The chairman of Liancheng CNC was investigated by the insider in the insider!1.36 billion yuan fixed increase was affected

Author:21st Century Economic report Time:2022.08.20

21st Century Business Herald reporter Lei Chen Beijing report

On the evening of August 19, Liancheng CNC (835368.bj) disclosed that the company's chairman Li Chunan was investigated by the CSRC.

Subsequently, the company stated in the inquiry letter of the Beijing Stock Exchange that Li Chunan's suspected insider trading target was not the company's shares, nor did he involve other companies in the Beijing Stock Exchange.

The company also said that Li Chunan's investigation did not affect his performance in the company. The company's daily operation and management was responsible for the company's executive team. , Standardize operations and major matters decision -making.

However, because the chairman was investigated by the Securities Regulatory Commission, Liancheng CNC does not meet the conditions for issuing stocks to specific objects. Liancheng CNC is bluntly, the company is exploring the relevant plan to eliminate the impact of the aforementioned matters on the issue of stock issuance. At the same time, it will also determine the relevant arrangements of stock issuance matters based on subsequent processing progress.

The 21st Century Economic Herald reporter noticed that in addition to serving as chairman of Liancheng CNC, Li Chunan also held two NEEQ companies and photovoltaic giants Longji Green Energy (601012.SH).

1.36 billion yuan fixed increase is blocked

Liancheng CNC was founded in 2007 and is a photovoltaic and semiconductor equipment manufacturer. The new three boards were listed in July 2020. In 2021, it was transferred to the Beijing Stock Exchange as a selected layer enterprise. As of the closing of August 19, the company's market value was 18.6 billion yuan, ranking second in the market value of the Beijing Stock Exchange.

The reporter noticed that on July 15 this year, Liancheng CNC released a fixed draft draft, which intends to issue shares of not more than 39 million shares to specific objects, raised funds of 1.36 billion yuan, and the issuance objects have not been determined.

Liancheng CNC says that the above -mentioned fundraising funds will be mainly used to expand production and supplement mobile funds.

Among them, 306 million yuan was used for the expansion of the single crystal furnace, 394 million yuan for photovoltaic battery films and photovoltaic component equipment projects, and 138 million yuan for the third -generation semiconductor material silicon base processing equipment production project, 168 million yuan for 168 million yuan For electronic -level silver powder expansion projects, 355 million yuan is used to supplement mobile funds.

Regarding the fixed increase, Liancheng CNC mentioned that one is to expand the production capacity of existing crystal silicon equipment and increase the investment in battery and component manufacturing equipment in the photovoltaic industry chain; the second is to deploy the core auxiliary materials industry of the photovoltaic in deployment to reduce the downstream production capacity cycle The impact of sexual fluctuations on performance; the third is to seize the new opportunities for the development of the third -generation semiconductor industry and increase the sales scale of semiconductor equipment; and the fourth is to supplement mobile funds.

Regarding the progress of the fundraising project, Liancheng CNC stated that "the fundraising project involved in the issuance of the company is being launched normally according to the actual progress. Keep as much as possible to ensure the progress of each fundraising project. "

However, from the current financial situation of Liancheng CNC, it is impossible to complete the expansion of production capacity with its own funds. Financial data shows that as of the end of the first quarter of 2022, the company's book currency funds were 402 million yuan and transactional financial assets were 137 million yuan.

According to Liancheng CNC, Li Chunan made it clear that if there is a demand for related funds in the production and operation of Liancheng CNC, he will provide financial funding for the company in an interest -free loan.

In March 2022, Li Chunan ranked 582th in the "2022 Big Wine · Hurun Global Rich List" with a wealth of 35.5 billion yuan. With Li Chunan's commitment, the possibility of completing the Liancheng CNC expansion plan has been greatly improved on time.

Or involve photovoltaic giants

The reporter noticed that at present, in addition to being the chairman of Liancheng CNC, Li Chunan also holds the shares of two New Third Board Company Longji Electromagnetic (873425.NQ), Longji Instrument (873628.NQ) and Listed Company Listed on the Shanghai Stock Exchange. The share ratio was 17.12%, 14.46%, and 2.11%, respectively.

Coincidentally, on the evening of the 19th, Longji Electromagnetic announced that the company's 22.78%of the actual controller, director, and general manager Zhao Nengping was investigated by the Securities Regulatory Commission for suspected insider trading of the securities market. Zhao Nengping also holds 5.99%of the shares of Longji instrument at the same time.

The names of the above -mentioned enterprises are "Longji", and the most well -known of them is undoubtedly Longji Green Energy.

Public information shows that Li Chunan was born on October 10, 1968, and was admitted to the Department of Physics of Lanzhou University in September 1986. He met Li Zhenguo and Zhong Baoshen, friends of his life. The throne was once known as the "Longji Three Swordsmen".

Zhong Baoshen is currently the chairman of Longji Green Energy, the chairman of Longji Instrument, and the director of Longji Electromagnetic Director, which overlap with Li Chunan's assets. At the same time, the two were the actual controller of Liancheng CNC, holding a total of 35.03%of the voting rights of the latter.

Liancheng Digital Control said in an annual report of 2021 that Zhong Baoshen mainly presided over the production and operation of Longji Green Energy, and did not directly participate in the company's daily management. The company's orders obtained from Longji Green can fulfill strict competitive negotiations and bidding processes. Zhong Baoshen's office does not directly affect the cooperative relationship between the two companies.

Even from the development trajectory of urban CNC itself, in the process of development and growth, it once relied on order support from Longji Green Energy. In 2021, the company's sales to Longji Green energy accounted for 72.42%.

However, on August 20, some relevant persons in Liancheng CNC told reporters that the company is committed to reducing their dependence on single customers and actively developing new customers. It is worth mentioning that in May this year, the company said in questioning investors' questions that as of the end of the first quarter of 2022, the company's orders in hand in hand were about 80%.

On the other side, Li Chunan has transferred most of the equity of the Rongji Green Energy to Gao Yan Capital. On December 20, 2020, Longji Green Energy announced that Li Chunan intends to transfer approximately 226.3 million shares to Gaoma Capital, with a transfer price of 70 yuan/share and a total transaction consideration of 15.841 billion yuan.

After Li Chunan's reduction, Longji Green Energy's stock price rose up to 73.53 yuan/share in the following time, and the closing price on August 19 was 56.12 yuan/share.

The Bei Stock Exchange keeps an eye on "key minority"

Insider transactions to destroy the fair principles of market transactions, damage the legitimate rights and interests of investors, and be prohibited by the new "Securities Law".

People in the legal community said that once the insider transaction is constituted, according to the new "Securities Law", not only does it confiscate illegal income, it will also be fined up to 10 times; if the illegal income or the income of less than 500,000 yuan will be confiscated Fined fines below 5 million yuan.

The reporter noticed that before the chairman of Liancheng CNC was investigated by the Securities Regulatory Commission, the Chairman of the Bei Stock Exchange's market value "One Brother" Betre (835185.bj) was also filed by the CSRC for investigation by the Securities Regulatory Commission for insider trading. It was affected, but the chairman was still re -elected in the election.

Earlier, the Bioshu (833266.bj) primitive controller was investigated by the Securities Regulatory Commission in May due to fund occupation and other problems. The company is easy, and the lawsuit follows.

In fact, the chairman of the listed company not only largely determines the direction of listed companies, but also effectively affects the quality of corporate governance and information disclosure. At the same time, if there are illegal matters such as capital occupation, violation guarantees, and insider trading, it will seriously harm the interests of investors.

Therefore, paying attention to the "key minority" including the actual controller of the listed company and the directors of the directors and supervisors is the core of improving the quality of the company's listed company.

The 21st Century Business Herald was informed that recently, the Bei Stock Exchange launched a series of measures to strengthen compliance awareness and supervision on the "key minority" of the listed company, including the "key minority" conducting insider transaction prevention and control training, and the signing of the "key minority" signing norms of the organization "key minority". The promise, the "first lesson" of the organization on the day of the enterprise listing, and so on.

It is understood that the Beijing Stock Exchange will continue to strengthen the "key minority" supervision in the future and firmly adhere to the risk bottom line.

The first is to strengthen the supervision of "key minority" behaviors, especially the company's foreign investment, the pledge of the controlling shareholder's equity, and the secondary market transaction to prevent the occurrence of capital occupation, illegal guarantee, and insider trading.

The second is to focus on "familyization" and "one person and multiple jobs", focusing on major issues decision -making procedures to prevent the company's internal control failure.

The third is to strengthen scientific and technological supervision, increase the "key minority" regulatory portrait module in the scientific and technological regulatory system, improve risk discovery capabilities, and deal with and deal with it in a timely manner.

The fourth is to increase the punishment of serious violations of the "key minority", strengthen the connection with administrative supervision, and timely transfer the case in time to investigate the case, and investigate the administrative or criminal responsibility.

- END -

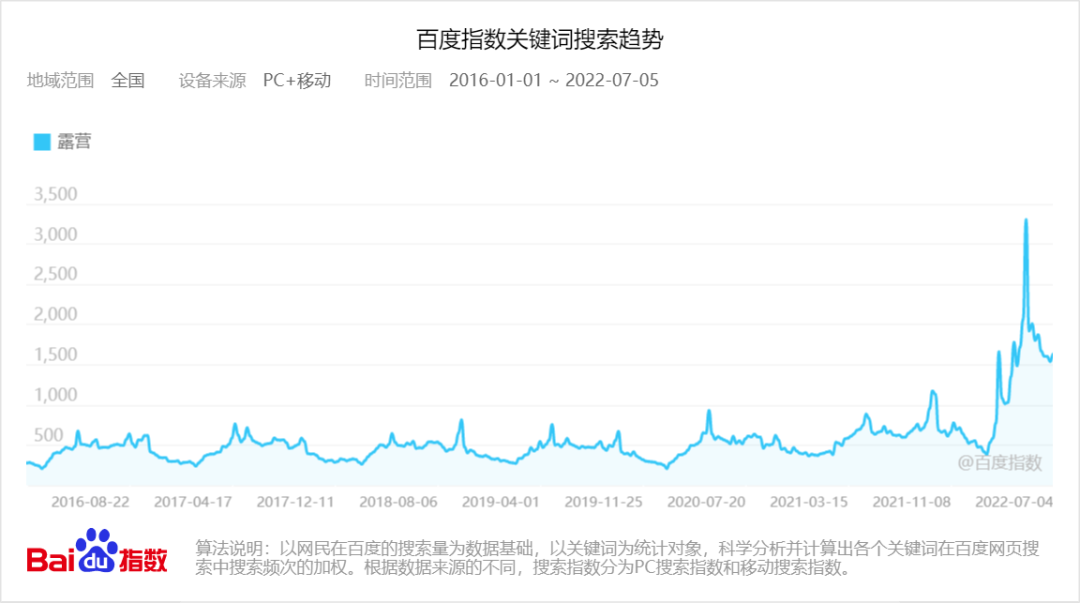

Camping fire to 618, the head brand is stable, niche brands rely on subdivided breakouts

In 2022, camping is undoubtedly one of the most outsiders lifestyles. Due to the p...

Where is the real barriers of the bicycle sharing industry?Three questioning bike sharing rises successively

Look at the mountain side to become a peak. Under the change of a hundred years, t...