The research report "sing more", listed companies directly "face"!Supervisory conversation

Author:China Fund News Time:2022.06.17

China Fund reporter Yan Ying

The research report of "singing more" was "faced" by listed companies, and the warning letter of supervision followed up.

On June 17, the Shanghai Securities Regulatory Bureau announced two announcements of administrative supervision measures that due to the inadequate basis of the reasonable analysis conclusion of the release of research reports, and the lack of quality control before the research report was released, Shanghai Securities was issued a warning letter. The director and analyst themselves were also asked to go to the Shanghai Securities Regulatory Bureau for supervision.

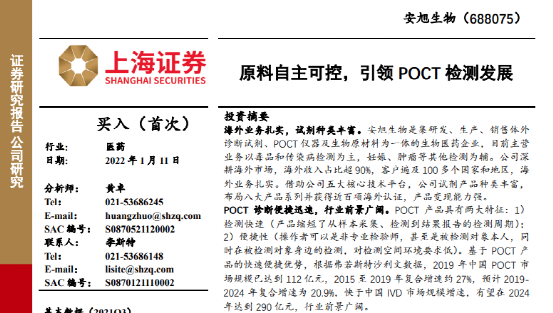

In January of this year, the Shanghai Securities Institute released a research report entitled "Autonomous and Controlling Raw Materials, Leading POCT Testing and Development". In the "investment recommendation", it is expected that Anxu Biological will achieve net profit of 726 million yuan, 2.988 billion yuan, and 1.655 billion yuan from 2021 to 2023, a year-on-year increase of 11.9%/311.5%/-44.6%.

In response, An Xu Bio issued a clarification announcement that it had not accepted any forms of interviews and investigations such as Shanghai Securities relevant personnel, and never provided the relevant performance data and company operating data that had not been disclosed to the outside world. The report is the opinion of Shanghai Securities Research Institute and does not represent its company's position.

Brokers+analysts are supervised

Look at the specific situation of this administrative regulatory measure--

The Securities Regulatory Commission pointed out that the securities research report "Autonomous and controllable raw materials, leading POCT testing and development" released by Shanghai Securities has insufficient reasonable basis for analysis conclusions, and insufficient quality control before the research report was released.

According to the "Interim Provisions on the Research Report on Securities", the production report of the production of securities should be compliant, objective, professional, and prudent. The signed securities analysts shall be responsible for the content and viewpoint of the securities research report, ensure the legal compliance of the source of information, the prudential of the research method, and the analysis conclusions have a reasonable basis.

In addition, securities companies and securities investment consulting institutions shall establish a review mechanism for the release of securities research reports, clarify the review process, arrange special personnel, and do a good job of quality control and compliance review before the securities research report releases.

The "Release of Securities Research Report Practice Specifications" also requires that the quality review of the research report shall be carefully reviewed in accordance with the standards prescribed by the company, covering information processing, analysis logic, and research conclusions. Carefulness.

Based on this, the Shanghai Securities Regulatory Bureau decided to adopt the supervision and management measures with a warning letter from Shanghai Securities, and asked Shanghai Securities to cope with it, carefully find and rectify the problem, continue to improve the internal control, and submit a written rectification report within 30 days.

In addition, Shao Mou, the deputy director of the Shanghai Securities Institute, believes that it is responsible for the lack of quality control before the company's research report was released; Not fully responsible. The Shanghai Securities Regulatory Bureau decided to take regulatory conversation measures for the two and asked him to go to the Shanghai Securities Regulatory Bureau for supervision conversation.

Forecast 2022 profit rising 311%

What kind of research report is the supervision that "the reasonable basis of the analysis conclusion is not sufficient" and "insufficient quality control"?

On January 11, the Shanghai Securities Research Institute issued Anxu Biological Stock Research Report entitled "Autonomous and Controlling Raw Materials, Leading POCT Testing and Development", and the full text was 40 pages.

Shanghai Securities stated in the report that it is continuously optimistic about the broad market test track. Anxu Bio is a high -quality track with high self -supply ability and rich category core POCT reagent provider. It is expected to be significantly thickened under the catalysis of overseas epidemic and exclusive self -test pen sales. In the future, the company can also use a large amount of profit cash to carry out product research and development, channel expansion and production capacity improvement, and the prospects are broad.

In the "investment recommendation", Shanghai Securities gave a "buy" rating, and it is expected that Anxu Biological will achieve net profit of 726 million yuan, 2.988 billion yuan, and 1.655 billion yuan from 2021 to 2023, a year -on -year increase of 11.9% /311.5%/-44.6%, the corresponding PE valuation is 15.08 times/3.67 times/6.62 times (calculated based on the closing price on January 7).

In addition, Shanghai Securities adopted a branch valuation method to give An Xu creature a "expected reasonable market value" of 25.2 billion yuan. Among them, the new crown detection product is given 7 times PE, corresponding to 19.7 billion yuan; 40 times PE is given to non -new crown detection products, corresponding to 5.5 billion yuan in market value. According to the calculation of the closing price on the day of the research report, the total market value of Anxu's biological biology was 15.775 billion yuan, which was very different.

Listed company "face": never accepts the survey

From the perspective of the stock price performance, before and after Shanghai Securities released the research report, An Xu creature was in the period of rising stock prices. On January 11th, An Xu Bio harvested the "20cm" daily limit, and this is the fourth day of the continuous harvest of Anx's biological harvest.

In the middle of the night on January 11, An Xu Bio released the annual pre -increase and clarification announcement of the 2021 annual performance. In addition to the announcement of the pre -increased performance, An Xu Bio also issued a clarification instructions on securities research reports at the same time.

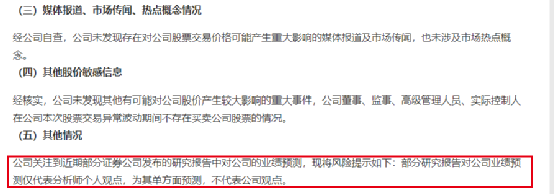

An Xu Bio said that he was paying attention to the "Anxu Bio (688075) in-depth report of the Shanghai Securities Research Institute: Autonomous and controllable raw materials, leading POCT testing and development" made profit predictions on the company's performance from 2022-2023, in order Investors have caused misleading and safeguarding the legitimate rights and interests of the company. They are explained as follows: 1. The company has not accepted any form of interviews and investigations such as Shanghai Securities.

2. The report is the opinion of the Shanghai Securities Research Institute and does not represent the company's position. As of now, the company has not done any performance forecast for 2022-2023. In view of the various influencing factors such as overseas epidemic development and control, selection of testing methods, overseas market promotion, customer recognition, market competition, and other countries' epidemic prevention and control policies, the company cannot predict the performance of 2022-2023.

In addition, An Xu Bio also said that its company's stock has hit the 20%daily limit on the last 4 consecutive trading days, and the stock price has continuously increased the risk of profit adjustment. In particular, investors are reminded that the number of company circulation shares is 140.6244 million shares, accounting for 22.93%of the total shares after the issuance, and there is a risk of being easy to speculate. Investors are requested to pay attention to investment risks, avoid follow -up, make rational decisions, and invest cautiously.

Repeatedly present the company's "face" singing more research report

Brokerage Research Report "Lift Cars", listed companies have realized market value management, which used to be used to the common operation of the barbaric growth period of the capital market. In recent years, the "anger" brokers' "singing" reports have occurred from time to time.

In August 2021, Lu Juan, chief analyst of CITIC Jianjian Investment Machinery Industry, released the research report of "own brand, power tools and cross-border e-commerce companies, all three dimensions performed well" in the circle of friends, predicting superstar technology 2021-2023 The year -on -year growth rate of returnees can increase as high as 25.74%, 27.45%, and 23.34%, and the corresponding PE prediction is 21.37, 16.77 and 13.60 times. Later, the secretary bluntly said in the circle of friends: "The performance forecast is too aggressive, and the company can't do it." Since then, CITIC Jiaotou deleted the research report.

On May 26, CITIC Securities issued a research report that Leit Optoelectronics is a leading company of domestic OLED terminal materials. It is expected to make a breakthrough in the performance harvest with the verification of new products and new customers. It is expected that the company's net profit from 2022 to 2024 will be 215 million yuan/4.06 billion yuan/548 million yuan, and the corresponding EPS forecast is 0.53 yuan/1.01 yuan/1.36 yuan.

Since then, Leit Optoelectronics has made a high -profile clarification through the announcement: Paying attention to the company's future operating income, profit level, and stock price indicators in the recent research report issued by some securities companies. The company prompts that the prediction of the above indicators is a unilateral prediction of securities companies. Litter Optoelectronics did not confirm the prediction of the above indicators. The relevant information is subject to the company's announcement.

On May 31, Anxin Securities released the research report entitled "Focus on the" Fast Charging Agreement+Power Management "track, deepening the construction of digital model hybrid IC design capabilities". Among them, the revenue of the Yingji core from 2022 to 2024 was 1.088 billion yuan, 1.526 billion yuan, and 2.146 billion yuan, respectively, and the net profit of the mother was 254 million yuan, 360 million yuan, and 508 million yuan, respectively. A "investment rating.

On June 2nd, British Xinxin said in an abnormal fluctuation announcement of stock transactions that paying attention to the company's performance forecast for the company's performance in the recent research report issued by some securities companies. The Yingjixin reminds that some research reports only represent the personal views of the company's performance prediction, which is unilateral prediction and does not represent the company's views.

Edit: Joey

- END -

The \"Matey Valentine's 66th Anniversary Celebration\" was launched, and nearly 100

Recently, American cuisine announced the launch of the annual \66th anniversary celebration\ event, helping the fresh e -commerce companies booming and the orderly recovery of the catering indust

Then push Xixian integration to build Xixian New District to accelerate the construction of a modern industrial development system

21st Century Business Herald reporter reported in Xi'an early in the morningAccelerate the construction of Xixian integration and build an important hub to open west, and the construction of Xixian Ne...