High temperature "not move" VC/PE investment fundraising, but "detonated" in July IPO: the return on the institution's book withdrawal of 42.4 billion yuan

Author:Daily Economic News Time:2022.08.15

Different from the hot weather in July, investment and financing activities in the VC/PE market continued to cool down.

According to CVSource China Investment Data, in July 2022, China's VC/PE market investment and fundraising continued to cool down. The number of new funds contracted 17.96%month -on -month, and the number of investment and financing transactions decreased by 10%month -on -month. However, the number of large financing cases increased increased. The influence of investment has rebounded. In addition, the number of Chinese IPOs in July reached a new high since this year, with a total of 52 Chinese companies successfully IPOs in A shares, Hong Kong stocks, and US stocks, rising by 36.84%month -on -month.

Photo source: Photo Network-500539504

Renminbi Fund is hot, and it is difficult to finance in growth period project

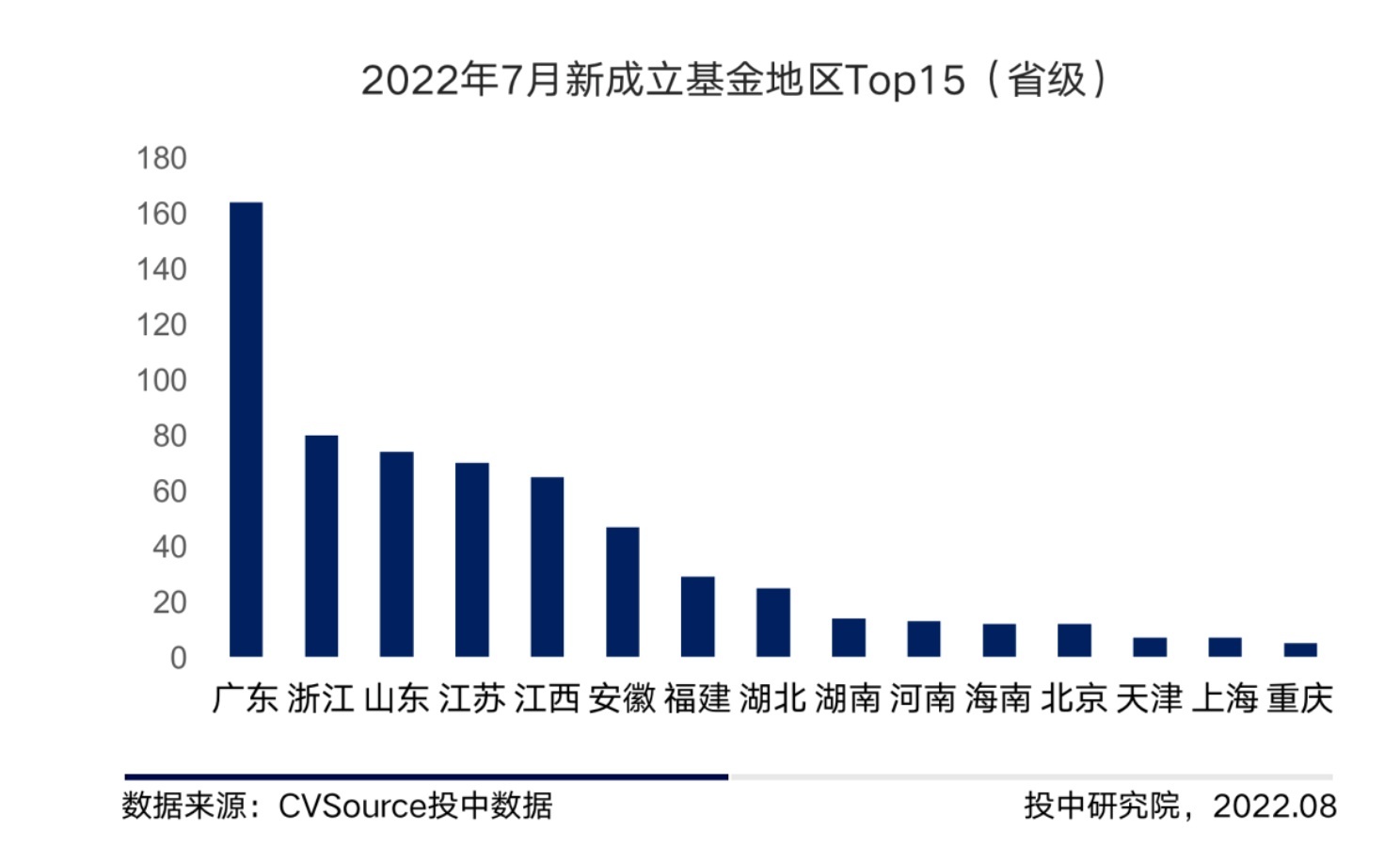

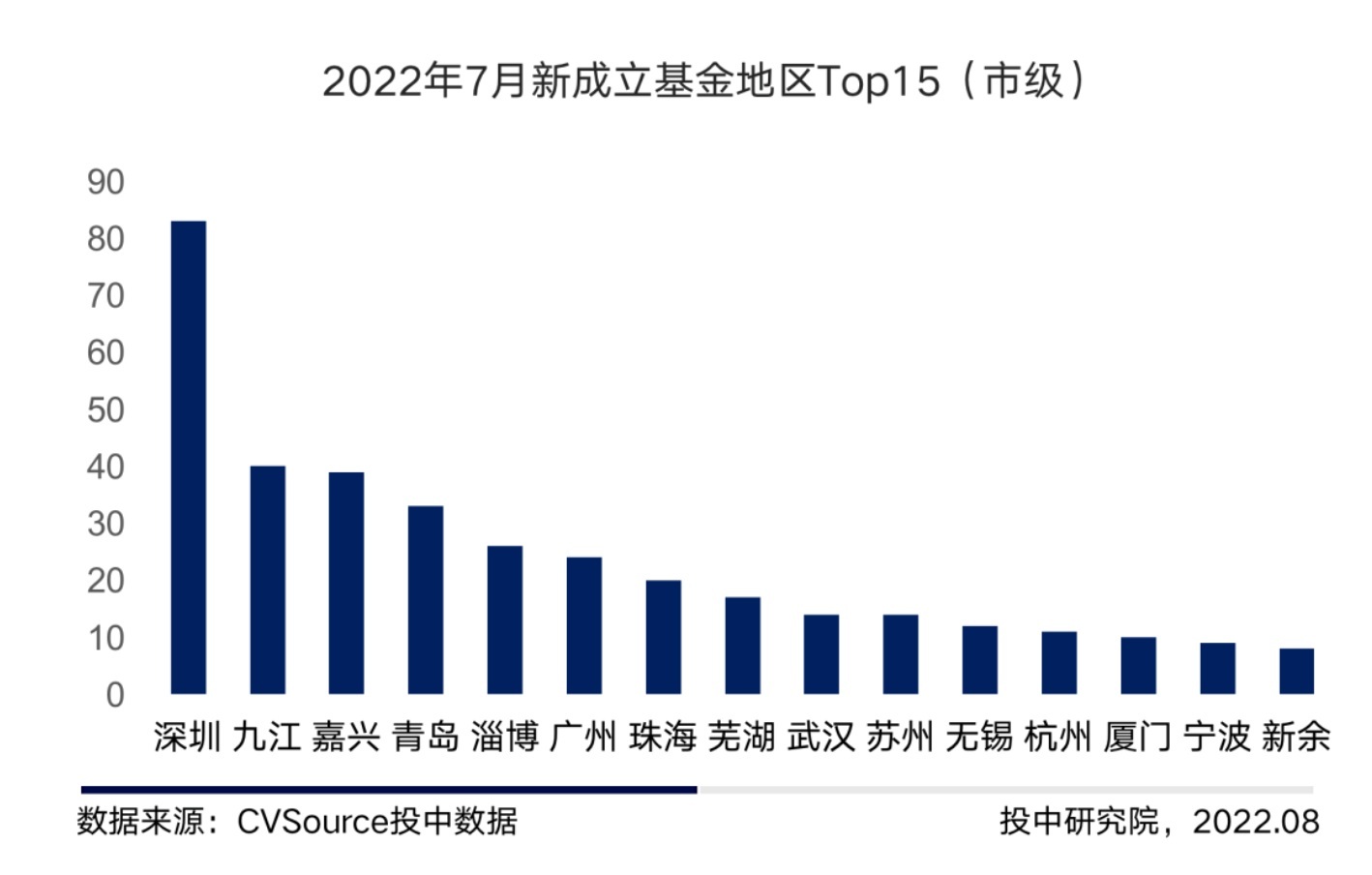

Specifically, according to CVSource China Data, in July of this year, the number of new funds in the Chinese VC/PE market was 658, a decrease of more than 30%year -on -year, and shrinkage of 17.96%month -on -month. Generally speaking, the fundraising market is still sluggish. In July, a total of 554 institutions participated in the new funds. Among them, Guangdong Province is the most active. In July, there were 164 new funds and 83 new funds in Shenzhen. The number of new funds in the aforementioned area was significantly ahead of other provinces and cities. In addition, Qingsong Capital, Cornerstone Capital, Zhongtianhui Fu, Wuyue Peak Science and Technology and other institutions are more active, and new funds are more than 3 or more.

It is worth noting that most of the new funds are the RMB industry guidance funds, and the scale is more than 10 billion yuan. For example, the scale of the development investment fund of the hydrogen energy industry development investment fund in Henan Puyang is not less than 20 billion. The scale is 10 billion, etc.; From the perspective of investment, the RMB guidance fund is mainly gathered in the fields of infrastructure, clean energy, and high -end manufacturing.

(Picture source: investment data)

At the same time, from the perspective of investment, the number of investment cases in July was 489, a decrease of 10%month -on -month, and a decrease of nearly 20%year -on -year; the investment scale was 14.343 billion US dollars, an increase of 7%month -on -month, and the year -on -year decrease was reduced. Increase. In fact, the VC/PE investment market fluctuated significantly this year. Due to the repeated impact of the epidemic in the first half of the year, the institutional investment and financing rhythm slowed down, and the market recovery progress was also slow.

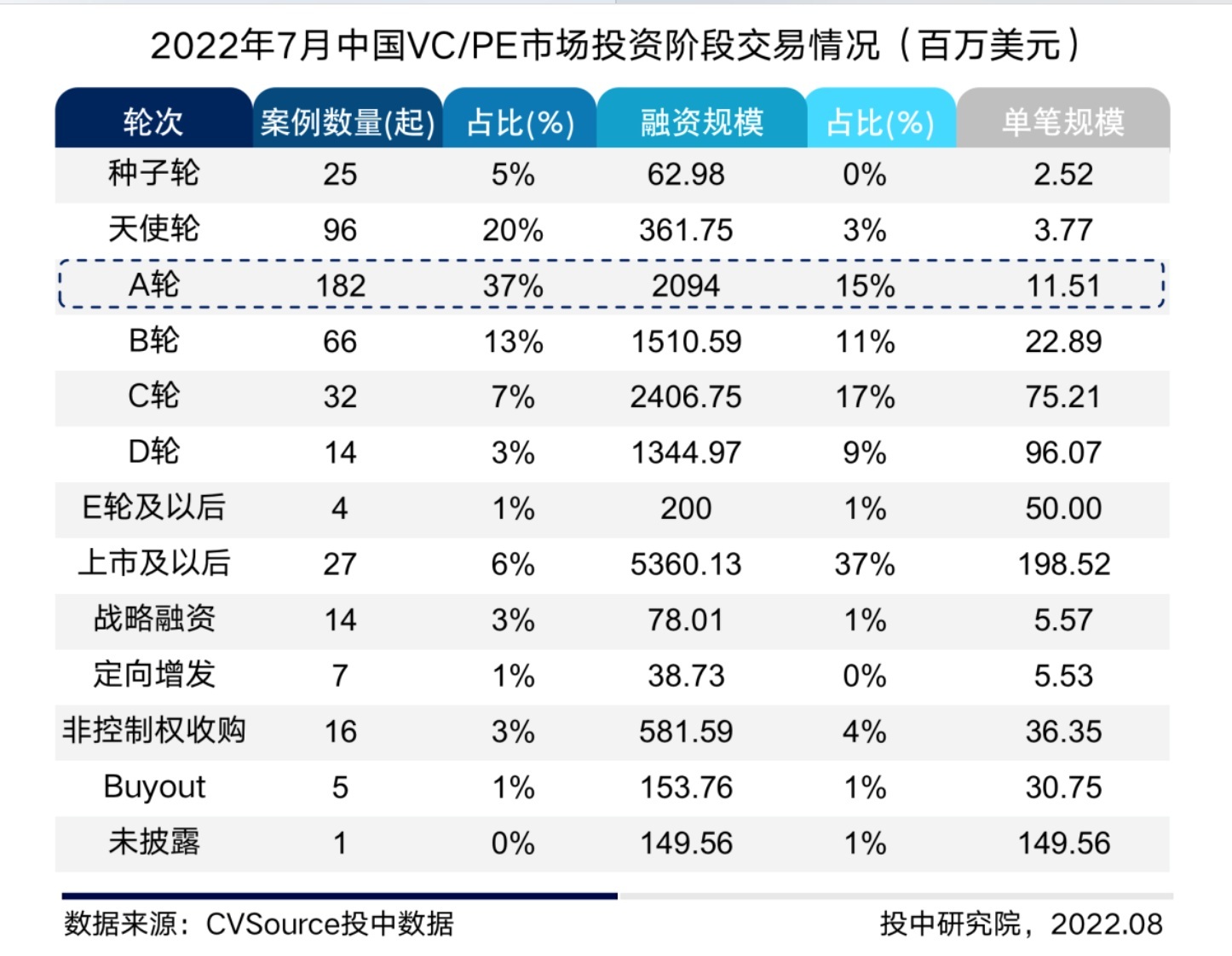

From the perspective of the financing enterprise, nearly 40 % of the enterprises that have been invested in July are in a Series A, with the number of cases from 182; Series C's financing enterprises involved the largest amount, reaching 2.407 billion US dollars. From the perspective of the transaction scale, more than 50%of the transaction case financing amount in July is less than 5 million US dollars, and the amount of financing amount of the remaining transaction cases is within a range of 10 million US dollars to $ 50 million. Essence

It is not difficult to see that under the overall cooling of the market, the polarization of the capital layout is obvious -the preference for projects with early and small investment amounts, or mature projects; overall, the difficulty of project financing in the July period is prominent.

The number of IPOs hit a new high since this year

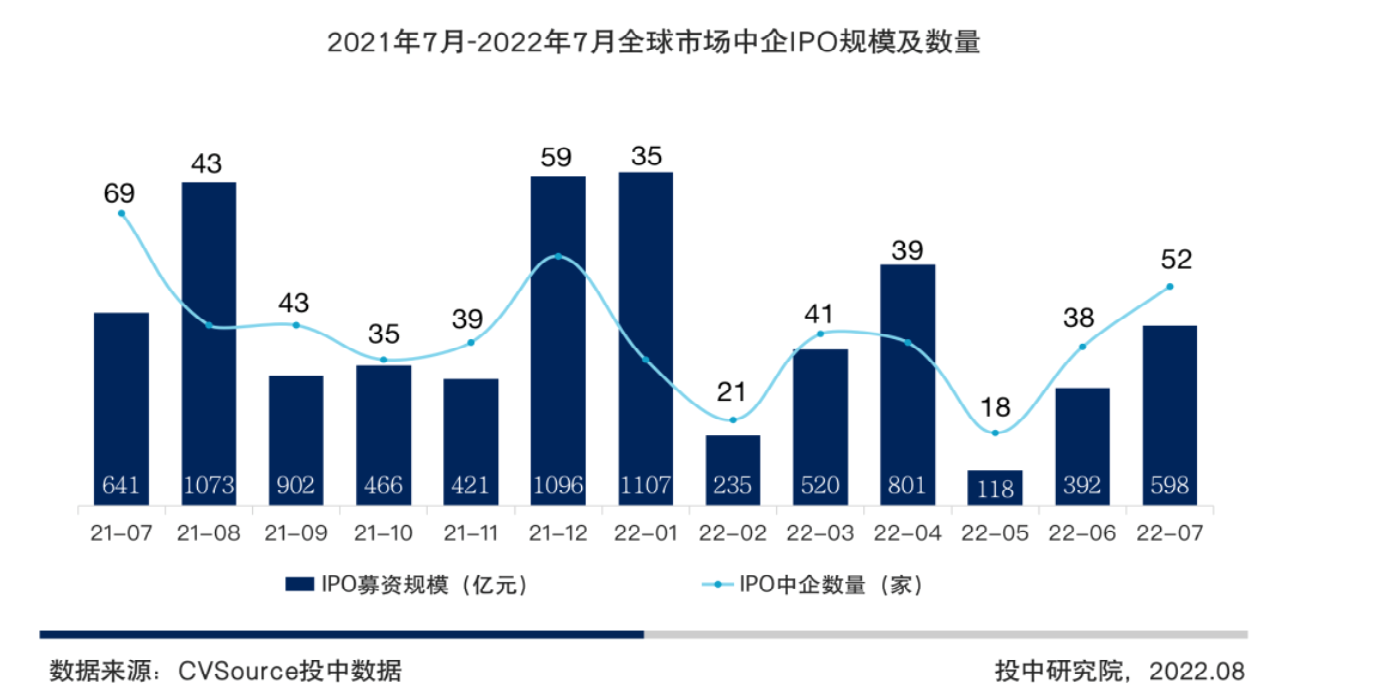

Unlike the continuous cooling of the first -level market raising and investment, the number of IPOs in July ushered in a new high this year -a total of 52 companies successfully landed on A shares, Hong Kong stocks and US stocks. The number of IPOs decreased by 24.64%year -on -year, an increase of 36.84%month -on -month, a month of the largest number of IPOs this year; the total fundraising amount was about 59.8 billion yuan, and the IPO scale decreased by 6.71%year -on -year, an increase of 52.55%month -on -month.

Among them, 34 companies successfully IPOs in the three cities of Shanghai and Shenzhen and Bei Stock Exchange, the number of IPOs decreased by 29.17%year -on -year, an increase of 9.68%month -on -month; the amount of fundraising was 38.2 billion yuan, and the IPO scale increased by 19.38%year -on -year, an increase of 1.33%month -on -month. This month's A -share market fund -raising TOP5 companies occupy 4 seats, which are mainly concentrated in the IT and information industries.

Similarly, the Hong Kong stock market also ushered in a small climax of Mainland companies this year in July -15 Chinese companies on the main board IPO of the Hong Kong Stock Exchange. The scale of the IPO decreased by 50.94%year -on -year, an increase of 12 times from the previous month. Among them, Tianqi Lithium (09696.HK) was listed on the Hong Kong Stock Exchange to achieve the listing of "A+H". This is also the largest IPO ushered in Hong Kong stocks in 2022.

In addition, three Chinese companies completed the IPO in the U.S. stock market in July, with a fundraising amount of 6 billion yuan. On July 15th, HKD.NYSE was listed on the New York Stock Exchange, with a fundraising amount of more than 5 billion yuan.

It is worth noting that 32 of the companies listed in July have received support from the wind investment. The IPO penetration rate of the VC/PE institution is 61.54%, of which The penetration rate is 100%.

In July, the IPO book withdrawal from the VC/PE institution was about 42.4 billion yuan, an increase of 65.63%month -on -month, and the average book return rate increased by more than double year, up 8.88%month -on -month. Among them, the book exit of the Hong Kong Stock Exchange is better than other sectors, mainly concentrated in popular investment fields such as semiconductors and high -end manufacturing.

Daily Economic News

- END -

[Emergency Science Popularization] Caption: Those things about the hedging of heavy rainy days

What are the dangers of heavy rainy days?How to scientifically hedge?Pred in the m...

Municipal Supervision Bureau: centralized rectification of "sky -high" moon cakes, crab card coupons and other issues

The State Administration of Market Supervision recently issued the Notice of the General Administration of Market Supervision on centralized rectification of overpassed packaging, sky -high moon ca