Nanwang Technology Prospectus many fabricated "fighting": The number of employees is different from 13 people's sales data of large customers

Author:Public Securities News Time:2022.08.19

On August 10, Fujian Nanwang Environmental Protection Technology Co., Ltd. (hereinafter referred to as "Nanwang Technology") was launched. There are still many doubts in the book.

In addition to many inconsistent prospectus and annual report data, Nanwang Technology is also contradictory with the information disclosed by its big client Wallace.

Packaging Company Transfer to GEM

Nanwang Technology was originally called Fujian Nanwang Packaging Co., Ltd. (May 2010-May 2016). The main business is the research and development, production and sales of paper bags. New three boards on the day.

In this IPO, Nanwang Technology intends to land on the GEM list. In the prospectus, Nanwang Technology added the term "environmental protection" in the main business description- "the main business is the research and development, manufacturing and sales of paper products such as environmentally friendly paper bags and food packaging." The fundraising projects are new capacity projects, of which 389 million yuan of raised funds will be used for "annual output of 2.247 billion green environmental protection paper products intelligent factory construction projects", 238 million yuan for "paper product packaging production and sales projects "".

It should be pointed out that the industry where Nanwang Technology is located is low and competition is fierce. During the reporting period, Nanwang Technology participated in the bidding and procurement of the largest customers in the largest customer each year. In order to obtain the expected share of the bidding strategy, the sales price of some products declined year by year.

According to Article 3 of the "GEM Public Public Public Release Management Measures (Trial)", the issuer applies for the first public offering of shares and listed on the GEM, and it shall meet the positioning of GEM. The GEM has thoroughly implemented the innovation -driven development strategy, adapts to the development of more relying on innovation, creation, and creativity. It mainly serves growth innovation and entrepreneurship enterprises, and supports the in -depth integration of traditional industries and new technologies, new industries, new formats, and new models.

Regarding the positioning of its GEM, both investors and Shenzhen Stock Exchange have questions. Some investors questioned in the stock bar: "Nanyang is packaged, paper is not his own, and the equipment is not his own. Is this technology?"

In the review and inquiry letter of Shenzhen Communications, Nanwang Technology also requires Nanwang Technology to "combine the advancedness and alternative level of technology, the future development direction and market potential of the industry, analyze in detail and explain their own innovation, creation, and creativity. Board positioning. "

Number of employees, customers are inconsistent with annual reports

When the reporter checked the prospectus of Nanwang Science and Technology, it was found that the data in Nanwang Technology's prospectus was inconsistent with the annual report disclosed during the listing of the New Third Board, and the authenticity and integrity of the letter attracted attention.

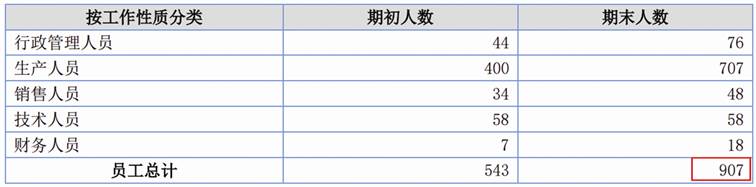

The most obvious number of employees. The prospectus shows that the total number of employees at the end of each period from 2018-2020 is 923, 1,250, and 1326. The 2018 annual report shows that the number of employees at the end of 2018 was 907 (see Figure 1). The 2019 annual report shows that the number of employees at the end of 2019 was 1,250. Obviously, the number of employees' number of employees at the end of 2019 is the same, but the number of employees at the end of 2018 is different, and the difference is 16.

Figure 1: The basic situation of the 2018 annual report of Nanwang Technology (company and holding subsidiaries)

In addition to the number of employees, the sales data of large customers and large customers, the annual reports disclosed during the New Third Board of Listing are also different.

In the prospectus, Nanwang Technology disclosed that the top five customers in 2018 were Betheng Foods, Wallace, KarioutCompany, Aoyut, and Tubu, with sales of 13.2206 million yuan, 80.375 million yuan, 30.512 million yuan, 260.765 million yuan, and 260.765 million yuan. 206.991 million yuan; the top five customers in 2019 are Betheng Food, Wallace, Tokyo Art, Lexin Trade, KarioutCompany, with sales amounts of 185.896 million yuan, 105.478 million yuan, 43.961 million yuan, 24.62 million yuan, 19.931 million yuan Essence

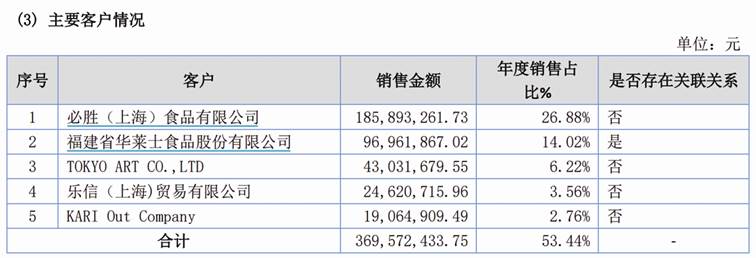

During the listing of the New Third Board, the main customer data disclosed in the 2018 and 2019 annual reports were not consistent with the prospectus, and even different customers appeared. The 2018 annual report shows that the top five customers of Nanwang Technology are Pishable Foods, Wallace, KarioutCompany, Australia, and Pure. Yuan (see Figure 2). The 2019 annual report shows that the top five customers of Nanwang Technology are Betheng Food, Wallace, Tokyo Art, Lexin Trade, Karioutcompany, with sales amounts of 185.893 million yuan, 96.961 million yuan, 430.31 million yuan, 24.6207 million yuan, 1906.49 10,000 yuan (see Figure 3).

Figure 2: Nanwang Technology 2018 annual report main customer situation

Figure 3: Nanwang Technology 2019 annual report main customer situation

In contrast, it can be found that there are obvious differences in the disclosure of Nanwang Technology's prospectus and annual reports: in 2018, the sales amount of Pizza Sheng food was nearly 1.03 million yuan; the fifth largest customer in 2018 was different. The disclosure of the prospectus was 20.6991 million Yuan, the annual report was disclosed as a pair of net sales of 14.4993 million yuan; in 2019, the sales amount of Wallace was approximately 8.51 million yuan; in 2019, the sales amount to Tokyo was about 930,000 yuan. So, why are the annual report data disclosed during the listing of the prospectus and the New Third Board, there are more obvious differences in the number of employees in the same period, and why can the number of employees and annual report data be different? What is the authenticity of the prospectus?

Large customers sell data "fight"

The information disclosed by Nanwang Technology and its large customer Wallace also has contradictions.

Wallace, a large customer of Nanwang Technology, Wastel Food (836475), a listed company listed on the New Third Board. Nanwang Technology's prospectus shows that in 2018, the company's sales amount to Wallace was 80.3754 million yuan. In the annual report of Chinese food disclosure, Nanwang Technology did not enter the top five suppliers of Winshi Food.

The 2018 annual report of Winshi Food shows that the top five suppliers of Chinese food were Shandong Jiuyuan Food Co., Ltd., Shandong Zhongke Food Co., Ltd., Jiangsu Yike Food Group Co., Ltd., and Aisiakawa Food ( Hebei) Co., Ltd. and Simpho (China) Food Co., Ltd., the purchases were 131 million yuan, 101 million yuan, 95.2 million yuan, 73.31 million yuan, and 65.49 million yuan (see Figure 4). Judging from Nanwang Technology's sales amount of Wallace in 2018, Banwang Technology is 80.375 million yuan, and Nanwang Technology should be ranked fourth largest customers in Watsters Food.

Figure 4: The main supplier of the 2018 annual report of Chinese Foods

Further inquiries found that the daily affiliated transactions occurred during the reporting period of Chinese food during the reporting period of the annual report. 44000000.00 yuan. "

It should be pointed out that Wallace is the affiliate of Nanwang Technology. Prior to this issuance, Wallace's affiliated parties Hui An Huaying, Hui'an Chuanghui, Huang Rong, Chen Xiaofang, and Chen Zheng held a total of 27.74%of Nanwang Technology. During the reporting period, the amount of affiliated transactions continued to increase. The prospectus shows that in 2019, 2020 and 2021, Nanwang Technology's operating income was 691,410,800 yuan, 848.211 million yuan, and 1195,555,500 yuan, of which the sales revenue of related parties was 105.465 million yuan, 135.7039 million yuan and 18837.35, respectively 10,000 yuan, accounting for 15.25%, 16.00%, and 15.76%of the company's operating income in the current company. In the future, Nanwang Technology and Wallace's business cooperation will continue to exist, and there is still a risk of greater related sales.

In addition, the full name of the shareholders disclosed by Nanwang Technology's prospectus is inconsistent with the business information of the enterprise. In November 2015, when Nanwang Co., Ltd. increased its capital (predecessor of Nanwang Technology), Hengqin Shangfeng contributed 11.625 million yuan. Before Nanwang Technology IPO, Hengqin Shangfeng withdrawn through several equity transfer.

In the interpretation of Nanwang Technology Prospectus, Hengqin Shangfeng refers to the Zhuhai Hengqin Shangfeng Investment Management Center (limited partnership). The company's investigation showed that Hengqin Shangfeng was renamed Zhuhai Hengqin Shangfeng Enterprise Management Center (limited partnership) as early as October 2016 (see Figure 5).

Figure 5: Hengqin Shangfeng Business Information

Why do you still use "Hengqin Shangfeng refers to Zhuhai Hengqin Shangfeng Investment Management Center (limited partnership)" in the prospectus? Is the prospectus disclosure? For the transaction amount in 2018, Nanwang Technology and Huasshi food disclosure are used. What is the reason for the inconsistent data? According to the above questions, the Public Securities Journal Mirror Finance Studio has previously reported to Nanwang Technology, and as of the time of press time, no reply was received.

Reporter Cheng Shu

- END -

Keynet stocks collectively move!Hang Seng Internet ETF (513330) opens high and goes high.

The Hang Seng Index rebounded in the morning, and the shares of Science and Technology rose collectively. The Hang Seng Internet Technology Industry Index opened up more than 2%.As of 9:40, Alibaba an

Optimized the business environment 丨 Xiangyang's loan balance in the first half of the year was 341.944 billion yuan, and then hit a new high

Hubei Daily Client News (all media trainee reporter Wu Yurui Correspondent Ren Yan) continued to optimize the financial business environment and realize a benign interaction of financial and economic.