Everbright Bank Zhang Xuyang: In the next ten years, the banking industry pursues three indicators

Author:Economic Observer Time:2022.08.19

Economic Observation Network reporter Hu Yanming "For the banker, all we have emphasized in the past are deposits and loans, emphasizing spreads. In the next ten years, I believe that the Chinese banking industry is pursuing three indicators."

At the 2022 China Baoding · Capital Conference held on August 18, Zhang Xuyang, secretary and chief business director of China Everbright Bank's board of directors, delivered a keynote speech entitled "Innovation, Capital and Commercial Banks".

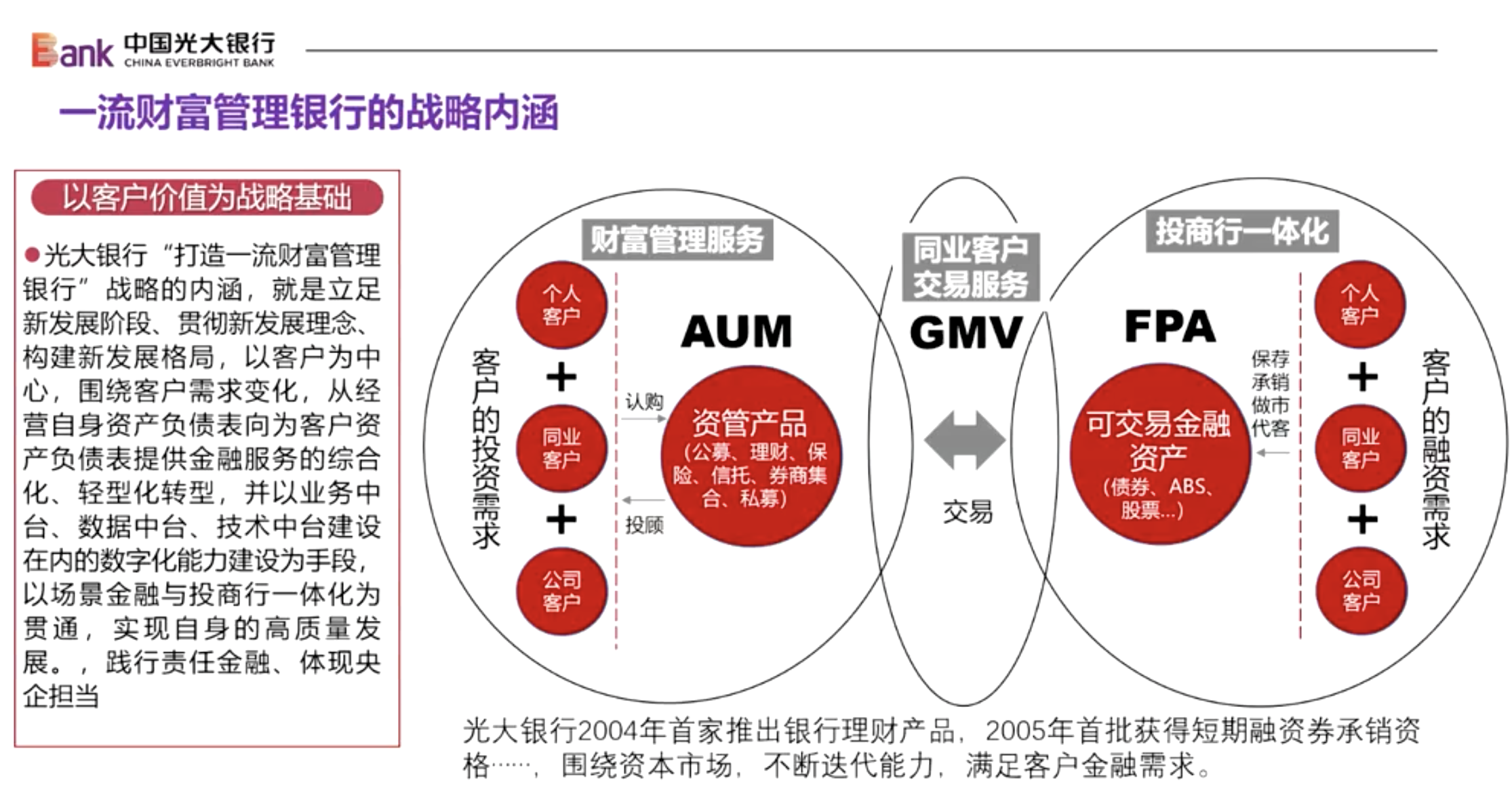

The three indicators of Zhang Xuyang's fingers are: AUM (asset management scale), FPA (total customer financing) and GMV (total transaction).

Zhang Xuyang said that Aum is the scale of investors to manage wealth; FPA is the scale of banks with comprehensive financing services for enterprises. Taking Everbright Bank as an example, Everbright Bank's loan scale will only be 2.8 trillion at the end of June this year, and providing enterprises with debt issuance and financial investment reached 6.4 trillion; Everbright Bank Shijiazhuang Branch has a scale of less than 4 trillion yuan, but the size of the FPA has reached 1230 100 million, this shows that banks need to provide more financing solutions for our companies.

The third indicator is GMV, which is a transaction from the same industry customers. Zhang Xuyang said that social public fundraising funds, trusts, and insurance that provides investors with product service management. It is a securities firm and bank wealth management institutions for the company. The total number of customers in the industry has increased. It is hoped that these three indicators make banks surpass banks, and banks are no longer traditional banks.

Speaking of bank self -iteration, Zhang Xuyang said that August 18th was the 30th anniversary of the establishment of Everbright Bank. After 30 years of development, Everbright Bank reached 2.6 trillion, becoming the 27th largest listed bank in the world. Listing banks themselves need to be self -innovation with development. This innovation is the process of improving and upgrading commercial banks from a business bank to improve and upgrade from an asset liability sheet to the customer's balance sheet.

"Banks can do more in terms of promoting innovation and long -term capital formation." Zhang Xuyang said that first, we can rely on wealth management companies to promote the transformation of asset management and increase the allocation of equity -shaped assets; second, I hope that through the deep industrial chain, I hope that through the deep industrial chain, I hope that through the deep industrial chain, I hope that through the deep industrial chain, Provide more financial services for the industrial upgrade of the local government; in the end, you want to provide new momentum and production capacity for local governments' assets and asset transformation through public offerings.

Before serving as the secretary of the board of directors of the Everbright Bank and the chief business director, Zhang Xuyang served as the chairman of Guangda Finance. Zhang Xuyang said that when he served as the chairman of the Everbright Financial Management, he believed that the new characteristics of the financial industry or the asset management industry were to better understand the world with technology and data support. understand. This sentence is also suitable for transformed commercial banks, which is the same for commercial banks. It needs to better understand the world with technical support and better understand and match customers. This is the road to transformation of commercial banks. Essence

- END -

The fifth phase of the province's "three batches" project construction activities were held, and the main venue was located in Luoyang

Lou Yangsheng emphasized at the fifth phase of the province's fifth phase of the three batches project construction activitiesGrasp the strategic opportunity of building a new development patternAcc...

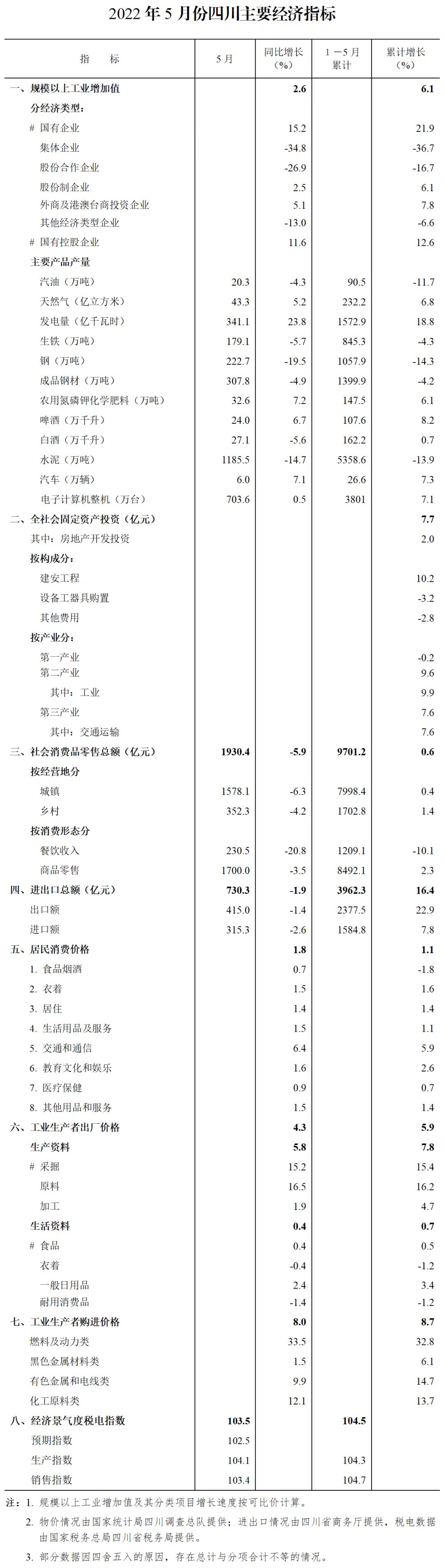

From January-May Sichuan residents' consumer price index rose 1.1% year-year

On June 16, the Sichuan Provincial Bureau of Statistics released data showing that...