Langzi's net profit in the first half of the year fell 90 %: difficulty in selling clothes, difficulty in doing medical treatment, and unclear transformation prospects

Author:Blue Whale Finance Time:2022.08.18

From the night market stalls to listed companies, from clothing dealers to brand founders, Langzi founder Shen Dongri completed his gorgeous turn with his clothing career on the North Drifting Road.

However, after a short -lived highlight, affected by the impact of e -commerce, the domestic traditional shoe and clothing industry has fallen into a downturn. Langzi in it has also experienced two consecutive years of performance. Obviously, in this context, clothing can no longer satisfy Shen Dongri and its company's development ambitions. Therefore, in addition to fashion women's clothing, the company extends the business sector to infant and child and medical beauty sector, and proposes the "pan -fashion industry interconnection ecosystem". The transformation strategy.

Since then, the two newly expanded business has also given the company good feedback, and the proportion of revenue has been growing. Especially the medical beauty sector has later become up. The development has even been flat with the fashion women's clothing business. At the same time, it has benefited from medicine. The concept of US is hot, and the company's stock price once climbed to a historical high.

However, the good times did not last long. With the disclosure of the high -level clearance reduction and executive departure of the major shareholders in June 2021, the company's stock price had a cliff -type daily limit, and it continued to decline in fluctuations. As of now, the stock price has fallen by nearly 60 % compared with the highest point, and the total market value has evaporated by more than 10 billion.

Recently, the disclosure of the company's semi -annual report in 2022 has caused many investors to reduce their confidence in its freezing point: the net profit has dropped by 90 %, and the medical beauty is strenuous ... what happened to this domestic high -end women's clothing Intersection

The clothing business has driven online, but it is not yourself who make money?

On the evening of August 15, Langzi Co., Ltd. (hereinafter referred to as "Langzi") disclosed the semi -annual performance report in 2022.

Data show that the company achieved operating income of 1.809 billion yuan in the first half of the year, an increase of 1.1%year -on -year; net profit of home mother was 9.25 million yuan, a year -on -year decrease of 90.09%. Regarding the reason for this net profit, Langzi said that it was a greater adverse effect on the epidemic.

In addition, during the reporting period, the company's operating costs decreased by 1.75%year -on -year. However, both sales and management costs increased double -digit growth. Among them, advertising costs increased by 131%year -on -year to 192 million yuan.

It is understood that since proposing the "pan -fashion industry interconnection ecosystem" transformation strategy, the company has formed a fashion business square with three major businesses: fashion women's clothing, green infants, and medical beauty. At present, the operating channels of the three major businesses are still mainly offline. Affected by the epidemic, the first two of them have experienced different degrees of performance in the first half of the year.

As far as the fashion women's clothing business with the first revenue is concerned, as of the end of the reporting period, a total of 603 offline sales terminals and 30 online channels (self -operated models) are possessed. It maintained an increase of nearly 20%year -on -year, reaching 196 million yuan, and the proportion of women's clothing revenue also increased.

However, behind the online growth, the price paid by the company is not small: In the first half of the year, in the online channels involved in the company's business, the Tmall platform contributed the most transaction amount, but at the same time, the fees they charged were even more expensive. High, the proportion has exceeded 30%of the transaction volume. In contrast, the two platforms of Douyin and Vipshop are slightly lower, but they lost to the company's products with a higher return rate of more than 60%of the three major platforms.

"The costume business is difficult to do," said the industry. Data show that in the first half of the year, the business profit of the company's fashion women's clothing business was -10.9057 million yuan, which was the lowest in the above three major business segments.

In addition, in terms of infant and child business, its main business model is basically the same as the company's women's clothing business. The overall revenue has not changed much. The gross profit margin is 60.78%, second only to 62.74%of the women's clothing business. From the perspective of products, infant supplies in the first half of the year achieved a growth of about 24%. However, infant clothing is the same as fashion women's clothing, and it is difficult to escape the fate of revenue.

From "clothing" to "medicine", it is difficult to pull the performance decline

Overall, in the first half of the year, the company's main fashion women's clothing and green infant business have experienced different degrees of performance. During this period, medical beauty has become the only highlights of the three major businesses to maintain positive growth.

According to Xinhua News Agency, Langzi's exploration of the field of medical beauty began in 2015. At that time, the company participated in the South Korean medical beauty service group DMG, and acquired the two major brands of Milan Baiyu and Jing skin in the following year. American industry. Since then, the medical beauty business is prosperous in the company's development.

Data show that in the first half of 2022, the medical beauty business sector realized operating income of 629 million yuan, an increase of 18.45%over the same period last year. This data increased in the company's overall revenue 41.27%of business fashion women's clothing. Because of this, there are many voices on the market, and some of them speculate, maybe Langzi shares may abandon "clothing" from "medical" in the future?

In response, the Blue Whale Finance reporter once interviewed the post company, but as of press time, no reply was received. However, from the perspective of the industry, abandoning "clothing" from "medical" is not a good strategy. Putting eggs in a basket will be greater.

First of all, in terms of profitability, the company's medical beauty business has limited advantages. It is understood that the three major medical and beauty brands under Langzi Co., Ltd. are mainly offline institutions and are in the middle reaches of the medical and beauty industry chain.

"Due to the high technical barriers to enter and different cost structures, the upstream suppliers often have a higher net profit margin than middle and lower reaches." In the previous interviews of Blue Whale Finance reporters, CIC Burning Consulting Partner Wang Wenhua pointed out that the medical U.S. upstream manufacturers have core technologies, and qualification certifications such as Class III medical device certificates have built a solid moat for upstream manufacturers. Therefore, their gross profit margin is generally around 90 %, with a net interest rate of 30 % to 60 %. At the same time, the gross profit margin of the midstream medical and aesthetic institutions is 5 to 60 %, because the cost of customer acquisition is too high, and the net interest rate is between 10 %. It is true that in the semi -annual report, although Langzi ’s medical beauty business has increased, the gross profit margin has declined year by year. In the first half of this year, it was only 48.76%, which was at the lowest level among the three businesses.

"Overall, the net interest rate indirectly reflects that upstream manufacturers are wider than the moat of the middle and downstream manufacturers, and their own research and development strength is the premise of solid product barriers. The barriers to their own research and development capabilities will continue to meet the diversified needs of consumers and enhance their competitiveness. "Wang Wenhua said.

In addition, in terms of product distribution, there is still a certain "partial" phenomenon in the company's medical beauty business. It is understood that Langzi Medical Meimei currently operates three major brands: "Milan Bai Yu", "Crystal Skin Medical Beauty" and "Gao Life", with a total of 29 medical cosmetic institutions.

Photo source: Langzi Co., Ltd. Semi -annual report

Among them, Milan Baiyu, which has only 4 institutions, accounts for nearly 65%of the company's medical beauty revenue, and a medical institution under Milan Baiyu has accounted for over 40%. At the same time, the company's top five medical institutions have the proportion of the main business of medical beauty, which is close to 80%. People in the industry said that under such distribution, the overall development prospects of the company's medical beauty institutions are not clear.

It is worth noting that in recent years, the chaos in the middle and lower reaches of the medical and beauty industry has also attached more attention to this issue. In the environment of medical beauty supervision, Milan Baiyu, a subsidiary of Langzi Co., Ltd., appeared in the false grass list of Xiaohongshu due to "false publicity of marketing advertising" earlier this year. The book platform was banned; in addition, the two brands of "Crystal Skin Medical Beauty" and "High Life" have also been punished for violations.

However, as a whole, the company's current development bottleneck and performance pressure are affected by the accelerated expansion of the epidemic and medical beauty business to a certain extent. The first Securities believes that with the gradual maturity of the new institutions, the profitability of Langzi shares is expected to gradually improve, and the clothing business has made multiple measures to maintain steady growth.

- END -

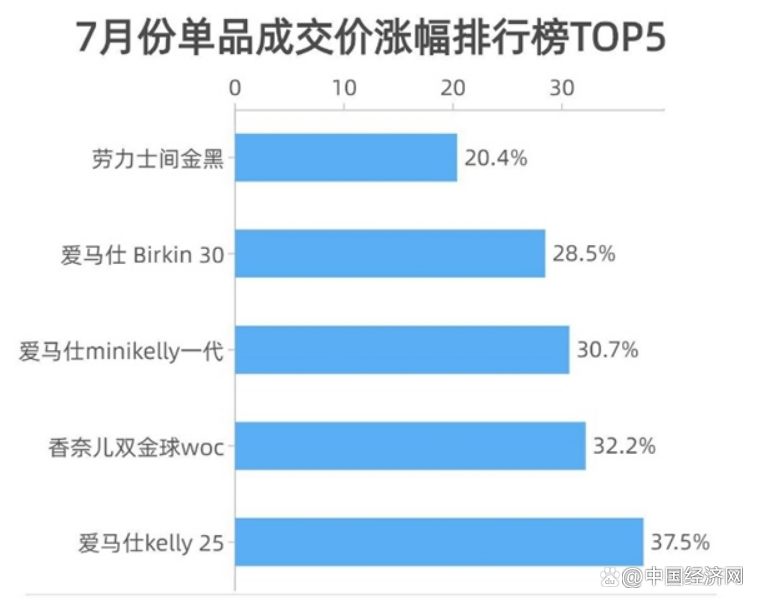

You luxurious Yipai July Report: Industry transaction trends have recovered, and "identification" will eventually become standard in the industry

Recently, the representatives of the two luxury head e -commerce platforms such as...

[Jingwei Afternoon Tea] The US Treasury Secretary said

【Hot spots and news】US Treasury Secretary said that tariffs on China lost strategic purposesU.S. Treasury Minister Yellen said that some tariffs on the Trump administration continued from the Trum