"Daily Rating" high -level stocks collectively ebb, and over 100 shares fell more than 7%.

Author:Federation Time:2022.08.19

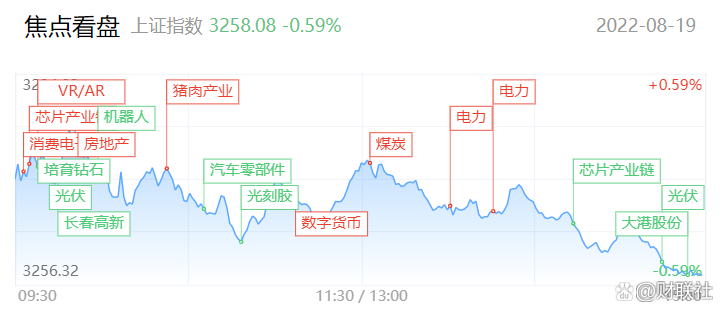

The broader market fluctuated and lowered, and the GEM finger led. On the plate, the power and coal stocks have strengthened in the afternoon, and many times such as Huaneng International have daily limit. The breeding sector was strong throughout the day, and Tianma Technology had a daily limit. Wen's shares, Tangshen, and Dongrui stocks rose more than 5%. Low -the -the -ms sections such as mobile games, education, and media have performed. In terms of decline, the recent continuous and powerful track stocks have been adjusted collectively. In addition, many high -level stocks have dived, and the limit of individual stocks such as Dagang shares has fallen. Overall stocks fell more, and over 3,500 stocks in the two cities fell. The sales of Shanghai and Shenzhen today were 1120.2 billion yuan, with a volume of 66.1 billion from the previous trading day. In terms of sectors, chickens, electric power, coal, education and other sectors have risen before, and the reduction of reducers, integrated die -casting, TOPCON batteries, and cultivation of diamonds.

Plate

In terms of sectors, first pay attention to the photovoltaic sector. The entrance of the photovoltaic sector has experienced a relatively obvious differentiation. Among them, Tianghe Light can fall more than 10%. Fall more than 9%. From the perspective of the market, since the photovoltaic sector has recently increased continuously and rapidly, it has accumulated a large profit selling pressure. After a large number of callbacks today, the short -term may enter the staged finishing. When the decline in individual stocks has obviously weakened doubts, it is more secure to stand in risk to avoid one party.

On the news, today's drop in photovoltaics may be related to the official entry of Tongwei. China Resources five batches of 3GW bidding, Tongwei quoted the minimum of 1.942 yuan/W. It will take over the unique list of central enterprises; market concerns that Tongwei's entry will further deteriorate domestic component competition pattern. From the trend of individual stocks, it can be seen that Tongwei shares rose nearly 5%against the trend, while Tiantuang Energy, Jing'ao Technology and Longji's component leading manufacturers plummeted in the market, which was voted by funds to vote with their feet. The most real feedback.

However, Haitong Dianxin expressed his own view on this incident. It believes that the market is worried about the component pattern, and the stock price response is too excited. The layout of overseas component channels takes time, and the most important component brand influence is required to be accepted by overseas customers. Therefore, Tongwei has made a certain breakthrough in the domestic market. In the short term, it has not caused an impact on the overall pattern of the component. The characteristics of the dispersed downstream customers are much lower than the various manufacturing links in the upstream. The market share of the first place in the industry is about 20%, and the market share is also difficult to increase. Entering the strength of strong strength is to clean up the market share of the second- and third -tier components, and it will not have a huge impact on the top 4 component companies.

On the other hand, the investment logic of the photovoltaic industry in this round of the photovoltaic industry has always been demand> supply. At present, competition is still secondary contradiction. There are always new enterprises, new technologies, and new capacity entering each year. The important thing is the continuous growth of the industry. The industry demand in 22-23 years is 250 and 350GW, respectively. The speed angle of the speed is 22-24 years. It is a rare period in history for three consecutive years of high growth. Not only is component, the competition in each link will be better than the market. Therefore, in the middle and long term, photovoltaic is still one of the highest investment directions in the current market. However, it should be noted that at present, the short -term risk has not yet been fully released during the period of related stocks, and it is not appropriate to rush to the bottom in this context.

The power sector strengthened in the afternoon. Among them, solar, Longyuan Power, Leshan Power, Huaneng International, and Dongxu Blue Sky daily limit. The institution stated that as the long -term associations in the third quarter landed, the proportion of the company's long -term associations continued to expand. Essence In addition, the construction of scenery is accelerated, green energy is the focus of future energy construction, and green power operation companies are also expected to usher in an inflection point. From the perspective of market performance, the amount of power sector can be significantly enlarged today. After the collective evacuation of funds such as photovoltaic, robotics, integrated die casting, power has become a better place to undertake these funds. However, the current market emotions are relatively low, and the risk of rashing prices is greater. Patience and other low -absorbing considerations are more secure after the differentiated and regulating recovery.

Individual stocks

Today, high -level stocks have more obvious ebb doubts. In the early trading stage, the popularity of photovoltaic, semiconductors, and robots has suffered a sharp plunge. In the afternoon, the loss of high stocks in the afternoon not only did not repair, but intensified. Among them, Mubang Hi -Tech, Chuanyi Technology, Dagang Co., Ltd., Southern Seiko, Zhongjing Electronics, Huangshi Group and other popular high -level stocks have fallen, and Dagang shares are even more intuitively reflected in the market. In the context, it is necessary to put the risk control in the first place. When the market risk is fully released, the money loss effect is repaired, and then the entrance considerations are made.

Join market analysis

As of the close, the Shanghai Index fell 0.59%, the Shenzhen Index fell 1.27%, and the GEM index fell 1.5%. Northern Fund buying 1.713 billion yuan throughout the day; of which the Shanghai Stock Connect was 2.681 billion yuan, and the Shenzhen Stock Connect sold 968 million yuan

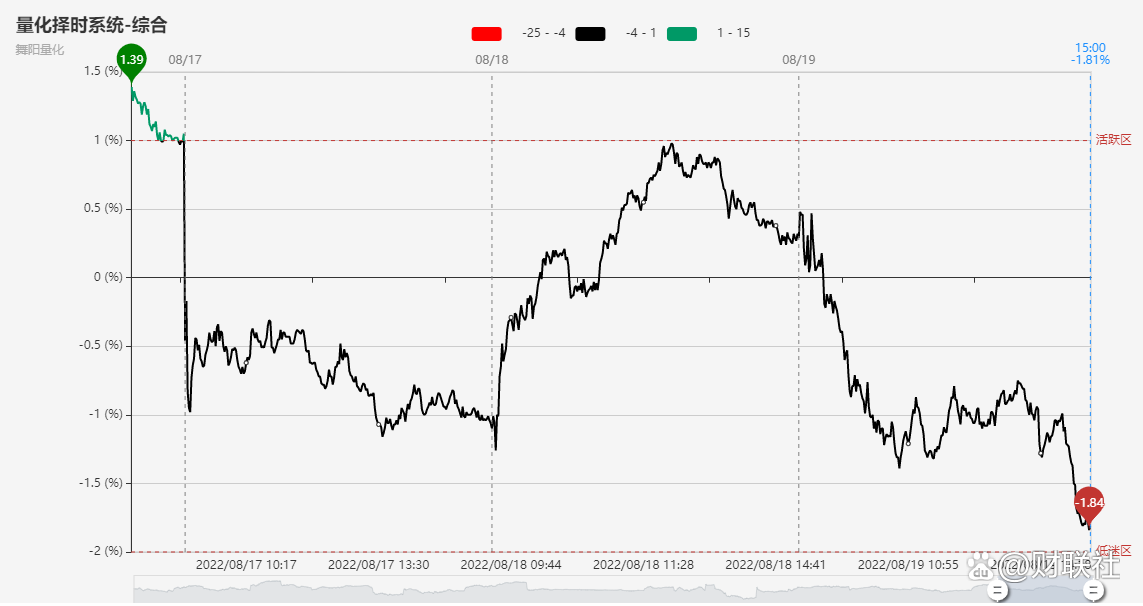

Today, the GEM shows a decline in volume and effectively falls below the 5 -day moving average. Combining with obvious doubts of short -term emotions, the probability of further sorting down next week is not low. The better thing is that the GEM rebounded the 30 -day moving average. As far as the medium -term structure is concerned, the overall display interval vibration structure, so the probability of supporting the support near 2630 near the interval is not low. Therefore, it is still mainly controlled by short -term risks. Patiently waited for the definition to the above -mentioned interval when it did not fall below the low red K when it fell below the previous day. It was expected to be relatively controllable. In terms of individual stocks, there were 1,205 households, a decrease of 770 compared with the previous trading day. In the case of excluding ST shares and new stocks, there are 48 daily limit, a decrease of 31 from the previous trading day; 16 frying boards, a decrease of 10 compared with the previous trading day; Home, a decrease of 9 more than the previous trading day; the limit of 0 daily limit is the same as the previous trading day.

In terms of emotions, with the collective decline of high -level stocks, the emotional indicators have fallen down and came to near the low -dimensional area. However, due to the short -term risk, the emotion may try the freezing point next week.

Focus on the market

1. Otvi: Holding subsidiary and Tianheguang signed a 260 million yuan procurement contract

"Science and Technology Board Daily" on the 19th, Otvi announced that the holding subsidiary of Porcelain Electrical and Electrical and Electrical and Electrical and Electrical and Electrical Corporation recently signed the "Procurement Contract" with Tianhe Guangneng (Qinghai) Crystal Silicon Co., Ltd. ) Crystal Silicon Co., Ltd. sells SC-1600 single crystal furnace with a contract amount of about 260 million yuan.

2. Industry insiders: Can consumer equipment chips be rebounded in the fourth quarter or it will only be determined by October

Financial Association August 19th, according to Digitimes, industry insiders revealed that, given the uncertainty of order visibility, IC Design Company's demand for the year -end shopping season this year is still cautious. According to sources, whether the chip demand of mobile phones, PCs and other consumer electronics equipment can be recovered in the fourth quarter, it may not be determined in October. At that time, the new iPhone will be launched, and channel vendors will make a procurement decision for the upcoming shopping season.

- END -

"Xue Si Pingzhi" Li Yang: Finding a reasonable path for financial help to help common prosperity

Li Yang: Looking for a reasonable path to help the common prosperityXue Si Pingzhi...

8 major measures to assist enterprises to issue debt financing, and will build the province's bond financing reserve resource library

As an important channel for direct financing of enterprises, bond issuance has bee...