Lithium Mine Cycle: The price will rise for seven years?

Author:Alpha Factory Time:2022.08.15

It is estimated that by 2030, in order to meet the decontamination and electric vehicle plans of various countries, 60 lithium mines will be needed worldwide, which will make the market expect to continue the lithium price cycle.

Mine, which will continue the market's expected lithium price cycle.

The car company's "lithium" for a long time. Faced with the price of lithium carbonate that continues to rise, the grievances between power battery manufacturers and the entire vehicle factory need not be said.

High -level lithium price, when will the top be seen in the future? Become the focus of the industry.

The market is generally expected that due to the continued popularity of the industry, lithium ore investment will continue to increase in 2021, which will make the relationship between lithium mine supply and demand began in 2023, and finally lithium prices will meet.

But recently, the industry in the industry seemed to splash a pot of cold water for the market.

On August 8th, the world's largest lithium producer Ya Bao CEO said that the supply of lithium mines is systematic. It is expected that the supply of lithium ore will continue to eat in the next seven to eight years.

In addition, the IEA report in July shows that the mining of lithium ore, from preliminary feasibility research to actual projects, basically takes 6-19 years.

It is estimated that by 2030, in order to meet the governments of various governments, 60 lithium mines will be needed worldwide, which will make the market expected lithium price period continue.

If this statement is followed, the entire power battery market will still be under too high cost pressure. Will this happen? Can this conclusion be supported by analyzing the logic of the supply and demand cycle of commodities?

No one can accurately judge the future. But all investors understand that doing financial market analysis and fundamental judgment is to increase the "win rate" as much as possible.

01 How much will lithium ore welcome?

Supply and demand decide the trend of commodity prices. Inventory, financial conditions and emergencies affect price fluctuations.

From excavation to final mining, the entire cycle takes 6 years, so it is necessary to calculate the actual increase in the "theory" around 2030. We need to sort out projects that have clearly excavated and have planned capacity today -this part is truly in 2030 that it really really in 2030 Lithium mineral capacity that can land.

(1) GreenBushhes (Australia): In the first quarter of 2022, the sales volume was 270,000 tons. In 2022 and 2025, the planned capacity was 1.62 million tons and 2.14 million tons/year.

TRP (Green Bush's tailings re -processing plant) was completed and put into operation in February, producing 1030 tons of junior lithium concentrate, and realizing 14,600 tons in March. It is currently in the climbing stage of capacity. Chemical -grade lithium concentrate.

(2) MT Marion (Australia): In the first quarter of 2022, the sales volume was 94,000 tons. It is expected to increase the mixed product of 900,000 tons per year by the end of 2022, equivalent to 600,000 tons of SC6 (6%lithium concentrate).

However, it is worth noting that due to the decline in ore products, the production and sales in the first quarter of this year were lower than the previous guidelines.

(3) WODGINA (Australia): In the first quarter of 2022, 22,000 tons were sold. Lithium concentrate.

By the end of 2022, the evaluation agency will evaluate the re -production time of Line 3 and the construction plan of Line 4, which is not yet determined.

(4) MT Cattlin (Australia): In the first quarter of 2022, the sales volume was 66,000 tons, exceeding the single quarterly output of 48,600 tons.

According to the company's conference, this part is to deliver goods in the first quarter of this year and the fourth quarter of 2021 at the price of $ 2218/ton.

The company's current concentrate is basically locked by the contract. At present, the additional storage is underway, and it is expected to be completed in the fourth quarter of 2022.

(5) Pilbara (Australia): In the first quarter of 2022, the sales volume was 58,400 tons. In the first quarter of this year, the shipment fell 25%, and the second quarter would increase significantly, but it did not give the future production capacity planning guidelines.

(6) Olaroz (Argentina): Design annual production capacity is 25,000 tons of lithium carbonate, and at the same time, it is equipped with a lithium hydroxide processing plant with an annual output of 10,000 tons in Changbin, Japan.

At present, the construction progress of the second phase of the Olaroz factory has reached 68%. It was built in mid -2022 and opened up the climbing in the second half of the year. It is planned to reach a full production state until the second half of 2024.

(7) Jams Bay (Canada): At present, the capacity of lithium essence is 321,000 tons and about 40,000 tons of LCE each year. It is expected to start construction in the second half of 2022, and was put into production in 2024.

(8) Arcadia (Zimbabwe): Shareholders intend to invest in about $ 300 million to develop the mine, and build a processing plant with an annual processing of about 4.5 million tons of ore and producing 400,000 tons of lithium concentrate. Specific production time does not give a clear guidance.

(9) Finniss (Australia): In the first quarter of 2022, the progress was mainly concentrated in the pre -stripped project and DMS factory debugging required by ore. The project is expected to be completed and put into operation by the end of 2022. At present, the specific production capacity planning guidelines have not been released.

(10) Manono (Congo): In the first quarter of 2022, the company invested $ 25 million in early engineering and exploration drilling programs for the Manono project. As a lithium mine project that has not been proven, the production capacity guidelines have not been given. The above ore, coupled with the latest prospectus data of the latest lithium ore company, the total global lithium ore output in 2021 is about 338,000 tons of LCE (lithium carbonate, refers to lithium carbonate in solid/liquid lithium ore, which can actually produce lithium carbonate discounts. quantity).

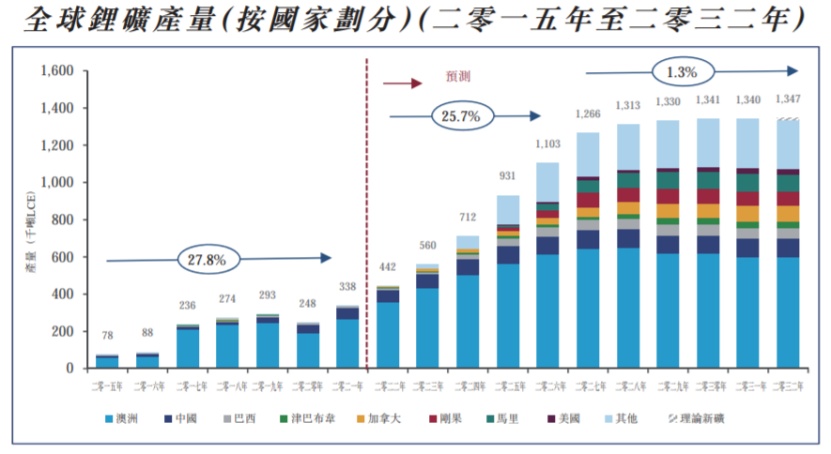

The industry is expected to increase the global lithium ore production to 931,000 tons of LCE in 2025, and by 2032, it will further reach 1.347 million tons of LCE.

As can be seen from the figure below, the stage with the highest growth rate of lithium ore supply volume is concentrated in 2022-2026, with an annualized growth rate of more than 25%. From 2032, it will maintain a low-speed growth of 1.3%.

Global lithium ore output from 2015 to 2032, Source: Tianqi Lithium Industry Hong Kong Stock IPO IPO Prospectus

However, it should be noted that the above data is calculated based on the lithium mine project that has been proven and the exploration. It does not include lithium mines to be proven during the next 7 years.

02 Consumer -grade battery+energy storage, downstream space geometry?

In addition to lithium ore deposits and increases, if we need to determine the probability of lithium prices, we also need to calculate whether the future downstream demand can be digested and then judge the price trend.

At present, lithium demand for rechargeable batteries accounts for the largest proportion. Back to 2015, 50%of lithium consumption comes from consumer -level batteries. However, in 2021, this number has been increased to 73%, and the median market expected by the market will increase to 92%in 2032.

In 2021, the two maximum largest electric vehicles markets were China and the United States. Assuming that in the next five years, the "American Clean Energy Act" incentive policy continued to implement, and the sales of local electric vehicles in the United States are expected to have a compound annual growth rate of 17.1%.

Last year, China's local new energy vehicle sales exceeded 6 million vehicles. The industry believed that before 2032, it exceeded 20 million units each year, and the global overall new energy vehicle sales were expected to reach 55 million units.

In addition to consumer -level batteries, energy storage is also the main demand scenario of lithium's other travel terminal.

According to the data, the capacity of the energy storage system of the power grid exceeds the installation of the system of departure energy (referring to the power grid without relying on the power grid) system in 2020.

The application of lithium ion technology in the field of power grids and public utilities is very important. Because the energy of a single public utilization project deployment is expected to be a magnitude of hundreds of MWh hours.

In 2021, a total of 19.8 Giva -free battery use in the world, as well as 32.2 Gavaco power grid usage.

From 2022 to 2026, the use of power grid applications is expected to have a compound annual growth rate of 44.2%. With the continuous improvement of power storage energy in power grid, it will reach 138,000 tons of LCE per year in 2032.

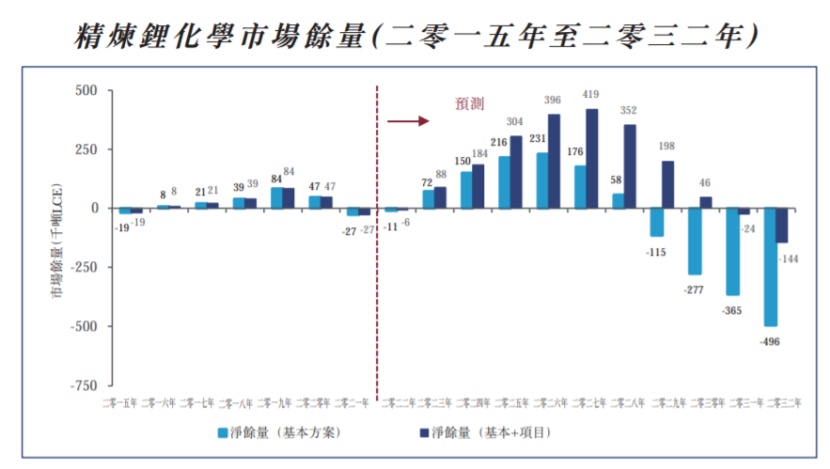

Therefore, from the perspective of incremental supply of lithium ore in the future, although the production of lithium chemicals has continued to increase, supply will still occur in 2022.

The subsequent turns will appear in 2023, which is also the starting year described above.

The increasing supply is greater than the gaps, and it is expected to reach the highest level in 2026 to 231,000 tons of LCE; then the situation of supply in short supply will appear again until 2032.

From 2015-2032 global refined lithium chemical market balance, source: Tianqi Lithium Hong Kong stock IPO prospectus

The above -mentioned calculation methods for lithium ore supply and demand gaps involve a general "expected difference" in a market.

Strictly speaking, the demand for lithium carbonate for power batteries is divided into the output of positive pole materials and the recycling of retired battery lithium carbonate.

Because retired batteries are only lithium carbonate that have been used, it does not involve the use of new lithium mines; and the discharge output of the Zhengji Factory corresponds to the demand for new lithium carbonate.

And the demand for battery -grade lithium carbonate is not a battery sales or installation. Because it does not include the scrap rate and the loss of the customer test phase, it is a bit insufficient.

Follow -up, with the launch of the new battery factory, with the high initial production scrap rate, this difference may expand.

According to the historical experience of the industry, the output of the positive pole material has been more than 6 months earlier than the sales of electric vehicles, and the industry has also appeared in the industry. The lithium demand for a certain year does not match the lithium battery of electric vehicles.

Therefore, as the most direct downstream of lithium, that is, the midstream of the entire industrial chain, the output of the positive pole manufacturers will be more intuitive high -frequency tracking data.

03 Factors in the industry: The supply of supply cannot be escaped

The calculations at both ends of the above supply and demand are based on the "linear push" in the industry. However, since 2021, the frequent disturbance factors on the supply side have also affected the supply of lithium ore (shipping volume).

The laborers caused by "against globalization". According to the public conference call of Western Australian companies, long -term closed policies have made it difficult for overseas workers to enter.

From March 20, 2020, Australia closed the border due to epidemic prevention demand until March 2022. During this period, it was difficult for overseas workers to enter Australia, which directly caused insufficient labor supply.

According to SEEK data, due to the continued popularity of mining, Western Australia's mining positions released in January 2021 increased by 16%year -on -year, while other positions in Australia were only the same year -on -year. The latest statistics from Western Australia Minerals and Energy Chamber of Commerce show that there are currently about 150,000 miners in Western Australia, and in the next two years, Western Australia's mining will still need to add 40,000 workers.

Labor scarcity is likely to cause lithium ore volume to not reach expectations. Affected companies include Pilbara, Wodgina and Finniss projects mentioned earlier.

In the same direction, due to the reduction of workers due to the epidemic, the backlog of cargo and the shortage of logistics capacity in the United States, and most of the positions of truck drivers are Mexican.

In order to think about the situation of "against globalization", will this phenomenon also appear on the supply side of lithium ore.

(1) Environmental protection limit.

Recently, the European Commission is evaluating a proposal to classify lithium carbonate, lithium chloride and lithium hydroxide as a material harmful material for human health. The final decision on this proposal will be At the end of 2022 or early 2023.

On the one hand, this decision not only affects ALB's German factories, but also affects the expansion of European lithium ore on the other hand.

(2) The extension of the green space project is the norm.

To explain it briefly, the two terms of Greenland and brown areas originated from residential and industrial construction projects.

The green land project is a project completed in the green area (undeveloped land); the brown land project is a project that has been used on the land for other purposes.

For the high -pollution mining industry such as lithium ore, because the land has been developed in the past, some problems may be faced when re -use. Like existing buildings, some can be discovered but not obvious, such as contaminated soil.

The green space project is even more obvious. Because there is no basis for being developed and approved, there is no reference for the impact of historical project pollution indicators on soil environment.

Therefore, starting in 2021, the green space project has been increasing from approval — mining -production and production, which has been increasing.

One thing to mention is that the new lithium mine projects in the next few years are basically green land, which also exacerbates the probability of expansion of production capacity than expected.

(3) Division of lithium carbonate and lithium hydroxide. In the industry only pays attention to lithium prices, another major expectation is different from the differences in lithium chemicals, that is, lithium carbonate and lithium hydroxide.

According to different raw materials, the production of lithium hydroxide is mainly divided into two routes: "lithium hydroxide hydroxide" and "salt lake preparation of lithium hydroxide".

Smart pyrone can directly produce lithium hydroxide, and salt lakes need to first produce industrial -grade lithium carbonate, and then severely produce lithium hydroxide.

Similar lithium hydroxide and lithium carbonate are lithium salt.

But the difference is that lithium carbonate is currently mainly used to produce low -nickel positive poles in lithium iron phosphate and ternary materials (NCM 111, 523, and part of 622). Lithium hydroxide is mainly used to produce high nickel positive materials in ternary materials (part of NCM622, all NCM811, 90505, and NCA).

According to the current market research, overseas battery factories are mainly high -nickel ternary batteries, and the trend of high nickelization in China's ternary battery is also accelerating. Therefore, the differentiation of lithium chemicals is also a point that needs to be paid attention to in the future.

Although through the above analysis, in 2023, there will be a high probability of lithium ore supply in short supply, but based on the "linear push", the supply terminal caused by emergencies is not as expected, and it still exists.

Lithium price maintains high expected high prices in the short term, and it still has great possibilities.

However, the conclusion of Yabao CEO's "cannot reverse the supply of lithium ore within 7 years is still short of shortage", which seems to be difficult to achieve. At least return to the situation of supply and inadequate, wait until 2028.

Another problem is how long will the supply -side sudden factors affect the lithium price? From the perspective of historical experience, it will basically be auctioned about three times in lithium concentrate, that is, within 5 months.

For investors, on the basis of 2023 lithium prices, the market generally underestimates the high duration of disturbance factors. This may be the "trading" opportunity brought by "expected poor".

- END -

Tesla's entry to detonate humanoid robot concept stocks already have some listed companies actively deploying

Reporter Li QiaoyuLear reporter Xu LinyanRecently, the activity of robotic concepts has increased. On August 8th, the robot concept stock rebounded. As of the close, the robot concept index rose 1.91%

Feng Quanpu, vice president of Jingdong Group: will build 20 million -level prefabricated vegetable brands in the next three years

[Dahe Daily · Dahecai Cube] (Reporter Ding Yangtao Wen Zhu Zhe, Ma Tengfei Ranhen...