Haitong Strategy: Growth style is expected to continue, focusing on new energy and digital economy

Author:Broker China Time:2022.08.14

Source: Stock Market Xunye ID: xunyugen

Core conclusions: ① The growth style cycle has internal large and small plate wheel movements. Since 21/07, small disks have grown to win the market, similar to 14 years. ② The background of the growth of small disks: the overall profit growth of the growth sector has slowed down, and the growth valuation of small disk growth is prevalent. ③ The growth style is expected to continue. The relatively strong and weak market in the future depends on the growth rate of profit. The industry pays attention to the new energy and digital economy.

Since July 5th, the major broad -foundation indexes of A shares have been clearly adjusted, and the CSI 1,000 has risen against the trend, causing investors' attention. Because the CSI 1,000 has both small disk and growth style, the departure of the CSI 1,000 and the GEM fingers actually reflect the differentiation of the internal disk of growth. What are the factors of the growth of the market and the relatively strong market growth? This article analyzes this.

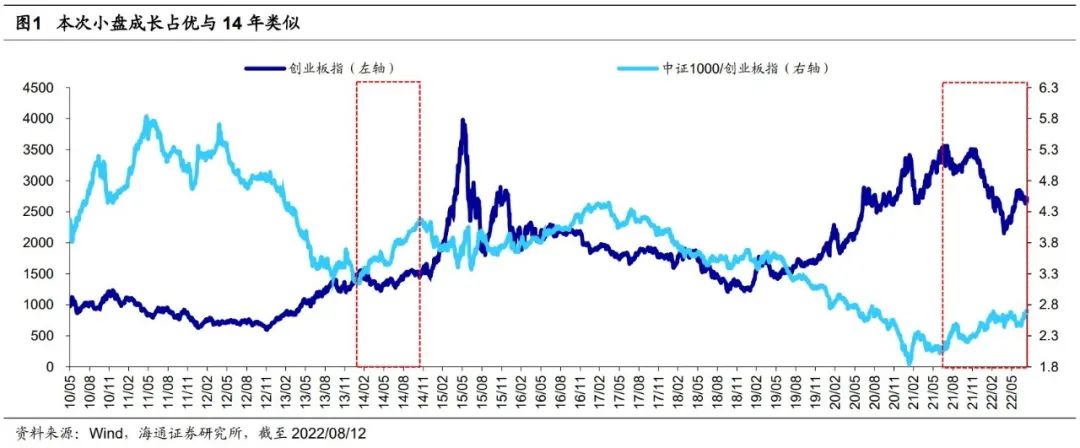

Since July to December and July 22nd, the growth (CSI 1000) has obviously won the growth of the market (GEM finger). In addition to representing small -cap stocks, the CSI 1000 index also has strong growth attributes. At present, (as of 2022/08/12, the same below), the industry distribution of CSI 1000 The growth section accounts for 47%(only 36%of the CSI 300). Therefore, we can regard the CSI 1000 as the representative index of small disk growth. In addition, given the GEM refers to the top 100 stocks of the GEM's largest market value, the average market value of its component stocks is about 65 billion yuan (1,000 yuan to 13 billion yuan), and the median number is 33 billion yuan (CSI 1000 is 10 billion yuan), so the GEM refers to better represent the growth style of the broader market. Recently, the trend of the GEM fingers and the CSI 1000 has fallen off, which reflects the differentiation of the A -share growth style.

In fact, if it is eliminated for a long time, the excess revenue of the CSI 1,000 relative to the GEM finger began at 21/07. At that time, the ratio of the CSI 1,000 relative to the GEM finger came to a phased low. At the time of the market stage, the GEM refers to the state of the horizontal vibration of the GEM, while the CSI 1,000 further increased, and the GEM index rose only 0.5%during 21/07/01-21/12/14. 12.9%. Subsequently, the A -share market was adjusted as a whole. The CSI 1,000 and the GEM finger fell simultaneously. Until July this year, the CSI 1,000 began to win the GEM finger again. %, CSI 1,000 has increased by 2.0%.

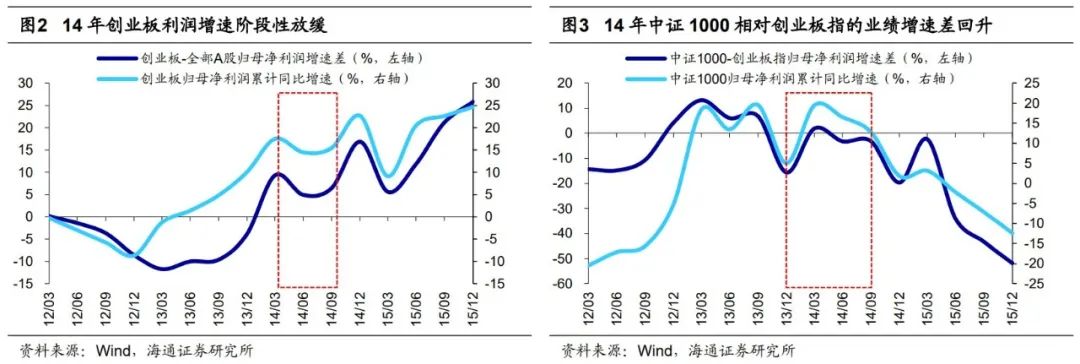

During the reference in 2014, the background of the growth of small market growth to win the market is the growth rate of growth sector's performance growth. Looking back at the history of A shares, the differentiation of the internal disk of this growth is similar to 2014. In the overall growth of the overall growth of 13-15 years, 13/01-14/01 grows a large market to win the small market. Small disk growth runs to win the market. During the period, the GEM finger rose 5.0%, and the CSI 1,000 rose 36.9%. 1000 rose 124.6%.

From the perspective of the fundamental dimension, in 2014, the market growth was rotated to the growth of small disks. The main time behind the growth sector's performance growth slowly slowed down: at that time, the GEM represents the overall growth sector, and you can find that entrepreneurship can be found on entrepreneurship. The overall net profit of the board's overall mother's net profit was 17.5%of the year -on -year growth rate of 14Q1 (relative to all A -share growth rates higher than 9.3 percentage points, the same below), and then fell to 15.4%(6.4 percentage points) of 14Q3. However, it is worth noting that although the growth rate of the growth sector in 2014, although the marginal growth rate has slowed down, under the horizontal comparison, it is still a direction of high prosperity at that time, but the market has accumulated a large increase in the early stage, and the cost performance is slightly significant. Insufficient, investors began to find a structural opportunity for small market value in the growth of high boom. At the end of 13 years, the PE (TTM) of the GEM fingers reached 58.4 times, while the CSI 1000 PE was only 44.1 times, and the net profit growth rate of CITIC 1000 relative to the GEM index during the 14Q1-Q3 period was picked up. Starting growth of the market, the growth of the market is staged. Until 14Q4 began to grow, the overall performance growth rate increased again, and the cumulative net profit of the GEM's net profit rose from 15.4%of 14Q3 to 24.6%of 15Q4. Essence

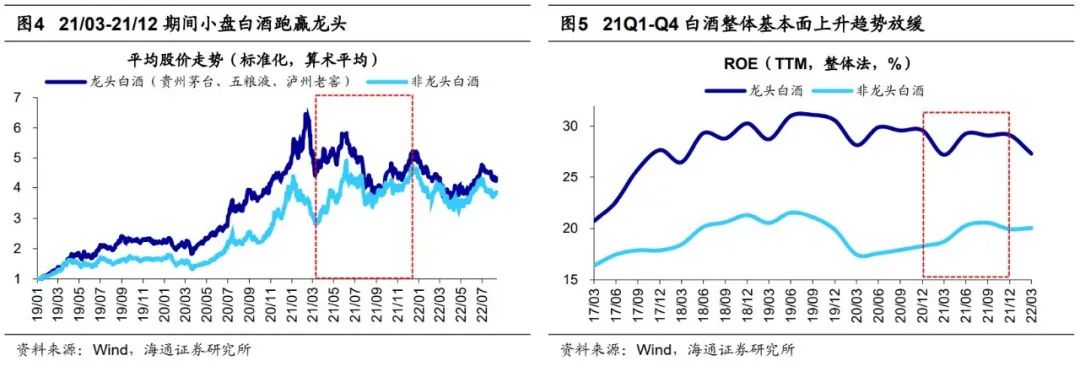

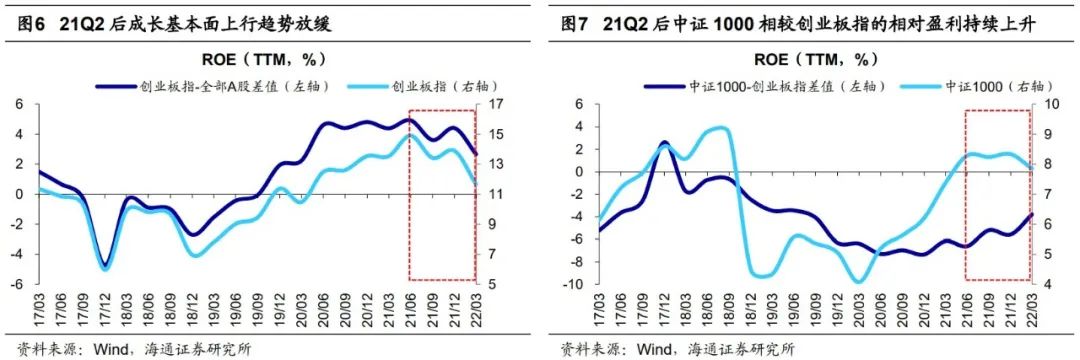

21 years of liquor: After the overall growth rate of the industry's fundamentals slowed down, Xiaogai wine ran to win big liquor. In addition to the 14 -year growth stock market, 21 years of liquor is also a typical case of rotating from the broader market to a small plate. During the market lows of 2020/3/19 to 2021/2/18, the increase in liquid liquor was significantly higher than other liquor. The average increase in the average increase in Moutai, Wuliangye, and Luzhou Laojiao was about 237%. The relatively small liquor stocks rose 165%average. However, the market began to call back after the Spring Festival in 21 years. The relatively weak and weak markets of the liquor industry reversed. 21/03/09 market lows until 21/12/14 market highs. The small market value liquor rose 67%average. Similar to the growth stocks in 2014, behind the relatively strong conversion of liquor, the overall fundamental trend of the industry has slowed down. Due to the disturbance of the base effect in 2021, the net profit of the mother -in -law in 2021, we measured with ROE (TTM, the same below), we can find that the overall ROE trend of the liquor industry is basically flat during 20Q4 to 21Q4, of which the leading liquor liquor ROE dropped from 29.6%to 29.1%, instead of the fundamental improvement of the faucet liquor, its ROE rose from 18.3%to 19.9%. In addition, the PE (TTM, the same below) of the faucet liquor at 21/02/18 has reached 69.3 times, corresponding to PEG 4.5 (calculated according to the year -on -year growth rate of the net profit of the mother of mother in 21 years, the same below), and the small liquor PE is the PE as the small liquor as the PE as the small liquor. 66.2 times, corresponding to PEG 2.7, therefore, the overall trend of the industry's fundamentals slowed down and superimposed, and the cost -effectiveness of the leading factor was insufficient, which jointly contributed to the relatively strong switching of the white wine industry in 21 years. Compared with 14 years of growth and 21 years of liquor, the fundamental changes are also changed behind this round of growth. The growth of small plates since 21/07 also began in the fundamental upward trend of the growth sector slowing down: ROE (TTM) of the GEM fingers has reached 14.9%of the phased high (higher than all A shares higher than all A shares. 4.9 percentage points), since then to 11.7%of 22Q1 (2.7 percentage points higher than all A-shares); In contrast, the ROE of China CSI 1000 during 21Q2-22Q1 is basically stable at about 8%, so the CSI The ROE difference between 1000 relative to the GEM finger increased from -6.6%to -3.8%. In addition, at the end of June 21st, the GEM refers to PE (TTM, the same below) of 63.1 times, corresponding to PEG 1.8 (calculated according to the cumulative growth rate of the net profit of 21Q2, the same is the same). It is 36.4 times, and the corresponding PEG is only 0.6. By this year, since July, the growth of small markets has obviously won the market again, which also originated from the market's concerns about the slowdown in the growth of some high prosperity growth. In July, the margin slowed to 119%.

Looking at it later, the growth style of A shares is expected to continue, and the size of the large and small plates depends on the fundamental aspect. At present, the growth of small plates represented by CSI 1,000 has achieved significant excess returns. Looking at the future growth style, how will the future growth style be performed? First of all, from the perspective of the comparison of growth value style, the trend of better growth in the future may still continue, mainly because the traditional value sector still has two aspects of disturbance:

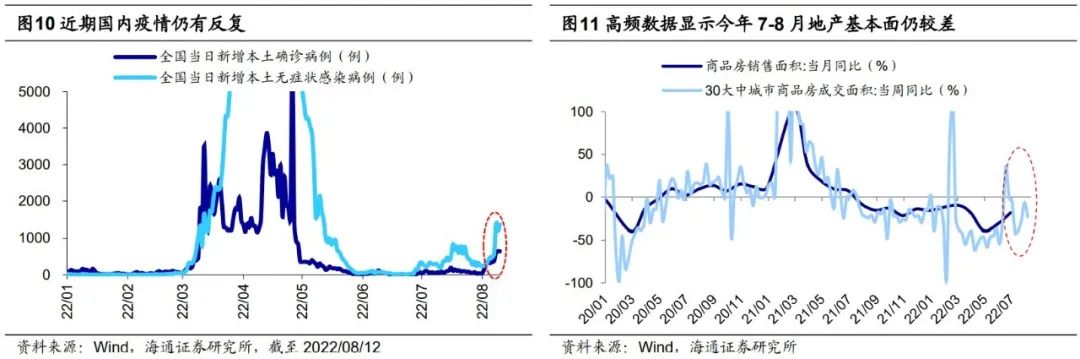

① The epidemic repeatedly affects consumption. Since July, the new crown epidemic has been distributed again in my country, and the number of new local cases (diagnosis+asymptomatic) in a single day in the country quickly expanded from the lowest 14 cases on June 25 to 2005 on August 12. With the rise of the epidemic, the prevention and control measures in many places have also been upgraded accordingly. From August 6th to 11th, Sanya, Hainan, key areas of Urumqi, Xinjiang, and Yiwu in Zhejiang have successively announced that temporary static management will be implemented. Therefore, the repeated epidemic and the upgrading of some regions has made the market's concerns about the fundamentals of the consumer sector.

② Real estate drags the traditional economy. Compared with consumption, real estate is currently more important factor in disturbing market risk preferences. Since last year, the fundamental downward trend of real estate in my country is obvious, and the recent "suspension" storm has further aggravated investors' concerns about the risk of the real estate industry chain. High-frequency data shows that the willingness to buy houses in July-August has been significantly weakened. The area of the transaction area of the commercial housing in China fell from -0.1%on June 26 to -23.1%from -0.1%on June 26. We are worried about the market? -20220731 analyzes that real estate and related industries account for nearly 1/3 in my country's economy. If the real estate fundamentals continue to decline, the performance of the relevant traditional cycle sectors may also be difficult to elastic.

Secondly, from the perspective of growth, the relatively weak and weak futures depend on whether the growth of growth can achieve rapid growth again. As mentioned earlier, for 15 years, when the performance of the growth sector has increased again, the style of the growth internal leadership has also been switched from a small plate of 14 years to a large market. Therefore, if the fundamentals of the future growth sector continue to improve, for example, new energy vehicles have a total sales of 6.5 million vehicles or more in 22 years, and the corresponding year -on -year growth rate is higher than 85%. The fundamentals of the future growth sector will still decline, and the trend of the growth of small disks may continue.

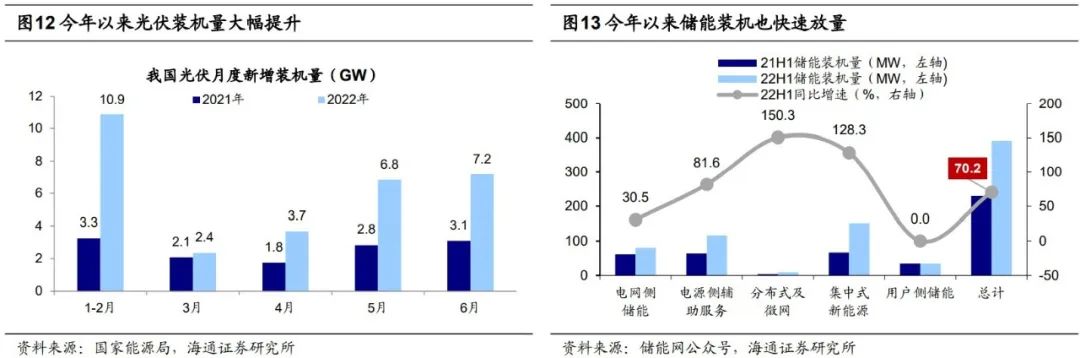

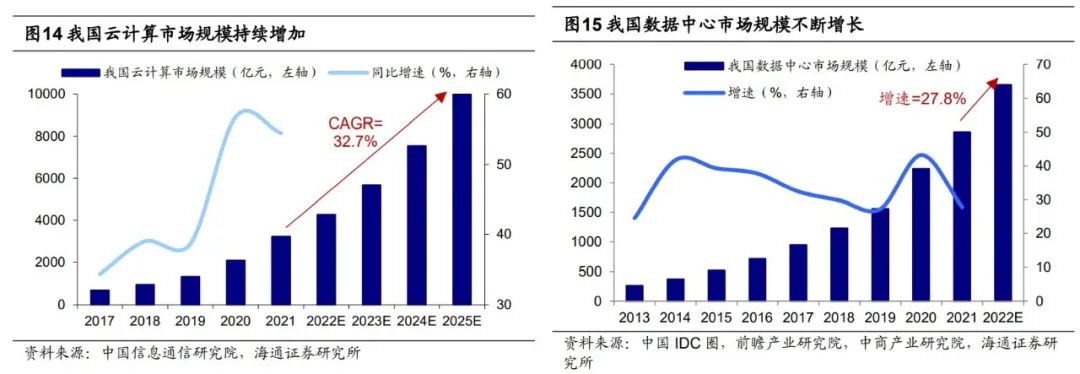

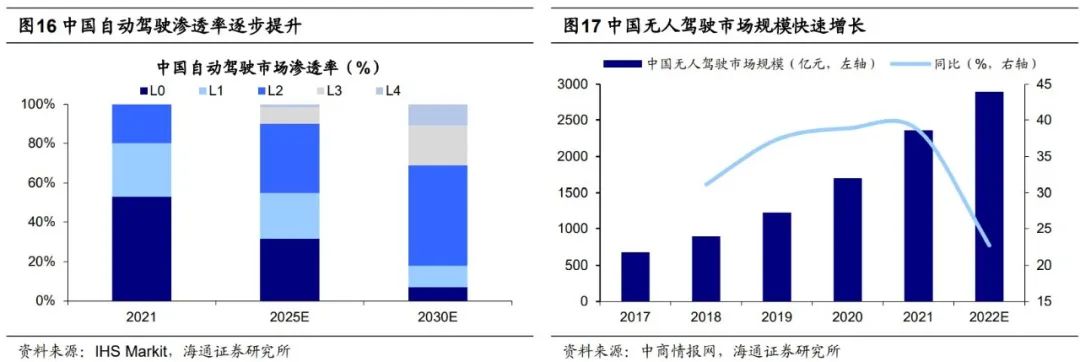

In terms of specific industries, continue to be optimistic about the growth of high boom, such as new energy. We have analyzed in the previous article that in the future, the growth style of A shares is still expected to continue to dominate, and in terms of specific industries, the high prosperity of new energy will support the industry's performance. In late April this year, we have repeatedly emphasized the growth of high prosperity represented by new energy combined with the fundamentals and market dimensions. Driven by the high prosperity in the first half of the year, the photovoltaic and automotive sectors have risen rapidly since April. In early July, the high growth popularity of high prosperity was at a high position. It was normal to take the opportunity to digest the valuation from July to August. Whether the growth of high prosperity in the future can further rise and wait for the blessing of fundamental data. At present, the domestic wind power optical installation machine has been rapid. In the first half of the 22nd year, the new photovoltaic installation machine increased by 137%compared with the same period last year, and the new installation of wind power increased by 19%. With the acceleration of the construction of wind power photovoltaic, the scale of new energy consumption continues to increase, and new energy storage will also usher in an important strategic opportunity period for development. In the first half of this year, the total amount of energy storage machines increased by 70%compared with the same period last year. In terms of new energy vehicles, according to the data of the China Automobile Association, the sales volume of new energy vehicles in July was 593,000, an increase of 119%year -on -year, a slight decline of 1%month -on -month. However, in July, it was the off -season. The overall performance was no longer dull. According to the latest forecast of the United August 9th, the sales volume of new energy vehicles will reach 6.5 million vehicles this year, which is expected to support the industry's further performance. You can also pay attention to the TMT section during growth. According to Guangming.com, the US President Biden officially signed the "2022 Chip and Science Act" on August 9. China increases production. At present, the control and controllable independence and controlling the core link of the semiconductor in my country is imminent, and domestic production replacement in related fields will accelerate. On July 5th, the market rose 7%since the adjustment of the market, and the computer rose by 1%, showing that the market's attention to the technology sector has increased. At present, domestic policies are continuously supporting the development of the digital economy, and digital infrastructure is the basis of the development of the digital economy. "East Digital and West Calculation" has been fully rolled out. 5G large -scale applications are accelerating. Infrastructure investment such as cloud computing and data centers is constantly increasing. We calculate that investment in my country's data center will reach 527.8 billion yuan. The Chinese Institute of Xinong is expected to have a compound growth rate of the cloud computing market in 21-25. 32.7%. In addition to digital infrastructure, the digital economy is also expected to become the second growth curve of Internet companies. On July 28th, the Central Political Bureau meeting of the Central Political Bureau "implemented normalized supervision of the platform's economic requirements and launched a batch of" green light 'investment cases ". It can be seen that the policy attitude towards the platform economy is becoming more and more positive. Or improve. In addition, Chinese Internet companies are actively developing autonomous driving technology, such as the "China Artificial Intelligence High -Value Patent and Innovation Driven Analysis Report" based on the "China Artificial Intelligence High -Value Patent and Innovation Driving Power Analysis Report" based on the National Industrial Information Security Development Research Center and the Ministry of Industry and Information Technology. Relevant patent applications reached 3115, ranking first in the country; at the same time, Baidu is gradually promoting the commercialization of autonomous driving, which helps promote the rapid development of China's autonomous driving industry. According to the prediction of IHS Markit, the penetration rate of Chinese autonomous driving in the future is expected to increase rapidly. In 2025, the penetration rate of new cars above L2 will reach at least 45%, and it will reach 80%in 2030. According to data from China Business Information Network, the scale of China's driverless industry in 2021 has reached 235.8 billion yuan, an increase of 38.5%year -on -year, and it is expected to reach 289.4 billion yuan in 2022.

Risk reminder: The deterioration of domestic epidemic affects the domestic economy; hard landing in the US economy affects the global economy.

Editor -in -chief: Wang Lulu

- END -

885,500 mu of silage corn in Wensu County received a bumper harvest

In Tong Turu Village, Jiamu Town, Wenjiu County, farmers use mechanical harvesting...

Create a "design strong area"!14 projects settled in Shapingba

On the morning of the 21st, Shapingba District, Chongqing City held a centralized ...