"Fengkou Research Report · Company" VR/AR+Lidar precision parts+smart car HUD has become a new growth point for this optical leader. The performance of the interim reporter exceeds analysts expectations.

Author:Federation Time:2022.08.18

① VR/AR+Lidar Precision Parts+Smart Motors HUD has become a new growth point for this optical leader. The interim performance exceeded analysts expectations, and both gross profit margin and net interest rate have increased by nearly 5 percentage points; In the fields of industrial control, network communication, consumer electronics, the company's shipments ranked first among local companies. In the short term, it will benefit from the high growth brought by the increase in domestic customer penetration.

"Fengkou Research Report" Today Introduction

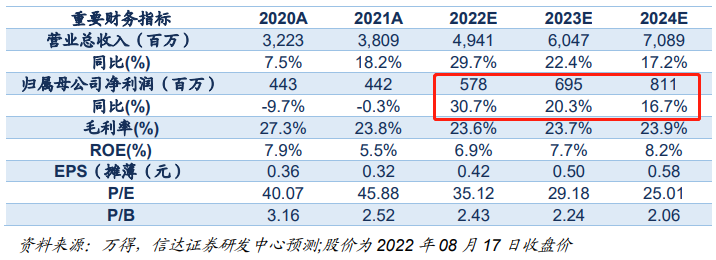

1. Company 1: ① The company's recent semi -annual reports have performed beautiful eyes. In the first half of 2022, revenue achieved revenue of 1.884 billion yuan, an increase of 9.54%year -on -year, and the net profit attributable to the mother was 245 million yuan, a year -on -year increase of 40.22%; ② the company insisted on deep cultivation " Optical+"business, smart cars and AR/VR have become the second growth curve, and lidar, HUD, and controllers increase; ③ Cinda Securities Jiang Ying expects the company to return to the mother's net profit from 2022-2024 to 5.78/6.95/8.11, respectively 100 million yuan, a year -on -year 30.7%/20.3%/16.7%, maintaining a "buy" rating; ④ risk reminder: downstream demand is not as good as expected.

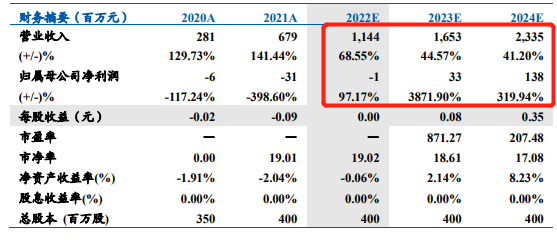

2. Company 2: ① The semiconductor industry transferred to China, the design value of the design and manufacturing industry has grown rapidly, and the international political and economic situation is becoming increasingly complicated. The supporting EDA tools even occupy a more important position during the development of FPGA chips. Northeast Securities Li Yan believes that with the increasing demand for localization of users in the Chinese market, the company is expected to continue to benefit; , Its market growth mainly lies in the wide range of applications, especially in unconventional areas with fast technical iterations. The company has established a stable cooperative relationship with suppliers such as SMIC, TSMC, and Huatian Technology. The penetration rate of the end continues to increase the high growth; ④ Li Yan is optimistic about the company's core highlight of the launch of the new product. It is expected to expand more customers. It is expected that the income of 2022-24 is 11.4/16.5/2.33 billion yuan, and PS estimates are used. The value is 25 times PS in 2023, about 0.56 PSG, corresponding to the market value of 41.333 billion yuan, and the corresponding stock price is 103.31 yuan (the current stock price is 74.41 yuan); ⑤ risk factors: new product research and development progress, production capacity growth, and communication industry prosperity.

Theme one

VR/AR+Lidar Precision Parts+Smart Motors HUD has become a new growth point for this optical leader. The interim performance exceeds analysts expectations.

At present, companies with high -end manufacturing+performance are highly paid attention to in the market and strong trend.

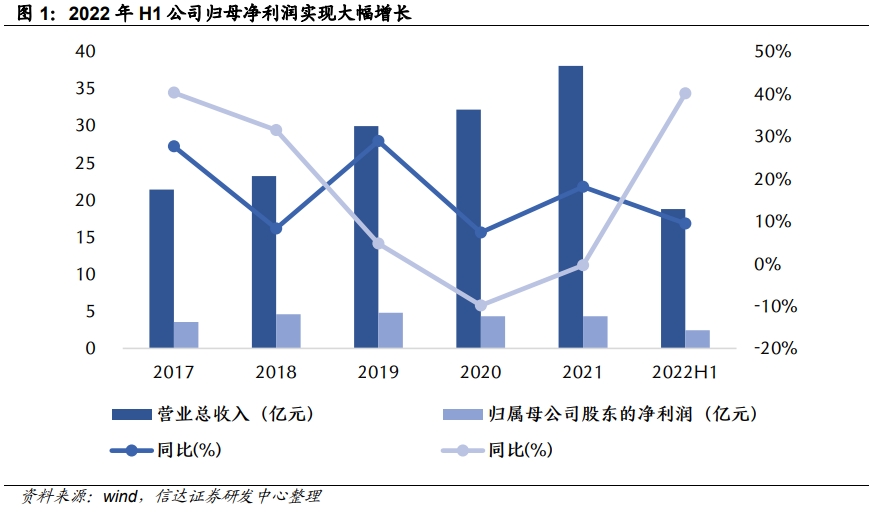

Yesterday evening, Crystal Optoelectronics (002273) released the performance of the 2022 semi -annual report. In the first half of 2022, revenue was 1.884 billion yuan, an increase of 9.54%year -on -year; the net profit attributable to mothers was 245 million yuan, an increase of 40.22%year -on -year.

In addition, the company adheres to the "optical+" business, and strengthens the implementation of the implementation of smart cars and AR/VR as the second strategic core business industry. The automotive electronics business has formed a volume, including laser radar protective cover products, AR-HUD, smart pixels Big lights, car holographic projection, etc.

Cinda Securities Jiang Ying believes that the company's semi-annual performance is slightly exceeded. Smart cars and AR/VR start the second round of growth curve. It is expected that the company's net profit from the mother from 2022-2024 will be 5.78/6.95/811 million yuan, respectively, a year-on-year 30.7% /20.3%/16.7%, maintain the "buy" rating.

The performance is slightly exceeded, and the business development opportunities of "optical+" business are tightly grasped

In the first half of 2022, the company insisted on deeply cultivating the "optical+" business, consolidating the foundation of the consumer terminal industry with mobile phones as the core, and strengthened the implementation of smart cars and AR/VR as the second strategic core business industry layout. Substantial growth.

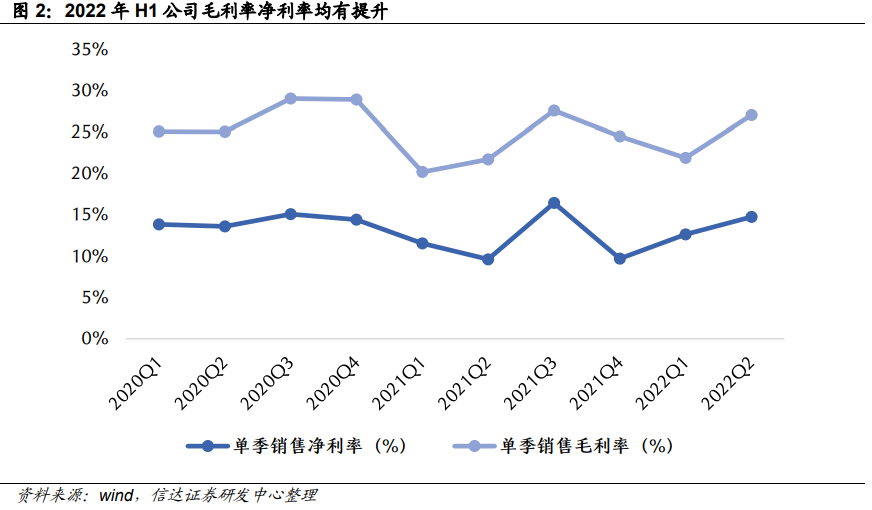

From the perspective of profitability, the company's gross profit margin and net interest rate in the second quarter increased year -on -year.

In terms of single quarter, the company's gross profit margin in Q2 in Q2 of 2022 was 27.03%, a year -on -year increase of 5.3PCT, an increase of 5.1PCT from the previous month, and a net interest rate of 14.75%, an increase of 5.1PCT year -on -year.

Auto electronic business: Lidar radar, HUD, controller increased volume, outline the company's second growth curve

The company actively seizes the development opportunities of the automotive electronics industry, combined with its own optical technology advantages, and deeply cultivates the layout of automotive head display, smart projection, lidar and other products, as well as other car key optical components: smart cockpit and intelligent driving.

Lidar protection cover products: R & D or mass production docking with major customers in the industry, with the technology and market foundation of continuous mass production;

AR-HUD products: Last year, mass production was achieved on the Red Flag model. This year, the AR-HUD standard has been achieved on the new models of Changan Deep Lan. In the first half of the year, due to the influence of the epidemic and the industry's lack of cores, some mass production projects are postponed, and the product is expected to be able to measure rapidly in the second half of the year;

Smart pixel headlights, car holographic projection: project development is smooth. In the first half of the year, due to the influence of the epidemic and the industry's lack of cores, some production projects were postponed, and the second half of the year is expected to gradually increase. Consumer electronics business: active expansion, stable and progressive

Based on the application of the smartphone side, accelerate the layout of the consumer electronics non -mobile phone field, and enrich the product structure.

Mature business such as traditional optical filter: through measures such as process optimization, management improvement, and cost decline, to create high -quality and low -cost competitive advantages, the market share has risen against the trend.

Absorbing reflective composite filter, miniature optical prism module, lens and other extensible new businesses: The company increases product development and marketing, enhances the proportion of mass production and application of new products, and maintains technology and market leading position.

Semiconductor optical business: The company deeply deployed 3D components and sensing component products in the semiconductor optical business, and continued to promote the development and process of optical wafer, narrow belt filters, DOE, and Diffuser in the semiconductor optical technology and process. In marketing, some 3D core components have entered the supply chain of large customers.

Film optical panel business: The company strengthens its stickiness with large North American customers, realizes the increase in the share of large clients and the product category expansion, and continues to expand the scale of the small and medium -sized camera cover of the plane, forming the main sales and profit support.

Recent high -end manufacturing series in this column:

On August 17th, "Pancake" optical realization of VR new technology replacement, now it has become a new product for "byte+Sony+Skyworth" in the second half of the year. This company is the core supplier of Pancake optical membranes. "Emerging materials for photovoltaic+electric vehicle charging+energy -saving appliances, this company expands 60,000 tons of swords in one breath to the number one in the country, the current valuation is still relatively low" August 15th The slope thick snow track, the beneficiary integrated die -casting+thermal management+integrated circuit and other downstream demand erupted, the brokerage firms covered this high -end new material company "on August 15" King Kong is one of the most promising semiconductor materials, the company Semiconductor -specific diamond products have achieved batch supply. Analysts are optimistic about the release of 3.75 times production capacity to promote significantly improved performance "

Theme two

The "universal" chip can be widely used in industrial control, network communication, consumer electronics and other fields. The company's shipments ranked first among local companies. In the short term, it will benefit from the high growth brought by the increase in domestic customers.

The semiconductor industry transferred to China, and the output value of design and manufacturing industries has grown rapidly, driving the demand for the domestic EDA market. In addition, the international political and economic situation is becoming increasingly complicated, supply chain security has been valued, and policies encourage domestic EDA enterprises to develop.

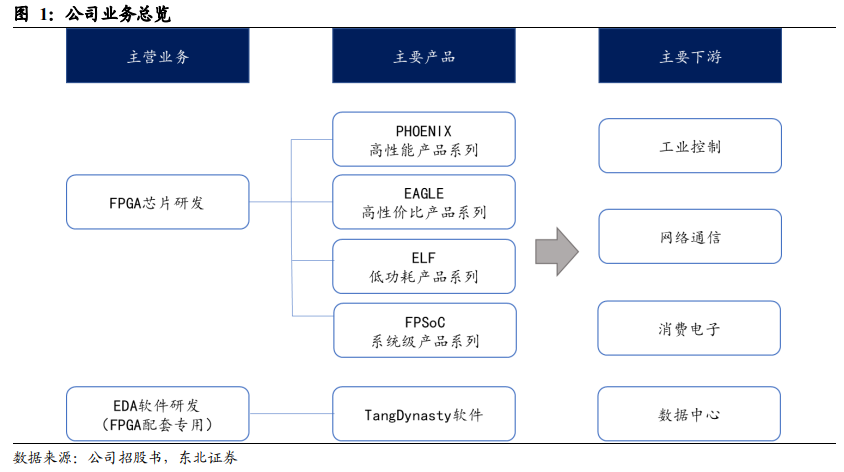

Today, Northeast Securities Li Yan covered Anlu Technology (688107) in depth. The company focused on FPGA chips and supported users. EDA tools even occupy a more important position during the development of FPGA chips. As the localization demands of users in the Chinese market are increasing, it is increasingly enhanced. The company's leading FPGA company is expected to continue to benefit.

Demand side: The biggest feature of FPGA is on -site programming, that is, flexibility. Its market growth is mainly in the wide range of application fields, especially unconventional areas with fast technical iterations, such as industrial control, network communication, consumer electronics, data centers, and data centers. Wait.

Supply side: The company is relatively leading in local manufacturers. It has established a stable cooperative relationship with suppliers such as SMIC, TSMC, and Huatian Technology. In the short term, it is expected to benefit from the high growth of the penetration rate of domestic clients.

Li Yan is optimistic about the company's core highlight is the speed of launch of new products. It is expected to expand more customers. It is expected that the income of 2022-124 years is 11.4/16.5/2.33 billion yuan. Corresponding to the market value of 41.333 billion yuan, the corresponding stock price is 103.31 yuan (the current stock price is 74.41 yuan).

Demand side: FPGA universal chip opens the road of steady growth in multiple scenes

The biggest feature of FPGA is that on -site programming, that is, flexibility, but when a large -scale application of a single scenario is not as economical as special chips.

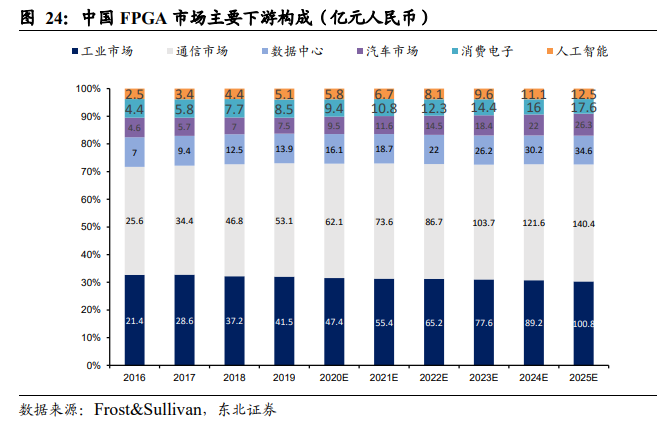

Li Yan believes that its market growth is mainly due to the wide range of applications, especially in unconventional areas with fast technical iterations. Industry and communications are the main downstream of the FPGA market.

FROST & Sullivan expects the global FPGA market to be US $ 12.58 billion in 2025, compound growth rate of 16.4%in 2021-25, and 33.22 billion yuan in the Chinese FPGA market, a compound growth rate of 17.1%.

Supply side: The top two lead the global market, Anlu Technology is relatively leading in local manufacturers

The Global FPGA market is mainly by Sali and Intel. In 2019, the market sales of 52%and 34%, respectively.

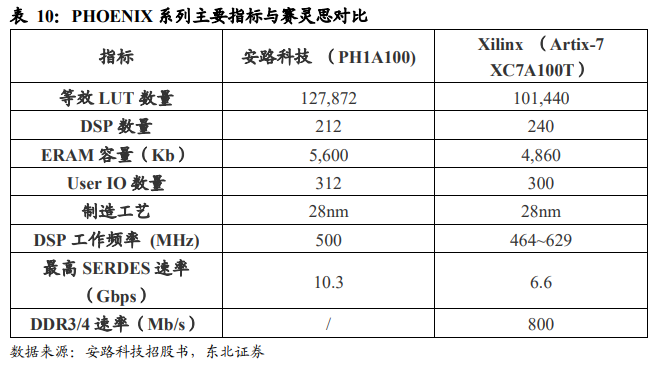

The company is a leading position among domestic manufacturers. In 2019, the sales and sales of local companies in the domestic market are ranked first. Currently, it has Phoenix high -performance product series, EAGLE high -cost product series, ELF low -power product series, FPSOC system Level product series.

Some products surpassed similar foreign products on several indicators. It is one of the few suppliers certified by many international leading communications equipment vendors in China. The number of 400K resource products has achieved a certain market competitive advantage.

In the short term, the company has established a stable cooperative relationship with suppliers such as SMIC, TSMC, and Huatian Technology. The high growth rate mainly comes from the penetration rate of the client to continuously increase, while expanding more customers. In the long run, the output value of the logical circuit of FGPA has continued to increase, and the localization demands of users in the Chinese market are increasing. The company is expected to benefit as a local FPGA company.

Recent semiconductor series in this column:

On August 18th, "How will this round of semiconductor industry chain rotate? 5G+new energy vehicles such as new energy vehicles take turns drivers. Analysts predict that the inflection point of the industry is coming and selected "Driver Underestima" & "Small and Beauty" Company "on August 10" Chiclet leads the advanced packaging prosperity upward, 2025 may have in 2025 may be available. 43 million wafers use advanced packaging to give birth to a large number of equipment demand, which can achieve 0.1 micron control accuracy accelerated replacement process "August 8" Ali joins the ChiPlet interconnect standard formulation alliance. The ChiPlet solution is an important alternative solution for advanced processes. , Analysts are optimistic about the right to speak and the autonomy of the Chinese side is expected to be strengthened. "On August 7," Semiconductor's localization will look at him in the next step, and the company takes 1.4 billion yuan to smash the third -generation semiconductor+module+power IC to fully lay out a new layout of new layout. Energy vehicles, photovoltaic and other fields are expected to achieve rapid increase in share. "On August 7," Semiconductor Comprehensive Counterattack, this semiconductor "domestic" simulation+manufacturing+digital EDA triple -growth new space opened, and the analyst also gave four four. "Different cognition from the market" On August 5th, "One article understands the" brick tile "of this chip building building, semiconductor IP can shorten the time of the chip listing and reduce the development cost. Important engine of Chinese semiconductors to achieve curve overtaking ""

- END -

Xinxiang opened the largest intelligent blood product production base in China!See what are the "three batches" project in the fifth issue

Henan Daily client reporter Zhao Tongzeng intern HangzhouOn the morning of July 5t...

The deciphering innovation password stimulates the surging motivation

Binzhou accelerates the cooperation of industry -university -research and research...