Analysts see the price of gold | up to $ 1,800 or down?

Author:China Gold News Time:2022.08.15

Investigation by the Beijing Gold Economic Development Research Center shows that market participants believe that the possibility of oscillation of golden prices this week is high.

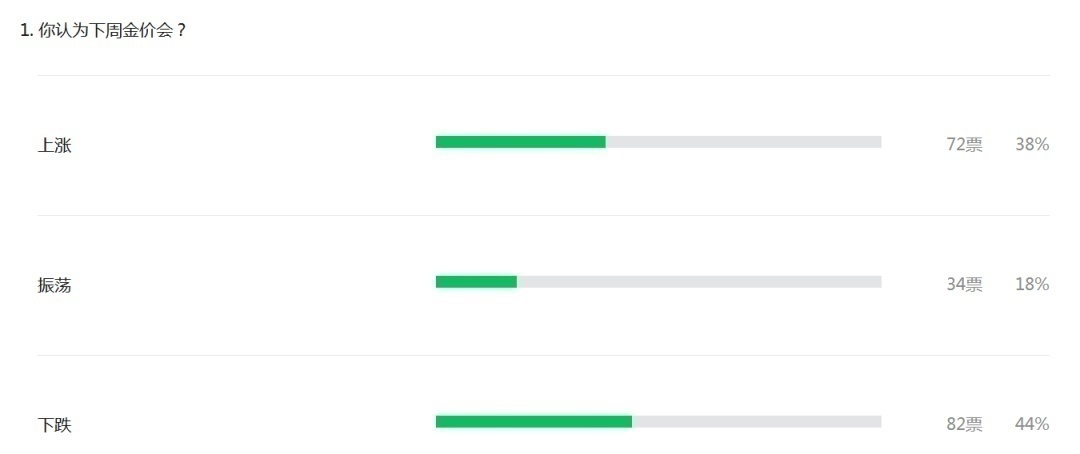

Voting shows that 38%of readers have watched this week's gold price, 18%look oscillating, and 44%bear.

Lu Jun

Chengdu Fengye Service Co., Ltd.

On August 8th, the international gold price continued to fluctuate, and at the beginning of the week, it relied on the support of $ 1770/ounce. It broke through the trend of US $ 1,800/ounce in the middle of the week and reached up to $ 1807/ounce, a high point since early July. The weekly level is also the first time to close above the $ 1,800/ounce mark for a few weeks, and the weekly line shows the four -month -old pattern, the longest weekly continuous increase in 12 months. From the perspective of the weekly level, the overall strong pattern is maintained.

Last week, the data performance of the consumer price index (CPI) released in the United States last week was better, not only fell from 9.1%to 8.5%, the largest decline in the year, and the market's expectations for the Fed to further raise interest rates in the future began to cool down. As the peak period of the Fed's interest rate hike has passed, the strong US dollar exchange rate that has been showing a strong US dollar has shown a continued decline. At the same time, the yield of US debt also shows a gentle operation, which is undoubtedly the greatest benefit for precious metals and silver.

Next, the market still pays attention to the performance of other economic data in the United States because it will judge the path of the Federal Reserve's future interest rate hike. As the US CPI data fell high, the market began to appear in the top of US inflation. Will this gradually reduce the efforts of the Federal Reserve and slow down the rate of interest rate hikes, which will directly have a significant impact on international gold prices.

In this way, the author said that the US dollar was basically undoubtedly at the top, and as the Fed's interest rate hike became more and more milder, the decline of the US dollar would also be expanded, thereby forming a strong role in promoting international gold prices.

In summary, the author expects that international gold prices will continue to move forward steadily on the weekly level of the four -line level. When the international gold price won the $ 1800/ounce mark, then the recent upsurge first pays attention to the pressure near $ 1835/ounce.

Wu Di

Independent analyst

In terms of fundamental terms, the initial value of the consumer confidence index of the University of Michigan in August of the United States recorded 55.1, which was higher than the expected 52.5. All components of the expected index improved, especially for consumers, which are particularly sensitive to inflation, and low -income consumers who are particularly sensitive to inflation. Word. The economic prospects in the next year will rise sharply, slightly higher than the average level of the second quarter of 2022, while the other two expectations index components are flat or lower than the second quarter average.

U.S. public debt yields fell after a week of turmoil. As investors assessing inflation increased significantly, whether the inflation increase would reduce the speed of the Federal Reserve's interest rate hikes. Data released earlier this week showed that U.S. inflation has been cooled, and market participants have subsequently reduced expectations of the Federal Reserve's interest rate hike. However, the recent statement of Federal Reserve officials continued to hold an eagle attitude, which inhibited the increase in gold prices. This week, the Minutes of the Federal Federal Public Marketing Commission will be announced. In addition, the United States will also announce the New York Federal Manufacturing Index, housing, industrial production and retail data.

From a technical point of view, the price of gold continued to fluctuate last week, and it fell slightly after touching the maximum of $ 1808/ounce. From the perspective of the overall trend, although the center of gravity of the gold price has shifted up, it is still in the oscillating model. From the 4 -hour chart, the random indicator enters the overbight area and has signs of forming a dead fork, indicating that the short -term gold price recovery may be compared big. This week, it was adjusted to nearly $ 1793/ounce. At present, the price of gold is hovering near the watershed, and the direction is unclear. If it falls below this position, the following supports US $ 1777/ounce, and the upward aspects will pay attention to the resistance of $ 1815/ounce. In terms of operating strategy, it is still the main transaction and strict stop loss. The above suggestions are personal views, for reference only!

Zhou Zhicheng

Guantong Futures precious metal researcher

The growth rate of the US CPI and core CPIs in July released last week fell, and the PPI also fell from double digits to 9.8%; the import price announced by the United States announced by the US Department of Labor did not include tariffs rose 0.3%in June. Fall 1.4%. This is the largest monthly decline since April 2020.

Various signs show that the pace of rising prices is slowing down, indicating that American inflation may have been seen, but it has not shown that it is enough to allow the Federal Reserve to give up the trend of tightening monetary policy; The value is 55.1, and expected 52.5, a slight rebound for three consecutive times; the United States Lilique Fed Chairman Balkin said that he hopes to see that American inflation is in a sustainable controlling state during a period of time. Weak economy should also avoid policy errors similar to the 1970s.

Last Friday, the latest capital flow issued by Bank of America showed that American investors were pouring into stocks and bonds, which means that with the current inflation, investors will bet on the Federal Reserve to end the interest rate hike cycle as soon as possible to in order Avoid decline in the US economy. However, the Chicago Fed Chairman Charles Evans, who will retire in January next year, said he believes that the Fed will continue to raise interest rates to next year.

About one -third of the fund managers interviewed predict that the global central bank's monetary policy will change in 2024 or later, which is higher than one quarter of the last month. On the whole, since the mid -year election is approaching at the end of the year, the Fed still has to lower its strength to lower the inflation and the political intentions of the White House. Therefore, it can be speculated that oil prices will still hover or even lower at the low position. Stopping, the trend of hedging assets such as gold and silver needs to wait patiently. The oscillation of ups and downs will be the mainstream of the future. Technically, the golden price of the gold price of the gold price is the Dayang line with the upper and lower leads. The gold price of the 4 -hour line is severely separated, and the US dollar index fell below 106 and there is a trend of further decline. Gold price resistance is $ 1836/ounce, $ 1850/ounce, $ 1874/ounce. Gold price support is at $ 1800/ounce, $ 1750/ounce, $ 1700/ounce, $ 1680/ounce.

Gold prices have reached a continuous rebound after the key support of $ 1680/ounce. This week, it is expected that the gold price will oscillate a lot between $ 1774/ounce of $ 1830/ounce. Due to the announcement of US retail data in July this week, the price of gold may fluctuate. Zhou Silver price closed the Dayang line, the gold and silver ratio fell to 86.6 times, and the price of silver was also separated from 4 hours and the 1 -hour line. This week, the price of silver is expected to be 20.2 US dollars/ounces to $ 21.5/ounce. The new warehouse can try high in the interval, and quickly go in and out.

Hongjie

Register for senior gold investment analysts

From the perspective of the news, last week's gold price rose with the help of US Treasury yields declined, and rose for the fourth consecutive week. Fed officials warned that the struggle against inflation was far from over, and it supported a certain support for gold prices in the short term.

From a technical point of view, the Yang Line was finally closed last week. In terms of technical form, there is still a demand for rebound in the short term. The following focus on support of $ 1720/ounce to $ 1750/ounce area support. The top is focusing on the pressure of $ 1850/ounce to 1,880 US dollars/ounce area. The overall idea this week: low is mainly, fast forward and fast out.

Shen Guofu

Wing Kun Holding Investment Research Center precious metal analyst

The July CPI data released by the United States last week was 8.5%, the decline exceeded expectations, showing that inflation showed signs of cooling down. Signs of inflation have greatly reduced the probability of the Federal Reserve ’s interest rate hike in September. The price of gold is promoted to break through the $ 1,800/ounce integer mark. 1800 US dollars/ounce is an important resistance. If you effectively break through this position, you can see $ 1850/ounce.

The gold price of the gold and gold of the K -line has been harvested in the price of Silinyang and has a strong trend. Currently competing for $ 1800/ounce integers. It is expected that the oscillating will increase this week to effectively break through the $ 1,800/ounce integer mark.

Please comment on the viewer you agree with the comments.

- END -

Xinjiang public medical institution new crown virus nucleic acid testing single -person single exami

Tianshan News (Reporter Ren Chunxiang reported) From June 10, the autonomous region has adjusted the price of new crown virus nucleic acid detection and antigen detection prices in the autonomous regi

Use Chinese herbal herbal medicine to solve the heat of the chicken, cover the sunscreen for the fruit of the fruit ... Agricultural experts guide the grassroots at the grassroots level to resist drought

The Yangtze River Daily Da Wuhan client August 17th The weather is too hot, now th...