Beer high -end, what is the foam?China Resources Beer revenue reached 21 billion yuan Hou Xiaohai said that in the next three years, it has seized more than 20%of the high -end market in the next three years

Author:Huaxia Times Time:2022.08.19

Huaxia Times (chinatimes.net.cn) reporter Jiang Yanxin Huang Xingli Beijing report

With the end of the peak season of beer sales, beer companies have also handled the transcripts in the first half of the year. On August 17, China Resources Beer released the results announcement in the first half of 2022, with revenue of 21.13 billion yuan; however, the net profit of the mother -in -law fell 11.4%. The sales of beer above increased by about 10.%compared with the same period last year, of which the sales volume of the Xili brand recorded double -digit growth in the first half of the year.

Beer companies are concentrated on the high -end beer track, and the competition of high -end beer has begun to become increasingly fierce. How can domestic beer heads led by China Resources Beer cope with the pressure from foreign beer boss Below Asia Pacific?

Revenue innovation

According to the financial report disclosed by China Resources Beer, in the first half of this year, its revenue increased by about 7%compared with the same period last year to 21.013 billion yuan, a new high of nearly 8 years; net profit attributable to the mother fell 11.4%to 3.802 billion yuan.

It should be mentioned that after eliminating the company's relocation compensation earnings last year, China Resources Beer's net profit in the first half of the year increased by about 27.8%compared with the same period last year.

Last year, Chongqing Beer, which was successful in revenue, also released the first half of the year on the 17th, with revenue on the 17th, with revenue of 7.936 billion yuan, an increase of 11.16%year -on -year; net profit attributable to mothers was 728 million yuan, an increase of 16.93%year -on -year.

In addition, according to data from the National Bureau of Statistics, beer companies above designated size in the first half of this year completed a total of 18.442 million liters of wine production, a year -on -year decrease of 2.0%. Chongqing Beer's sales increased by 6.36%year -on -year, which is higher than the industry level.

The impact of the epidemic is also a severe test on the beer business that depends on the catering industry, but the impact of the epidemic is not obvious on China Resources Beer and Chongqing Beer. China Resources Beer stated in the financial report: "In the first half of 2022, the epidemic situation brought a greater impact on beer sales. The overall beer sales of the Group in the first half of the year decreased slightly by 0.7%compared with the same period last year, which was basically the same as the same period last year."

In an interview with the "Huaxia Times" reporter, Cai Xuefei, an expert in wine marketing, said: "Compared to Parkway, China Resources and heavy beer products belong to the Volkswagen Consumer Price Belt, have multiple advantage markets in the national market, and have extensive consumption consumption The crowd, and these two wine companies have introduced high -end products accordingly. By continuously improving the product structure and product prices, they have made up for the shrinkage and decline in the consumer market, maintaining the growth trend of the enterprise. "

In contrast, the impact of the epidemic is particularly obvious in Budweiser Asia -Pacific. In the first half of this year, the sales volume of the Chinese market in the Asia -Pacific Asia Pacific fell 5.5%, and the revenue fell 3.2%. %.

"Because Budweiser's long -term focus on high -end consumer scenarios, its advantageous consumer venues are some high -end hotels, night venues, clubs, which are affected by the epidemic, which directly leads to the disappearance of scene sales, so the negative impact on sales is greater."

Cai Xuefei believes that compared with the catering channels focused on China Resources and heavy beer, the demand is more affected by the epidemic.

In addition, because the cost of raw materials and packaging materials continued to rise, China Resources Beer adjusted the prices of some products in the first half of the year. The overall average sales price in the first half of the year increased by about 7.7%compared with the same period last year. 6.9%.

However, at the media performance briefing held on the 17th, Hou Xiaohai, CEO of China Resources Beer, believes that the overall beer environment in the second half of the year is better than the first half of the year. As cost pressure is expected to alleviate, China Resources Beer has not further increased its price in the second half of the year. Plan, but do not rule out the normalized price adjustment of individual markets according to local business conditions.

From grabbing high -end markets to grabbing channels

As China Resources Beer said, its overall sales in the first half of the year have slightly dropped, but high -end beer has become a new driving force for the development of China Resources Beer.

After the acquisition of Xili (China) in 2019, China Resources Beer has cut into the high -end market through the Xili brand. In 2020, the support of the Xili brand in the field of high -end beer began to appear. This year, the sales of China Resources high -end beer increased by 11.1%from 2019 to 1.46 million liters. In the first half of this year, the sales of beer in the second half of high -end and above increased by 10%year -on -year to 1.142 million liters. Among them, the sales of the Xili brand achieved double -digit growth.

Regarding the development plan of the Xili brand and the expansion of the high -end market, China Resources Beer said in an interview with the reporter of the Huaxia Times: "The Group is expected to maintain a high -speed development and will continue to consolidate the brand status of Xili, strive to strive Cover more regions and implement the combination of "Chinese brand+international brand" to expand the high -end beer market in China. "

Last year, the sales of high -end beer companies in various beer companies also achieved good results. Among them, the fastest development of high -end beer is Chongqing Beer. Last year, its sales of high -end beer increased by 40.48%year -on -year to 661,500 liters, accounting for 23.71%of the total sales.

Judging from the data of the first half of this year, Chongqing Beer high -end beer continued last year's growth trend. Its high -end beer business revenue increased by 13.3%year -on -year. In addition, in the first half of the year, Budweiser Asia Pacific was able to fall by 4.2%per 100 liters of income in the first half of the year, which also benefited from high -end development.

Enterprises are in a hurry to fight for the high -end beer market. Hou Xiaohai stated at the media performance briefing that China Run Beer hopes to seize 20%to 30%in the high -end market in the next three years.

In addition, in the first half of the year, China Resources Beer continued to cultivate and promote various high -end brands through various theme promotion and channel marketing activities.

In terms of Chinese brands, in addition to signing the spokesperson to enhance the brand's influence, China Resources Beer has also sponsored multiple variety shows to increase brand exposure, including "Camping together" and other programs. Among them, the sales of SUPERX, Snow Pure and Snow Marlon Malus Green Beer in the first half of the year have continued to grow. In terms of international brands, China Resources Beer has held a number of marketing activities to promote the Xili brand with the help of the Champions League events and the theme of Xili Electrical Music, which has led to the double -digit growth of the sales volume of the Xili brand products in the first half of the year.

In addition to the development of high -end beer, the competition for channels has also become the focus of development. At the performance briefing, China Resources Beer proposed that it will further deepen channel layout and expand emerging channels. Hou Xiaohai believes that after the epidemic occurs, due to the great suppression of the current drinking channels and the rapid development of drinking, although e -commerce and other drinking channels will not occupy the main part of beer consumption in a short period of time, there will be It may be 5%-10%. In this case, China Resources Beer has increased its development of O2O, community group purchase, chain convenience stores and e -commerce since last year.

Cai Xuefei believes: "Now the traditional channel distribution, the cost of the hierarchical agency system is getting higher and higher, and the distribution efficiency is getting lower and lower. The development of modern logistics supports the delivery of products to the home to provide consumers with great convenience, which is also in line with young people. At the same time, the online consumption of the epidemic has become the mainstream. Enterprises choose to bet on these three channels (referring to community group purchase, chain convenience stores and e -commerce, the same below) that meet the development trend of the entire social development. "

He also believes that the refined cultivation of these three channels of China Resources and heavy beer is actually the inevitable result of changes in the entire Chinese retail consumption form. The development of China Resources Beer in new channels also has its own advantages. On the one hand, China Resources Beer has local advantages. On the other hand, its strong state -owned background provides a good support for its national expansion.

Editor -in -chief: Editor Yu Yujin: Hanfeng

- END -

China's gold industry celebrates the party's birthday

Hubei Sanxin CompanyRecently, Hubei Sanxin Company held the 101st anniversary of t...

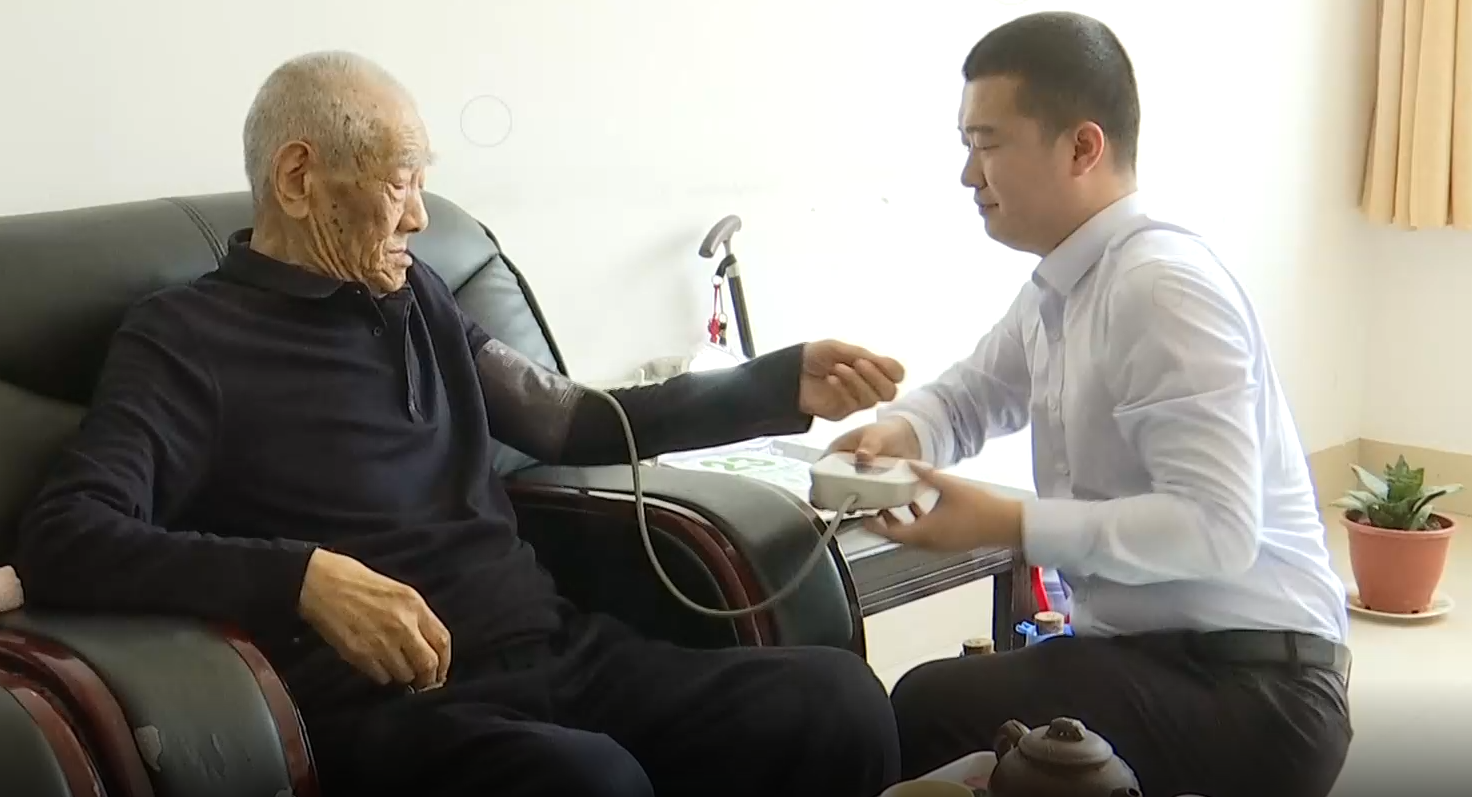

Shouguang: The new model of "Smart Pension" entrusts the elderly "happy old age"

#— — — — — —#In recent years, Shouguang City has continuously extended big d...