Is the high -end manufacturing style military worker worth getting on the car?

Author:Capital state Time:2022.08.17

Military workers have always been known as the "big country". With the changes in the international environment, the strong country and strong army have become more and more demanding, and the military sector has recently earned enough attention. Since the bottom of April, the market has rebounded strongly, and its rise is like a rainbow. It has become a proper "rebound pioneer".

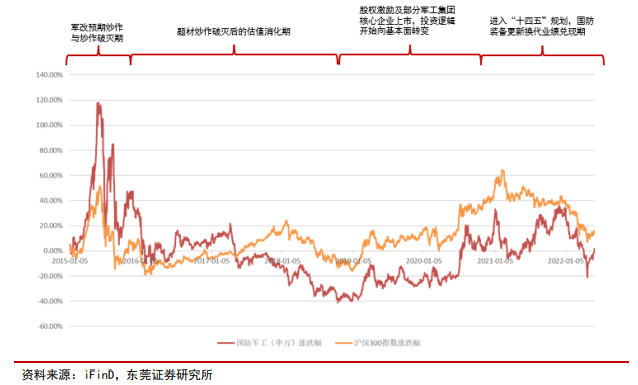

However, as a typical representative of high -end manufacturing, military industry is often not optimistic about investors. This emotion is not groundless. Specifically, there are three main reasons. One is that the historical volatility is too large. Even in the high -end manufacturing industry of "emotional", it is too moody. The second is opaque. Compared with other sectors, military stocks are more "mysterious", which is reflected in the low frequency of information updates, making investors a greater barriers to research on the military industry. The third is the lack of imagination. In the past, due to the existence of the cost pricing mechanism, the profits of military enterprises were seriously limited.

Therefore, the national defense military industry has always been a representative of the concept of speculation, and it is difficult to get the trust of value investors. In the current market of the military industry, many investors are still doubtful. Is there a fundamental support for national defense military workers? Is it worth investing in the current point? Today, we start with the situation of domestic and foreign situations and military track logic, and sort out these issues. It is clear why it is the golden period of the military sector and why is the military sector worth investing?

Military era comes

Performance -driven replacement theme hype

The status quo of the international situation has more or less hearing. Recently, the U.S. Navy announced the 2022 "Navy Development Plan". The document stated: "The world is entering a new era of conflict. In this era, it is not just the size of the fleet. Win in the conflict. "

As the above plan said, at present we are facing a major change in a century, and the importance of the construction of the national defense forces is becoming more and more prominent. For example, the Japanese government decided that the defense expenses will not have a upper limit in 2023, and Australia has launched military strategic review for the first time in 10 years.

The next ten years will be a decade full of uncertainty. In order to defend national security and in response to various uncertainty in the international international defense, the investment in the national defense and military reserve has continued to grow rapidly. Public data shows that China's military expenditure budget this year was 1.45 trillion yuan, an increase of 7.1%year -on -year. After a lapse of 2 years, China's military expenses increased by 7%again!

However, from the horizontal comparison, my country's military expenditure is less than one -third of the United States. China is already the world's second largest economy, but my country's national defense strength and economic strength are still disconnected. In the context of global turmoil, my country's military industry sector will still have much room for improvement in the future, and military confrontation will continue to upgrade traction weapons and equipment. Therefore, the rise of the military sector has the support of international background.

After speaking, let's take a look at the endogenous factors. In 2020, my country's national defense policy has transformed from the "steadily advancement of strong army goals" to "comprehensive preparation capacity building", which means that the demand for military reserve has continued to expand. In addition, this year is the second year of the "Fourteenth Five -Year Plan" plan. In addition, it is only less than 5 years before the "Centennial Struggle Objectives for the founding of the Army" in 2027. my country's national defense investment will continue to grow rapidly. The high growth rate of equipment procurement will become new. normal. Under the east wind of the policy, the prosperity of the national defense and military industry is expected to travel along the way.

Therefore, under the drive of dual factors at home and abroad, the military industry will soon enter a new round of production capacity release, which drives the landscape of the military version to increase.

So at present, is the current prosperity of the military industry have the support of performance? With the promotion of the domestic and foreign environments, the answer has been called out. For a long time, military stocks have been considered the subject of the story, and their investment is emotional. However, the investment logic of the industry has changed significantly, and the underlying logic has shifted from "theme hype" to performance and fundamental drive. In 2021, 111 listed companies in the military industry achieved operating income of 503.967 billion yuan, an increase of 13.31%year -on -year; net profit attributable to mothers was 30.940 billion yuan, an increase of 25.66%year -on -year. It can be seen that at present, the national defense army sector has entered the performance exchange period of equipment renewal.

In the historical style, the future development path of the military sector is highly determined, the performance is strong, and the attributes of value investment have gradually appeared. After the industry recovery at the beginning of the year, the valuation of the military sector has fallen relatively. Improved. Therefore, in the new era, in the face of the upside -down changes in the national defense military industry, we must look at the development of development.

Selected military equipment leader

Find anchor of long -term value

From the perspective of stretching, the "big era" of national defense military industry is worthy of attention, but the internal and corporate division of the internal industry and company of the military industry is relatively large. How can invest in better to seize the opportunity? As mentioned earlier, this subdivision sector in high -end manufacturing may be worthy of attention, and many companies are the pioneers of this wave of military industry.

Among the top ten heavy stocks in the second quarter of the second quarter of Tianhong High -end Manufacturing Hybrid Fund (Class A: 012568, Class C: 012569), national defense equipment is its main layout. It is worth mentioning that Gu Qibin and Li Jiaming, the two fund managers who manage Tianhong's high -end manufacturing mixed, have long cultivated the cycle manufacturing industry for a long time, excavate long -term investment opportunities, and lead investors to tap the long -slope thick snow track and high -quality stocks.

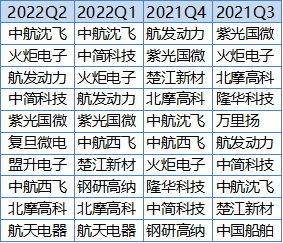

In Li Jiaming's speculative logic, stock selection mainly starts from three major dimensions. The first is growth, that is, whether the company's industry has very broad growth potential, and whether the company has the characteristics of self -reliance and product iteration at the level of the company. Only in this way can we continue to maintain the growth of the industry's average growth rate. The second is to look at the company's competitiveness. This is also what Tianhong Fund has always emphasized. Therefore, there is a complete model to judge whether the company's core competitiveness is strong enough. In addition, the company's business management is also the direction of Li Jiaming, including whether the company's management is stable and whether there is a complete management system or management model. Tianhong High -end manufacturing heavy warehouse holding changes (data source: Wind)

Following this, the investment team adopts a relatively neutral and stable configuration strategy, selects high -quality companies and holds it for a long time. From the perspective of the position of the position, in the environment of a large downturn at the beginning of the year, Li Jiaming still insisted on selecting the configuration idea of the leading leader, and at the same time increased the hidden championship of some segmented fields to capture the opportunity to "kill" by the market. As Tianhong's high -end manufacturing mixed second quarter report stated, "long -term value is still the anchor of pricing."

Facing the future, Li Jiaming said that if new energy is a teenager, then the military industry is now a child and the sun at eight or nine o'clock in the morning. From the "post -economic post -cycle" industry characteristics, to the concentrated volume of supply end and the promotion of industry marketization, Li Jiaming believes that his investment logic of military stocks is still continuously strengthened.

The National Defense Army Industry has always been the pinnacle of scientific and technological warfare, a strategic industry for the establishment of the country and the military power, and the national defense equipment is an important guarantee for maintaining the integrity of national sovereignty and security in various fields. In the era of turbulence, investors may be mixed with Tianhong High -end manufacturing (Class A: 012568, Class C: 012569) to witness the tomorrow of the rise of great powers.

- END -

Our province's first imported aluminum ingot train reached the new area

Follow usRecently, the imported aluminum ingot international freight trains import...

Yike Commercial Review | Siku is still applying for bankruptcy review luxury e -commerce insurance is still a difficult problem

Siku is applied for bankruptcy reviewAccording to the information network of bankr...