Semiconductor and photovoltaic leadership, science and technology innovation "track stocks" rotate the policy benefit sector

Author:Public Securities News Time:2022.08.18

On Thursday, the Shanghai and Shenzhen A -shares shrunk, and the semiconductor, components, and electrical equipment led the rise, and hotel catering, electricity, winemaking, and tourism sector fell the top. On the 18th, the Shanghai Composite Index fell 14.99 points, a decrease of 0.46%; the Shenzhen Stock Exchange Index fell 78.14 points, a decline of 0.62%; the GEM index fell 2.09 points, a decline of 0.08%; 1.26%. On the 18th, the two cities sold a total of 1054.1 billion yuan, shrinking from Wednesday. Regarding the short -term market, industry insiders believe that the recent market hotspots still focus on popular track stocks. The trend of the traditional industry sector is weak, and investors should pay attention to the rotation rhythm of the sector.

Science and Technology 50 Index Floating

Dragged by the weakening of the weights such as electricity, brewing, agriculture, insurance, and coal. point. The GEM refers to the lower yang on the 18th, down 0.08%. The science and technology 50 index rose 1.26%against the market to close at 1146.63 points. After four consecutive days of adjustment, the Science and Technology 50 Index has been raised on the 18th.

The reporter noticed that the science and technology board was strong on the 18th due to the rise in the semiconductor sector. The fellow flowers show that semiconductor and components are at the forefront, with an increase of 1.47%and 1.65%, respectively; the average increase of individual stock stocks exceeds 3%. The rising stocks of science and technology board stocks on the 18th include Huicheng shares, vast depth, Tianyue Advanced, Mingzhi Technology, Chuangyao Technology, Huarong Biology, Pai Neng Technology, Yongzuka Technology, Yuneng Technology; except for new stocks, Tianyue's advanced and Mingzhi technology daily limit, they are all semiconductor stocks.

At the same time as semiconductors and photovoltaics are strong, the trend of the traditional industry sector is weak, and hotel catering, electricity, winemaking, coal, and real estate are at the forefront. The brewing sector fell 1.54%on the 18th. Among the stocks, only 4 stocks rose, which were Yanjing Beer, Huiquan Beer, Lanzhou Yellow River, and Qingdao Beer. , Drime wine fell 3.11%, Guizhou Moutai fell 1.17%.

GEM refers to Si Lianyang

Since the beginning of this week, the GEM fingers have closed the sun for four consecutive days, and the weekly increase has exceeded 3%. The GEM refers to the recent strength of the Ningde era. The fellow flowers showed that the Ningde era has increased by more than 8%this week. On Thursday, it closed at 544.80 yuan/share. Although the GEM fingers fell slightly on the 18th, five stocks rose daily limit, namely Qi Zhi Technology, Tianyi Medical, Minde Electronics, Taixiang Co., Ltd., and Scenery. In addition, ST Tianlong rose 19.92%, and Guangpu rose 17.79%.

On the 18th, in addition to semiconductor performance, the photovoltaic sector was also a hot spot. On the news, the US House of Representatives passed the "Inflation Act" (IRA), which involved climate, medical insurance, tax reform, etc. The plan will provide support for $ 369 billion in energy security and climate change plans in the next ten years. Especially in the field of photovoltaic, the bill mainly provides a series of tax credits and subsidy measures for demand and supply. For the specific production links, photovoltaic components, inverters, and energy storage batteries have all submitted subsidies, and subsidies are unprecedented than before.

Donghai Securities believes that the bill has brought more opportunities to the Chinese photovoltaic industry chain in the short term. Considering that the production capacity of US components is difficult to expand in the short term, domestic manufacturers, especially component factories with production capacity in Southeast Asia, may be expected to boost shipments. In the middle and long term, if the US components are landing, domestic silicon wafers and battery exports are expected to boost. At the same time, domestic auxiliary materials such as glue film and equipment exports deserve further attention.

Pay attention to the rotation rhythm of the sector

Regarding the short -term market, industry insiders believe that the recent market hotspots still focus on popular track stocks, and investors should pay attention to the rotation rhythm of the sector.

Galaxy Securities believes that the market is currently in the weak rebound range, and it is recommended to configure new energy and military industries such as policy support and high prosperity. In addition, the Fed's liquidity tighten the heating and heating expectations of the rise and overlay of the policy surface economy, electronics, media, computers and other sectors may have certain opportunities.

Guosheng Securities said that the current index breaks through the suppression of the short -term moving average system, and the market transaction is relatively active. Under the premise of coordination of the transaction volume, the index is expected to further go up. In terms of operation, short -term should be paid to high and low capital switching. The current high -prosperity of photovoltaic, wind power, energy storage and other sectors can continue to pay attention to the continuous blessing of favorable blessings. In addition, as Apple's new products are approaching, short -term opportunities can be paid to short -term opportunities for the Apple industry chain and consumer electronics sector.

Reporter Tang Xiaofei

- END -

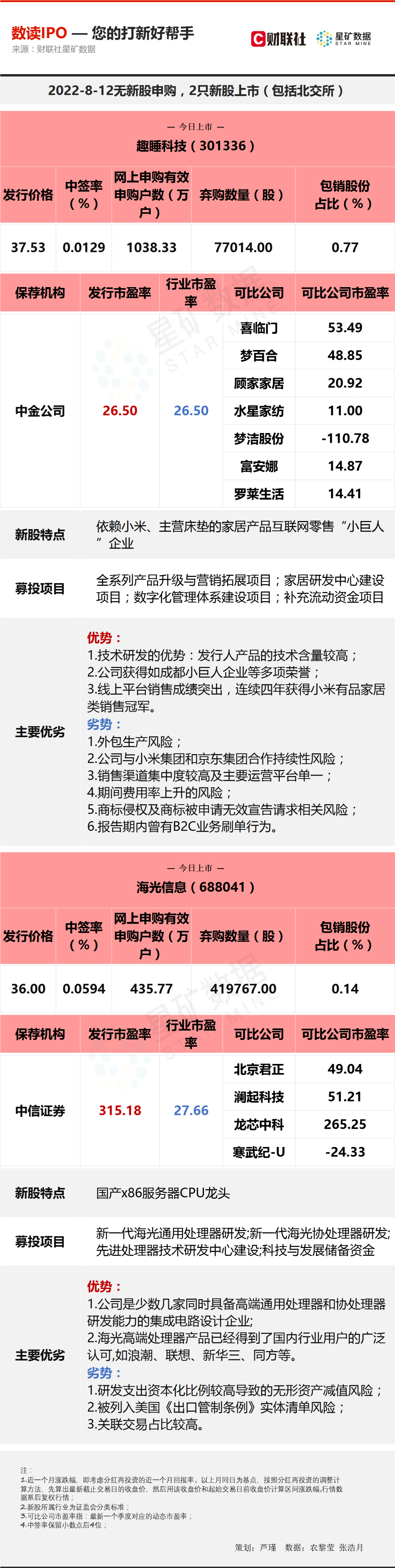

Issuing price -earnings ratio is higher than the industry 10 times the domestic CPU leader is listed today

There are no new shares to purchase today; the two new shares are listed, which ar...

Jiuquan's high -quality agricultural development trend is good in the first half of the year.

Recently, the reporter learned from the Jiuquan Agricultural and Rural Bureau that in the first half of the year, the city insisted on problem -oriented, target -oriented, and results orientation. The