There are contradictions in the disclosure of biological information in Chuanning, and the production capacity has shrunk significantly compared with the previous public data

Author:World Wide Web Time:2022.08.17

[Global Network Zero Observation] Chuanning Biological is a pharmaceutical intermediate manufacturing enterprise. It is mainly engaged in the research and development and industrialization of biological fermentation technology. The products mainly include thiocyanic acid erythromycin, cephalosporte intermediate (7-ACA, D-7ACA, and 7-ADCA), penicillin intermediates (6-APA and penicillin G potassium salt) and bear-removed oxygenic acid coarse products, and the company is currently applying for listing.

The controlling shareholder of Chuanning Bio is a listed company Coren Pharmaceutical. At the same time, the main project of the Sichuan -Ning creature is also the "Yili Chuanning Biotechnology Co., Ltd. 10,000 -ton antibiotic intermediate project" invested by Kelun Pharmaceutical in 2011. The investment is as high as 4 billion yuan. According to the public information released by Coron Pharmaceutical at the time, the project would build two thybocyanic acid erythromycin production lines and 3 cephalosporte production lines. Public engineering system, 4,800 tons of erythromycinocyrinin and 9,000 tons of cephalosporte can be produced annually after delivery; it is expected that the total sales revenue of the project is 6.8 billion yuan, net profit is 1.484 billion yuan, the total investment profit margin of the project is 37.17%, the investment recycling 6.36 years.

However, in fact, according to the prospectus released by the IPO of Chuanning Bio, as of the end of 2021, the company has 3,000 tons of thiocyanicininin and 3,000 tons of cephalosporin series. Earlier public data, and the peak of biological profits in Sichuan in recent years appeared in 2018, and its net profit was only 391 million yuan. It was not as good as the net profit of Caren Pharmaceutical's expected net profit of 1.484 billion yuan before. Not only that, when investing in a 10,000 -ton antibiotic intermediate project at the beginning, Kellen Pharmaceutical used the fundraising funds to invest. The second listing of assets.

According to the disclosure of page 399 of the prospectus, the issuer's business expenditure was mainly due to the damage of non -current assets and the loss of foreign donation. The proportion of operating profit was 0.78%, 6.38%, 0.95%, and 40.23%, respectively, accounting for relatively small. Among them, the loss of work in 2021 caused an out -of -business expenditure amount of 76.2548 million yuan, accounting for more than 40 % of the operating profit of the same year, which was equivalent to nearly 70 % of the company's net profit of 111.3471 million yuan in the same year. The disclosure of information is "small", which is difficult to be convincing and questioned whether the Sichuan -Ning Bio, together with the sponsors, is suspected of misleading statements.

Not only that, public information shows that in 2020, the military construction group claimed to be the power design institute and Sichuan -Ning as the owner's unit of China Energy Construction Group Xinjiang Electric Power Design Institute Co., Ltd. and the Chuanning creature as the owner unit due to the construction contract dispute. The end payment of biological joint payment projects is 514.876 million yuan and related interest and litigation costs. On September 29, 2020, the court made a first -instance judgment to determine that the cost of the project involved was 252.744 million yuan, and the Power Design Institute paid the project funds of the military construction company of 20.2718 million yuan and the interest of overdue payment. Within the scope of 18.2691 million yuan, the above -mentioned project funds are liable for liability. However, the out -of -business out -expenditure part disclosed in the prospectus issued by Sichuan Ning creatures did not have such a large amount of compensation, and even the total operating expenditure in 2020 was only 2.649 million yuan.

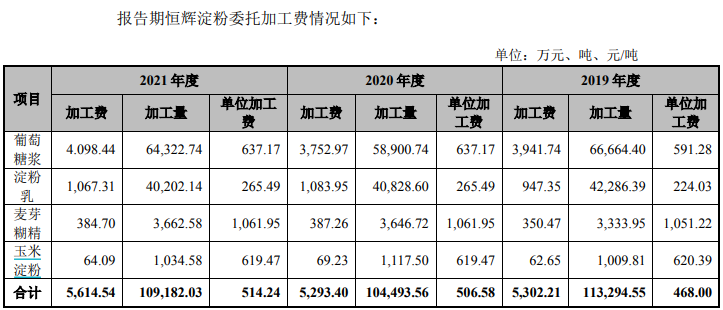

In addition, according to the "reply of the second round of review and inquiry letter", page 68, the issuer should pay 32.2708 million yuan in the supplier of Huifeng Investment Department at the end of 2019, accounting for 24.48%of the current purchase deposit. Mainly to deal with Henghui Starch entrusted processing fee of 21.48 million yuan and the purchase of corn germ and feed for the purchase of corn germ and feed, the total amount of the supplier of Huifeng Investment Department at the end of the period was 94.28%.

The "Reporting Period of Henghui Starch Entrusted Processing Fees" disclosed on page 298 of the prospectus shows that starch entrusted processing costs are not the main items for Chuanning creatures to procurely procurement from related parties Henghui starch. 626,500 yuan, even if the processing fee of starch milk is only about 10 million yuan, the "payable amount mentioned in the second round of review inquiry letters" is mainly to cope with Henghui starch entrusted processing costs 214.806 million The information of Yuan "is contradictory.

- END -

2022 Chengdu International Advertising Festival in September comes the highlights to reveal the secrets in advance

Cover reporter Zhao ZixuanOn August 12, the 2022 Chengdu International Advertising...

Taxi drivers who have not changed a civil servant now, what's going on now?

With the deepening of the degree of the internal society, there is another wave of...