Dongxing Medical Patent inventor and customer actual controller's financial report change face gap in the face of 30 million

Author:Jin Ziyan Time:2022.08.19

"Golden Syllabus" northern capital center Yan Qing/Author Xi Hai/Risk Control

Information disclosure is the core of the reform of the registration system, and it is also the focus of law enforcement of the securities regulatory authorities in recent years. Among them, information disclosure illegal and violations are still the "focus" of attention. As of August 14, a total of 60 listed companies and related parties were investigated during the year, of which more than 70 % were suspected of violations of the law.

Looking at this time, Jiangsu Dongxing Smart Medical Technology Co., Ltd. (hereinafter referred to as "Dongxing Medical"), which is listed, is also suspicious. In 2019, Dongxing Medical reorganized assets and acquired the second largest shareholder to participate in the shares. Regarding the financial data of the target, multiple places disclosed data contradictions with the Market Supervision and Administration Bureau, of which up to 30 million yuan.

On the other hand, Dongxing Medical's total patent is not to comparable to peers, and its R & D investment share is lower than the same value. Secondly, the inventor of Dongxing Medical Patent has the same name as the actual controller of the customer, and the patent application field of both parties may be overlapping. In addition, Dongxing Medical's second largest shareholders control the manager of the company, as shareholders of customers, Tenxing Medical's 10 million yuan income may be blessed by "acquaintances".

1. A number of patent inventors and customers' actual controllers.

Gou is new, new and new. Innovation ability is the inherent driving force for enterprise development, and one of the core factors to improve the competitiveness of the enterprise market. However, Dongxing Medical's authorized invention patent number is at the bottom of the peers.

1.1 The total number of patents is at the bottom, and the number of invention patents may not have advantages

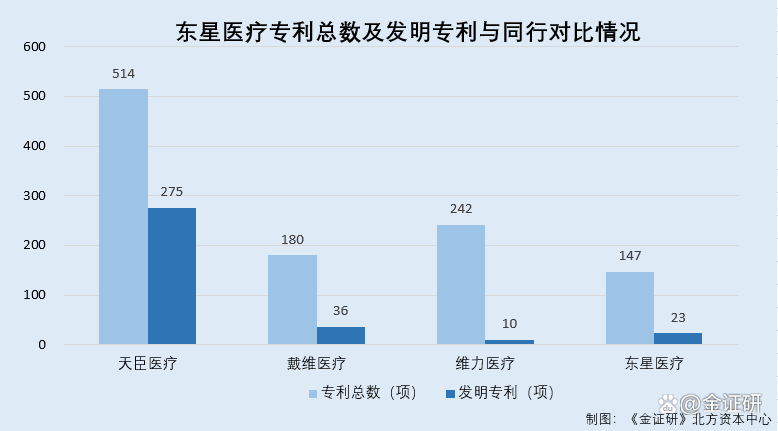

According to the prospectus signed by Dongxing Medical on May 23, 2022 (hereinafter referred to as the "Prospectus"), as of February 28, 2022, the number of Dongxing Medical has a patent of 147, of which the number of invention patents is to the invention patent is 23 items.

In addition, the comparison companies in Dongxing Medical are comparison companies (hereinafter referred to as "Tianchen Medical"), Tianchen International Medical Technology Co., Ltd.), Ningbo David Medical Device Co., Ltd. (hereinafter referred to as "David Medical"), Guangzhou Victoria Liang Medical Devices Co., Ltd. (hereinafter referred to as "Weili Medical").

According to the 2021 annual report of Tianchen Medicine, as of the end of 2021, the number of patents obtained by Tianchen Medicine was 514, of which the number of invention patents was 275.

According to the 2021 annual report of David Medical, as of the end of 2021, the number of David Medical obtained patents was 180, of which the number of invention patents was 36.

According to the annual report of Weili Medical in 2021, as of the end of 2021, the number of patents obtained by Weili Medical was 242, of which 10 invention patents were 10.

It is not difficult to see that the total number of patents of Dongxing Medical is at the bottom of the peers compared with the comparison company, and the number of invention patents may not have an advantage.

In addition to the total number of patents, the proportion of R & D investment in Dongxing Medical is not as good as peers.

1.2 R & D investment accounted for many years lower than the average of peers, and the average value of low peers in 2021 was more than five percentage points.

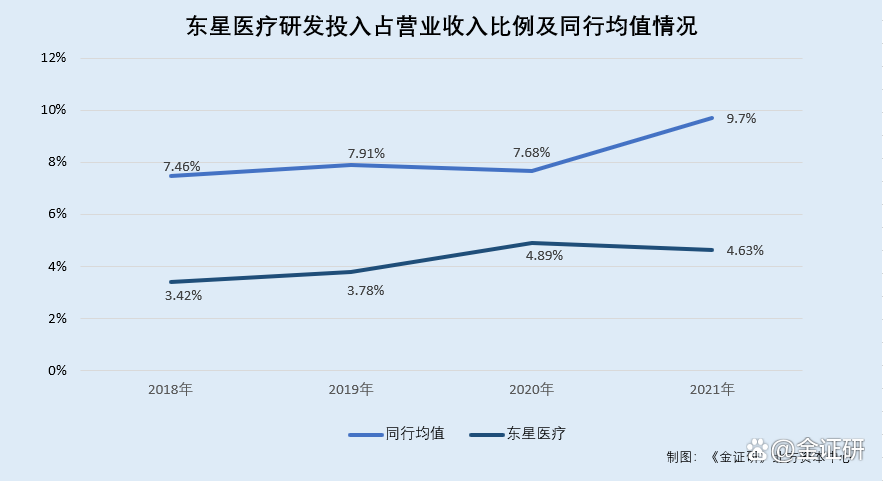

According to the prospectus signed by Dongxing Medical on October 22, 2021, in 2018, Dongxing Medical's R & D investment accounted for 3.42%of its current operating income.

According to the prospectus, from 2019 to 2021, Dongxing Medical's R & D investment accounted for 3.78%, 4.89%, and 4.63%of its current operating income, respectively.

According to the prospectus signed on April 12, 2020, the annual report of Tianchen Medicine 2020-2021 and Tianchen Medical. From 2018-2021, Tianchen Medical R & D investment, accounting for 8.93%, 8.16, respectively %, 9.41%, 13.7%.

According to the annual report of David Medical 2020-2021, from 2018-2021, David Medical's R & D investment accounted for 9.41%, 11.32%, 8.75%, and 10.48%of its current operating income.

According to the annual report of Weili Medical 2018-2021, from 2018-2021, the total investment of Weili Medical R & D, accounting for 4.04%, 4.25%, 4.89%, and 4.92%of its current operating income.

According to the research of the Northern Capital Center of "Jin Securities", from 2018-2021, the average value of the comparison company R & D investment in the East Star Medical Industry is 7.46%, 7.91%, 7.68%, and 9.7%, respectively. Among them, in 2021, Dongxing Medical's R & D investment accounted for 5.07 percentage points lower than the average of the peers.

In addition to the proportion of R & D investment, the actual controller of Dongxing Medical customers, or participated in the R & D of the Core Technology Corresponding Patent of Dongxing Medical, or participated in the R & D.

1.3 2020-2021, customer Rup medical treatment has contributed more than 30 million yuan in income in two years

According to the feedback letter signed by Dongxing Medical on April 20, 2022 (hereinafter referred to as the "reply letter"), Jiangsu Rup Medical Equipment Technology Co., Ltd. (hereinafter referred to as "Rup Medical") was an alien in Dongxing Medical Parts client.

From 2020 to 2021, Dongxing Medical's sales of Rup Medical were 1,9409,100 yuan and 15.1541 million yuan, respectively, accounting for 5.47%and 3.42%of Dongxing Medical's current main business revenue, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2020-2021, Dongxing Medical's cumulative sales of Rup Medical were 34.563 million yuan. In fact, the inventor of Dongxing Medical Patent is the same as the actual controllers of Rup Medical.

1.4 Rupp Medical Real Controller and East Star Medical Inventor's inventor, one of which patent or core technology involves core technology

According to data from the Market Supervision and Administration Bureau, Rup Medical was established on November 8, 2011, with a registered capital of 10 million yuan. Its business scope is medical device research, development, and manufacturing. As of July 13, 2022, Wu Xiaoping was a shareholder and executive director of Rup Medical. From 2018 to 2021, Wu Xiaoping's capital contribution to Rup's medical treatment was 5 million yuan.

According to the research on the Northern Capital Center of "Jin Securities", on July 13, 2022, Wu Xiaoping's shareholding on Rup Medical was 50%.

In addition, Wu Xiaoping, a inventor of many patents in Dongxing Medical, has named itself with the actual controller of Rup Medical.

According to the prospectus, as of December 31, 2021, Jiangsu Zihang Precision Hardware Co., Ltd. (hereinafter referred to as "Zihang Precision") was a subsidiary of Dongxing Medical.

According to data from the State Intellectual Property Office, the patent number of 2017211468512 Practical new patent "one -time foreskin cutting coherent component transmission device", the application time is September 8, 2017, as of the inquiry date, July 13, 2022, 2022 The status of the case is to maintain patent rights, and the inventors are Jiang Shihua, Wu Yulei, Wang Hailong, Jiang Shihong, Ding Xiquan, and Wu Xiaoping. The applicant is precision and Zerp medical treatment.

The invention patent of the patent number 2017108041944 "disposable foreskin cutter". The application time is September 8, 2017. As of July 13, 2022, the case status is waiting for the real trial proposal. , Wang Hailong, Jiang Shihong, Ding Xiquan, Wu Xiaoping, the applicant is precision and Rup medical treatment.

The patent number of 2017211467651 "Pushing Device of Disposable Foreskin Cutting Commoner", the application time is September 8, 2017. As of July 13, 2022, the case status is to maintain patent rights and invented the invention. Human artificial Jiang Shihua, Wu Yulei, Wang Hailong, Jiang Shihong, Ding Xiquan, and Wu Xiaoping, the applicant is precision and Rup medical treatment.

The exterior design of the patent number of 2017304243007 patent "disposable foreskin cutter". The application time is September 8, 2017. As of July 13, 2022, the case status is maintained. , Wang Hailong, Jiang Shihong, Ding Xiquan, Wu Xiaoping, the applicant is precision and Rup medical treatment.

The patent number of 2017211469661 Practical new patent "Domestic cutting instruction device for one -time foreskin cutter", the application time is September 8, 2017, as of July 13, 2022, the case status of the patent right, the inventor as the inventor as the inventor as the inventor as the inventor as the inventor as the inventor as the inventor. Jiang Shihua, Wu Yulei, Wang Hailong, Jiang Shihong, Ding Xiquan, Wu Xiaoping, the applicant is precision and Rup medical treatment.

The patent number of 2017211469676 Practical patent "Detainet Fixed Device of Disposable Foreskin Cutting Incomes" is September 8, 2017. As of July 13, 2022, the case status is maintained. Human artificial Jiang Shihua, Wu Yulei, Wang Hailong, Jiang Shihong, Ding Xiquan, and Wu Xiaoping, the applicant is precision and Rup medical treatment.

The patent number of 2017211469873 "one -time foreskin cutter", the application time is September 8, 2017. As of July 13, 2022, the case status is maintained by the patent right. , Wang Hailong, Jiang Shihong, Ding Xiquan, Wu Xiaoping, the applicant is precision and Rup medical treatment.

The invention patent with the patent number 2017108042595 "Pushing Device of the Disposable Foreskin Cutting Commoner", the application time is September 8, 2017. As of July 13, 2022, the case status is waiting for the real review proposal. Human artificial Jiang Shihua, Wu Yulei, Wang Hailong, Jiang Shihong, Ding Xiquan, and Wu Xiaoping, the applicant is precision and Rup medical treatment.

According to the research of the Northern Capital Center of "Jin Securities", as of July 13, 2022, Wu Xiaoping, the actual controller of Rup Medical, and the inventor of the eight patents applied for Dongxing Medical Application, the six of them were the patents. The patent has been authorized.

According to the prospectus, Dongxing Medical said that from 2019-2021, there is no cooperative research and development. In addition, the patent of the above name is "Pushing Device with Disposable Foreskin Cutting Commoner", and it is also the name of a core technology of Dongxing Medical.

It is important that the technical fields involved in a number of patents in Dongxing Medical are overlapping with the fields of Ruop's medical patent.

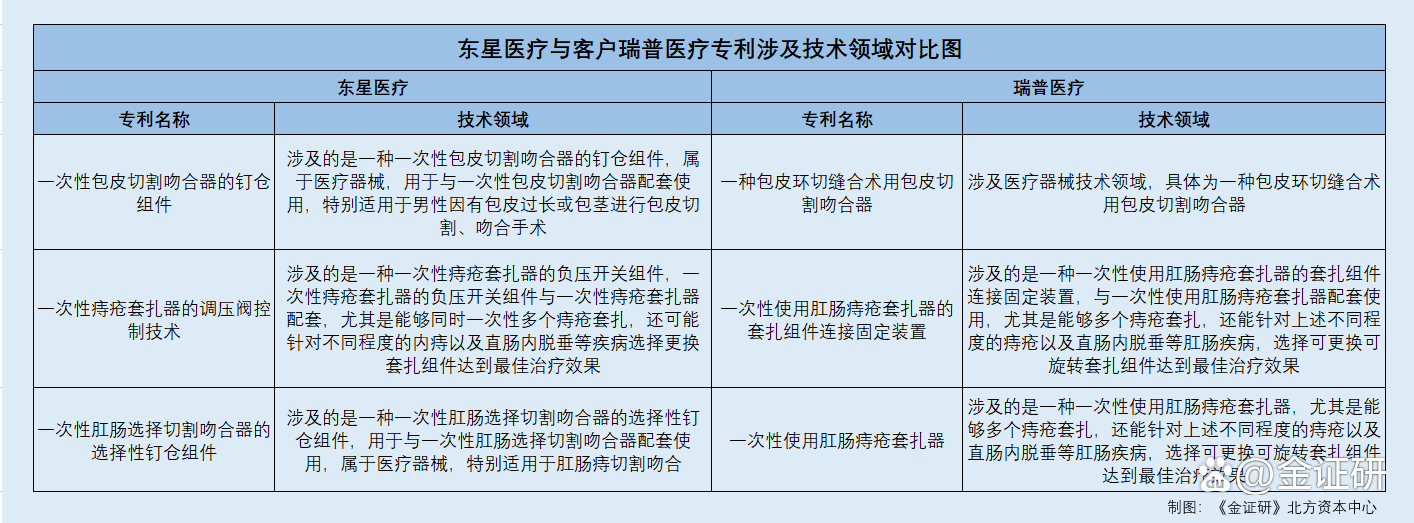

1.5 Application fields of a number of patents in Ruoper Medical, with Dongxing Medical or Stocking

According to the prospectus, the practical new patent of the patent number of 2018202461097 "Disposable Foreskin Cutting Complex", the patent number 2015206895481 Practical new type patent "one -time hemorrhoids controlling valve control technology", and patent patent The practical new patent of "2017204927985" "Selective Nail Warehouse Component of Disposable Anorectal Selection Cutting Commoner" is a patent corresponding to the core technology of Dongxing Medical. According to data from the State Intellectual Property Office, the patent "one -time foreskin cutting closer component" involves a nail component of a disposable foreskin cutter. Use, especially suitable for men with foreskin or phimosis for foreskin cutting and syringic surgery.

At the same time, the patent "disposable hemorrhoids covering the pressure control valve control technology" involves a negative pressure switch component of a disposable hemorrhoid cover, the negative pressure switch component of the disposable hemorrhoids case, and the disposable hemorrhoid cover The tie machine is supported, especially the at the same time can be tied with multiple hemorrhoids at the same time. It may also choose to replace the component of different degrees of internal hemorrhoids and internal internal hemorrhoids and internal dispelction of the rectum to achieve the best treatment effect.

In addition, the patent "selective nail component component of the one -time anorectal selection of cutter" involves a selective nail component component of the disposable anorectal selection cutter, which is used to support it with disposable anorectal selection. It belongs to medical equipment and is especially suitable for cutting anorectal hemorrhoids.

In fact, Dongxing Medical's above -mentioned core technologies corresponding to the patent areas overlapped with a number of patents in Ruopu.

According to data from the State Intellectual Property Office, the patent number is 2021228797551, a practical new patent "one kind of foreskin seam suture, the foreskin cutter", the application time is November 23, 2021. As of July 13, 2022, the inquiry date, as of The status of the case is to maintain patent rights, and the applicant is Ruopu Medical. This patent involves the field of medical device technology, and is specifically cut into a foreskin suture.

According to data from the State Intellectual Property Office, the patent number of 201921213433X "one -time use of anorectal hemorrhoids with an anorectal hemorrhoids is connected to a fixed device". The application time is July 30, 2019. As of the inquiry date 2022 On the 13th, the status of the case was maintained by patent rights, and the applicant was medical treatment.

This patent involves a one -time use of anorectal hemorrhoids and tie components to connect a fixed device, which is used with an anorectal hemorrhoids with anorectal hemorrhoids. The degree of hemorrhoids and anorectal diseases such as internal velocal prolapse of the rectum, choose a replaceable rotating capsule component to achieve the best treatment effect.

According to data from the State Intellectual Property Office, the patent number of 2019212127209 "one -time use of anorectal hemorrhoids", the application time is July 30, 2019. As of July 13, 2022, the case status is the patent. The right of power is maintained, the applicant is a Rupe medical treatment. This patent involves a disposable use of anorectal hemorrhoids, especially the can be tied with multiple hemorrhoids. It can also be used for the above -mentioned hemorrhoids and anorectal diseases in the rectum. The component achieves the best treatment effect.

It can be seen from the above data that the patents of Dongxing Medical and Customer Rupe Medical involved the cut components, devices and technologies used in foreskin, hemorrhoids and anorectal surgery, and there is a overlap in the application field of the patent of the two.

In addition, Dongxing Medical's second largest shareholder and core technicians also participated in the invention of the above patents.

1.6 The second largest shareholder and core technicians also participated in the invention of the above patents

According to the prospectus, as of May 23, 2022, Jiang Shihua and Wang Hailong were the second and fourth largest shareholders of Dongxing Medical, respectively, with a shareholding ratio of Dongxing Medical 6.75%and 5.74%, respectively. From December 2019 to April 2021, the deputy general manager of Jiang Shihua Dongxing Medical, from January 2020 to April 2021, Jiang Shihua served as a director of Dongxing Medical. In addition, Jiang Shihong is Jiang Shihua's brother. Both Wang Hailong and Wu Yulei are the core technicians of Dongxing Medical.

It is not difficult to see that, compared with the comparison company, Dongxing Medical's total patent is the bottom, and the proportion of R & D investment has been lower than the same value for many years. It is worth noting that the actual controllers of Dongxing Medical customers Rup Medical, and the inventors who have authorized patents in Dongxing Medical Pavilion. Is this coincidence, or is it a patent for the R & D patent of Dongxing Medical? It also involves a patent corresponding to the core technology of Dongxing Medical. At the same time, Dongxing Medical and Rup Medical have overlaped a number of patents involved in a number of patents. In this regard, is Dongxing Medical's technology hidden the risk of leakage?

In addition, Dongxing Medical or its customers may have a lot of relationships.

2. The manager and customer shareholder of the second largest shareholder control enterprise "fellow", income for 10 million yuan may be blessed by acquaintances

Gongsheng is bright, and it is dark. In the context of the reform of the registration system, information disclosure has become increasingly the focus of supervision. In fact, Dongxing Medical is closely related to its customers.

2.1 2019-2021, customer Shukang medical contribution exceeds 27 million yuan in income

According to the reply letter, from 2020 to 2021, Wuxi Shukang Medical Device Co., Ltd. (hereinafter referred to as "Shukang Medical") was the third and fifth largest direct sales customers of Dongxing Medical, respectively. The sales amount was 115.909 million yuan and 10.632 million yuan, respectively. According to the response opinion of Dongxing Medical's second round of audit inquiry letter signed on April 20, 2022, in 2019, Cihang Precision of Dongxing Medical's subsidiary Cizami Precision's sales amount to Shukang Medical was 5.1548 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", from 2019 to 2021, Dongxing Medical and its subsidiaries' cumulative sales of Shukang Medical's cumulative sales were RMB 27.777 million.

It can be seen that Shukang Medical is a customer of Dongxing Medical for many years.

In fact, Dongxing Medical and Customer Shukang Medical or Relative.

2.2 The second largest shareholder and the original director Jiang Shihua Jianghua Copper Agricultural Sciences, Chen Bin is a shareholder and manager

According to the prospectus, as of May 23, 2022, Anhui Tongli Agricultural Technology Co., Ltd. (hereinafter referred to as "Tonglong Agricultural Sciences") was an enterprise holding 80%of Jiang Shihua.

According to the data of the Market Supervision and Administration Bureau, the Tongji Agricultural Sciences was established on January 2, 2018. Its business scope is agricultural scientific research and experimental development. The planting, storage and sales of rice, wheat, corn, etc. As of July 13, 2022, the shareholders of the Copper Agricultural Sciences were Chen Bin, Jiang Shihua, and Cheng Yong. Among them, Chen Bin is the manager of the Agricultural Department of Tonglong.

On December 4, 2019, the Copper Agricultural Sciences changed investors to change. Before the change, Jiang Shihua, Wu Hao, Cheng Yong, and Chen Bin's shareholding on Tonglong Agricultural Sciences were 50%, 30%, 10%, and 10, respectively. %, After the change, Jiang Shihua, Cheng Yong, and Chen Bin's shareholding on Tonglong Agricultural Sciences were 80%, 10%, and 10%, respectively. During the same period, the Copper Grass Agricultural Sciences made a change of senior management personnel. Before and after the change, Chen Bin was a senior managers of the Copper Agricultural Sciences. In addition, as of July 13, 2022, the Copper Agricultural Sciences had no other record of changes in Jiang Shihua and Chen Bin.

In other words, from January 2, 2018 to July 13, 2022, the actual control of the Copper Agricultural Sciences is Jiang Shihua, the second largest shareholder and original director of Dongxing Medical. The shareholding ratio of Shinkeepers is 10%, and it is a manager.

However, the inventor of dozens of patents of Dongxing Medical customers Shu Kang Medical, also named Chen Bin.

2.3 Chen Bin holds 10%of Shukang Medical, and has participated in more than 40 patent inventions in customers Shukang Medical

据市场监督管理局数据,舒康医疗成立于2013年8月2日,注册资本为500万元,其经营范围为二类6808腹部外科手术器械、6809泌尿肛肠外科手术器械及6865医用缝合材料及Manufacturing of adhesives.

As of July 13, 2022, Chen Bin was one of the shareholders of Shukang Medical, with a shareholding ratio of 8%.

According to public information, Chen Bin, a shareholder and manager of Shukang Medical, is the same person as Chen Bin, a shareholder of Shukang Medical.

In addition, Chen Bin is also a inventor of more than 50 patents in Shukang Medical.

According to data from the State Intellectual Property Office, as of July 13, 2022, Chen Bin participated in the invention of 47 patent applications of Shukang Medical as an inventor. Among them, the number of authorized patents was 34.

It is worth mentioning that Shukang Medical's actual controller and Dongxing Medical's second largest shareholder or shareholder.

2.4 The actual controller of the customer Shukang Medical, the former colleague of the second largest shareholder Jiang Shihua

According to a reply letter, Dongxing Medical said that in the year of the establishment of Shukang Medical, Shuang Medical started cooperation with Dongxing Medical subsidiaries. The cooperation between the two parties is mainly the actual controller of Shukang Medical, and is the former colleague of Jiang Shihong, the original shareholder of Jihang. Jiang Shihong is the former director and deputy general manager of Dongxing Medical Jiang Shihua.

That is to say, on the one hand, Chen Bin, the inventor of more than 40 patents of Dongxing Medical Customer Shukang Medical, or Jiang Shihua, the second largest shareholder, former director and deputy general manager of Dongxing Medical, manager. On the other hand, the actual controller of Dongxing Medical customers Shukang Medical is the former colleague of Jiang Shihua, the second largest shareholder of Dongxing Medical. Behind the income of Tenxing Medical's 10 million yuan may be connected by "acquaintances".

It is worth noting that in 2019, Dongxing Medical conducts asset reorganization, and its financial data disclosed with the official data is "opposed" with official data.

Third, a number of financial data and official announcement gaps in the official announcement of up to 30 million yuan, audit institutions frequently "eat" warning letters due to practice issues

For the mountains and nine crickets, there is a loss. Under the registration system, the regulatory level strictly performs the review of the duties, and requires the truth, accuracy, and completeness of the disclosure of information. In 2019, when acquiring the affiliates, Dongxing Medical disclosed the financial data of the related parties and contradicted the official data.

3.1 In November 2019, the acquisition of affiliated parties was precision, and the second largest shareholder of the acquisition held its 30%equity

According to the prospectus, on June 19, 2019, Dongxing Medical held the seventh meeting of the second board of directors to review and approve the "Proposal about the company's issuance shares and pay cash purchase assets and major asset reorganizations", "about the company's issuance shares Proposal of supporting supporting funds "and" Proposal about the company's issuance of shares and pay cash purchase of assets to constitute related transactions "and other related proposals. On the same day, the Cizuhang Precision Shareholders' Association made a resolution to agree to the acquisition of Dongxing Medical to acquire 100%equity of Jihang Precision in Jiang Shihua, Wang Hailong, Jiang Shihong, Ding Xiquan and Wu Yuli. On November 22, 2019, Cihang Precision completed the industrial and commercial change procedures and became a wholly -owned subsidiary of Dongxing Medical.

In addition, according to the prospectus, Cihang Precision was established on May 8, 2008. It is mainly engaged in the research and development, production and sales of components such as components and components such as heastomers and other medical devices. sex. Prior to the acquisition, Jiang Shihua and the core technicians Wang Hailong, who were originally a director and executive of Dongxing Medical, held 30%of the equity of Jihang Precision, respectively. Therefore, Cihang Precision is the related parties of Dongxing Medical.

According to the prospectus, this reorganization, Cizuhang Precision On December 31, 2018, the value value of the shareholders' entire equity value was 399 million yuan, and the transaction price was 398 million yuan.

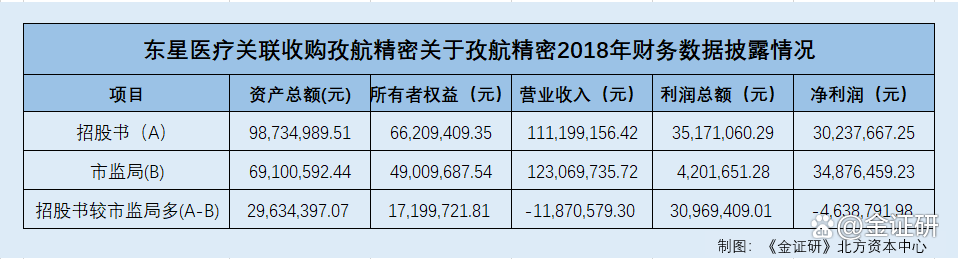

However, during the above transaction process, the financial situation of Dongxing Medical disclosed on December 31, 2018, with the data of Cizuki Precision on December 31, 2018, and the data of the Market Supervision and Administration Bureau, "no".

3.2 Related acquisition and disclosure financial report data is official, of which the biggest "gap" reaches 30 million yuan

According to the prospectus, as of the end of 2018, Cizu's precision assets, owners' equity, operating income, total profits and net profit were 98.735 million yuan, 6,6209,400 yuan, 11,199,900 yuan, 35.171 million yuan, and 30.237 million. Yuan.

According to data from the Market Supervision and Administration Bureau, as of December 31, 2018, the total assets of Cizu Airlines, the total ownership of the owner's equity, the total operating income, the total profit and net profit were 69,00,600 yuan, 4909,700 yuan, and 12,30.697 million Yuan, 420.165 million yuan, 34.8765 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", Dongxing Medical disclosed the total assets, owners' equity, operating income, total profit and net profit of 2018 in the prospectus, and compared the data disclosed by the Market Supervision and Administration Bureau There are 29.634 million yuan, 17.1997 million yuan, less than 11.87 million yuan, more than 30,969,400 yuan, and less than 46.388 million yuan.

It is worth noting that Dongxing Medical's audit institution has been issued many warning letters for audit issues.

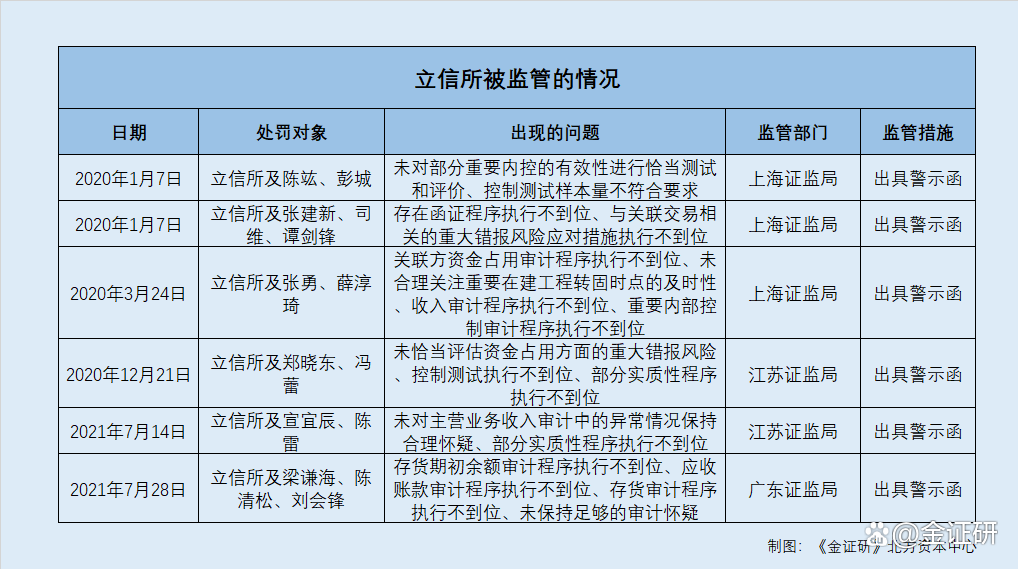

3.3 2020-2021, the Lixin Institute and its registered accountant were issued a warning letter many times for audit issues

According to the prospectus, Dongxing Medical's audit institution was listed on the listing accounting firms (hereinafter referred to as "Lixin Institute").

According to the Shanghai Stock Exchange Monitoring [2020] No. 3, on January 7, 2020, Lixin Institute and its registered accountant in Changjiang Investment Industry Co., Ltd., CEO, in the 2017 internal control audit project. The effectiveness of the effectiveness of proper testing and evaluation, the amount of control of the test sample does not meet the requirements, the non -proper execution of the travel test, the incomplete control matrix information is complete, the control test sample list and the specific execution of the audit procedures are not in place. The bureau adopts supervision and management measures with alert letter.

According to the Shanghai Stock Exchange Monitoring [2020] No. 2, on January 7, 2020, Lixin Institute and Registered Certified Public Accountant Due to the execution of Shanghai Zhijiang Biotechnology Co., Ltd., from January 1, 2015 to June 30, 2018, IPO declaration In the audit project of the financial report, there are not in place to implement the letter of procedure, the risk response measures related to affiliated transactions are not implemented, the internal control of the internal control of important error reporting measures, not fully concerned about the follow -up management of external equipment, ERP system order review, inventory cash management and other internal controls and other internal controls The effectiveness of the legal person, the non -fully concerned the confirmation of the domestic sales income confirmation of the key documents of the existence of defects and the confirmation policy of export income confirmation policy, and the notice of the bank account that did not cancel part of the cancellation. Essence

According to the Shanghai Stock Exchange Monitoring [2020] No. 69, on March 24, 2020, Lixin Institute and Certified Public Accountants are performing Shanghai to Zhengdao Polymer Materials Co., Ltd., 2017, 2018 annual report audit projects, and 2018 internal control audit audits In the project, there are issues where related party funds occupying audit procedures are not in place, and the timely of the time of the construction of important construction projects, income audit procedures are not implemented, and important internal control audit procedures are not implemented. The bureau adopts supervision measures with alert letter.

According to the Jiangsu Bureau [2020] No. 121, on December 21, 2020, Lixin and Registered Certified Public Accountants In the execution of Vivienan Food and Beverage Co., Ltd., in the 2018 audit and practicing project, there are major wrong reports on the occupation of non -appropriate assessment funds. The risk, the implementation of the risk, the execution of the control test, and the implementation of some substantive procedures were not in place, and the Jiangsu Securities Regulatory Bureau took administrative supervision measures with alert letter. According to Document No. 74 of Jiangsu Bureau, on July 14, 2021, Lixin and Certified Public Accountants in the execution of Jiangsu Poqianli Video Technology Group Co., Ltd., in the 2015 and 2016 annual report audit projects, there was no main business. The abnormal situation in the business income audit maintained reasonable doubts and some substantial procedures were not implemented. The Jiangsu Securities Regulatory Bureau took a warning and management measures with a warning letter.

According to the Guangdong Bureau [2021] No. 51, on July 22, 2021, Lixin Institute and Certified Public Accountants were implemented in Zhanjiang Guolian Water Property Development Co., Ltd. In the audit project of 2018 and 2019 annual reports, the audit procedures for the initial balance period of the inventory period did not implement the implementation of the amount of the balance period. The issues that are in place and accounts receivable audit procedures that are not in place, the inventory audit procedures are not implemented, and the audit doubts are not maintained.

According to the research of the Northern Capital Center of Golden Syllabus, from 2020-2021, the Lixin Institute and its registered accountant, because of the incompetence risk of misconduct for the implementation of related party funds and part of the substantive audit procedures, inadequately evaluated the capital occupation of funds, The Securities Regulatory Commission has been adopted by the Securities Regulatory Commission many times without sufficient audit suspicion.

In other words, in November 2019, when Dongxing Medical Association acquired 30%of its shareholders holding 30%of its shareholders, the financial data of their disclosure targets were inconsistent with the official data, of which the difference was 30 million yuan. As an audit institution listed on Dongxing Medical, Lixin's frequent "eat" warning letter for practice issues, or is hard to diligently responsibilities.

A thousand miles begins with a single step. Can Dongxing Medical take the wind and waves in the capital market? Wait and see.

- END -

Jiangsu Zhenjiang: Release the brand of "Zhenxingong" service enterprise (agricultural -related) brand

A few days ago, the Zhen Xingong service enterprise (agricultural -related) brand ...

The agricultural hair infrastructure fund invested over 10 billion yuan

Xinhua News Agency, Beijing, August 13th (Reporter Hou Xuejing) The reporter learn...