The net profit of commercial banks in the first half

Author:WEMONEY Research Room Time:2022.08.19

On August 19, the China Banking Regulatory Commission disclosed the main data of the banking industry in the second quarter.

At the end of the second quarter of 2022, the total domestic and foreign currency assets of my country's banking financial institutions were 3.6777 trillion yuan, an increase of 9.4%year -on -year. Among them, the total domestic and foreign currency assets of large commercial banks were 15.14 trillion yuan, accounting for 41.2%, an increase of 11.2%year -on -year; the total domestic and foreign currency assets of joint -stock commercial banks were 65 trillion yuan, accounting for 17.7%, an increase of 7.8%year -on -year.

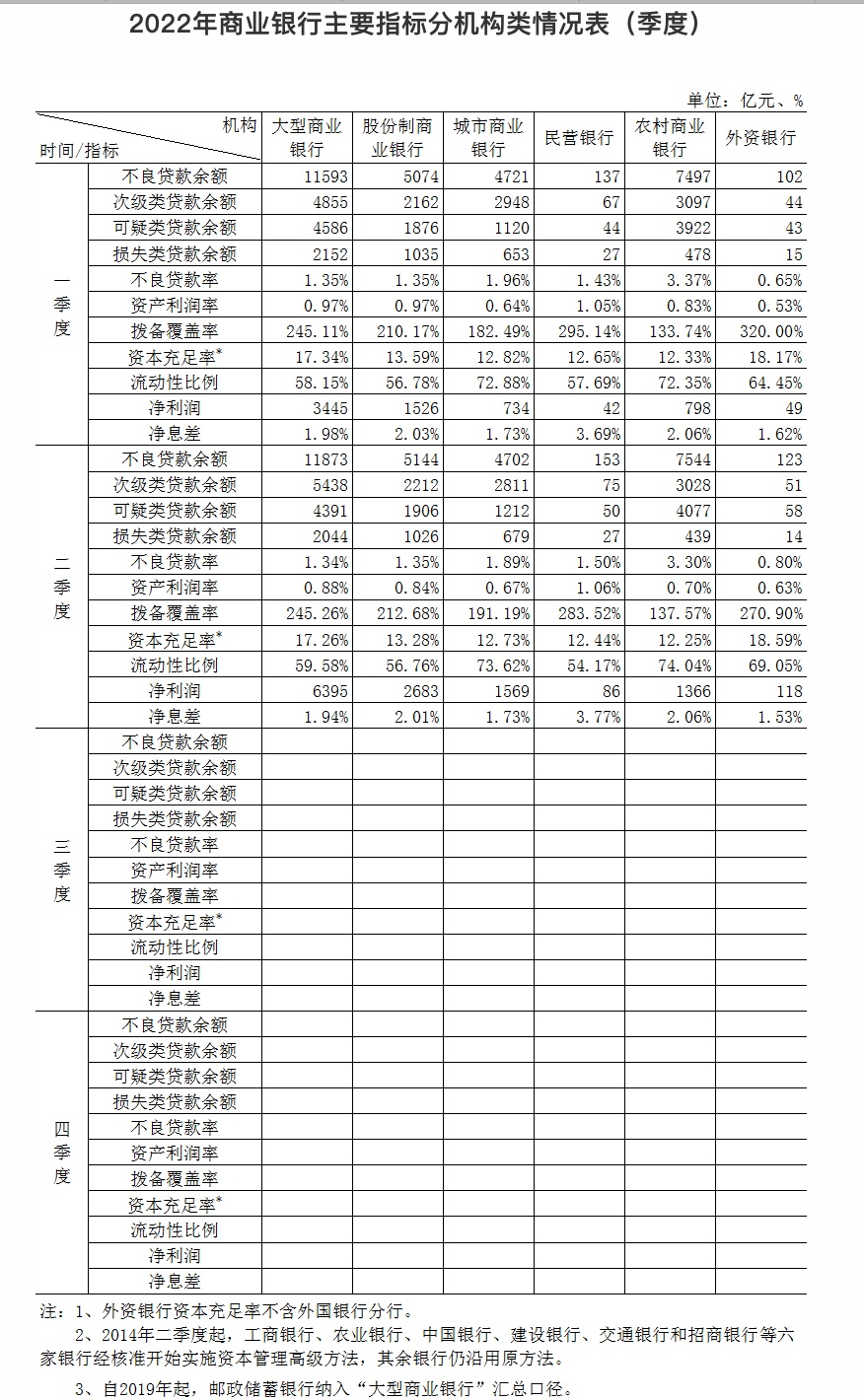

At the end of the second quarter, the balance of the normal loan of commercial banks was 17.42 trillion yuan, of which the balance of normal loans was 17.02 trillion yuan, and the balance of the loan was 4 trillion yuan. The balance of non -performing loans was 3 trillion yuan, an increase of 41.6 billion yuan from the end of the previous quarter; the non -performing loan rate was 1.67%, a decrease of 0.02 percentage points from the end of the previous quarter.

In terms of classification, the non -performing rate of large commercial banks at the end of the second quarter was 1.34%, a decrease of 0.01 percentage points from the previous quarter; the non -performing rate of joint -stock commercial banks was 1.35%, which was the same as the month -on -month. The adverse rate of commercial banks was 3.3%, a decrease of 0.07 percentage points from the previous month.

It is worth noting that in the second quarter, the adverse rate of private banks and foreign banks increased from the previous month. Among them, the non -performing rate at the end of the second quarter of private banks was 1.5%, an increase of 0.07 percentage points from the previous quarter; the adverse rate of foreign banks was 0.8%, an increase of 0.15 percentage points from the previous month.

In terms of performance, in the first half of 2022, commercial banks achieved a total of 1.2 trillion yuan in net profit, an increase of 7.1%year -on -year. The average capital profit margin was 10.1%, a decrease of 0.81 percentage points from the end of the previous quarter. The average asset profit margin was 0.82%, a decrease of 0.08 percentage points from the end of the previous quarter.

At the end of the second quarter, the balance of loan losses in commercial banks was 6 trillion yuan, an increase of 174.4 billion yuan from the end of the previous quarter; the dial -up coverage rate was 203.78%, an increase of 3.08 percentage points from the end of the previous quarter; the loan loan preparation rate was 3.4%, and the loan reserved rate was 3.4%. 0.01 percentage points from the end of the previous season. The capital adequacy ratio of commercial banks (excluding foreign banks) was 14.87%, a decrease of 0.14 percentage points from the end of the previous quarter. The first -level capital adequacy ratio was 12.08%, a decrease of 0.17 percentage points from the end of the previous quarter. The core first -level capital adequacy ratio was 10.52%, a decrease of 0.18 percentage points from the end of the previous quarter.

- END -

Antu Bio has accumulated a total of 4.4163 million shares, spent 205 million yuan

[Dahecai Cube News] On July 1, Antu Bio announced that as of June 30, 2022, the company had accumulated a total of 4.4163 million shares by concentrated bidding transactions, accounting for 0.75%of th

Data is released!The total value of Maoming imports and exports in the first half of the year was 10.16 billion yuan

The reporter learned from Maoming Customs yesterday that in the first half of this...