Taixiang's first share of the first share of "North Transfer" mainly produces car engine's main bearing cover

Author:Cover news Time:2022.06.18

Cover reporter Liu Xuqiang

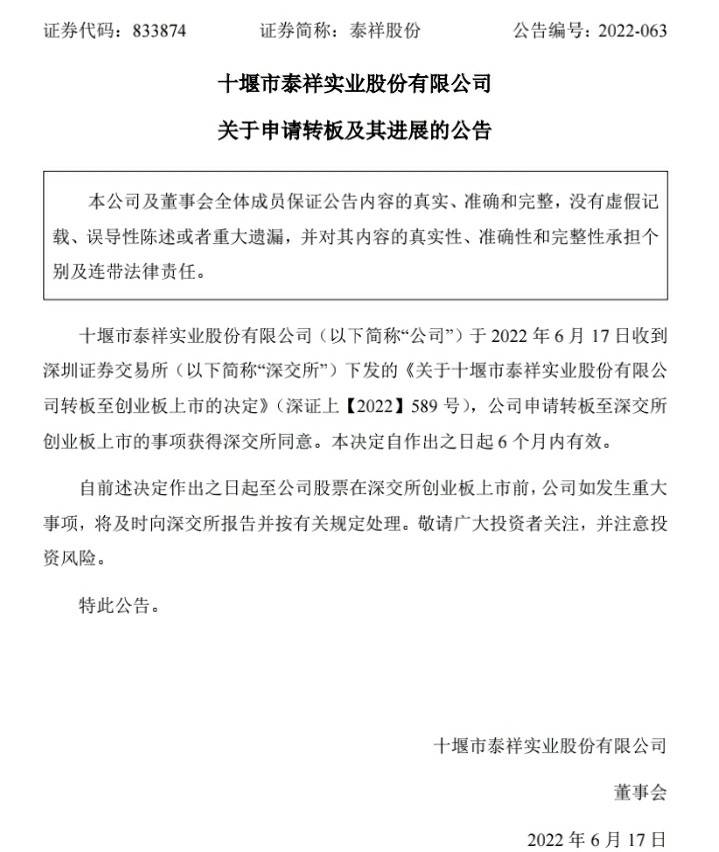

Following the defense of the Code, the Second Family Transfer Enterprise of the Bei Stock Exchange came. On the evening of June 17, the official website of the Shenzhen Stock Exchange showed that Shiyan Taixiang Industrial Co., Ltd. (hereinafter referred to as "Taixiang Co., Ltd.") was agreed to be listed on the GEM.

Taixiang's decision to be approved by the Shenzhen Stock Exchange also marks that it will become the first share of the Beijing Stock Exchange's transfer. Zhou Yunnan, the founder of Beijing Nanshan Investment, believes that as the second place to transfer to the board and the first of the GEM, the approval of Taixiang also marked the passage of the Beijing Stock Exchange to the science and technology board and the GEM. It also marks that the interconnection of China's multi -level capital market is truly fully realized.

At the same time, Hangbo High -tech, who was once regarded as the first "Northern Creation" by the market, was still waiting for the listing of the Shenzhen Stock Exchange to be approved.

Taixiang, the first successful "Northern Capital", is a new "Little Giant" company that mainly produces the main shaft of automotive engine.

Public information shows that Taixiang Co., Ltd. focuses on the research and development, manufacturing and sales of automotive parts. In July 2021, it was identified as the third batch of special new "giant" enterprises by the Ministry of Industry and Information Technology.

The company is mainly engaged in the production and sales of the main bearing cover of the automotive engine. This product is one of the key parts on the engine, and it is also the absolute core source of the company's performance income. The prospectus shows that from 2019 to 2021, the company's product sales amount accounted for more than 98%of operating income each year.

It is worth mentioning that the company's revenue mainly comes from Volkswagen Group. The prospectus shows that from 2019 to 2021, the proportion of sales revenue achieved by Taixiang shares to Volkswagen and its global control or shareholding enterprises every year accounted for more than 96%of operating income.

From the perspective of turntable efficiency, Taixiang's GEM IPO was accepted on November 10, 2021, and will be approved on March 25 this year. Compared with the approval of the transition board listing and the official landing of the scientific and innovative board for less than 2 months, the turnover efficiency of Taixiang shares is lower.

In terms of performance, Taixiang's first quarter performance report showed that the company's revenue and net profit dropped during the reporting period, of which the net profit was about 13.4853 million yuan, a year -on -year decrease of 16.41%.

After the first day of the listing of Guandian Defense Decades, it fell 23.63%on the first day of the market. Cover journalists will continue to pay attention.

- END -

Pudong Power Supply Institute Strengthening Production Professional Warehouse Construction Construction

On May 12, the construction of Pudong Power Supply Institute of Pujiang County, State Grid, was officially started. At present, the shelves and ground strokes of the Pudong Power Supply Office's wareh...

Overnight Europe and the United States · June 8th

① The three major US stock indexes rose across the board, and it was recorded for the second consecutive day. The Dow rose 0.8%to 33180.14 points, the S \u0026 P 500 index rose 0.95%to 4160.68 poi...