Deepen the marketization reform of exchange rates is not shaken

Author:Economic Daily Time:2022.08.17

A few days ago, the central bank released the "China Monetary Policy Implementation Report in the Second quarter of 2022", which proposed to grasp the balance of internal and external balance, deepen the market -oriented reform of the exchange rate, and adhere to the decisive role of the market in the formation of the RMB exchange rate. The 7th anniversary of the "8 · 11" exchange reform, sorting out and summing up the exchange of exchange reform, is of great significance to deepen the marketization reform of the exchange rate in the background of financial openness.

On August 11, 2015, the People's Bank of China decided to improve the quotation of the intermediate price of the RMB against the US dollar. From the same day, it was required to provide intermediate prices for the closing price of the Shanghai interbank foreign exchange market. Since then, the central bank has made a series of reform measures such as the CFETS RMB exchange rate index, clarifying the middle price formation mechanism, increasing the number of basket currencies, and adjusting the closing price time point, making the RMB exchange rate formation mechanism more scientific and market -based.

The "August 11" exchange reform has achieved remarkable results, the RMB exchange rate formation mechanism has been improved, the impact of market supply and demand on the exchange rate has increased, and the independence of the RMB exchange rate has increased. After the reform, the difference between the intermediate price and the closing price of the previous day was significantly narrowed, which could better reflect the changes in market supply and demand. The two -way fluctuation characteristics of the RMB exchange rate were more obvious, and the function of the automatic stabilizer of the international revenue and expenditure was fully exerted. Especially in recent years, in the face of the international complex and changing situation, the renminbi has played a good role in absorbing external impact and regulating international revenue and expenditure, and creating conditions for achieving external balance. International investors and market entities have enhanced confidence in holding RMB assets, and RMB's international insurance currency, investment and financing currency and reserve currency functions have been continuously strengthened.

However, with the increase in financial opening, the challenges facing the RMB exchange rate are also increasing. The first is that the renminbi is still affected by external factors to a large extent, and super -adjustment will occur in the short term. Although the impact of a basket of currencies on the renminbi has increased, when the adjustment of the Fed's currency policy and the significant fluctuation of the US dollar index, the RMB will still follow the US dollar index. Second, exchange rates have increased due to financial factors. In the past, in international revenue and expenditure changes, the main body of cross -border capital flows under the frequent accounts and direct investment items is the core factor that determines the exchange rate trend. With the increase in the opening level of capital accounts and the increase in two -way interconnection and interoperability mechanism, the scale of short -term cross -border capital flow has increased significantly, which has gradually become an important factor affecting the exchange rate trend. And more factors affecting the financial market have increased the volatility of the RMB exchange rate. Third, the scope of intermediate price effects is mainly concentrated in the shore market, which has a relatively limited impact on the offshore market. The actual situation shows that the impact of the offshore market cannot be underestimated. When the market fluctuates, the offshore exchange rate usually guides the changes in the coastal exchange rate. The middle price cannot cover the offshore market for the time being. It is often in a passive adjustment state, and the pricing power needs to be improved. Fourth, market entities such as enterprises have not completely established risk neutral concepts, resulting in insufficient attention to risk management, and failed to give full play to the price discovery and risk aversion function in the foreign exchange market.

In the future, the market -oriented reform of exchange rates should be steadily advanced on the basis of considering economic tolerance to prevent exchange rates from amplifying economic fluctuations. After the economic recovery is stabilized, you can consider further relaxation of the fluctuation limit of exchange rate fluctuation at the right time, continuously optimize the middle price formation mechanism, and increase the guidance of the offshore exchange rate on the offshore exchange rate. We should continue to strengthen investor education, stabilize market expectations, guide the establishment of risk neutral concepts, encourage financial institutions to innovate foreign exchange derivative products, and help enterprises effectively hedge exchange rate risks. At the same time, the macro -prudential management of cross -border capital flows has been continuously improved, and high -risk areas such as international stock markets, Chinese -funded US dollar bonds, cross -border credit, and offshore RMB, as well as non -traditional risk monitoring and management, and adjust the tool system for different risks.

(Source of this article: Author of Economic Daily: Wang Youxin, a senior researcher at the Bank of China Research Institute)

- END -

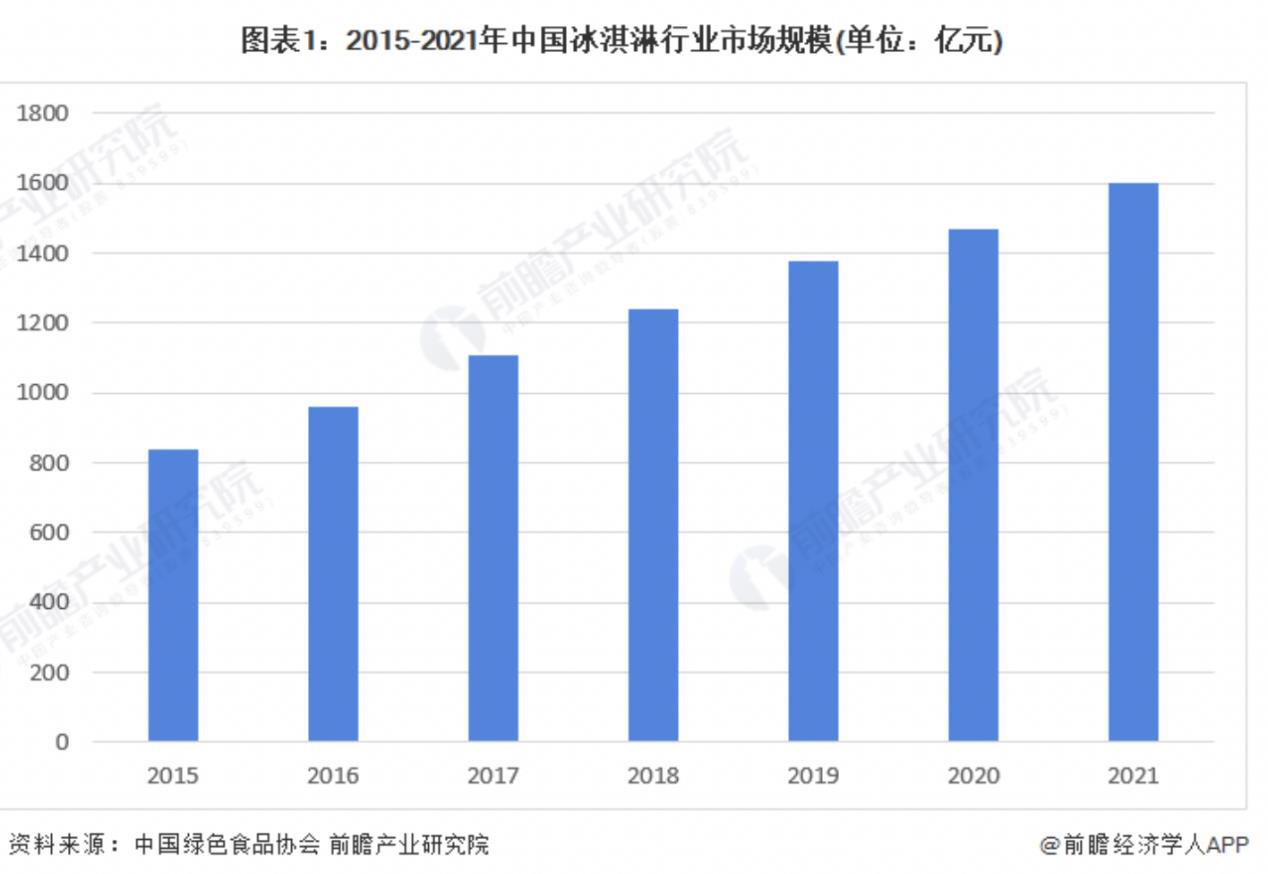

"Why the ice cream is more expensive and more expensive." Behind the sky -high price ice cream: How far can the 100 billion track giant Lin Lili unicorn?

In the hot summer, the cooling artifact ice cream that eliminates the summer is ho...

Digital transformation white paper shows: my country's digital economy has made an unprecedented vitality

On August 10, the 2022 Digital Transformation and Development Summit Forum sponsor...