Sudden flash collapse!Pozo 80%, "dye blue curse"?11 times the biggest decline in the current year

Author:China Fund News Time:2022.08.16

China Fund reporter Yao Bo

Economic data was released in July, and the central bank's interest rate reduction and maintenance market confidence once raised the market. However, under factors such as the situation of Taiwan Strait and the price of chips, the Hong Kong stock market fluctuated repeatedly.

The HSI fell more than 80 points today and kept 20,000 points; the state -owned enterprises and the technology index fell slightly.

The exit of state -owned enterprises and US stocks set off in the market. Today, five state -owned enterprises such as China Petroleum, Sinopec, Shanghai Petrochemical, China Life, and China Aluminum have fallen. The market is expected to take the effect of related ADRs from US stocks to early September.

However, some positive factors are still playing a role, and consumption has become a leading sector today. In the first half of the year, Haidilao, which had a loss of nearly 300 million yuan in the first half of the year, today rose by nearly 8%, the largest increase since June. Recently, Haidilao's flip rate exceeded the same period last year, showing that the operating conditions are improving, and the market is still hoping for consumption recovery.

The concept of medical beauty crashes!

On August 15th, Xingke Rong's pharmaceutical disk plummeted 83%!

After the crash of the morning, the stock price rose at a time, and still closed -68%, and the market value fell below 1 billion Hong Kong dollars in one fell swoop.

Xingke Rong Pharmaceutical was established in 2011 and was listed on the main board of the Hong Kong Stock Exchange in 2016. It is headquartered in Chengdu, Sichuan Province, China. It is the only marketing, promotion and channel management service provider in Chinese blood products. White protein marketing, promotion and channel management service providers.

Beginning in September last year, Xingke Rong Pharmaceutical entered the medical beauty blue sea track, laid out the "girl needle" research and development, and plans to invest nearly 90 million yuan. Medical beauty products are suitable for various parts of the face, neck. Xingke Rong Pharmaceutical pointed out that it is the first product of the company's layout in the medical beauty industry. The non -surgical medical beauty products represented by the girl's needle are sought after by consumers at home and abroad with their simple operation, fast recovery, and small risk.

At the same time, as the marketing network of Xingke Rong Pharmaceutical Company is fully rolled out, the cold chain logistics industry is actively deployed. The company has formed a complete industry closed loop in all stages of research and development, production, warehousing, logistics, sales, and drug clinical applications.

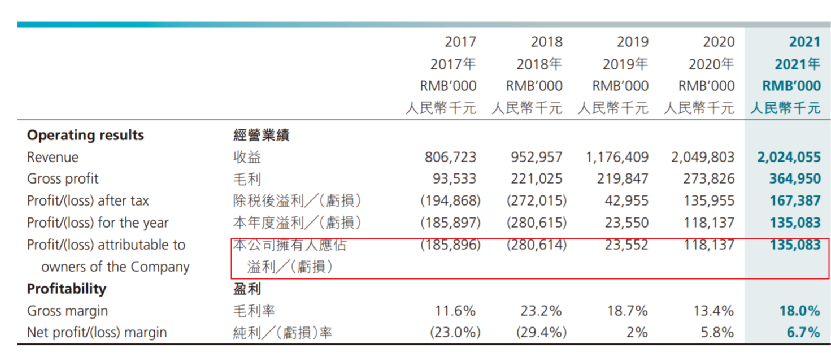

Under the layout of the diversified product matrix of "Blood Products+Medicine Beauty", the introduction of new products is expected to increase its performance, and the company has been highly hoped by many securities firms. The company's fiscal interest in 2021 was 135 million yuan, an increase of 14%year -on -year. After the stock price fell today, there was no additional negative news.

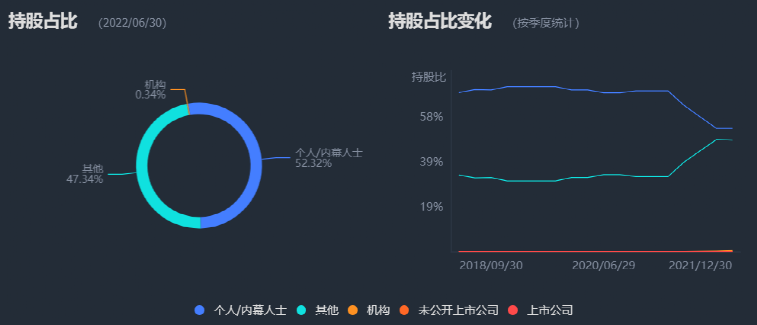

However, in terms of shareholding, the controlling shareholders hold more than 50%of the shares, and the institutions hold less. Generally, companies with a higher shareholders in the Hong Kong stock market are relatively high and small market value companies are often reduced to high -incidence zones in stock prices.

11 times the biggest decline in Daniu stocks!

Oriental Overseas International is one of the global comprehensive international container transportation and logistics companies. Since the second half of 2020, with the re -production of various countries, the demand for inventory has emerged; at the same time, countries have driven economic recovery through financial expansion methods, which effectively drives global trade growth. This shipping stocks began to enter a period of gold.

From November 2020 ~ July this year

Oriental Overseas International has risen 11 times

Since 2021, the situation of mismatches of supply and demand has not been resolved, and the freight rate has been strongly supported. Even in the first half of this year, the transportation prosperity remained high. Many brokerage companies expect the company's profit in the first half of the year will still increase by 60%year -on -year.

However, as the economic prospects in Europe and the United States have declined and the inventory has increased, the demand for shipping in the second half of the year has shrunk rapidly, and shiplocker's freight rates have fallen. On August 15th, the freight index of dry bulk cargo in the Baltic Sea fell 5%to a new low of half a year, and fell for the fourth consecutive week. This year, the cumulative decline has reached 33%. In addition, the Shanghai export container freight index fell 4.7%last week and fell nine weeks.

The market environment has changed a lot, and the stock price of the shipping may have seen it in advance. Dongfang Overseas International has risen in early June this year to a record high of HK $ 284.8.

Aside from the fundamental factor, the Hong Kong market also has the saying of "dyeing the blue curse", that is, as a blue chip stock, it has been incorporated into the Hang Seng Index for a period of time.

Since the Hang Seng Index was included in the Hang Seng Index on June 13 this year, Oriental Overseas International has fallen 4%so far, and today it has fallen sharply as if it is particularly fulfilled. In the same period, the SMIC that was included in the same period fell 15%, far exceeding the 8%decline of the same period.

Before the plunge, the prophet's awareness Hong Kong stocks were the first to withdraw. In March of this year, Oriental Overseas International was included in the Hong Kong Stock Connect, and domestic funds were rising all the way. However, in the past March, the Hong Kong Stock Connect has sold 1.52 million shareholders' overseas international, and the sales volume has reached 1.42 million in the past month. The Hong Kong Stock Connect's position continued to decline after seeing it in June this year, and the shareholding accounted for below 0.5%.

Edit: Captain

- END -

Five Chinese enterprises have announced that they will delist from the New York Stock Exchange

On the evening of the 12th, China Life, Sinopec, China Petroleum, China Aluminum, ...

Dangyangnong issued the development of the citrus industry

[Source: Yichang Local Financial Work Bureau_ Financial Dynamics]Recently, Dangyang Nong issued 147 million yuan in rural land circulation and land scale operation loans to Dangyang Xinquan Industrial