A "sun order" in a 500 crowd: a mysterious household sells 9,000 convertible bonds at a time, a daily loss of 77,000 yuan

Author:Huaxia Times Time:2022.08.20

China Times (chinatimes.net.cn) reporter Ma Xiaochao Chen Feng Beijing report

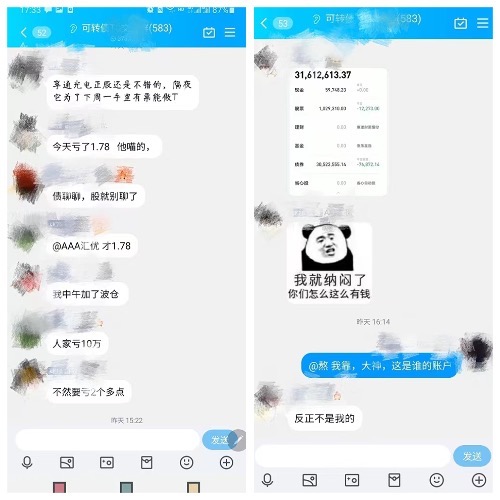

"Wow, Great God, whose account is this?" After the stock market closed on the afternoon of August 19, a convertible bond investment exchange group with more than 500 people, netizens 2 asked netizens who had just been exposed to the group 1 Essence

The picture in the group is a clear list of income of an investment account. The owner's bond asset position is about 30 million yuan, and the loss of about 77,000 yuan on the day. The netizens who were asked about the source of the picture were taboos, saying that they were not their own, but then they "showed off" they knew that this account sold nearly 1.5 million yuan today. Essence

This operation made the "Bien" show staged in the group at that time reached a climax: Before a netizen 1 speaking, the netizen 6 complained that "the full position loses the lies in the middle". Netizens 4 responded to "there are 3 million yuan positions, and they lost 100,000 yuan" ...

On Monday, the turnover of the convertible bond market reached a new low -day low since the implementation of the new regulations. On Thursday and Friday, the CSI convertible bond index appeared for two consecutive days. Some speculators, arbitrage retail investors, and arbitrage retail investors in the field of convertible bonds have been retreated for a long time.

Mysterious big households sell convertible bonds

On August 19, the SCR convertible bond index continued the downturn before the day before, and continued to fall after a slight low opening. The decline of about 10:50 expanded to 1.06%. Since then, the rebound has been rebounded. The turnover of the whole day is 62.358 billion yuan. The decline and turnover are almost the same as the previous day.

In the investment exchange group of several hundreds of people joined by the reporter of Huaxia Times, many arbitrage retail investors have "reported" their losses in real time in real time in the group, which is the wind and the convertible bond market. The debt bubbles are in a large period of time, forming a strong contrast.

The aforementioned performance of more than 500 people in the "Big" show, nearly 400 online number of online people, the group is very active, there are a large number of retail investors, and there are some people who are suspected of traveling money and brokerage business departments. Sometimes they talk about getting rich. Sometimes sharing debt selection techniques, sometimes discussing the fundamentals of a certain debt.

Netizen 1's income details of the investment account showed that the total assets of the mysterious large account account were about 31.61 million yuan, of which about 60,000 yuan was cash, about 1 million yuan was stock assets, and the remaining 30 million yuan was bond assets; The "today's income" of bond assets is about -777,000 yuan, and the stock assets "today's income" is about 12,000 yuan.

Regarding the question of who is the owner, netizens 1 is not their own, netizens 2 ask the source of the picture, netizens 1 did not respond, and said deeply: True guys are all bonds, there are very few stocks, and the fund manager income of solid -income fund manager income income Very high ... The big guy bought basically convertible bonds below 115 yuan.

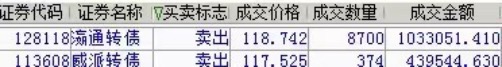

"This is the operation of the convertible bond of transactions on August 19th." It seemed to be a group of friends who questioned the trust. Netizens then exposed the subsequent transaction of the target transaction of the mysterious account in the group. The table shows that the account sold 8,700 Zhangtong convertible bonds and 374 Zhangwei convertible bonds on the day, with a turnover of about 1.5 million yuan.

In response to the identity of the owner, an old shareholder of a million yuan position analyzes the reporter. Theoretically, the possibility of the personal account of the fund manager is very unlikely, because the trading securities of the employees are illegal. The risk preferences are low, and it is more like a product account of a partial debt mixed fund, that is, asset management accounts for contemporary customer wealth management. Of course, it may also be cow scattered or swimming, but will they allocate such a large proportion of low -risk assets?

In fact, for arbitrage retail investors in the group, the authenticity of the owner, and even the authenticity of the account screenshot may not be important. They are willing to believe, or the reason why the "Better" show is staged in the group is that in the context of the convertible bond market's shrinking turnover, some debt to foam, and the significant recovery of the index, even some large households will encounter a significant income significant income. The evacuation situation is that they themselves, and it is in line with their mentality of retreating.

Rap the threshold for convertible bonds

The new rules implemented this year are also guiding non -professional investors to stay away from the hype of the convertible bond market. Before the implementation of the new regulations, whether it is a new first -level market or a transaction in the secondary market, the convertible bond market can be described as no threshold for investors.

Until June 17, the Shanghai and Shenzhen Exchange issued the "Notice on the Proper Management of Extraordinary Management of Corporate Bonds", which added the entry requirements for "2 -year transaction experience+100,000 yuan assets" to the newly -entered investors. (Existing investors can continue to participate in the influence of new rules).

The "little white" eager to enter the market arbitrage was blocked outside the convertible bond door.

But there are still some "little white" unwillingness, hoping to bypass this threshold. On August 19, a person close to a securities firm's business department revealed to the reporter of the Huaxia Times that the above new rules had just begun to implement in the past few days. The asset volume "threshold, but now I don't know if it's still possible.

Another brokerage business department told reporters that I am afraid that this threshold can't bypass which securities firms are. After all, it is the provision of the exchange.

With the bottom line, there will be an intermediary to do a gray business. Through the method of crossing the bridge, it will help investors to bypass the threshold of "100,000 yuan in assets" and collect fees to make money? The reporter contacted a person who claimed to provide "convertible bond account opening" services in a convertible bond exchange group.

But after a detailed understanding, he can only introduce a person who needs to go to a securities dealer to open a household with a low commission when transaction convertible bonds. Whether he meets the requirements of "2 -year transaction experience+100,000 yuan assets".

A private equity fund manager in Shenzhen told reporters that the new regulations set this threshold to protect unprofessional retail investors, while curbing market bubbles and hype, and returning convertible bond transactions to reason.

"The entry threshold is mainly to restrict some of the personal investors and other money, so we expect that the number of new convertible bond accounts will slow down in the future." The newspaper said.

Jia Qinglin said that the current number of investors in the current convertible bond market is relatively sufficient, and the proper management measures do not involve the stock convertible bond account account. But it will not be significantly affected.

After the turnover shrinks

The convertible bond market staged a wave of rapid valuations last year. The CSI Convertible Index rose from 370 points to 430 points at the end of last year; during the same period, a number of convertible bond themes Different color, finally got 30 % or forty annual income.

Entering 2022, the CSI convertible bond index fell and shocked, but the market transaction once increased greatly. Last year, the number of transactions exceeded 100 billion yuan last year. From mid -April to the end of July this year More than 100 million yuan, exceeding 200 billion yuan on June 8, the degree of speculation is evident.

The supervision was finally shot again. On August 1, the exchange implemented a new trading rules. The upper limit of the increase in convertible bond settings on the first day of listing was 57.3%, and the lower limit of the decline was 43.3%. %Restrictions.

In the past week, the turnover of the convertible bond market has shrunk significantly, with an average daily average of about 60 billion yuan.

In response, Zhang Yongzhi, deputy general manager of the Fixed Income Department of the China Business Fund and the manager of the China Business Convertible Bonds Fund, told the reporter of the Huaxia Times that although the current transaction volume of the convertible bond market has shrunk, these are mainly some of the previous hype. Small convertible debt shrinkage, so it has little effect on the transaction of most convertible bonds.

Jia Qinglin also said that as of August 3, 2022, the market closing price of the entire market for convertible bonds has increased by more than 20%or less than 20%. Social debt and other vouchers that are easy to be hyped. Generally speaking, the introduction of ups and downs restrictions on the overall impact of the convertible bond market will have little impact, but the phenomenon of speculation of demon debt will be greatly reduced.

However, while the transaction is shrinking, the CSI Convertible Index has recently performed well. After the two trading days on Thursday and Friday, the two trading days were retracted sharply and finally closed at 425 points. This is only 10 lower than the beginning of the year. A few points.

In this regard, Zhang Yongzhi explained that from the perspective of the equity market, the small and medium -sized growth stocks represented by the CSI 1,000 and the Stock Exchange 2000 recently have performed strongly. The liquidity is relatively abundant, so the valuation level of the convertible bond market represented by indicators such as the conversion premium rate is also rising. These two factors work together, so the convertible bond index performed well.

Regarding the direction of the market outlook, on August 15, the analysts of the fixed income of China Merchants Securities Yin Ruizhe and Li Ling said in the research report of "After the Valuation", according to historical experience, the valuation of the convertible bonds was in the historical extreme position. It will always be adjusted due to the callback of the bond or the stock market. Due to the incompleteness of the current bond market, the situation of "asset shortage" has not been fundamentally improved; after the stock market rebounds at the end of April, the structural market is presented, and the small market growth stocks are still better than the value of the large market. Therefore, for convertible bonds, the probability of short -term valuation is higher, and the possibility of further rushing towards a record high is not ruled out; By 7%, the amount of quantitative price that may occur in the market outlook will fall.

Editor: Editor Yan Hui: Xia Shencha

- END -

Longyou farmers have "knocking on the door"!The "Family Asset Pool" financing model broaden the Gongfu Road

Thanks to the new model of financing of Yishang Bank 'Family Asset Pool', with my ...

Changbao live broadcast room entered the 2022 World Health Fair

On August 5th, the World Health Fair in 2022 opened in Wuhan.(Photo by Gao Yong, a...