interconnection mechanism, investors in the two places have increased their demand for optimizing the calendar of Shanghai -Shenzhen -Hong Kong -connected transactions and increasing trading days.

A person in charge of the China Securities Regulatory Commission's market pointed out that the optimization of the calendar of Shanghai -Shenzhen -Hong Kong -connected trading calendar can better meet the reasonable needs of domestic and foreign investors to participate in the allocation of capital market equity and interests of the two places, which is conducive to further improving the interconnection and interoperability of the mainland and Hong Kong stock market transactions The mechanism is conducive to improving the attractiveness of the capital market between the two places, consolidating the status of Hong Kong's international financial center, and promoting the long -term stable and healthy development of the capital market in the Mainland and Hong Kong.

For the optimization of trading calendars, all parties in the market show higher recognition.

The person in charge of the Securities Investment Department of the National Social Security Foundation said: "The optimization of trading calendar is conducive to further improving the efficiency of Hong Kong Stock Connect trading, and it is also conducive to better protection of the interests of mainland and Hong Kong investors.

He introduced that since 2018, the National Social Security Fund has begun to invest in Hong Kong Stock Connect by commissioning. So far, there are 10 types of products in two types of products, with a scale of more than 30 billion yuan. "We have always paid attention to the progress of the Hong Kong Stock Connect Trading Calendar Optimization Plan. This move further rationalize the institutional arrangement of the Hong Kong Stock Connect as an interconnection mechanism, which is conducive to the relevant investment work of the National Social Security Fund."

Huaxia Fund said that the optimization of this trading calendar has increased the number of trading days of investors in the two places, better guarantee the continuity of investors' transactions, and helps deepen the interconnection of the capital markets between the two places.

Many overseas institutions also welcome the optimization of trading calendars. Relevant sources of the FTSE Russell Index said that the optimization has shortened the gap between the Shanghai -Shenzhen -Hong Kong Universal Trading Day and the A shares and the Hong Kong stock trading day, reducing the risk of asymmetric trading day.

Related optimization arrangements take 6 months to land

A person in charge of the China Securities Regulatory Commission market said that the China Securities Regulatory Commission will organize exchanges and settlement companies with the Hong Kong Securities Regulatory Commission to organize the implementation of the Shanghai -Shenzhen -Hong Kong -connected trading calendar within 6 months.

In this process, the relevant parties will formulate a revision of business rules to provide business guidance and system basis for reform; formulate amendments to related business agreements to do a good job of business connection; complete the entire market technology transformation and testing; do market preaching, business training, investors, investors Education and other work.

In the future, the China Securities Regulatory Commission will continue to optimize and improve the interconnection mechanism of the Mainland and the Hong Kong capital market, steadily expand the scope of Shanghai -Shenzhen -Hong Kong Standard, promote the opening of the exchange bond market, consolidate and maintain the status of Hong Kong's international financial center, and comprehensively enhance the competitiveness of the capital market system. , Promote the coordinated development of the capital markets between the two places. (Reporter Liu Hui)

- END -

10 reorganizations and integration of state -owned enterprises in Hunan Province into 5 -state -owned enterprises' "flagship lineups" will be newly sailed

As the three -year operation of state -owned enterprise reform is about to end, Hu...

Li Guowei, aid cadre of Tibetan: 12 years of rooting at the plateau, and creating a wealthy industry

Four times aid in Tibet and dedicated the beautiful 12 years of life to the snowy plateau -this is the life choice of COFCO Cadres Li Guowei. In the days of rooting in Tibet, he was full of body and m