Chase 7 billion expansion!The 400 billion photovoltaic giants shot again, and these companies have also increased the photovoltaic track

Author:Broker China Time:2022.08.15

The photovoltaic giant Longji Green Energy intends to expand its production again.

Longji Green Energy announced on the evening of August 14 that the annual production capacity of Ordos monocrystalline silicon rods and slicing projects will be increased to 46GW, which is expected to increase investment of 6.95 billion yuan. In fact, this is not the first time that Longji Green Energy has raised the scale of single crystal silicon investment. In March of this year, Longji Green Energy changed the investment scale of Qujing (Phase II) single crystal silicon wafer project from an annual output of 20GW to 30GW.

As of 10:30 am on the 15th, Longji Green Energy reported 59.99 yuan/share.

In addition to Longji Green Energy, companies such as Jingyuntong, Shuangliang Energy Energy, Tiantu Optical Energy, and CNC are all in the overtime photovoltaic track.

Longji Green Energy intends to add nearly 7 billion to expand production

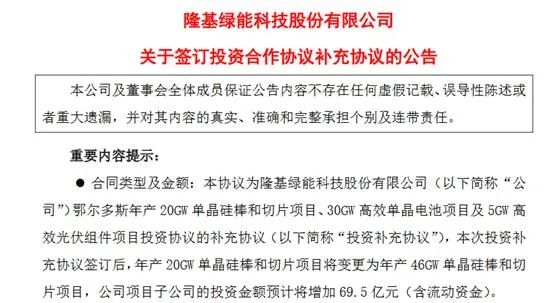

Longji Green Energy announced on the evening of the 14th that according to the company's future production capacity layout and planning situation, the company signed the "Investment Cooperation Agreement Supplementary Agreement" with the People's Government of Ordos and the People's Government of the Ijin Hollow Banner on August 14, 2022 to the original The annual output of 20GW single crystal silicon rods and slicing projects agreed in the agreement is changed to the annual output of 46GW single crystal silicon rod and slicing projects. The investment amount of the company's subsidiary is expected to increase by 6.95 billion yuan (including mobile funds).

Earlier, the company and the People's Government of Ordos and the People's Government of the Ijin Hollow Banner signed the "Investment Cooperation Agreement" on March 12, 2022 to invest in the company in the Ellola Banner Economic Development Zone of Ikinhlo Banner in Ordos City, Inner Mongolia Autonomous Region. 20GW single crystal silicon rods and slicing items, 30GW high -efficiency single crystal battery projects and 5GW high -efficiency photovoltaic component projects reached cooperation intention.

According to the investment supplementary agreement, all parties agreed to change the annual output of 20GW single crystal silicon rod and slicing project agreed in the original agreement to the annual output 46GW single crystal silicon rod and slicing project. Limited (hereinafter referred to as "Ordoslon") as the main body, responsible for the purchase, installation and commissioning of project production equipment, office life and warehousing equipment, and investment, and mobile fund investment.

Ordoson's estimated investment in 46GW single crystal silicon rods and slicing projects was 14.55 billion yuan (including mobile funds), an increase of 6.95 billion yuan (including mobile funds) before the change. According to the project implementation plan, the project feasibility analysis and calculation based on the actual needs of the project construction and operation, the actual investment budget is subject to the amount of approval of the company's internal institutions within the company.

In fact, this is not the first time that Longji Green Energy has raised the scale of single crystal silicon investment. In March of this year, Longji Green Energy raised the investment scale of Qujing (Phase II) single crystal silicon wafers.

The company announced on March 7 that according to the company's future capacity layout and planning situation, the company signed the "Qujing (Phase II) annual output 20GW single crystal with the Management Committee of the People's Government of Qujing City and the Qujing Economic and Technological Development Zone Management Committee on March 4, 2022 "Silicon rod and silicon wafer project investment supplementary agreement", Qujing (second phase) single crystal silicon rod project investment scale maintains an annual output of 20GW unchanged, the investment scale of single crystal silicon wafers is changed from an annual output of 20GW to 30GW.

It is reported that Longji will carry out a new round of capacity expansion this year. In the 2021 annual report, the company proposed that it plans to achieve operating income by more than 100 billion yuan in 2022. By the end of 2022, the annual production capacity of single crystal silicon wafers reached 150GW, the annual production capacity of single crystal batteries reached 60GW, and single crystal component production capacity reached 85GW. In 2022, the target of the single crystal silicon wafer shipment target 90GW-100GW (including itself), and the component shipment target is 50GW-60GW (includes self-use).

It is worth noting that since this year, Longji Green Energy has raised prices for silicon wafers eight times, and the most recent time was on July 26.

On July 26, the price of single crystal silicon wafers announced by Longji Green Energy's official website. The P -type M10 was priced at 7.54 yuan/piece, an increase of 0.24 yuan month -on -month, an increase of 3.29%; Yuan, an increase of 4.11%; the price of 158.75 of the P -type was 6.13 yuan/piece, which rose 0.25 yuan month -on -month, an increase of about 4%.

The main business data from January to June released by the company's recent announcement shows that from January to June, the company is expected to achieve operating income between 50 billion yuan and 51 billion yuan, an increase of 42%-45%year-on-year; The net profit of shareholders is between 6.3 billion yuan and 6.6 billion yuan, an increase of 26%-32%year-on-year.

Soochow Securities pointed out that the company's production capacity continues to expand. It is expected to expand 45GW, 22GW, 20GW silicon wafers, batteries, components at the end of 2022. At the end of the year, the production capacity of silicon wafers, batteries, and components reached 150GW, 60GW, and 85GW. The new technology landed quickly. After September, the Taizhou 4GW technical reform HPBC and Xixian 15GW will be put into operation one after another. The new technology shipped 2GW throughout the year. The power station will further launch a new type of technology products, accelerating the volume of the T -type era.

These companies are also adding a photovoltaic track

In addition to Longji Green Energy, many companies are overweight photovoltaic tracks. For example, Beijing Express announced on August 11 that it was planned to change the original fund -raising project Wuhai 10GW high -efficiency single crystal silicon rod project to the new project Leshan 22GW high -efficiency single crystal silicon rod and slicing project. The total investment of the new project was 5.364 billion yuan. It is expected to be 2023 It was put into production in December. The company stated that the scale of the new project has increased its scale and the production capacity planning of slices, which not only follows the trend and background of the sustainable development of the photovoltaic industry, but also fits the strategic development direction of the company's continued expansion of the main business of new materials. Shuangliang Energy Conservation recently disclosed non -public issuance. The company raised about 3.488 billion yuan for this time for Shuangliang Silicon Materials (Baotou) Co., Ltd. 40GW single -crystal silicon first phase project (20GW) and supplementary mobile funds.

Tianheguang Energy announced on June 18 that the company plans to invest in the construction of an annual output of 300,000 tons of industrial silicon, an annual output of 150,000 tons of high pure silicon, an annual output of 35GW single crystal silicon, an annual output of 10GW slices, annual annual production 10GW battery, annual output 10GW component, and 15GW component auxiliary material production line.

On June 23rd, the company was announced that the company intends to be invested by the wholly -owned subsidiary Hongyuan New Materials (Baotou) Co., Ltd. to invest in the construction of 40GW single crystal silicon stroke and related supporting production projects in Baotou. The total investment of the project is about 14.8 billion Yuan. The project is divided into the implementation of the second phase, the first phase of the construction of 20GW single crystal silicon production, and the construction of 20GW single crystal silicon production capacity in the second phase.

Regarding the silicon film industry, Guosheng Securities said that although the current silicon wafer industry ushered in a large scale expansion, it was limited by the supply of upstream raw materials (polysilicon, high pure quartz sand), and the output of silicon wafers was limited. In the context of continuous exceeding expectations, the production capacity of high -efficiency large -sized furnaces in total production capacity is relatively tight. Under the superposition of multiple factors, the status of the silicon film industry chain is still strong, and structural differentiation may occur in the future, realizing raw material guarantee+large -size production capacity Enterprises with high proportion are expected to achieve a high level of profit in the future.

Responsible editor: Yang Yucheng

- END -

Agricultural distribution Ganzhou Branch completed the first agricultural hair infrastructure fund launch

Agricultural distribution Ganzhou Branch completed the first agricultural hair infrastructure fund launchOn August 13, the Ganzhou Branch successfully launched the first agricultural hair infrastructu

Baidu making a car, suddenly changing

Flower Finance OriginalWhy does cooperation with Huawei lose soul?After Huawei's a...