Wen's shares have suffered losses in the past ten years, and the asset -liability ratio has climbed a new high

Author:Radar finance Time:2022.08.21

Radar Finance | Editor Wu Yanrui | Deep Sea

On August 19, Wen's shares released the half -annual report of 2022. In the first half of the year, the total operating income of Wen's shares was 31.544 billion yuan, an increase of 2.97%year-on-year; the net profit attributable to shareholders of the parent company was -3.524 billion yuan, a year-on-year decrease of 41.07%. Radar Finance found that this is the company's largest interim losing loss since 2012.

At the same time, the company's asset -liability ratio is 65.7%, which is the highest point in the company's interim liabilities in recent years.

Radar Finance combed and found that the huge losses of Wen's shares were mainly affected by the pig cycle.

"Company+Farmers" model is difficult to reach the pig cycle

Sky Eye Check information shows that the main business of Wen's shares is the breeding and sales of meat chickens and meat pigs, and also operates the breeding of meat ducks, cows, eggs, pigeons, etc. and their products. At the same time, the company focuses on the upstream and downstream of the livestock and poultry breeding industry chain, supporting the operation of livestock and poultry slaughter, food processing, modern agricultural and animal husbandry equipment manufacturing, veterinary drug production, and financial investment.

Wen's shares are one of the largest companies in the country's breeding of meat and chicken, and it is also a national lean meat pig production technology demonstration base, the pig germ project demonstration base, and the public -free meat pig production base. Ranking is the forefront.

At present, the company's operating income mainly comes from the sales revenue of meat chicken products and meat pork products. In the first half of the year, the proportion of operating income was 47.09%and 44.80%.

The customer group of the meat chicken of Wen's shares is mainly wholesalers, supplemented by terminal retailers; the main customer group of meat pigs is wholesaler and meat co -factories. The company's meat chicken and meat pig sales are mainly living chicken and living pigs, supplemented by slaughter sales and cooked food processing. The company directly wholesale sales to customers, which are distributed from customers to markets across the country.

Wen's business model is a close "company+farmer", which has been operating for more than 30 years. The company is responsible for the research and development of chickens and pig breeding, nutrition and epidemic prevention, and produces chicken seedlings, pig seedlings, feed, veterinary drugs and vaccines, and provides cooperative farmers to raise meat chickens and meat pigs to columns.

In the process of cooperative farmers' breeding, the company provides a complete set of technical support and services such as breeding management, epidemic prevention and control, and environmental protection treatment. At the same time, process supervision and management work to ensure that cooperative farmers are regulated in accordance with the company's quality standards. After the cooperative farmers raised meat chickens and meat pigs, they were returned to the company according to the designated location and method of the company, and the company organized foreign sales. In the end, the company paid the commissioned farmers to the cooperative farmers. The batch of cooperation was over and entered the next batch of cycle cooperation.

When the cooperative farmers deliver the products, the company calculates the total income of the product quality, weight and settlement price, and minus the costs required by the seedlings, feeds and veterinary drugs received by the cooperative farmers, and obtain the commissioned farmers who should pay the cooperative farmers.

During the reporting period, the number of farmers in the company has not changed significantly, with a total number of 44,200 households. The proportion of the total number of households in each region accounts for: 43.09%in the South China region, 19.64%in the East China region, 15.63%in Central China, 16.62%in the southwest region, 3.55%in North China, 0.91%in the northwest region, and 0.57%in the northeast region.

According to data released by the National Bureau of Statistics, in the first half of 2022, 365.87 million national pigs were raw, a year -on -year increase of 8.4%. The sales of meat pigs in the first half of the year (including hair pigs and fresh products). Based on this calculation, Wen's share in the pork market is 2.19%.

In 2021, the company sold 1,321.74 million meat pigs (including hair pigs and fresh products), accounting for about 2%of the national pigs, ranking third among the A -share listed companies in the industry.

Why does the market share of the market slightly increased, but the largest interim losses since 2010? Radar Finance combed and found that the company's broilers did not lose money. The reason for the loss was that Wen's shares encountered the pig cycle.

During the reporting period, the company sold 488 million meat chickens (including chicken, fresh products and cooked food). The company's poultry industry has maintained a historical high, with a market rate of 94.9%, and the cost control industry is leading. During the reporting period, the price of the chicken was generally stable. The average sales price of the company's chicken was 13.88 yuan/kg, an increase of 0.43%year -on -year. Although the price of feed raw materials has continuously increased the cost of breeding, the company's chickens and duck poultry industry still achieve overall profit. The average sales price of the company's hair pigs was 13.59 yuan/kg, a year -on -year decrease of 41.74%.

According to the financial report, the market price of pork has stabilized and recovered from March, but it is still low in general. With the rise of pig prices in June, the company's pig industry achieved monthly losses after a year of loss.

During the reporting period, the total sales revenue of veterinary drugs was 902 million yuan, of which 322 million yuan was exported. The company sells raw materials for 65,100 tons and 440,000 tons of finished milk. The total sales revenue is 645 million yuan, an increase of 0.36%year -on -year. The total sales revenue of agricultural and animal husbandry equipment was 255 million yuan, of which the export revenue was 13 million yuan, a year -on -year increase of 103.8%.

In the first half of 2022, Wen's sales profit was -283 million yuan. During the same period, the company's sales costs and management costs decreased compared to the same period last year. The company's financial expenses increased due to increased interest expenditure, an increase of 111.68%year -on -year. Wen's R & D investment was 214 million yuan, a year -on -year decrease of 28.5%. Investment has lost 400 million, and the asset -liability ratio is innovative

The financial report shows that due to the slowdown of long-term asset investment, the net cash flow generated by investment activities was -2.948 billion yuan. The net cash flow generated by the company's fundraising activities due to the repayment of financing borrowings was -379 million yuan.

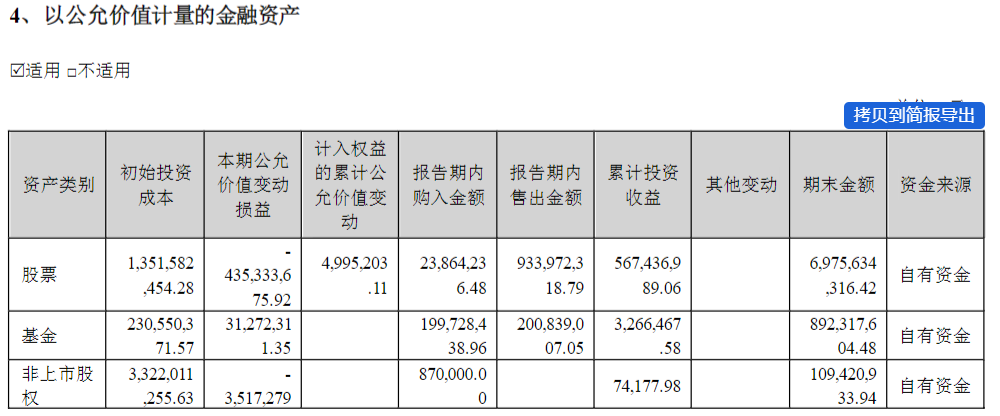

Due to disposal trading financial assets back to the profit or loss of fair value changes, the company's fair value change income account company decreased by 1173.56%compared with the same period last year, and from 554 million yuan in the first half of 2021 to -408 million yuan.

Specifically, the value of Wen's shares using its own funds reduced by 435 million yuan during the reporting period.

In the first half of 2022, the company's asset -liability ratio was 65.70%, which was a high level since its listing in 2015.

The company's recent announcement shows that Wen's shares have lowered the "19 Wen's 01" ticket interest rate in accordance with the regulations. According to the current market environment, the company's interest rates in the next two years have reduced the number of ticket interest rates from 3.80%of the previous three years. It is 3.30%.

According to the statistics of the same flowers, as of now, Wen's shares have issued a total of 22 bonds, with a total of 26.488 billion yuan. There are still 6 currently within the issuance period, with the existing scale of 14.932 billion yuan.

In the scale of stock, medium -term bills accounted for 6.03%, corporate bonds accounted for 18.75%, overseas bonds accounted for 23.39%, and 51.83%of convertible bonds.

- END -

300 acres of ginger ginger in Datong Village, Zigong Gongjing, Sichuan was harvested: Ginger farmers planted ginger for more than 30 years this year, nearly 200,000 yuan

Cover news reporter Liu Ke ShengHurry up, come and dig ginger! On August 19th, a ...

Super sweet water and corn pretty market, "black and sweet corn" becomes the new pet of the city

Jimu Journalist Cheng YuxunCorrespondent Wang BoThe fruit corn is lush, and the fa...