The National Defense Forces ETF (512810) closed up 0.95%.

Author:Capital state Time:2022.08.18

On the afternoon of the 18th, the National Defense Army Workers' sector rose against the market. Filihua rose by more than 10%, hitting a new high, and the daily limit of July 1st. Hangxin Technology and Zhongjian Technology have risen by more than 4%.

The National Defense Forces ETF (512810) rose steadily in the afternoon, closed up 0.95%, and strongly recovered the 5 -day moving average. The turnover exceeds 63 million yuan, and the turnover rate exceeds 12%.

As one of the high -growth industries in the market expected, the National Defense Army Workers Plate has handed over a dazzling transcript. According to statistics, only eight listed companies are currently disclosed in the disclosed interim performance forecast data. The net profit limit of the parent company is a loss state.

Of the 33 military companies with a net profit limit of the upper limit of net profit, the net profit limit of the four companies exceeded 5 billion yuan, of which the 5th largest ownership of the National Defense Forces ETF (512810), 1.33 billion yuan, the lower limit was 1.18 billion yuan.

From the perspective of changes in performance, the net profit of 34 listed companies increased from the same period compared with the same period of 2021. Among them, the performance growth of 9 companies such as Zhenhua Technology, Great Wall Military Industry, and CNPC defense exceeded 100%.

AVIC Securities analysts believe that the current situation facing the military industry at this stage is that demand is unprecedented, and the current supply is in short supply. The industry has entered a new round of production expansion cycle. After decades of investment, the military industry has basically possessed the technical foundation and material conditions of "internal circulation". In the next 10 to 15 years, it will be the harvest period and blowout period of weapons and equipment construction.

Northeast Securities Analysts pointed out that with the current equipment volume and the increase in military exercise intensity, the consumption of military products has further accelerated, which is reflected in the continuous expansion of the industry's demand growth in the military industry. Essence

[In the last 3 years, the excess returns were 26.66%, and ETF (512810) of the National Defense Forces Workers was significantly significant]

At present, there are 6 military ETFs on the market. From the perspective of actual income, the return of defense military workers (512810) is significantly prominent. From 2019.6.30 to 2022.6.30 %Of the increase, the cumulative excess return of 26.66%, an average annual excess return of 8.89%, significantly leading similar ETFs!

In terms of annual perspective, the National Defense Forces (512810) obtained significant excess returns each year. From 2019 to 2021, the annual excess revenue is 3.58%, 9.11%, and 11.07%; as of 2022.6.30, the National Defense Forces ETF (512810) last year , 3 years and 5 years of excess returns were 3.04%, 26.66%, and 23.74%, respectively.

Data source: Huabao Fund, as of 2022.6.30

The premier and excess returns, which are mainly due to the moderate scale of the ETF (512810) of the National Defense Forces, and the new shares are more obvious. According to the Deloitte China report, in 2021, 524 new shares in the A -share market were listed, and the total amount of actual raised funds reached 546.6 billion yuan, and the number and amount reached a new high in recent years. This is the first IPO financing in A -share history exceeding 500 billion yuan. Deloitte China estimates that there are 170 to 200 new shares issued in Shanghai Science and Technology Board in 2022; 210 to 240 new shares are issued on the GEM, and Shanghai and Shenzhen motherboards are expected to be issued 120 to 150 new shares.

Since the beginning of the GEM registration system and the beginning of the science and technology board, the pace of issuance of new shares has accelerated significantly. With the establishment of the Beijing Stock Exchange, the new shares have been steadily advanced to further promote the advent of the era of straight integration. The issuance of new shares will still maintain a high level, and public funds that benefit the policy advantage will continue to benefit from the distribution of new shares!

The above, based on the investment of the national defense military sector, the best repayment of the best species, pay attention to the ETF of the National Defense Forces, Code 512810.

Risk reminder: The target index tracked by the ETF of the National Defense Army is the Sino -Stock Exchange Military Industry Index (399967). The historical performance of the index is based on the current constituent structure simulation recovery. Its index component stocks may change, and their historical performance does not indicate the future performance of the index. Any information that appears in this article (including but not limited to individual stocks, comments, predictions, charts, indicators, theories, any form of expression, etc.) is only used as a reference. Investors must be responsible for any self -determined investment behavior. In addition, any viewpoint, analysis and prediction in this article do not constitute any form of investment suggestions for readers, and the company does not bear any responsibility for direct or indirect losses caused by the content of this article. Fund investment is risky. Fund's past performance does not represent its future performance, and investment needs to be cautious.

- END -

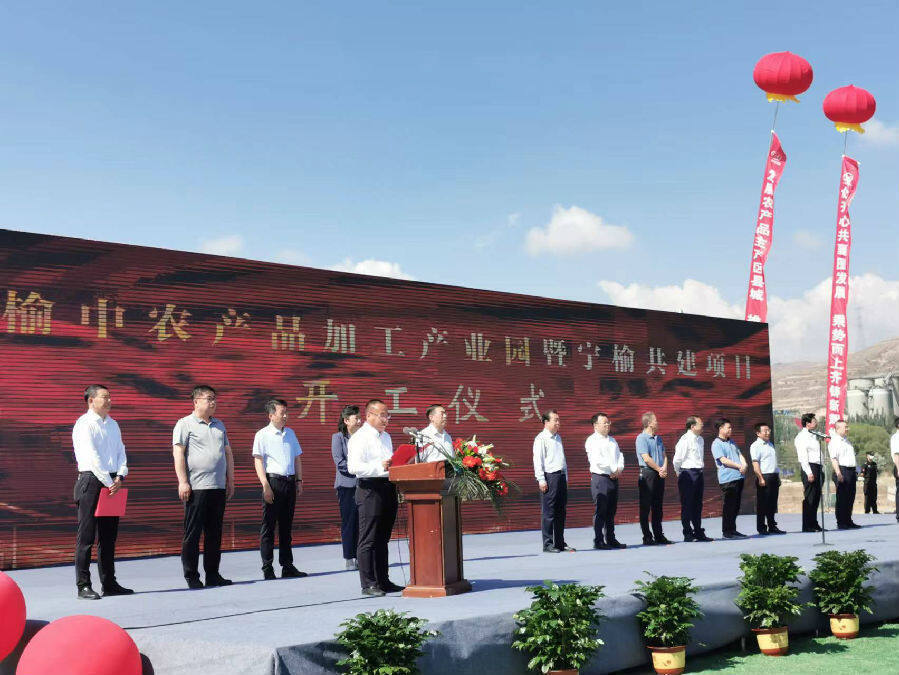

Gansu Yuzhong Agricultural Products Processing Industrial Park officially opened a total investment of 1.5 billion yuan

150 companies in Zibo declared high -tech enterprises for the first time

Walk to new! The number of high -tech enterprises in our city is a year -on -year high.Yesterday, the Municipal Science and Technology Bureau came from Jia News: Our city successfully completed the ap