"Vigorously optimize the business environment to accelerate high -quality development" Focus on demand for excellent services to precise efforts and excellent processes -Wu'an Taxation Bureau fully builds a first -class business environment

Author:Handan News Network Time:2022.08.18

In recent years, the Wu'an Taxation Bureau has optimized the business environment as an important starting point for promoting the reform of taxation and management, implementing tax refunds, and improving the satisfaction of taxpayers. Doing articles on the "excellent service, excellent process", work on "quality improvement, grades", united high -quality development new kinetic energy, and won the title of "Handan City's Advanced Collective Optimized Business Environment in 2021".

Highlight fine taxes to create a convenient and efficient environment

The Wu'an Taxation Bureau will implement the reform of "fine services" as the key point to optimize the business environment and enhance the convenience of service.

The bureau promotes the construction of smart taxation, and is guided by taxpayer's personalized service needs. Business applications and demand processing and other businesses can make taxpayers who can do it at any time without leaving home. Since the beginning of this year, the remote assistance center has received more than 1,500 telephones, has accepted 830 of the Electronic Taxation Bureau's business, and 420 business centers business.

The bureau takes the self -service tax service area as a carrier to actively promote the tax payment and running to the Internet. A number of businesses have realized online and home office, reducing taxpayers' tax burden, and improving the tax handling experience. And set up a special seat in the tax service hall, "Please find me", in response to the taxpayer's request for the taxpayer, in response to the taxpayer's concerns, and helping to solve more than 100 problems and hope of expectation.

At the same time, the bureau vigorously promoted the "non -contact" taxation tax, implemented the "maximum run once" services, relying on the "non -contact" tax payment service channel such as the electronic tax bureau, mobile app, WeChat public account, and mail. Effective measures such as the online office of "reservation office" and "tolerance" to ensure that the taxpayer is handled safely, efficiently, and conveniently to complete various tax -related matters. The bureau also collects multiple channels for taxpayer counseling needs, and adopts different ways to promote counseling for different needs, such as tax companies interactive platforms, remote video gangs, WeChat, etc., to meet the personnel needs of taxpayers. , More people's hearts.

Focus on tax refunds to stimulate the vitality of the market subject

Tax and tax reduction are the key measures to optimize the tax business environment and improve the satisfaction of taxpayers. After the introduction of the new combined tax support policy, the Wu'an Taxation Bureau implemented tax refund and reduction policies to ensure that the policy dividends directly reached the market entity.

"This refund is too timely. Due to the economic situation and epidemic situation this year, the company has a difficult step. Due to the large investment in the company, it has formed huge capital pressure." Thinking of the tax refund this year, the tax refund has effectively reduced the company's burden, revitalized the company's capital flow, and added confidence to the company's development. "

In order to allow enterprises in the area to enjoy the dividend of the tax refund policy faster, the Wu'an Taxation Bureau establishes a special class to implement the tax refund policy. Perform strokes, establish tax refund and ledger; on the other hand, carry out policy publicity and counseling work, adopt the "online+offline" combination model, and use WeChat service groups, tax companies exchange groups and nails Nail Live conducts online counseling, solve doubts on one -to -one solution, and effectively enhance the targeted and effectiveness of propaganda training and counseling. The bureau regulates 10 business backbones to set up the "Value -added Tax Tax Tax Expert Service Troupe" to implement "grid" management for enterprises enjoying tax refund, carry out "point -to -point" reminder and "one -to -one" consultation, guide them to guide them Quickly apply to ensure that policy dividends are directly enjoyed. At the same time, the bureau actively coordinated the financial, crowds and other departments, shortened the approval time limit, followed up the tax refund progress, and strived to receive the tax refund at the first time at the fastest speed and the highest efficiency.

Follow -up law enforcement to increase tax service temperature

"What problems you encounter or suggestions and suggestions can be put forward one by one. We will reply and implement item by item." In June of this year, the Wu'an Taxation Bureau launched a special action and tax policy interpretation of "Spring Rain and Runnoli". The symposium conducted targeted explanations on the key, difficulty, and blocking problems encountered in the development of the enterprise.

During the discussion, tax cadres answered some questions on the spot to ask the enterprise on the spot, and established a special ledger tracking solution for difficult problems. They hired 12 tax service experience supervisors and 6 tax service volunteers from various industry associations to collect extensive taxpayers' opinions and suggestions, and sincerely accept supervision.

The bureau also organized a large -scale visiting activity to collect the opinions and suggestions of the enterprise, set up a team of tax consultants and experts to answer the tax -related issues in a timely manner, and provides a full process and personalized customization service for the taxpayer payment. Comprehensively implement the "three systems", actively explore the effective connection between rigid law enforcement and flexible law enforcement, and effectively use non -compatible law enforcement methods such as persuasive education, interview warnings, etc., so as to achieve generosity and harmony. At the same time, the bureau takes "the first violation of penalties" as an important measure to carry out the "private taxation spring breeze" and promote the reform of the "decentralization of management", which reflects the "flexible law enforcement temperature", which has improved the taxpayer and deduction obligations. The sense of gain and tax law compliance.

Source: Handan Daily

- END -

"Early repay compensation" must be well balanced

Zong Zongming/WenCong Bank recently announced that it will adjust the personal mor...

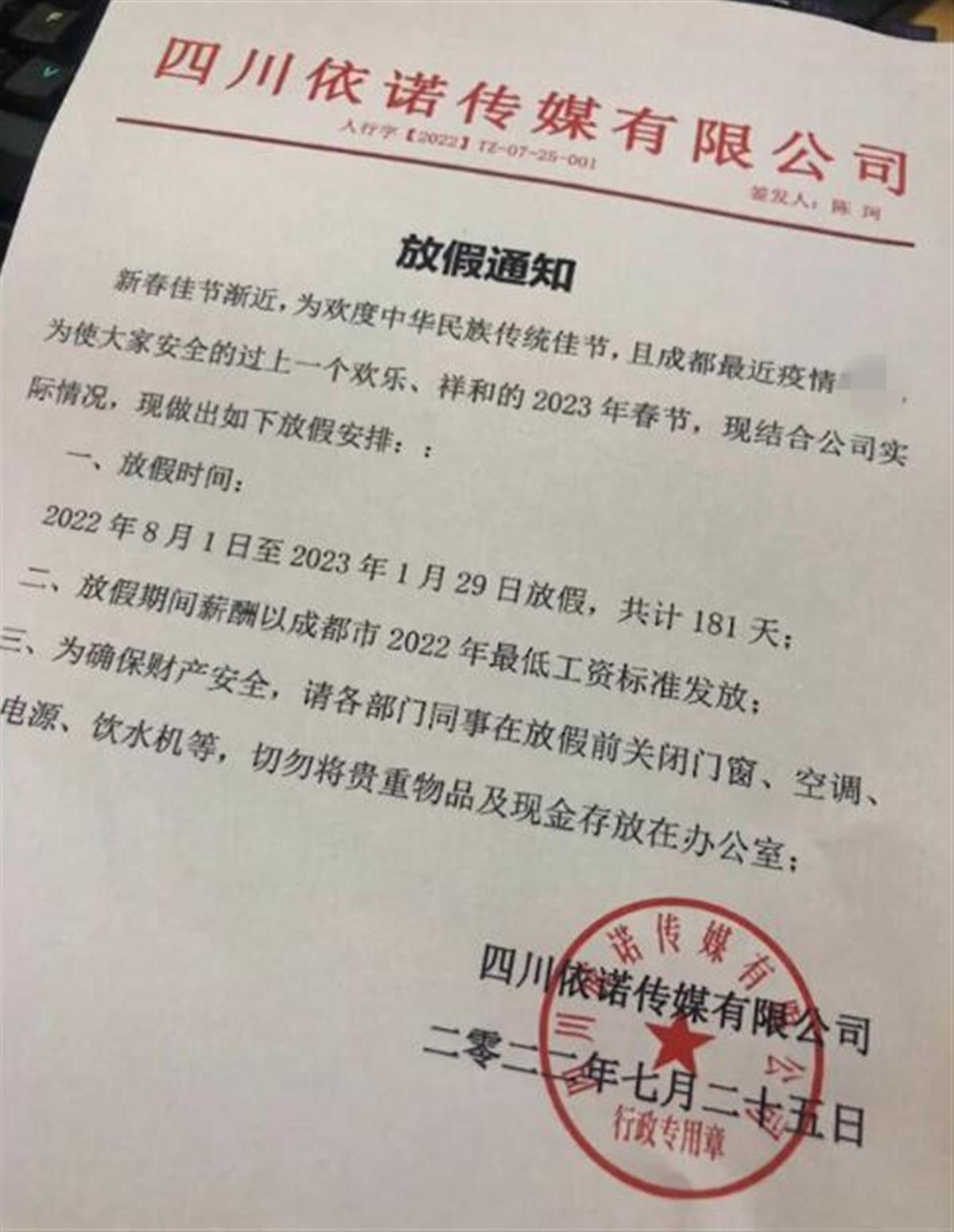

An early New Year in the Chengdu company for 181 days?Official response: The authenticity is verifying the authenticity

Jimu Journalist Ding PengVideo editing Ding Peng